38 shareholder basis worksheet excel

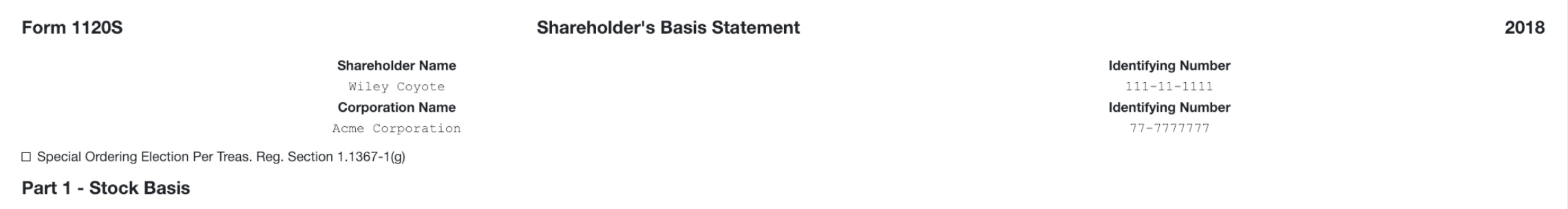

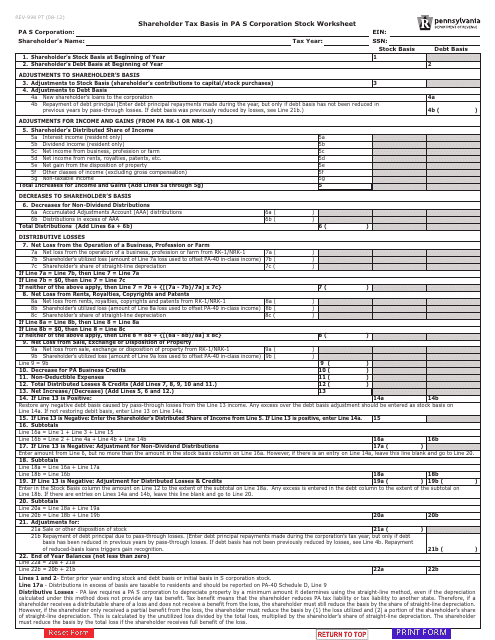

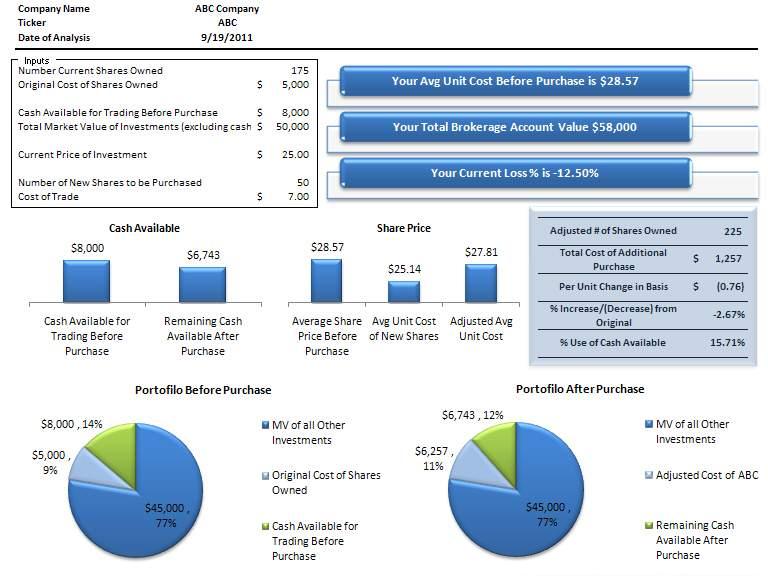

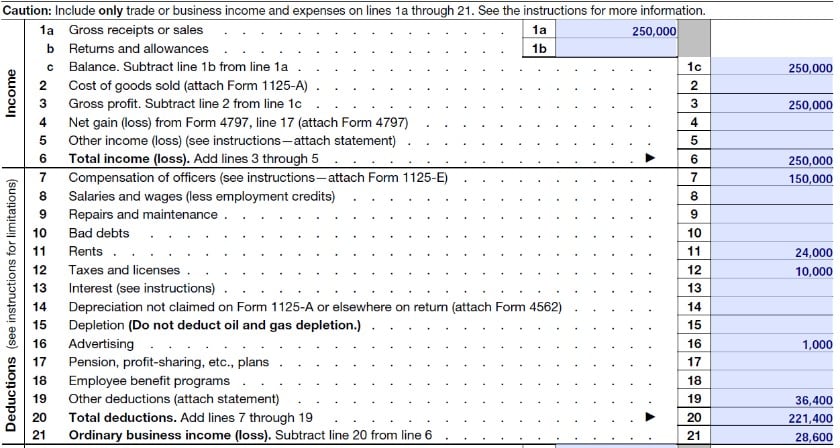

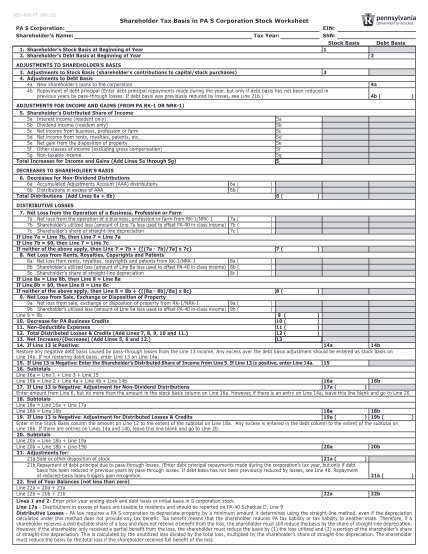

How to calculate shareholder basis in an S Corp? ... the calculation of basis for an S corporation will not purely be calculated by the initial contribution made by shareholders to the corporation. S-Corporation Shareholder Basis distribution, which is contingent on the stock basis. ... Please see the last page of this article for a sample of a Shareholder's Basis Worksheet.

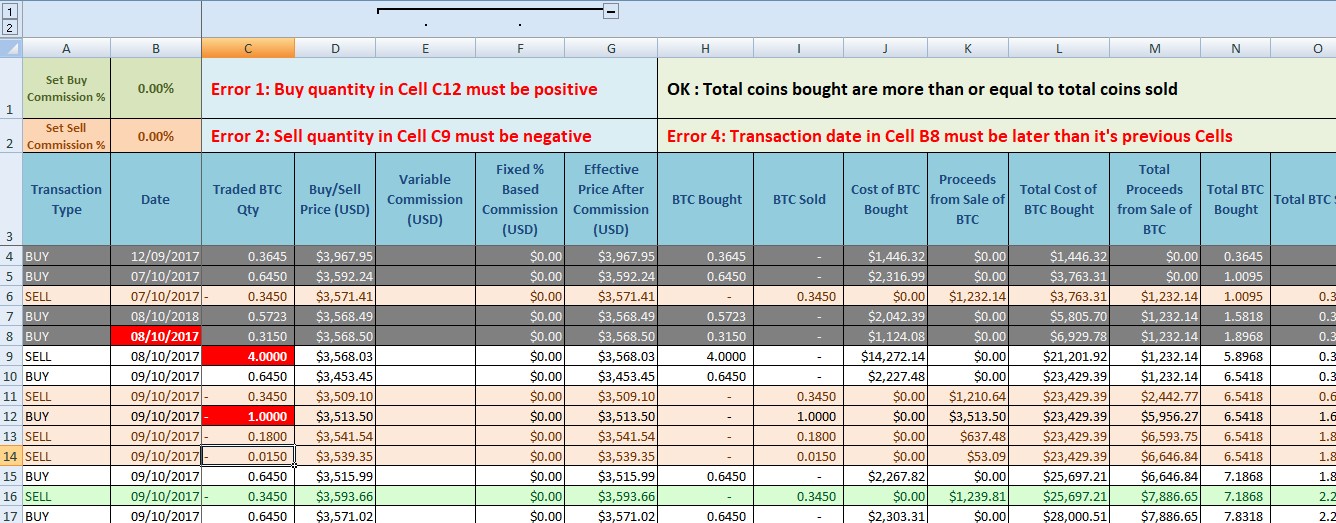

S Corp Basis Worksheet | UpCounsel 2022 An S corp basis worksheet is used to compute a shareholder's basis in an S corporation. Shareholders who have ownership in an S corporation must make a point to ...

Shareholder basis worksheet excel

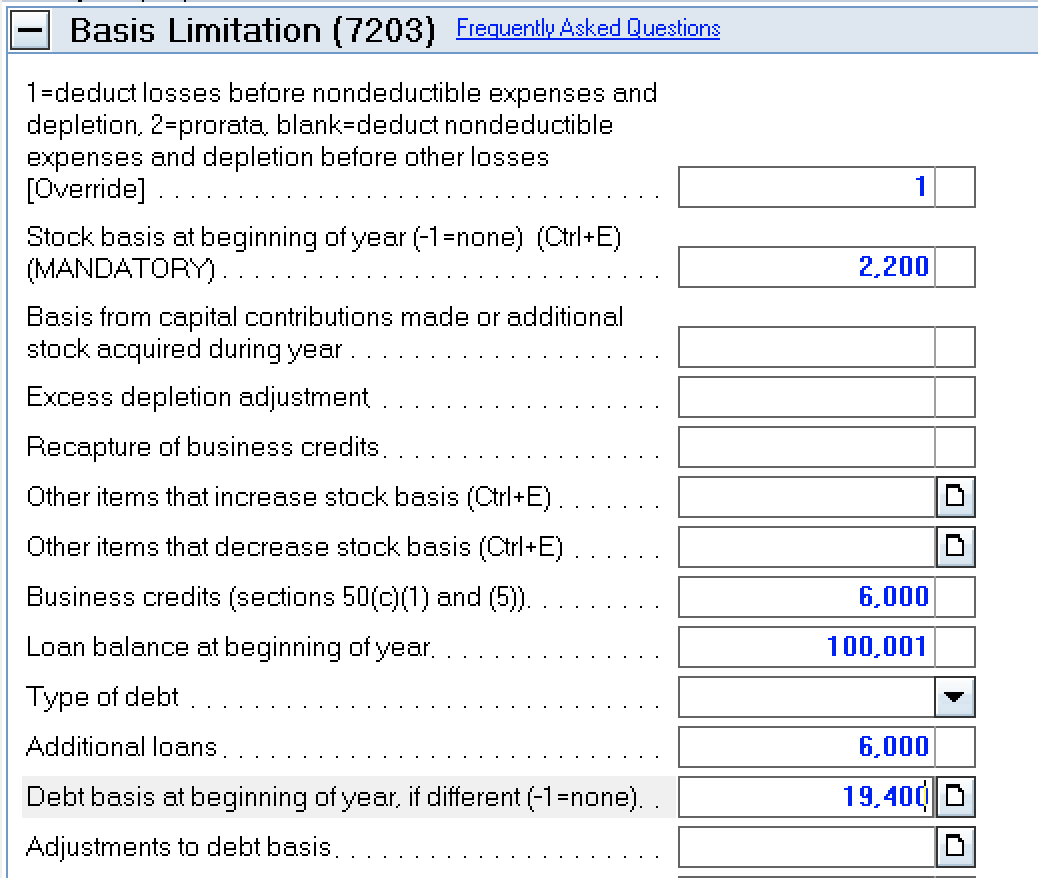

Shareholder's Basis in S Corporation for Tax Year ______ * Payments made on reduced basis loans result in taxable income (See worksheet below) Enter the full loan repayment amount in the Loan Face Amount column. Loan ... S Corp Shareholder Basis Worksheet Excel - pdfFiller Fill S Corp Shareholder Basis Worksheet Excel, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now! Get the up-to-date s corp shareholder basis worksheet excel 2022 now How is shareholder basis calculated in S corp?

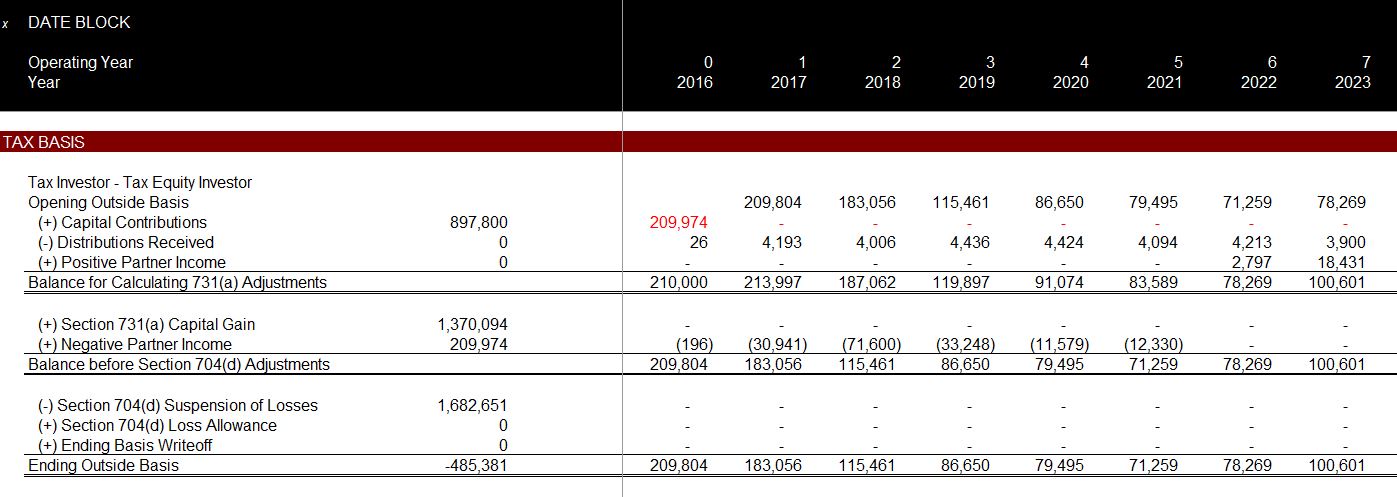

Shareholder basis worksheet excel. S Corporation Shareholder Basis Schedule | Resources - AICPA Among other purposes, shareholder basis will determine how much loss a shareholder can recognize on his or her individual income tax return and whether ... partnership basis calculation worksheet excel: Fill out & sign online Got questions? · How does Basis work in an S Corp? Computing Stock Basis. · What is partnership capital account? · Is partnership basis the same as capital account ... Shareholder's Basis Worksheet - calculation of basis limitation The adjusted basis of the shareholder's stock of the S Corporation is calculated without regard to the shareholder's share of the losses and deductions. 1120S - Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) Use screen Basis Worksheet and Basis Worksheet continued, to calculate a shareholder's new basis after increases and/or decreases are made to basis during the ...

Get the up-to-date s corp shareholder basis worksheet excel 2022 now How is shareholder basis calculated in S corp? S Corp Shareholder Basis Worksheet Excel - pdfFiller Fill S Corp Shareholder Basis Worksheet Excel, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now! Shareholder's Basis in S Corporation for Tax Year ______ * Payments made on reduced basis loans result in taxable income (See worksheet below) Enter the full loan repayment amount in the Loan Face Amount column. Loan ...

.png)

0 Response to "38 shareholder basis worksheet excel"

Post a Comment