45 self employment expenses worksheet

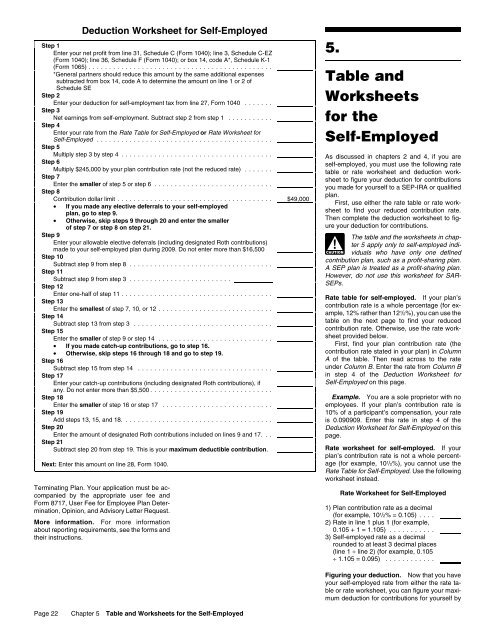

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Self-Employment Tax: Everything You Need to Know - SmartAsset WebSelf-Employment Tax Filing. When filing your annual return, use Schedule C of Form 1040 to calculate your net self-employment income. If your business expenses come out to $5,000 or less, you may be able to file Schedule C-EZ instead of Schedule C. The Schedule C or Schedule C-EZ will give you your calculated income or loss. This number will then …

About Form 1099-MISC, Miscellaneous Income - IRS tax forms Web28.09.2022 · Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to report rents, royalties, prizes and awards, and other fixed determinable income.

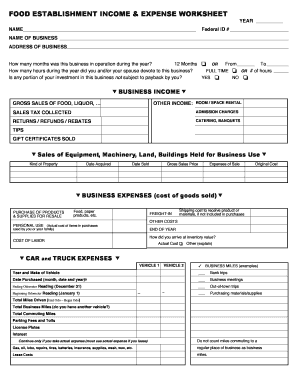

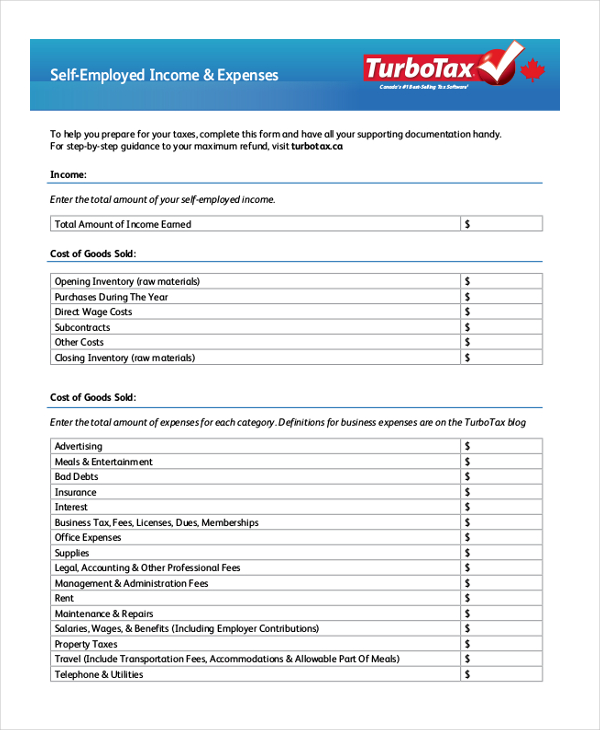

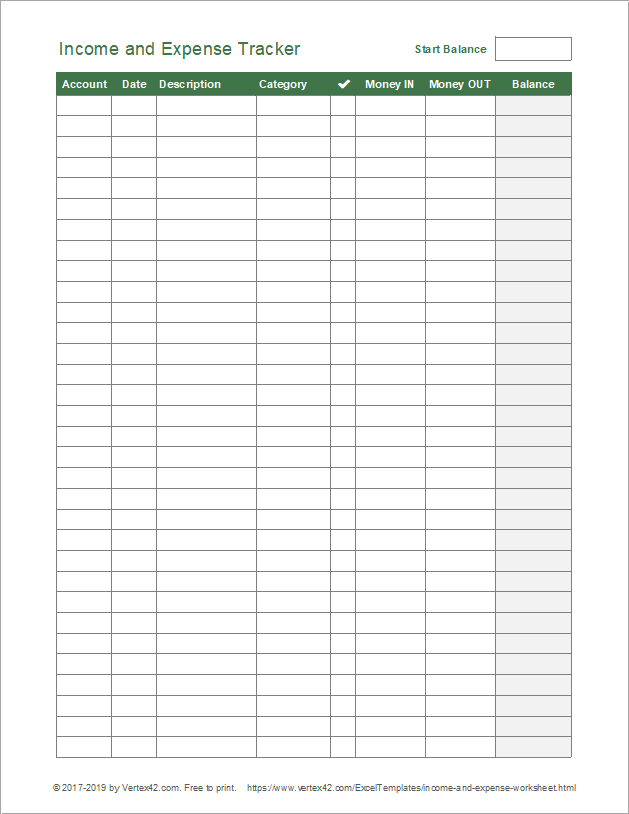

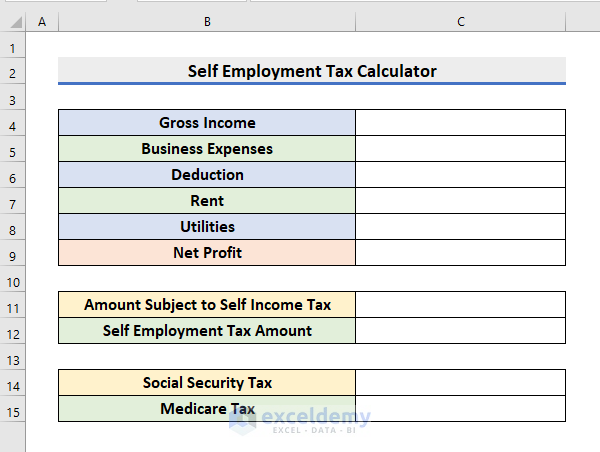

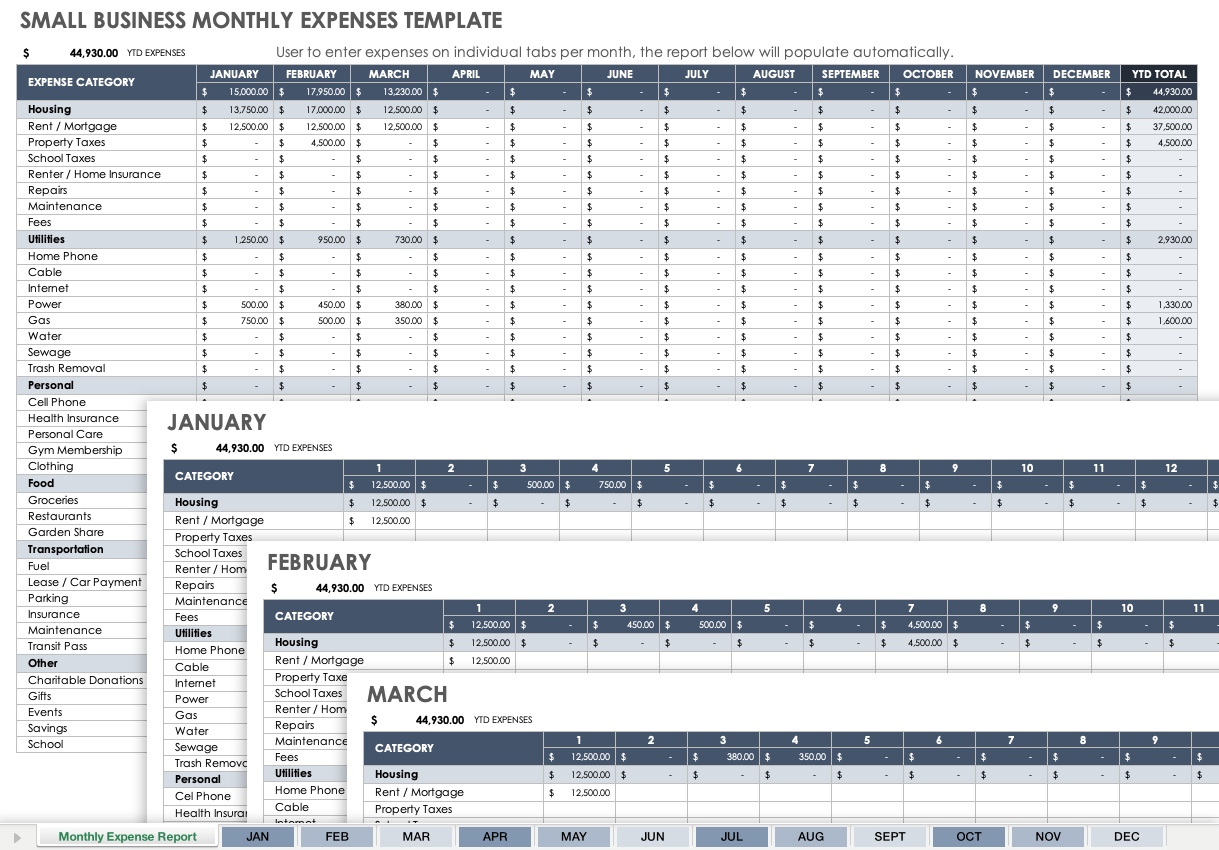

Self employment expenses worksheet

Deferral of employment tax deposits and payments through … Dec 31, 2020 · Similarly, an individual may use any reasonable method in applying the Social Security wage base or taking into account partnership income in determining the portion of 50 percent of the Social Security portion of self-employment tax attributable to net earnings from self-employment for the period from March 27, 2020, through December 31, 2020. 25. FHA Self-Employment Income Calculation Worksheet Job Aid WebFHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self-employment business per borrower. • A new worksheet will need to be used for additional borrowers and self -employment, even if there are multiple borrowers who share ownership in a business. Publication 969 (2021), Health Savings Accounts and Other Tax ... Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. These are explained in Pub. 502. Amounts paid after 2019 for over-the-counter medicine (whether or not prescribed) and menstrual care products are considered medical care and are considered a covered expense.

Self employment expenses worksheet. Publication 502 (2021), Medical and Dental Expenses Web13.01.2022 · You had more than one source of income subject to self-employment tax. You file Form 2555, Foreign Earned Income. You are using amounts paid for qualified long-term care insurance to figure the deduction. If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure … Self-Employed Individuals Tax Center | Internal Revenue Service WebIn general, the wording "self-employment tax" only refers to Social Security and Medicare taxes and not any other tax (like income tax). Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your ... Gig Economy Tax Center | Internal Revenue Service - IRS tax forms Web04.10.2022 · Small Business and Self-Employed; Gig Economy Tax Center Gig Economy Tax Center. English ... Find forms, keep records, deduct expenses, file and pay taxes for your gig work. Manage Taxes for Your Gig Work. Digital Platforms and Businesses. Classify workers, report payments, pay and file taxes for a digital marketplace or business. … 16 Tax Deductions and Benefits for the Self-Employed Web15.11.2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

2022 Form 1040-ES - IRS tax forms Websome of the household employment and/or self-employment tax payments you owe for 2020, don't use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. … 1040 (2021) | Internal Revenue Service - IRS tax forms WebFor that purpose, you must take into account all your self-employment income for the year from services performed both before and after the beginning of the case. Also, you (or the trustee if one is appointed) must allocate between you and the bankruptcy estate the wages, salary, or other compensation and withheld income tax reported to you on Form W-2. A … Publication 969 (2021), Health Savings Accounts and Other Tax ... Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. These are explained in Pub. 502. Amounts paid after 2019 for over-the-counter medicine (whether or not prescribed) and menstrual care products are considered medical care and are considered a covered expense. FHA Self-Employment Income Calculation Worksheet Job Aid WebFHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self-employment business per borrower. • A new worksheet will need to be used for additional borrowers and self -employment, even if there are multiple borrowers who share ownership in a business.

Deferral of employment tax deposits and payments through … Dec 31, 2020 · Similarly, an individual may use any reasonable method in applying the Social Security wage base or taking into account partnership income in determining the portion of 50 percent of the Social Security portion of self-employment tax attributable to net earnings from self-employment for the period from March 27, 2020, through December 31, 2020. 25.

.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/maxresdefault.jpg)

0 Response to "45 self employment expenses worksheet"

Post a Comment