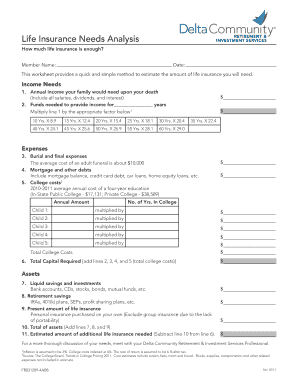

39 life insurance needs analysis worksheet

Before Making a Purchase Use This Life Insurance Needs Calculator - WAEPA A needs analysis can help you determine how much life insurance you should buy. Consider Current and Future Expenses A good needs analysis will take into account the immediate, ongoing, and future expenses. Immediate expenses comprise the total cost of a funeral and any outstanding medical bills. Life Insurance Needs Analysis Worksheet - Calculators Life Insurance Needs Analysis Worksheet Home Retirement Life Insurance Life Insurance Needs Calculator As anyone with a family knows, you need to plan to provide for your family, even after you're gone. This calculator will help you determine what your life insurance needs are. First enter potential funeral costs and estate taxes.

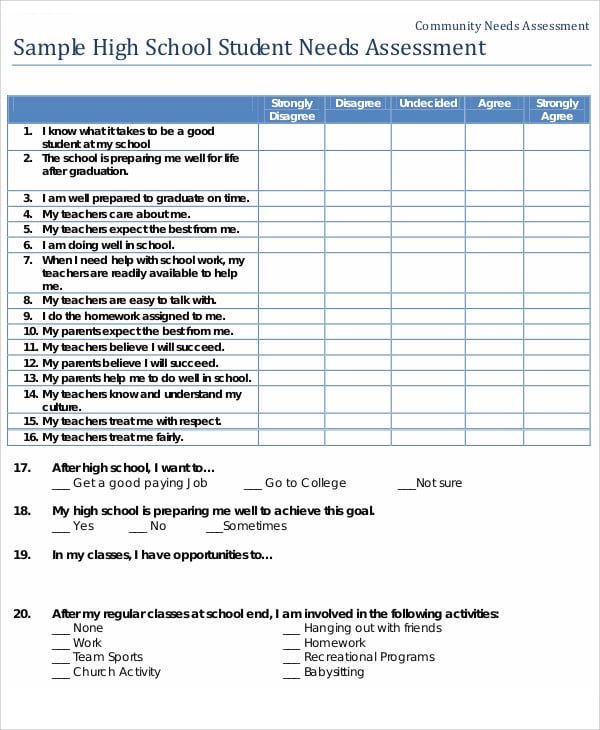

Quiz & Worksheet - Life Insurance Needs Analysis | Study.com Print Worksheet 1. What are some things to keep in mind when deciding how much life insurance to have? Mortgage, Auto Loans, Funeral Expenses Vacations, Build Ons for Your Home Clothing Needs,...

Life insurance needs analysis worksheet

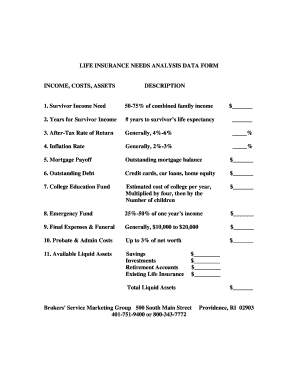

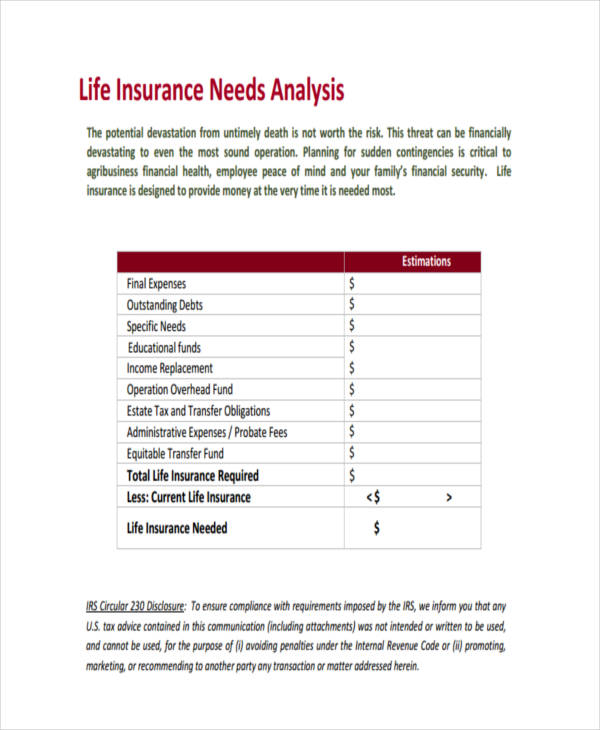

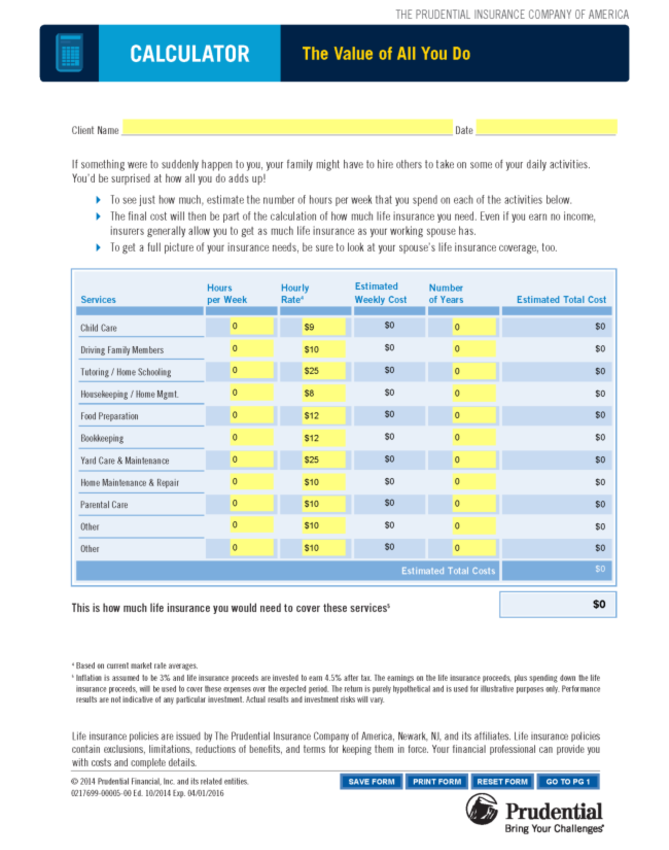

PDF Easy Life Insurance Needs Analysis Total Additional Life Insurance Needs $0 Applicant print name: Sign name: Date: As Surviving Spouse or Beneficiary, I understand that any changes to my estimated life insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than ... Life Insurance Needs Calculator for Excel | Excel Templates Microsoft Excel Worksheets and Templates Life Insurance Needs Calculator It is the desire of everyone to plan the financial needs of the survivors to ensure a safe future for them. You can create a safe and sound financial plan for your family if you opt for a better life insurance option. PDF Life Insurance Needs Analysis - The National Alliance for Insurance ... Life Insurance Needs Analysis A Tool to Estimate the Right Amount of Life Insurance Coverage Immediate Cash Needs 1. Final Expenses: The amount needed to cover all final expenses upon your death. This includes funeral costs, medical expenses, probate fees, etc. Current average funeral expenses are about $10,000. 2.

Life insurance needs analysis worksheet. worksheet 8.1 - LIFE INSURANCE NEEDS ANALYSIS METHOD... worksheet 8.1 - LIFE INSURANCE NEEDS ANALYSIS METHOD Insureds Name Step 1: Financial resources needed after death 1. Annual living expenses and other worksheet 8.1 - LIFE INSURANCE NEEDS ANALYSIS METHOD... School Kodiak High School Course Title FINANCE 102 Type Homework Help Uploaded By brittanynicole669 Pages 2 Life Insurance Needs Calculator - Life Happens Life Insurance Needs Calculator Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. This is an estimate only. For a complete assessment, contact a qualified insurance professional. Question 1 of 7 How much annual income would you like to provide, if you were no longer here? PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date PDF How much Life Insurance Do you need??? - amben.com funds, existing life insurance, invest-ments. $ _____ 9. INSURANCE NEED Part 7 minus part 8 $ _____ Ï YOUR POTENTAL LIFE INSURANCE NEED Your goal is to have enough insurance so at a 3%* annual return on the death benefit, your family would be able to sustain themselves. *3% could be aggressive in this market environment

PDF Life Insurance Needs Analysis Worksheet - Empire Life Insurance Needs Analysis Worksheet Date: _____ This Worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. The type and amount of information required to be collected will vary depending on each client's particular circumstances, therefore the information ... DIME worksheet - North American Company A needs analysis can provide a snapshot of your current and future needs to help answer the question, "How much life insurance do I need in the event of my spouse's death?" And the best part? This version is so simple, it can be done on the back of a napkin! Client name: D = Debts... How much debt do you wish to pay off? Debts $ I = Income... How to do a 'needs analysis' before you buy life insurance - Insure.com A good needs analysis will look at immediate, ongoing and future expenses. Immediate expenses include any outstanding medical bills and the cost of a funeral, he says. Ongoing expenses include your mortgage and any other outstanding debt you have. People typically want their families to be able to pay off their debts and mortgage when they die. . How much life insurance do I need? - Life Happens Calculation 1: One of the simplest ways to get a rough idea of how much life insurance to buy is to multiply your gross (a.k.a. before tax) income by 10 to 15. Another popular formula recommends adding $100,000 to that amount for each child's college education expenses.

Solved Life Insurance Financial Needs Analysis Worksheet - Chegg Transcribed image text: Life Insurance Financial Needs Analysis Worksheet Step 1: Calculate the Family's Income (Cash Flow) Needs for Each Period. Empty Nest/ Blackout Period of Surviving Spouse (Age XX. 60) Retirement Period for Surviving Spouse (X Years) Readjustment (1 or 2 Years) Children's Area) (X-16) Children's Agas) (17-18) Surviving Spouse's Age Deceased Spouse's (Would Be Age Annual ... PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H ... Life Insurance Needs Analysis Worksheet - Pruneyardinn Life Insurance Needs Analysis Worksheet (LNAW) helps to analyze the life-insurance requirements of a person. This worksheet helps to analyze and calculate all the various aspects of life assurance policy required by an applicant, including premium, contributions, discount, death benefit, and other financial matters. Life Insurance Financial Needs Analysis Worksheet | Chegg.com Transcribed image text: Life Insurance Financial Needs Analysis Worksheet Step 1: Calculate the Family's Income (Cash Flow) Needs for Each Period. Empty Nest/ Blackout Period of Surviving Spouse (Age XX. 60) Retirement Period for Surviving Spouse (X Years) Readjustment (1 or 2 Years) Children's Area) (X-16) Children's Agas) (17-18) Surviving Spouse's Age Deceased Spouse's (Would Be Age Annual ...

Life Insurance Needs Analysis Sue.pdf - Course Hero Step 1: Calculate How Much Income your survivors will need each month.

PDF Easy Disability Insurance Needs Analysis - My Family Life Insurance Total Add'l Monthly Income Needs Applicant print name: Sign name: Date: As Spouse or Beneficiary, I understand that any changes to my estimated disability insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than what I require ...

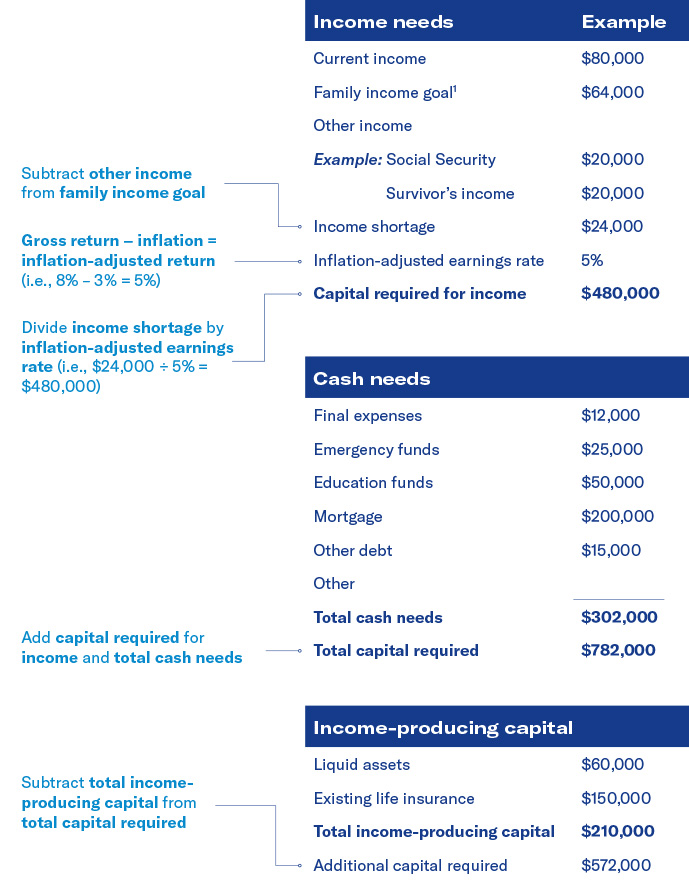

Calculating Life Insurance Needs: Capital Needs Analysis So to create an annual income of $40,000 per year, you'd need a lump sum $1,000,000. As you get older, the payoff gets better. A more conventional approach seems to multiply by about 15. Add in lump sum expenses. You'll probably want to take care of debts like student loans, credit cards, funeral costs, and medical bills.

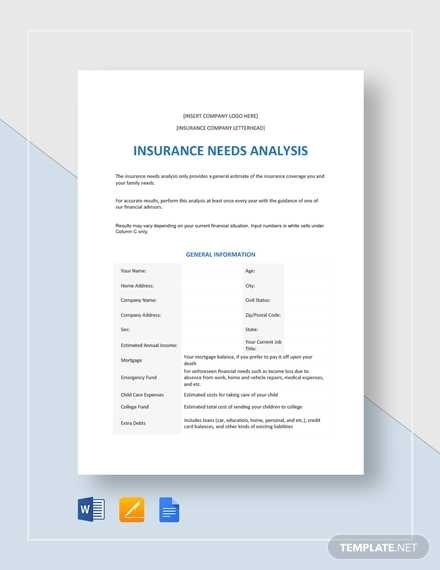

PDF Insurance Needs Analysis Worksheet Insurance Needs Analysis Worksheet - Term Life Term Life Pays out a Lump Sum in the event of your death, or being told you have less than 12 months to live Lump Sum Needs Client 1 Client 2 Clear Mortgage $ $ Clear Investment debt(s) $ $ Clear other debt(s) $ $ Funeral costs $ $ Other $ $ A. Total $ $

PDF LIFE INSURANCE NEEDS WORKSHEET - alterrawm.com LIFE INSURANCE NEEDS WORKSHEET. Death of Client Death of Spouse 15. Cash/Savings $ 16. Marketable Securities (Stocks, Bonds, Mutual Funds, etc.) $ 17. Other $ 18. Net After Tax Retirement Plan Balances $ Market Value Less Outstanding Loans & Transaction Costs 19. Real Estate #1 $ 20. Real Estate #2 $ 21. Real Estate #3 $

Life Insurance Needs Worksheets - K12 Workbook Displaying all worksheets related to - Life Insurance Needs. Worksheets are Life insurance needs work, How much life insurance do you need work, Life insurance needs work, Easy life insurance needs analysis, Life insurance needs prepared by date, Life insurance needs analysis work, Life insurance needs analysis, Dime work.

PDF FINANCIAL NEEDS ANALYSIS WORKSHEET - Producers XL This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully.

PDF Life Insurance Needs Worksheet - Independent Benefit Solutions, LLC Get a general sense of how much life insurance you need to protect your family. Before buying life insurance, it makes sense to consult with an insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 1. Total annual income your family would need if you died today What your family needs ...

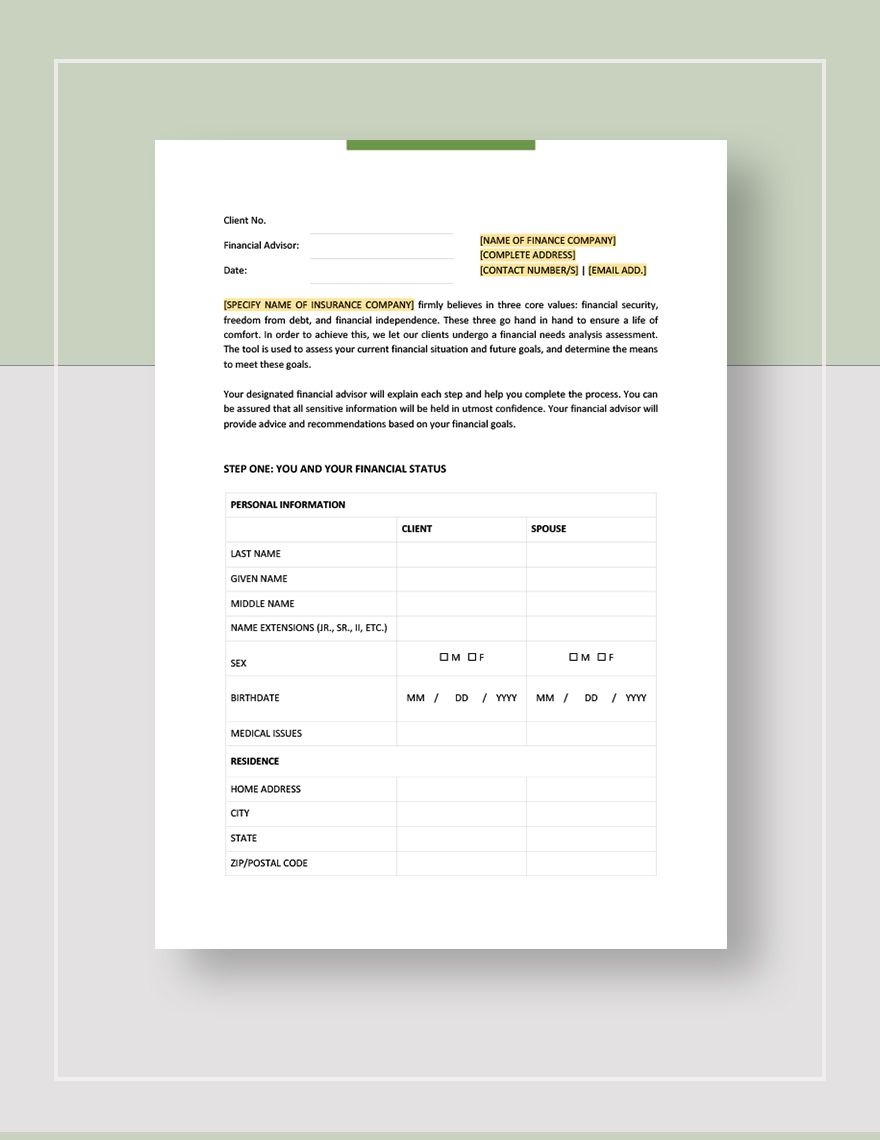

Life Insurance Needs Worksheet Form - signNow Follow the step-by-step instructions below to design your financial needs analysis form for life insurance: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

XLSX Captcha My net need for life insurance as of today is At this time I have decided to purchase additional coverage of ` HOUSEHOLD LIABILITIES: LEGACY NEEDS AND WANTS: (E) (F) This needs analysis demonstrates a life insurance need of (A+B+C-E) = This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME ...

A life insurance needs analysis is a first step toward peace of mind By Robin Jones. 09-01-2021. Life insurance is top of mind for many people this year. According to the 2021 Life Insurance Barometer Study by worldwide research and consulting company LIMRA and the nonprofit Life Happens, 36 percent of respondents planned to purchase a policy this year—the highest percentage in the survey's 11-year history.

PDF Life Insurance Needs Analysis - The National Alliance for Insurance ... Life Insurance Needs Analysis A Tool to Estimate the Right Amount of Life Insurance Coverage Immediate Cash Needs 1. Final Expenses: The amount needed to cover all final expenses upon your death. This includes funeral costs, medical expenses, probate fees, etc. Current average funeral expenses are about $10,000. 2.

Life Insurance Needs Calculator for Excel | Excel Templates Microsoft Excel Worksheets and Templates Life Insurance Needs Calculator It is the desire of everyone to plan the financial needs of the survivors to ensure a safe future for them. You can create a safe and sound financial plan for your family if you opt for a better life insurance option.

PDF Easy Life Insurance Needs Analysis Total Additional Life Insurance Needs $0 Applicant print name: Sign name: Date: As Surviving Spouse or Beneficiary, I understand that any changes to my estimated life insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than ...

![Advisor Tool] Survivor Income and Cash Needs Analysis ...](https://i.pinimg.com/736x/ef/04/5a/ef045a90787223bf94713853a2f0087f.jpg)

0 Response to "39 life insurance needs analysis worksheet"

Post a Comment