41 nc-4 allowance worksheet

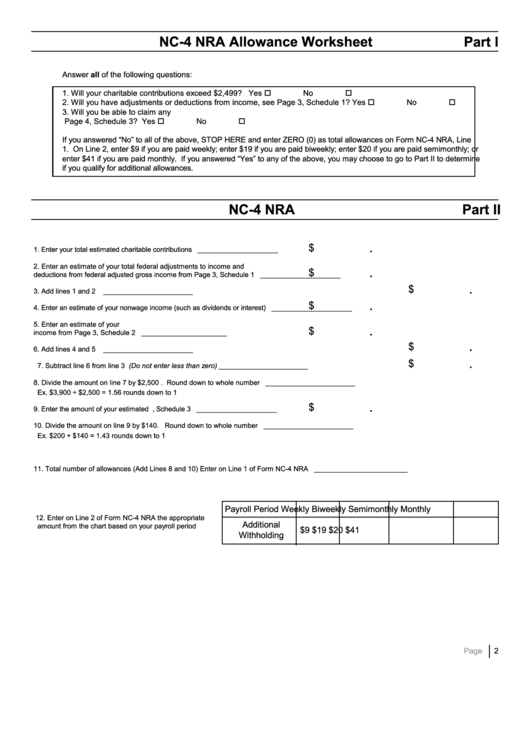

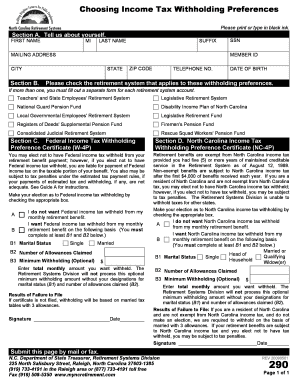

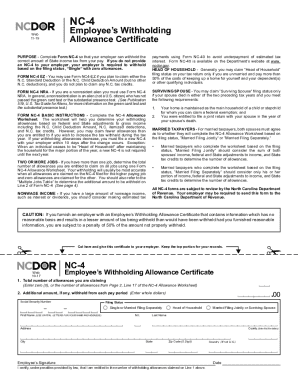

Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. Withholding Allowance Certificate NC-4 NRA 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars ...

It will send you to the NC-4 Allowance Worksheet to determine the number to enter here. Find the secton for your Marital Status and answer all the questions for that section and follow its directions. It may send you back with a number to enter on Line 1 or send you to complete Part II of the Allowance Worksheet.

Nc-4 allowance worksheet

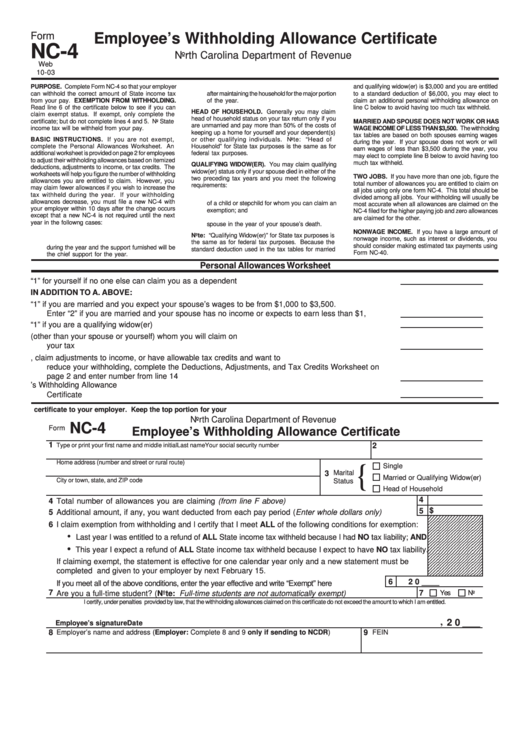

» Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax; Withholding Tax ... FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

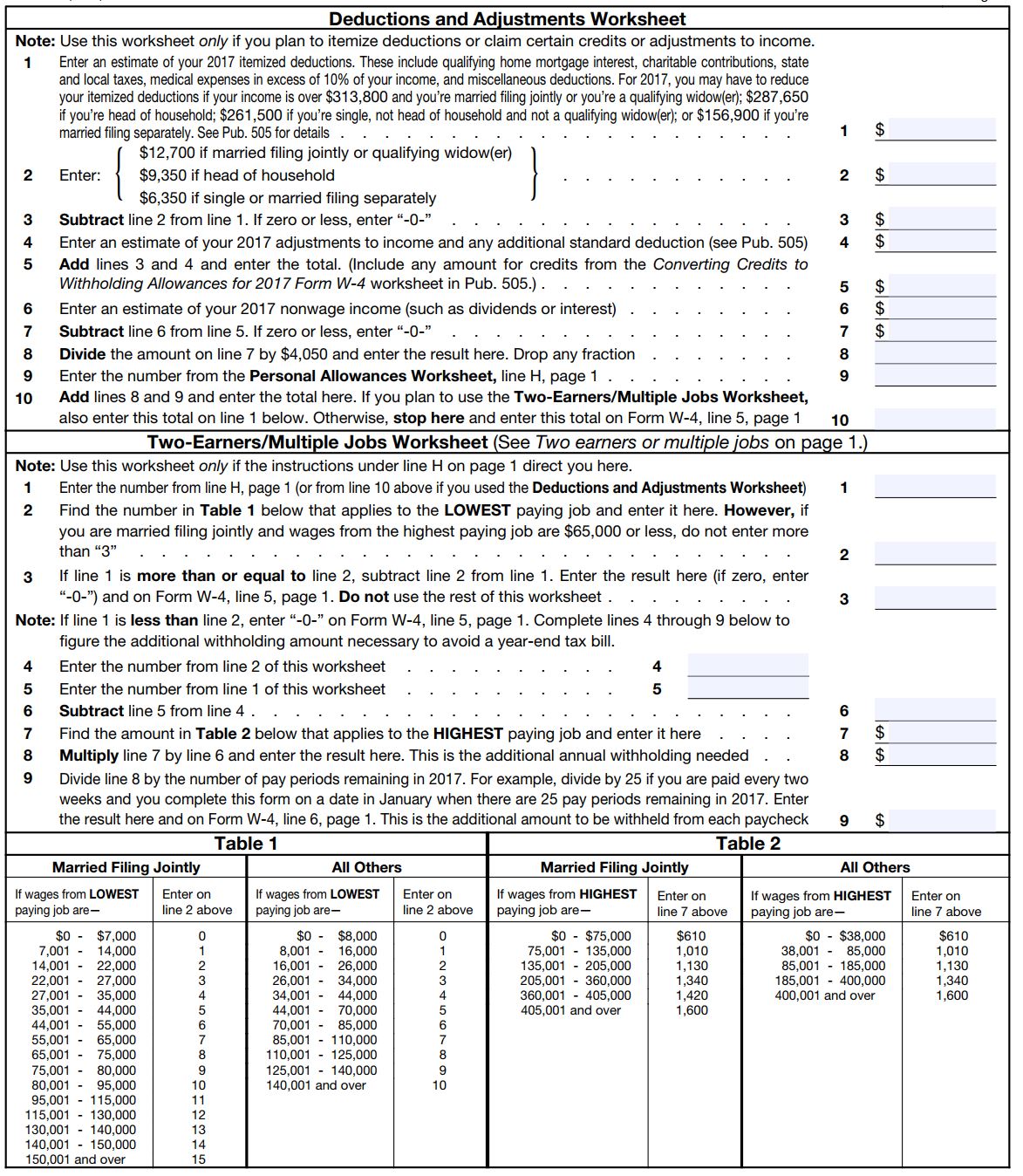

Nc-4 allowance worksheet. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). NC-4 Allowance Worksheet Part II; Schedule 1 Estimated N.C. Itemized Deductions Qualifying Mortgage Interest: Real estate property taxes: Charitable Contributions (Same as allowed for federal): Medical and Dental Expenses (Same as allowed for federal): Itemized Total (after limits) Schedule 2 Estimated Child Deduction Amount NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

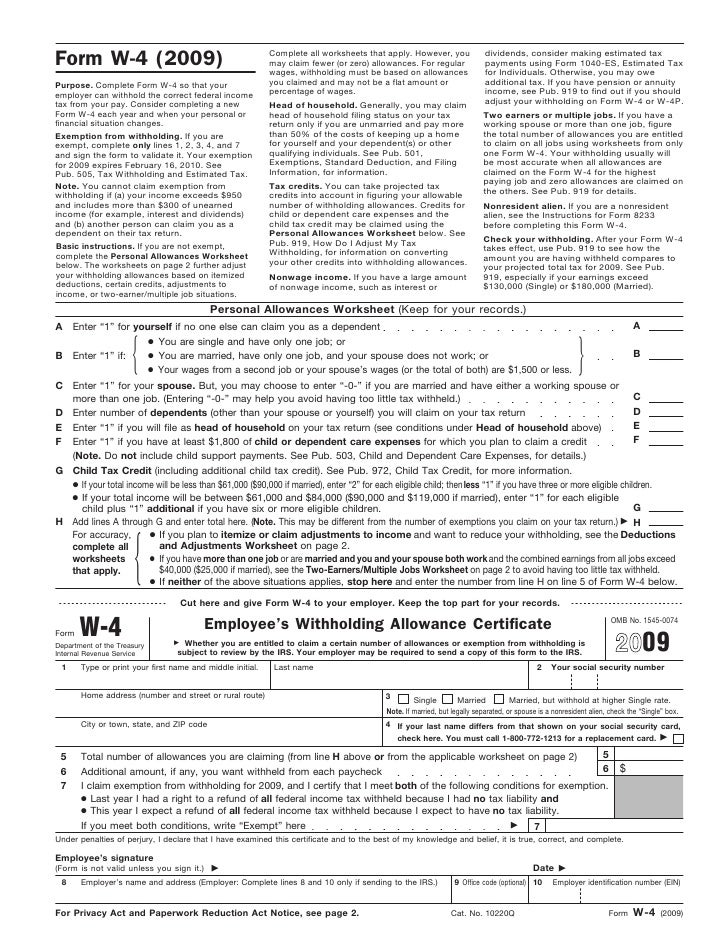

Step 2(b)—Multiple Jobs Worksheet (Keep for your records.) If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note: Items needed to fill out NC-4 EZ Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 led for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5). North Carolina Department of Revenue. Web 10-17 NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars)

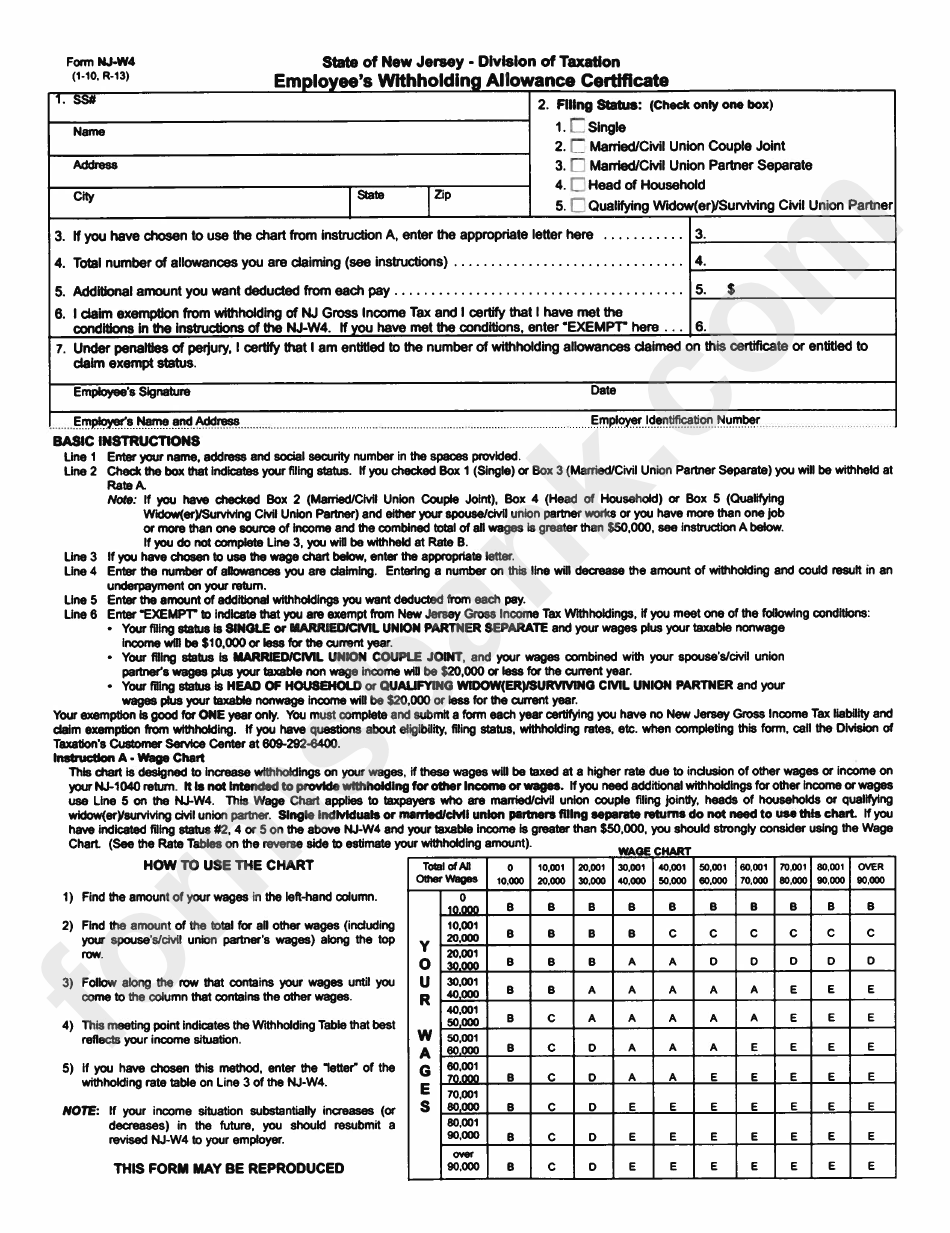

Allowance Worksheet to determine the number of allowances. • For married taxpayers completing the worksheet on the basis of portion of income, adjustments, additions, deductions, and credits on the Allowance Worksheet to determine the number of allowances. All NC-4 forms are subject to review by the North Carolina Department of Revenue. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Employee's Withholding Allowance Certificate North Carolina Department of Revenue. 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

North Carolina Department of Revenue Employee's Withholding Allowance Certificate Single Head of Household Married or Qualifying Widow(er) Marital Status ... Personal Allowances Worksheet Page 2 Your Last Name (First 10 Characters) Your Social Security Number NC-4 Web 10-12. Created Date:

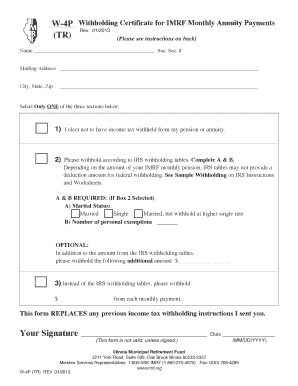

you should complete the Form NC-4P Allowance Worksheet. You can designate an additional amount to be withheld on line 3 of Form NC-4P. Submit the completed form to your payer. If you do not submit Form NC-4P to your payer, the payer must withhold on periodic payments as if you are single with no withholding allowances.

Form NC-4EZ Web Employee's Withholding Allowance Certificate

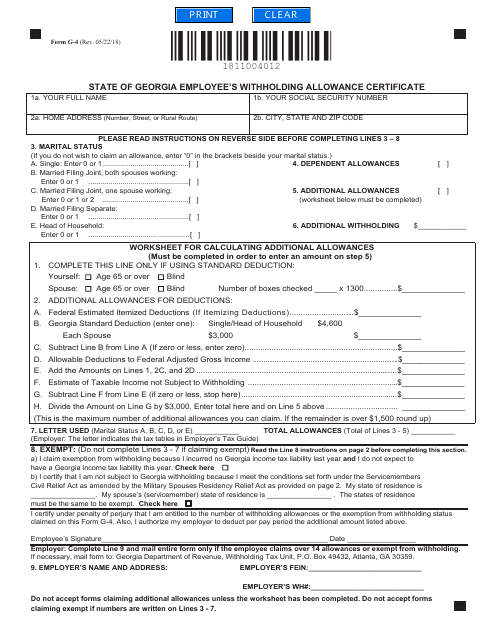

28.7.2021 · When you hire new employees, you need to collect information to verify employment eligibility and run payroll. Federal Forms W-4 and I-9 are just the beginning when it comes to new employee forms.You may also need to collect state-specific forms, including your state’s W-4.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

consider completing a new NC-4 if your personal or financial situation has changed from the previous year. BASIC INSTRUCTIONS - Complete the Personal Allowances Worksheet on Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income,

FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheets will help you figure the number of withholding allowances you are entitled to claim. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 See Allowance Worksheet.

9 Enter the number from Personal Allowances Worksheet, line G, on page 1 9 Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earner/Two-Job Worksheet, also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, on page 1 10 10 Two-Earner/Two-Job Worksheet

of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars) 3..00.00 Total additional withholding from each pay period..00 (Add Lines 2 and 3) 4. M.I. Last Name

Other Standard Deductions by State: Compare State Standard Deduction Amounts IRS Standard Deduction: Federal Standard Deductions North Carolina Income Tax Forms. North Carolina State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed in conjunction with a IRS Income Tax Return.

NC-5501: Request for Waiver of an Informational Return Penalty NC-4EZ: Employee's Withholding Allowance Certificate NC-4: Employee's Withholding Allowance Certificate NC-4 NRA: Nonresident Alien Employee's Withholding Allowance Certificate NC-4P: Withholding Certificate for Pension or Annuity Payments NC-1099M: Compensation Paid to a Payee NC-AC

NC-4 NRA Allowance Worksheet Schedules Schedule 1 Estimated N.C. Child Deduction Amount A taxpayer who is allowed a federal child tax credit under section 24 of the Internal Revenue Code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

NC-4 NRA Allowance Worksheet Schedules Schedule 1 Estimated N.C. Child Deduction Amount A taxpayer who is allowed a federal child tax credit under section 24 of the Internal Revenue Code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits.

» Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax; Withholding Tax ...

0 Response to "41 nc-4 allowance worksheet"

Post a Comment