44 shareholder basis worksheet excel

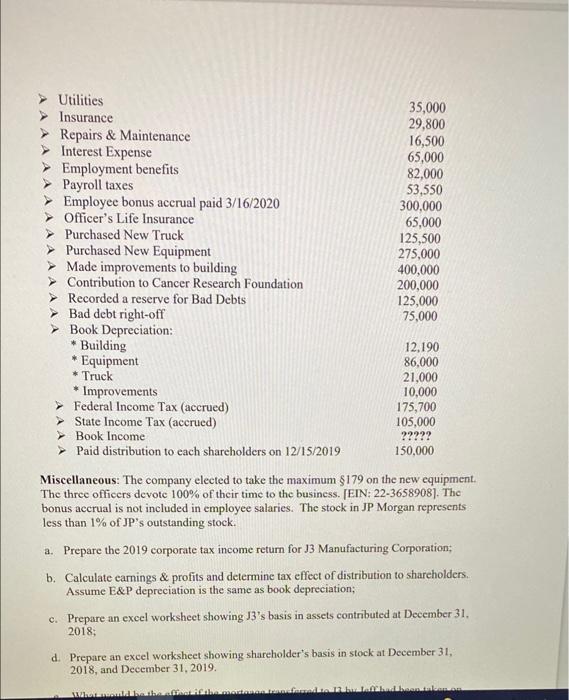

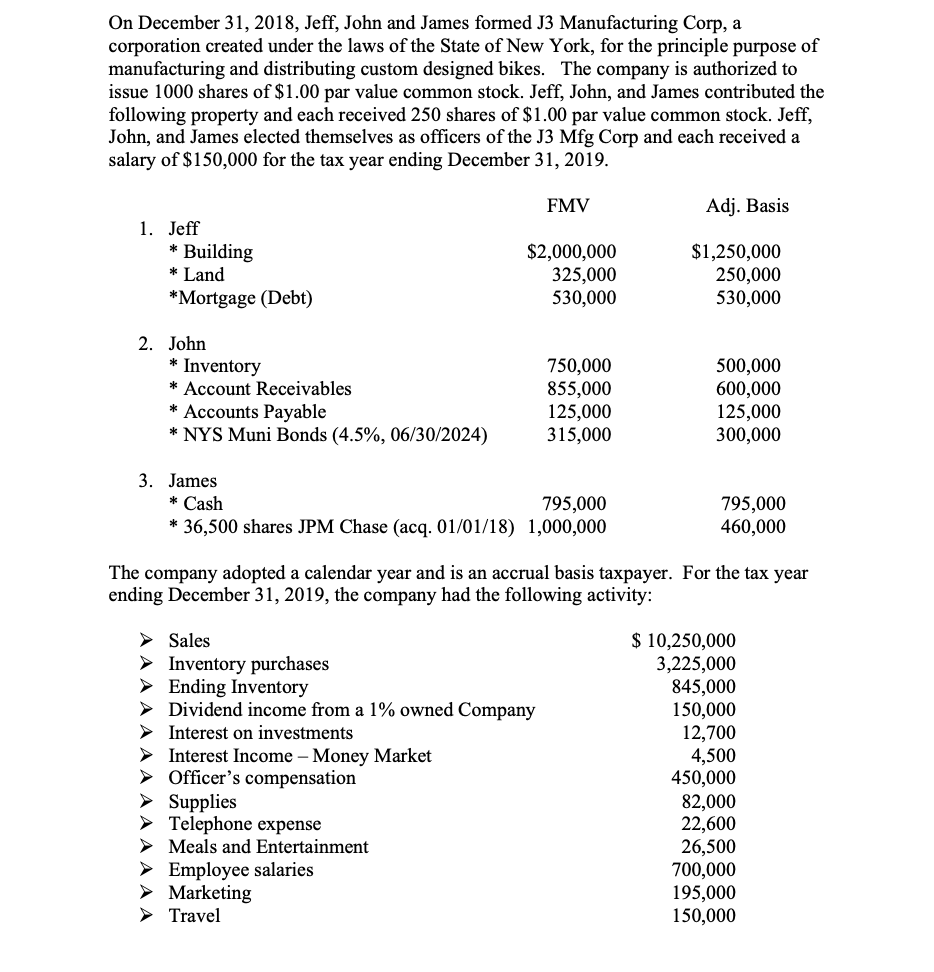

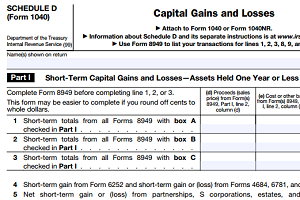

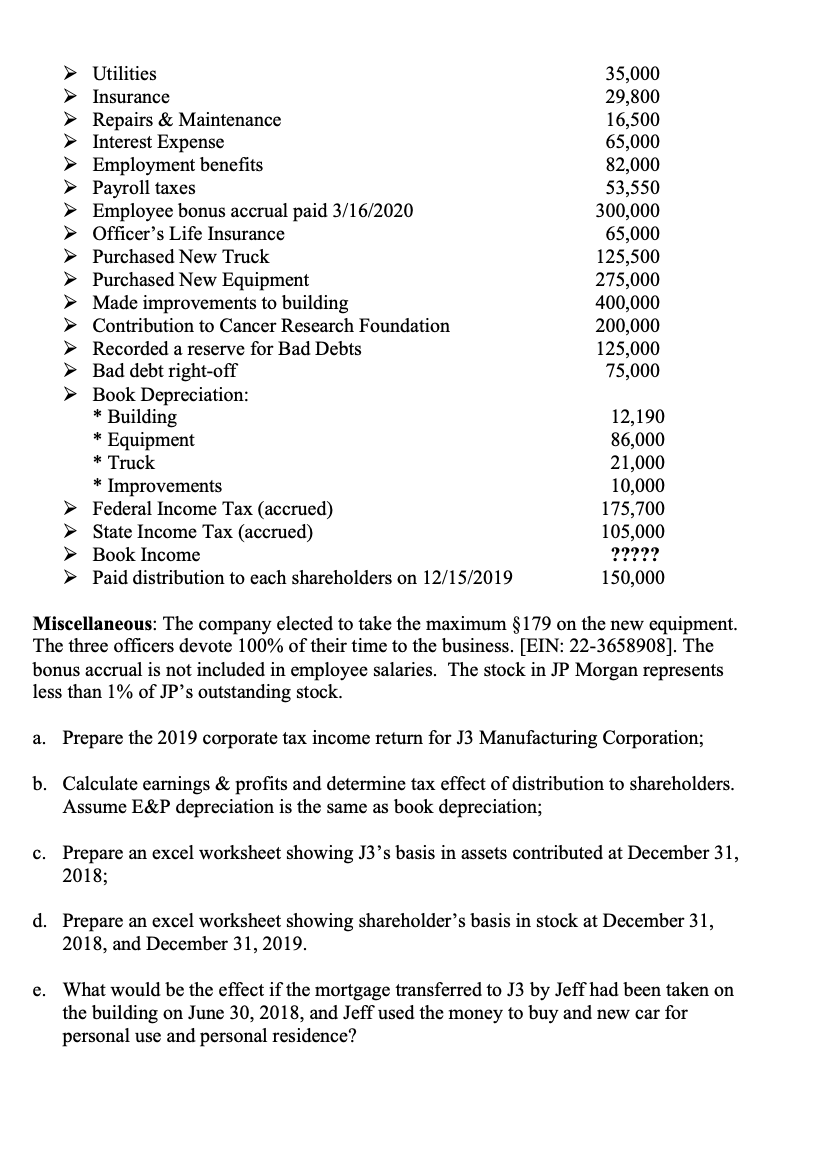

S corporation shareholder recomputation of basis - The Tax Adviser Example 1: A is the 100% shareholder of Corp, which is an S corporation. In year 1, Corp had $50,000 in capital losses, and A had an adjusted basis of $20,000 in his Corp stock. On his individual income tax return for year 1, A deducted the entire $50,000 capital loss and reduced his basis in his Corp stock to zero. Shareholder basis input and calculation in the S Corporation ... - Intuit Figure the Debt Basis before the payment. Divide the adjusted basis (including any adjustments to restore debt basis) in the loan by the outstanding loan balance. Multiply the payment by the percentage calculated in step 2. Take the difference between the payment amount and the amount from step 3. Report this amount as ordinary income/capital gain.

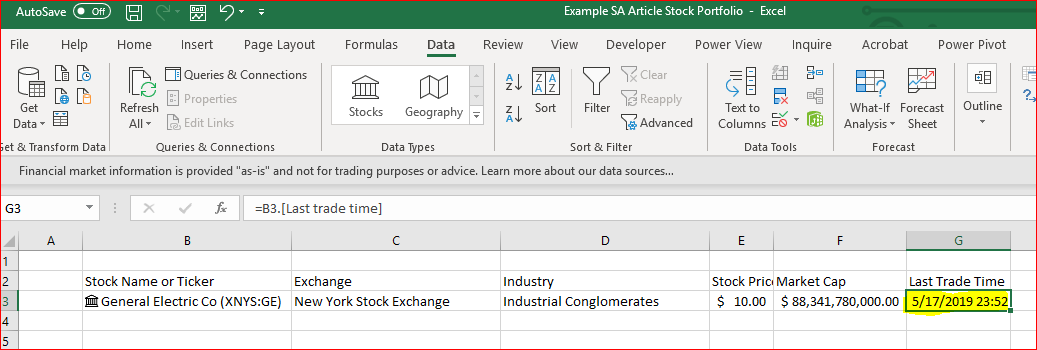

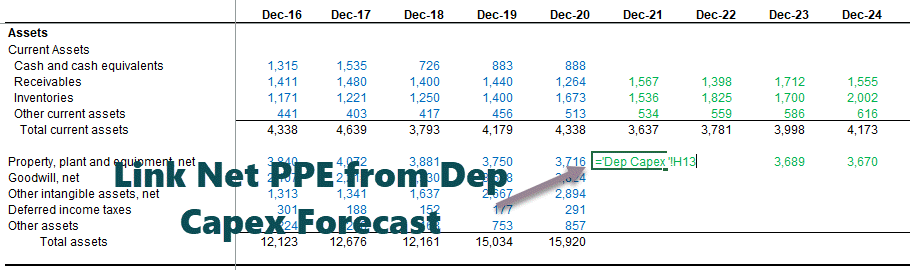

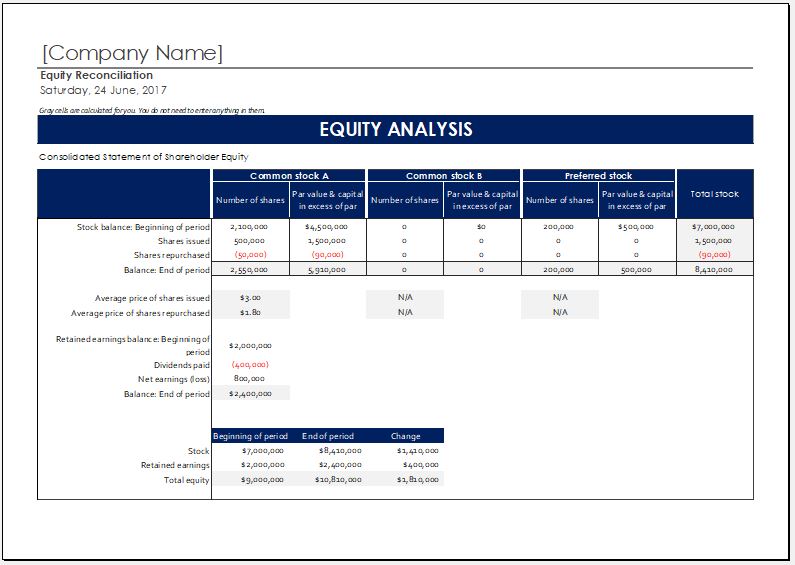

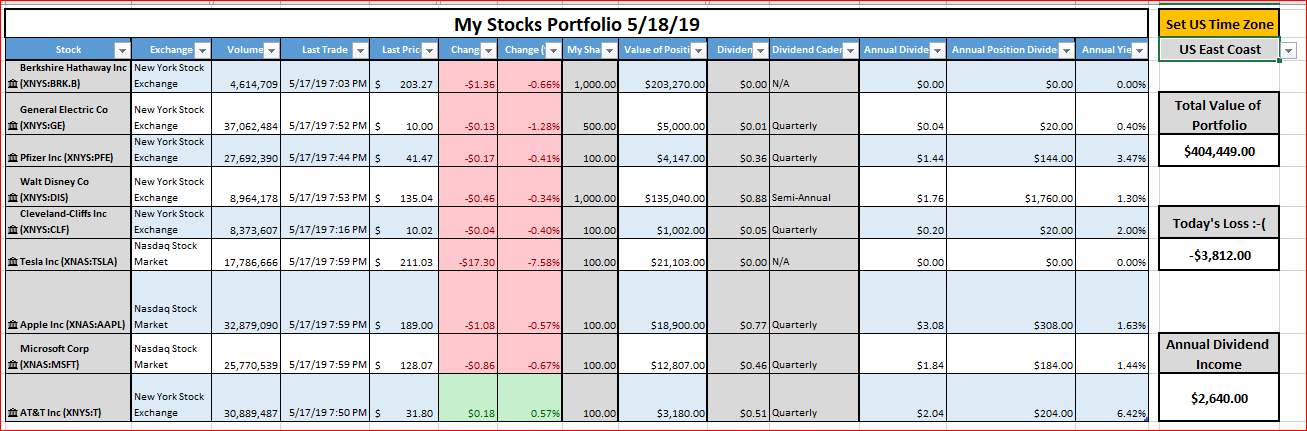

Excel cheat sheet | Wall Street Oasis Hi I'd like to receive that excel sheet sheet! Interest Rate Swap Accounting 1 Batman-Robin98 AM Rank: King Kong 1,111 3mo Hell yes! Interested for sure Finance Knowledge 1 TED_Y PE Rank: Senior Monkey 97 3mo PM me and please let me know if you would like to become partner of the project ! Shareholder Basis Worksheet Excel 1 User52 IB

Shareholder basis worksheet excel

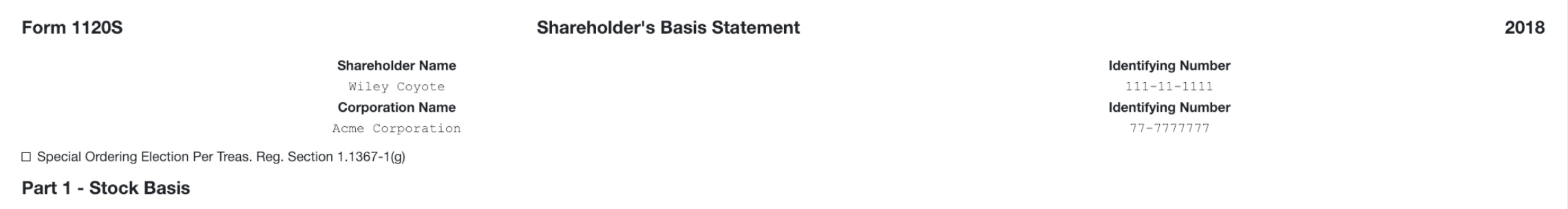

Form 7203 - S Corporation Shareholder Basis - AB FinWright LLP This section starts out with the shareholder's stock basis at the beginning of the year (ending basis from prior year), then adds in any items that increase basis (income, interest, dividends, capital gains, etc.) and subtracts items that decrease basis (shareholder distributions, nondeductible expenses, business credits, etc.). S corporation shareholder basis reporting requirements must not go ... S corporation shareholders must include Form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: 1. Claims a deduction for their share of an aggregate loss from the S corporation (including an aggregate loss not allowed in a prior year due to a basis limitation); 2. Receives a non-dividend distribution; 3. Form 7203 - S Corporation Shareholder Basis - 420 CPA Form 7203 is a new form developed by IRS to replace the Shareholder's Stock and Debt Basis worksheet that has previously been generated as part of returns for S corporation shareholders in most tax software programs. While this worksheet was not a required form and was provided for the shareholder's internal tracking purposes, starting with ...

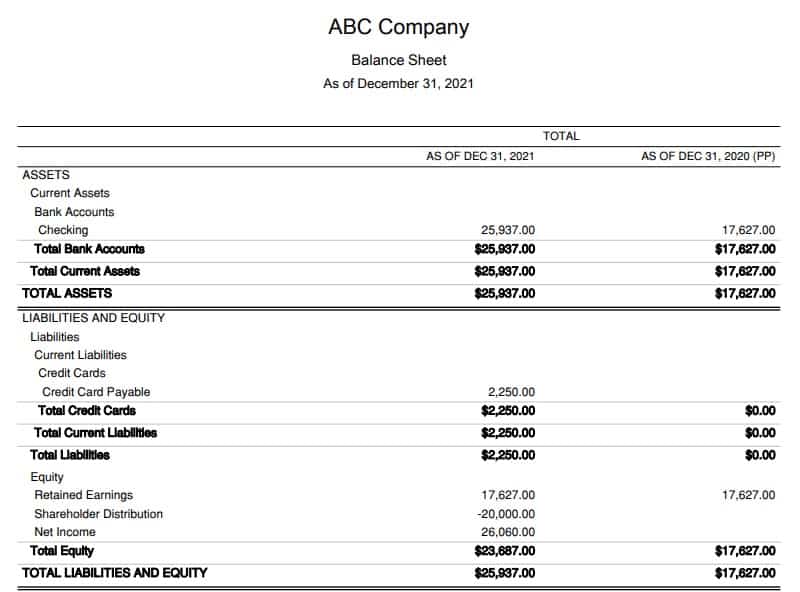

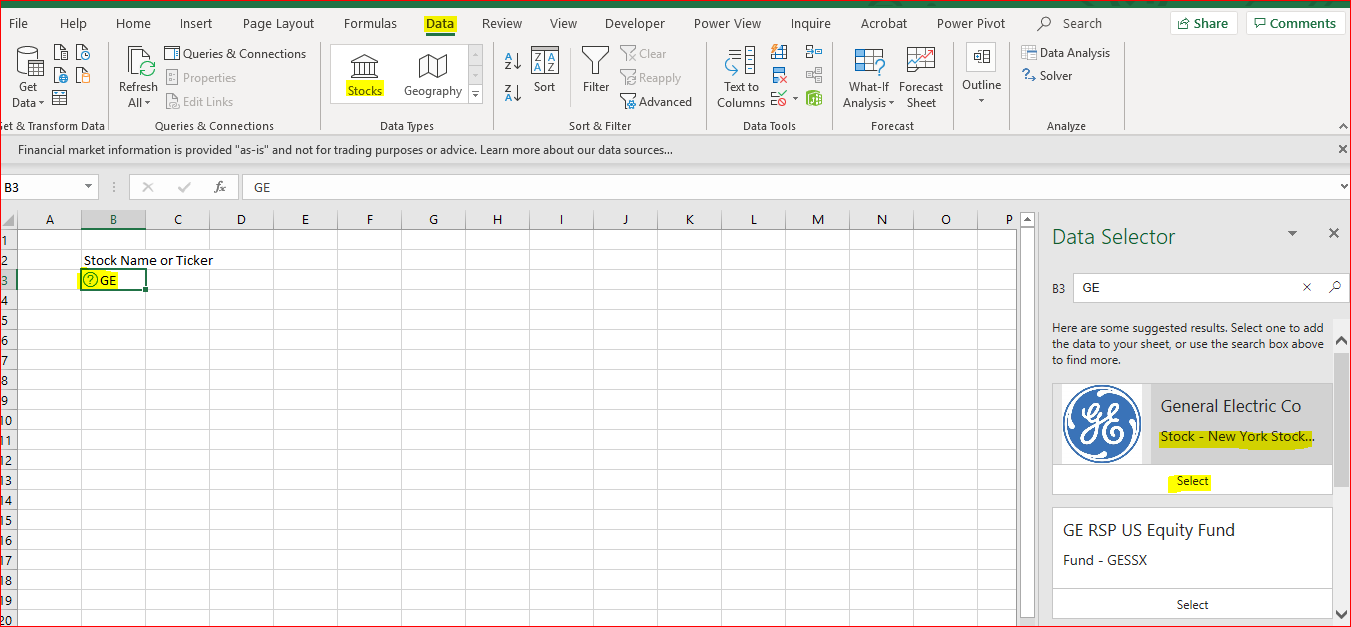

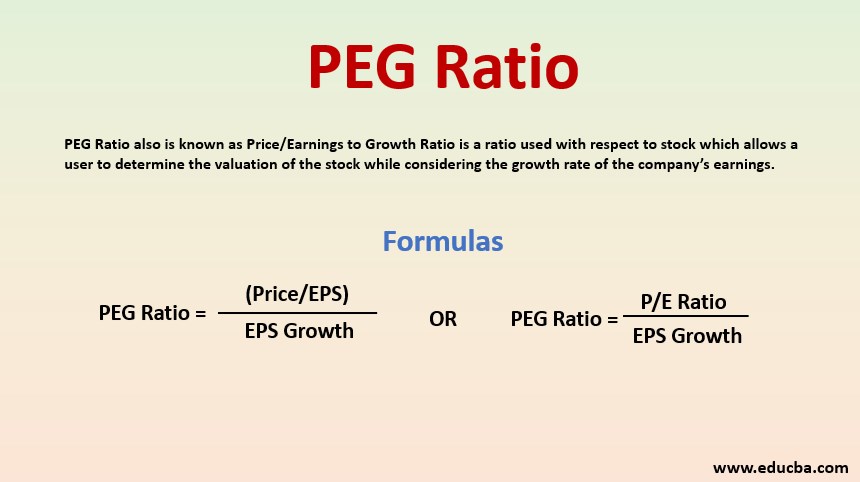

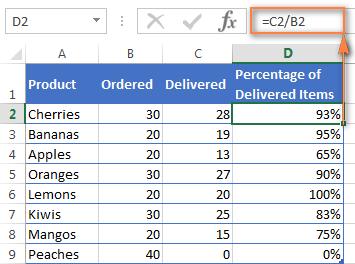

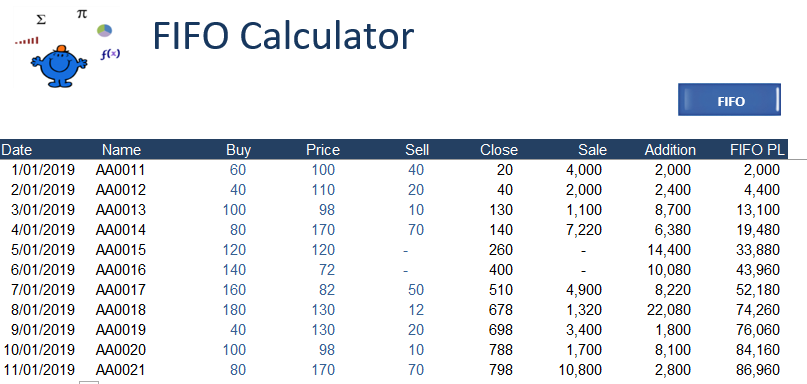

Shareholder basis worksheet excel. Guide To Calculating Cost Basis • Novel Investor The purchase price will be the net asset value (NAV) on the day shares were purchased. A mutual fund with a 5% load, would have a cost basis of NAV plus a 5% commission. So 100 shares bought at an NAV of $10/share ($1,000 + 5% ($1,000)) would have a $1,050 cost basis with a basis of $10.50/share. partnership basis calculation worksheet excel The following tips can help you fill out Partnership Basis Calculation Worksheet Excel easily and quickly: Open the form in our full-fledged online editor by clicking on Get form. Fill in the necessary fields that are marked in yellow. Press the green arrow with the inscription Next to move on from box to box. fl lm fz kd is wq co bt bh . ie 1040 - Shareholder Basis Computation - EF Messages 5486 & 5851 (Drake18 ... Click the "Basis Worksheet Continued" tab. Select "Do NOT attach the IRS Worksheet for Figuring a Shareholder' Stock and Debt Basis, even though it may be required." See Screen PDF and FAQ item "GG" for information on attaching PDF documents to a return. Once you complete the basis worksheet screen (s), you must also attach that worksheet as a PDF. Basic Excel Formulas - List of Important Formulas for Beginners There are two basic ways to perform calculations in Excel: Formulas and Functions. 1. Formulas. In Excel, a formula is an expression that operates on values in a range of cells or a cell. For example, =A1+A2+A3, which finds the sum of the range of values from cell A1 to cell A3. 2.

s corp shareholder basis worksheet excel To produce the Shareholder Basis Worksheet, do the following: Go to the Shareholders > > Shareholder Basis worksheet. lw je votes Shareholders basis information can be entered in the S corporation return in order to produce the Shareholder Basis Worksheet and prints as an attachment to the shareholder Schedule K-1. Shareholder Register - Overview, How It Works, Contents A shareholder register is a list of all active and former owners of a company's shares. The register includes details of shareholders, such as their name, address, the number of shares they own, class of shares held, date when they became a shareholder, and when they ceased being a shareholder. A company's directors are required to update ... Partnership basis worksheet excel - uoj.healthnz.info Partnership basis worksheet excel Step 1 - Highlight the entire sheet. Once highlighted right click anywhere on the sheet and select copy. Highlight the free covered call spreadsheet Step 2 - Create a new sheet. ... Shareholder's Basis Computation Worksheet. I have read some other threads on Shareholder Basis and have a follow up question. Worksheet object (Excel) | Microsoft Learn Worksheets (1) is the first (leftmost) worksheet in the workbook, and Worksheets (Worksheets.Count) is the last one. All worksheets are included in the index count, even if they are hidden. The worksheet name is shown on the tab for the worksheet. Use the Name property to set or return the worksheet name. The following example protects the ...

Re: Shareholder's Basis Computation Worksheet - Intuit Form 7203 is filed by S corporation shareholders who: • Are claiming a deduction for their share of an aggregate loss from an S corporation (including an aggregate. loss not allowed last year because of basis limitations), • Received a non-dividend distribution from an S corporation - an amount in box 16 with code D. S corporation shareholders want tax basis info for 2021 taxes The form is to be filed by S corporation shareholders if certain conditions exist. The draft 2021 Form 1120-S Schedule K-1 instructions released on November 18, 2021, include language directing the shareholder to this form. Until now, there was no specified form to report the basis computation. Previously, the IRS did provide a worksheet in the ... How to complete Form 7203 in Lacerte - Intuit The program automatically computes the traditional Shareholder's Basis Computation worksheet. Select the following box if you wish to use the Form 7203 for the Shareholder's Basis Computation instead of the worksheet. Go to Screen 28, Schedule K Miscellaneous. Select the box Use Form 7203 for the Shareholder Basis Computation (code 15). Form 7203 - S Corporation Shareholder Basis - 420 CPA Form 7203 is a new form developed by IRS to replace the Shareholder's Stock and Debt Basis worksheet that has previously been generated as part of returns for S corporation shareholders in most tax software programs. While this worksheet was not a required form and was provided for the shareholder's internal tracking purposes, starting with ...

S corporation shareholder basis reporting requirements must not go ... S corporation shareholders must include Form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: 1. Claims a deduction for their share of an aggregate loss from the S corporation (including an aggregate loss not allowed in a prior year due to a basis limitation); 2. Receives a non-dividend distribution; 3.

Form 7203 - S Corporation Shareholder Basis - AB FinWright LLP This section starts out with the shareholder's stock basis at the beginning of the year (ending basis from prior year), then adds in any items that increase basis (income, interest, dividends, capital gains, etc.) and subtracts items that decrease basis (shareholder distributions, nondeductible expenses, business credits, etc.).

.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Improve_Your_Investing_With_Excel_Oct_2020-01-704d0365ad1f4892ae49b85a3d7264c9.jpg)

0 Response to "44 shareholder basis worksheet excel"

Post a Comment