39 self employed expenses worksheet

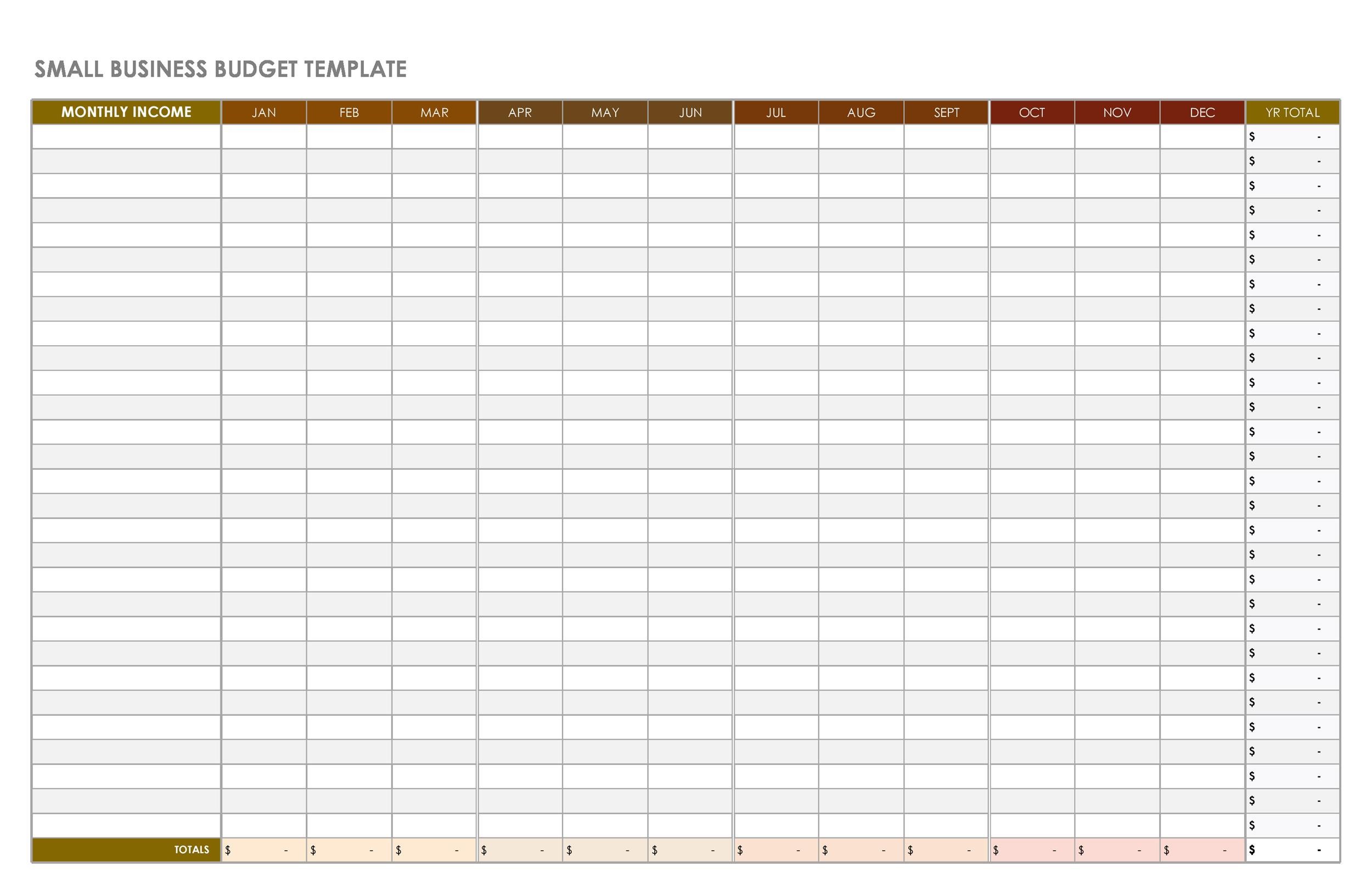

12+ Business Expenses Worksheet Templates in PDF | DOC self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair. Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

The Best Home Office Deduction Worksheet for Excel [Free Template] Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it's usually better to just track your actual home expenses. Hopefully, this free worksheet — and the Keeper Tax app — can take the hassle out of expense tracking. {filing_upsell_block}

Self employed expenses worksheet

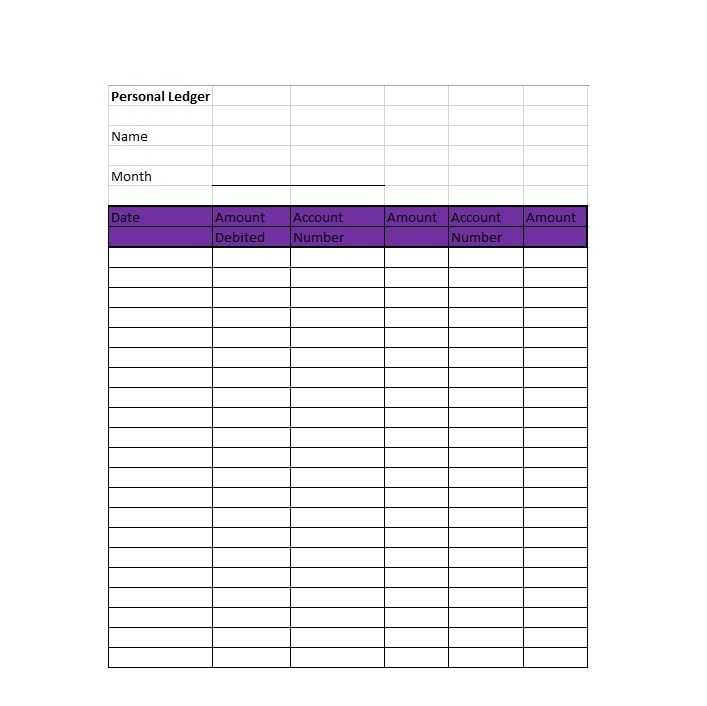

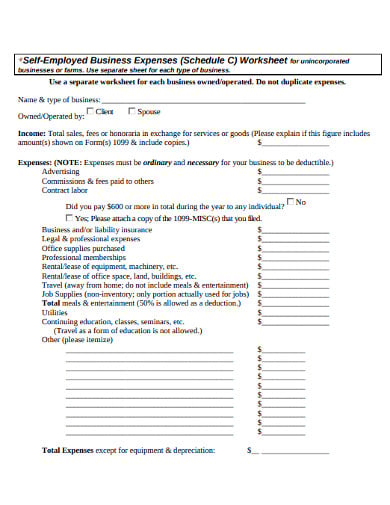

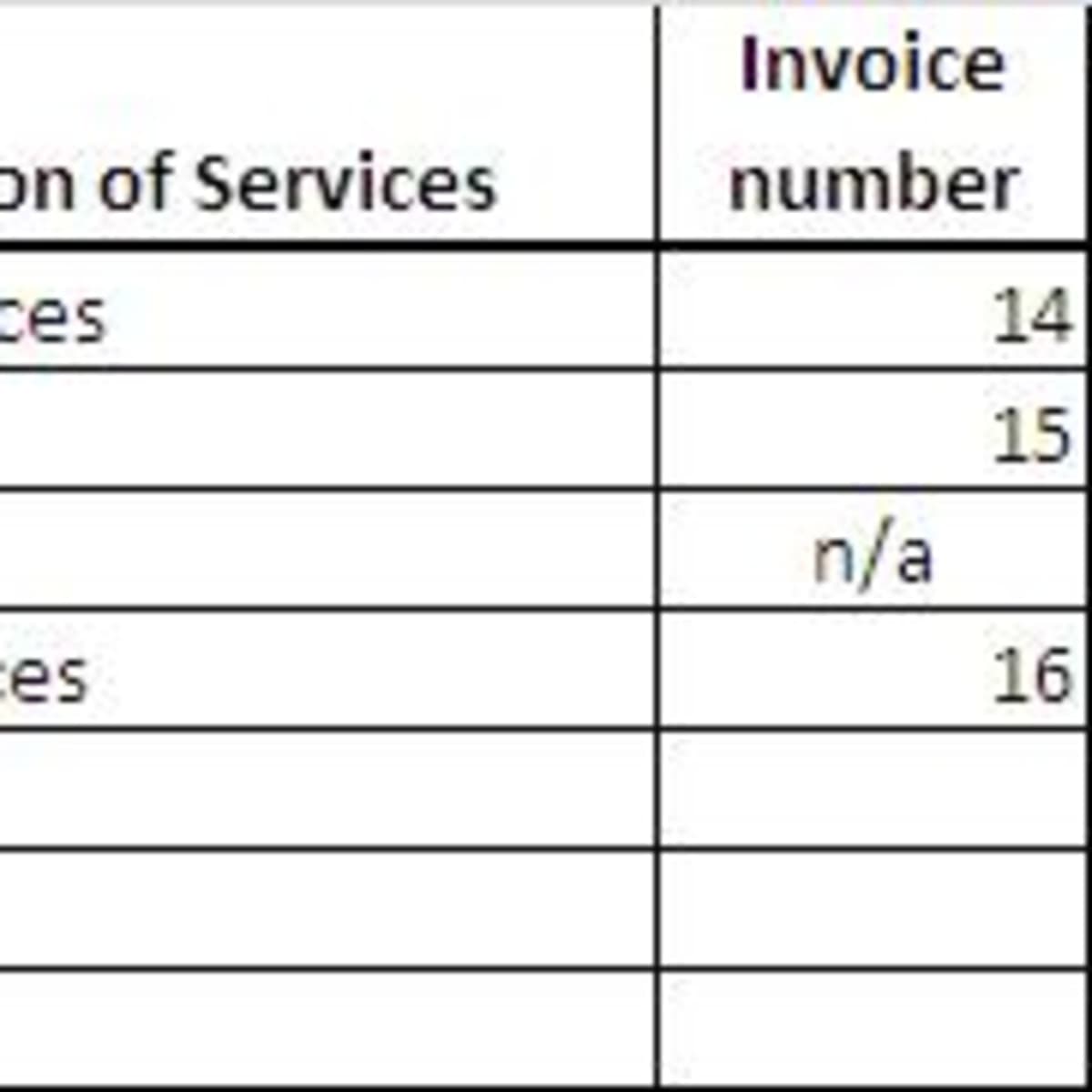

PDF Self Employment Income Worksheet - Kcr - Entertainment Expenses - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify ... Guide On Self-Employed Bookkeeping With FREE Excel Template The self-employed bookkeeping template runs from April to March. If your accounting period is 6th April to 5th April, the best advice is to add the end of the year April figures into March. It keeps checking the bank figure much easier. Full instructions on using the cash book template are available here. PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

Self employed expenses worksheet. PDF Contractor's Deduction Worksheet - MB Tax Pro Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... *Expenses must be ordinary and necessary and have a business purpose. The income and expenses above must be backed by ... Contractor's Deduction Worksheet Author: Peg Hadley Created Date: 2/22/2014 1:56:43 PM ... 15 Tax Deductions and Benefits for the Self-Employed - Investopedia The self-employment tax refers to the Medicare and Social Security taxes that self-employed people must pay. This includes freelancers, independent contractors, and small-business owners. The... Self Employed Tax Deductions Worksheet Form - Fill Out and Sign ... The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details. Self Employment Worksheet - First Choice Tax Service Directions: 1. Click on the button below to get the Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person. Download Here.

PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: self employment expense worksheet self employment expense worksheet Spend Less than What You Earn - Money Girl PH. 11 Images about Spend Less than What You Earn - Money Girl PH : 35 Self Employed Expenses Worksheet - Worksheet Resource Plans, Self Employed Tax Deductions Worksheet 2019 | AdiPurwanto.com and also Pin di Worksheet. Spend Less Than What You Earn - Money Girl PH Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your... Publications and Forms for the Self-Employed Instructions for Schedule F (Form 1040 or 1040-SR), Profit or Loss from Farming PDF Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Instructions for Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Schedule K-1 (Form 1065), Partner's Share of Income, Credits, Deductions, etc. PDF

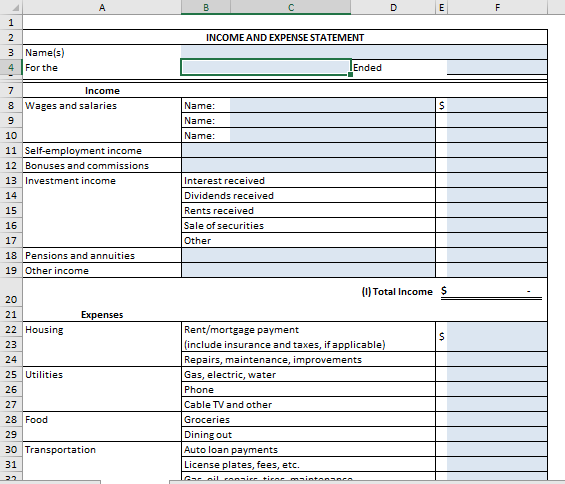

PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... self employed expense worksheet Tax Expenses Spreadsheet in Self Employed Expense Sheet And Expenses. 10 Pics about Tax Expenses Spreadsheet in Self Employed Expense Sheet And Expenses : Expenses For Self Employed Spreadsheet — db-excel.com, Car and Truck Expenses Worksheet and also Car and Truck Expenses Worksheet. 8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... So, here are the steps that will help you create your own sample expense report and income statement spreadsheet: Open your spreadsheet or worksheet application Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan. This also includes your spouse's plan.

PDF FHA Self-Employment Income Calculation Worksheet Job Aid the worksheet is also being used for any other type of self -employment (ex. Schedule C). a. W-2 Income from Self -Employment Input the gross earnings directly from the borrower's W-2 issued by the business being evaluated. (Form 1040 > Line 1) b. Subtotal The W-2 income will be reiterated as a subtotal for the purpose of future calculation.

PDF Self Employment Monthly Sales and Expense Worksheet - Washington SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) 3. Expenses List your business expenses for the month. See instruction on page 1 for information on business expenses and what we do not count as a business expense. List additional expenses on a separate sheet of paper if needed. DATE PAID TO EXPENSE TYPE

PDF Schedule C Worksheet for Self Employed Businesses and/or ... - Kristels Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

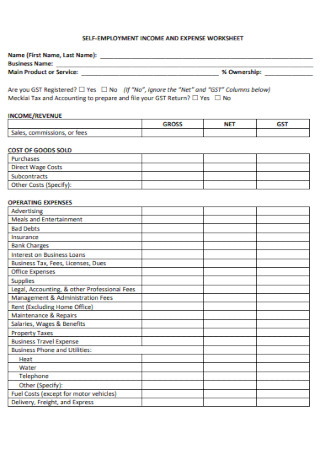

PDF Self-employed Income and Expense Worksheet INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ $ OTHER BUSINESS INCOME COMMISSIONS $ $ OTHER BUSINESS INCOME INSURANCE (Other Than health) $ COST OF GOODS SOLD INTEREST (Business Loans) $ COST OF INVENTORY AT THE BEGINNING OF THE YEAR $ INTEREST (Business Loans) $

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

PDF Self Employment Income Worksheet - mytpu.org Self Employment Income Worksheet . Self Employed Applicants Name: _____ Home Address: _____ ... Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS.

Free Expense Tracking Worksheet Templates (Excel) Expense Tracking Sheet This template is perfect for both personal use, as well as small business use. It comes with two sheets. The first sheet is dedicated to tracking your expenses in various categories throughout weeks, months or years. The second sheet is a streamlined summary chart of your budget vs. the money you spent in this time period.

Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The ... A self-employed borrower's share of Partnership or S Corporation earnings can only be considered if the lender obtains ... expense associated with nonrecurring casualty loss.- Line 8f - Mortgage or Notes Payable in Less ...

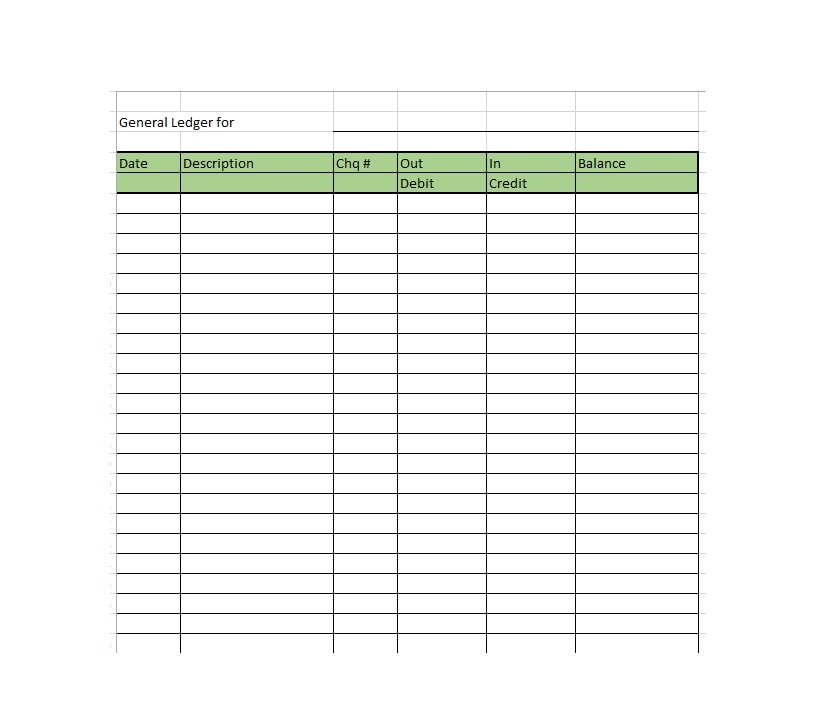

Tracking your self-employed income and expenses Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

Guide On Self-Employed Bookkeeping With FREE Excel Template The self-employed bookkeeping template runs from April to March. If your accounting period is 6th April to 5th April, the best advice is to add the end of the year April figures into March. It keeps checking the bank figure much easier. Full instructions on using the cash book template are available here.

PDF Self Employment Income Worksheet - Kcr - Entertainment Expenses - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify ...

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

.png)

0 Response to "39 self employed expenses worksheet"

Post a Comment