44 tax write off worksheet

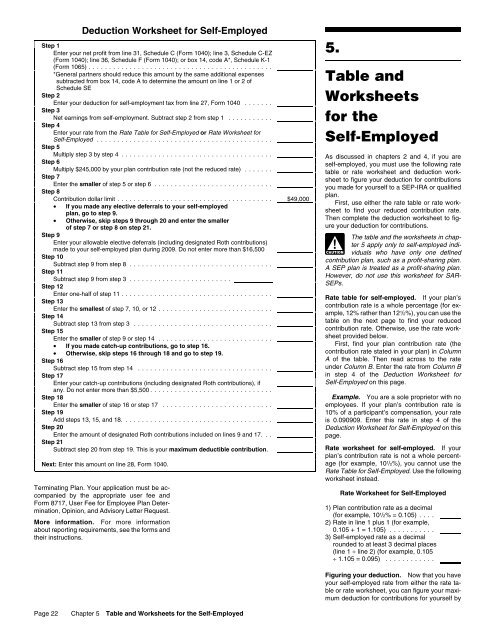

Publication 972 (2020), Child Tax Credit and Credit for Other ... WebIf your employer withheld or you paid Additional Medicare Tax or Tier 1 RRTA taxes, use this worksheet to figure the amount to enter on line 7 of the Line 14 Worksheet. Social security tax, Medicare tax, and Additional Medicare Tax on wages. 1. Enter the social security tax withheld (Form(s) W-2, box 4) 1. _____ 2. Tips on Rental Real Estate Income, Deductions and Recordkeeping WebOct 27, 2022 · Report all rental income on your tax return, and deduct the associated expenses from your rental income. If you own rental real estate, you should be aware of your federal tax responsibilities. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms WebITINs assigned before 2013 have expired and must be renewed if you need to file a tax return in 2022. If you previously submitted a renewal application and it was approved, you do not need to renew again unless you haven't used your ITIN on a federal tax return at least once for tax years 2018, 2019, or 2020.. Frivolous tax submissions.

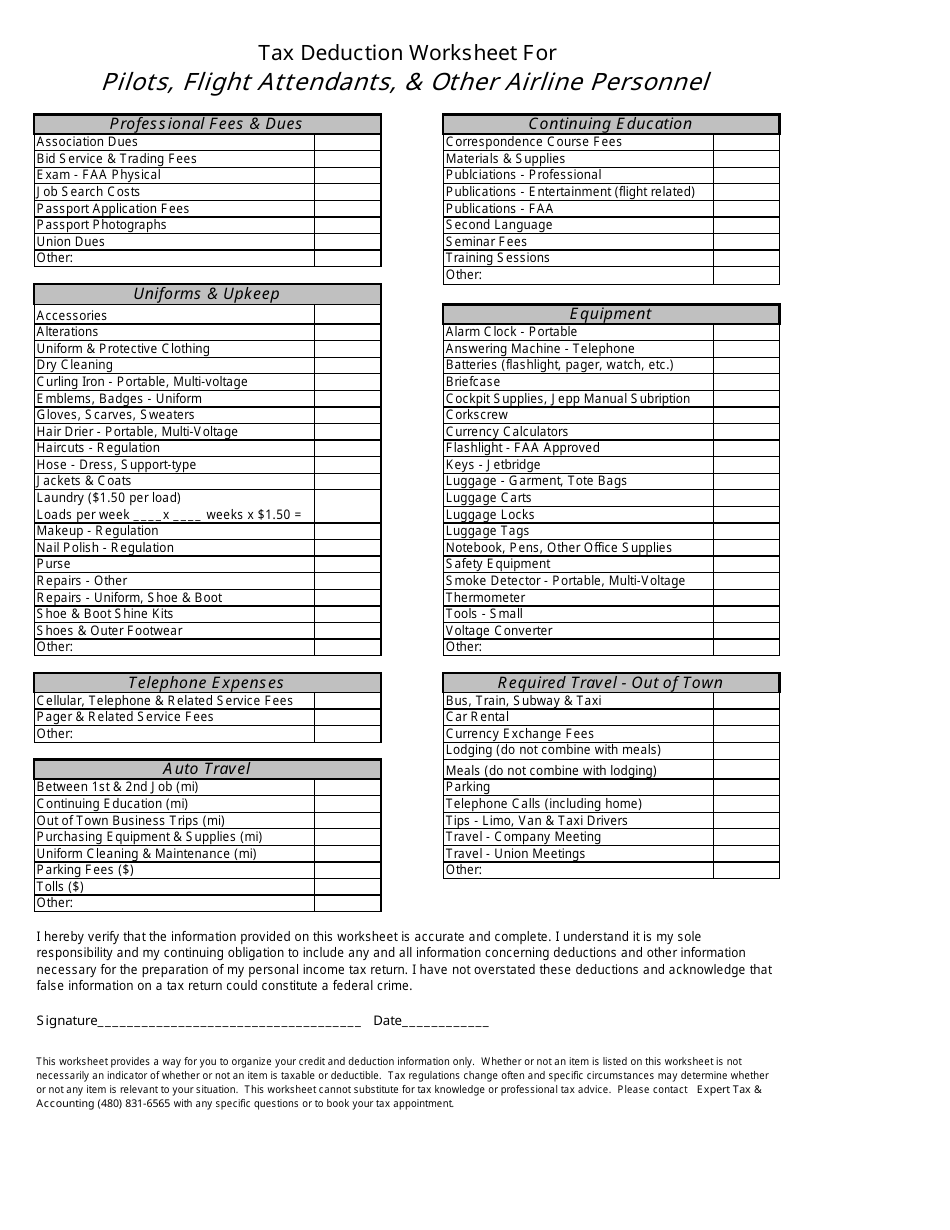

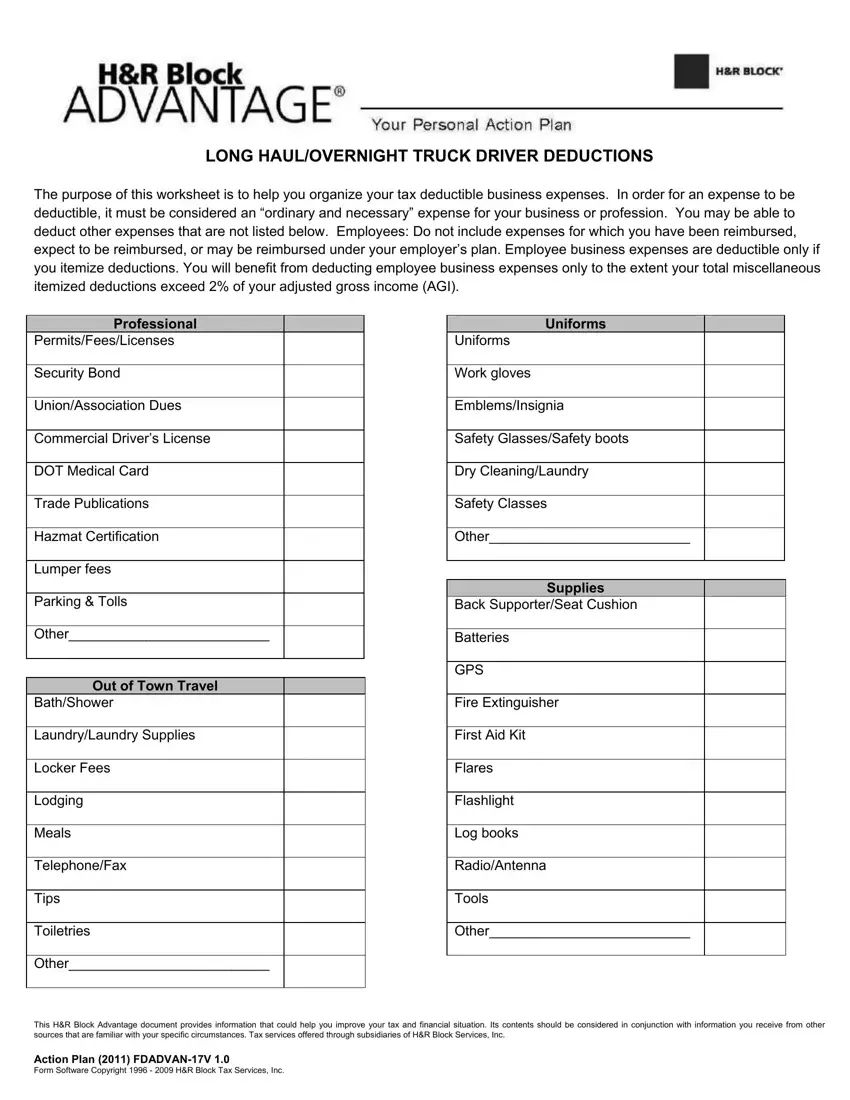

Tax write off worksheet

Publication 936 (2021), Home Mortgage Interest Deduction WebIt contains Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. ... you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. ... If you pay off your home mortgage early, you may have to pay a penalty. ... Application for Employment Authorization | USCIS Nov 22, 2022 · Certain aliens noncitizens who are in the United States may file Form I-765, Application for Employment Authorization, to request employment authorization and an Employment Authorization Document (EAD). Other aliens noncitizens whose immigration status authorizes them to work in the United States without restrictions may also use Form I-765 to apply to U.S. Citizenship and Immigration Services ... Topic No. 409 Capital Gains and Losses - IRS tax forms WebNov 25, 2022 · Capital Gain Tax Rates. The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er).

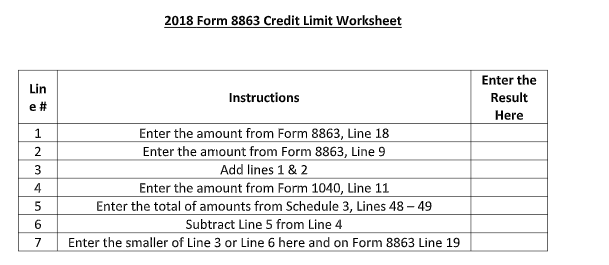

Tax write off worksheet. Publication 535 (2021), Business Expenses - IRS tax forms WebComments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 970 (2021), Tax Benefits for Education | Internal ... WebOr, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. ... Worksheet 1-1. You can use Worksheet 1-1 to figure the tax-free and taxable parts of your athletic scholarship. Worksheet 1-1. Taxable Scholarship and Fellowship Grant Income Publication 503 (2021), Child and Dependent Care Expenses WebWorksheet for 2020 expenses paid in 2021. ... you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. ... You take 8 days off from work as vacation days. Because the absence is less than 2 consecutive calendar weeks, your absence is a short, temporary absence. ... Microsoft takes the gloves off as it battles Sony for its ... WebOct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Topic No. 409 Capital Gains and Losses - IRS tax forms WebNov 25, 2022 · Capital Gain Tax Rates. The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er). Application for Employment Authorization | USCIS Nov 22, 2022 · Certain aliens noncitizens who are in the United States may file Form I-765, Application for Employment Authorization, to request employment authorization and an Employment Authorization Document (EAD). Other aliens noncitizens whose immigration status authorizes them to work in the United States without restrictions may also use Form I-765 to apply to U.S. Citizenship and Immigration Services ... Publication 936 (2021), Home Mortgage Interest Deduction WebIt contains Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. ... you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. ... If you pay off your home mortgage early, you may have to pay a penalty. ...

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-01.jpg)

0 Response to "44 tax write off worksheet"

Post a Comment