44 sec 1031 exchange worksheet

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet. XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031 Corporation Exchange Professionals - Qualified Intermediary for ...

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Sec 1031 exchange worksheet

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary Exchanges Under Code Section 1031 - American Bar Association Exchanges Under Code Section 1031 What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings. The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) The new property you've targeted is only priced at $750,000. You're now undertaking a partial 1031 exchange, since you're not reinvesting all the proceeds from the sale of your relinquished property. That excess $250,000 is considered cash boot, and is subject to capital gains taxes as well as depreciation recapture.

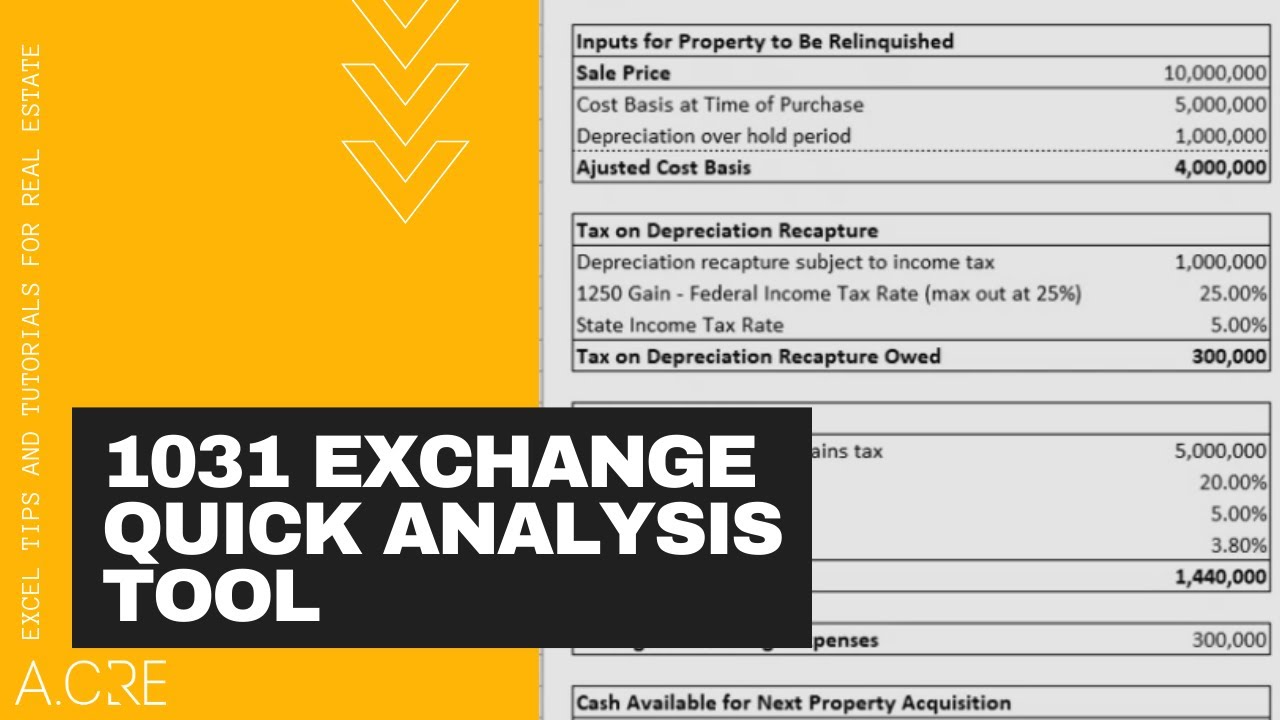

Sec 1031 exchange worksheet. 1033 exchange worksheet 1031 Exchange Calculation Worksheet - Worksheet List nofisunthi.blogspot.com. 1031. 30 Sec 1031 Exchange Worksheet - Worksheet Project List isme-special.blogspot.com. worksheet exchange 1031 example summary property 1040 kind smart sec completing business accountants worksheets. 29 Sec 1031 Exchange Worksheet - Notutahituq Worksheet Information 1031 Exchange with Multiple Properties [Explained A-to-Z] Rules for ... A 1031 exchange is that tailor-made answer. You can relocate and diversify your real property investments. All in a tax-deferred exchange, you can leverage new market conditions. At the same time there's improved cash flow and potentially accelerated appreciation. Instructions for Form 8824 (2022) | Internal Revenue Service Exchanges limited to real property. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Definition of real property, later, for more details. Publication 550 (2021), Investment Income and Expenses Line 7; also use Form 8949, Schedule D, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet: Gain or loss from exchanges of like-kind investment property : Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in …

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms taxpayer exchanges for like-kind property of lesser value. This fact sheet, the 21. st in the Tax Gap series, provides additional guidance to taxpayers regarding the rules and regulations governing deferred like-kind exchanges. Who qualifies for the Section 1031 exchange? Owners of investment and business property may qualify for a Section 1031 ... Get the free 1031 exchange worksheet 2019 form - pdfFiller Form Popularity 1031 exchange worksheet form Get, Create, Make and Sign 1031 exchange excel spreadsheet download Get Form eSign Fax Email Add Annotation 1031 Exchange Worksheet Excel is not the form you're looking for? Search for another form here. Comments and Help with sec 1031 exchange worksheet . ... ... ... Taxpayer. Replacement Property. Microsoft says a Sony deal with Activision stops Call of Duty … 21/10/2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and Real Estate: 1031 Exchange Examples - SmartAsset You use the total profit from the sale at $400,000 and take out a new loan worth $600,000. With this, you meet the 1031 exchange requirements. Example 4: Partial 1031 Exchange. It's actually possible to sell an investment property and satisfy the 1031 exchange rules without using all of your sale proceeds. This is called a partial exchange.

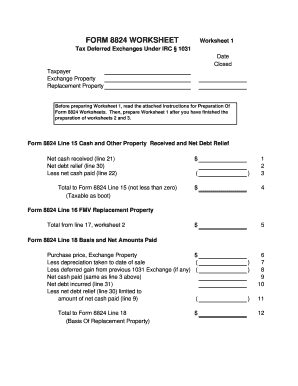

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) PlayStation userbase "significantly larger" than Xbox even if … 12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... 1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 Replacement Property received.....(=)$ _____ 4.2 Allocation of basis between two or more §1031 Replacement Properties: a.Identification: _____

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

1031 exchange worksheet 29 Sec 1031 Exchange Worksheet - Notutahituq Worksheet Information notutahituq.blogspot.com. 1031 irs. 1031 Exchange | Discover 1031 Investment Rules . 1031 exchange rules estate real taxes exchanges process realty island isle sea does reasons seller properties.

What Is a 1031 Exchange? Know the Rules - Investopedia A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. The term—which gets its name from Section 1031 of the Internal...

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

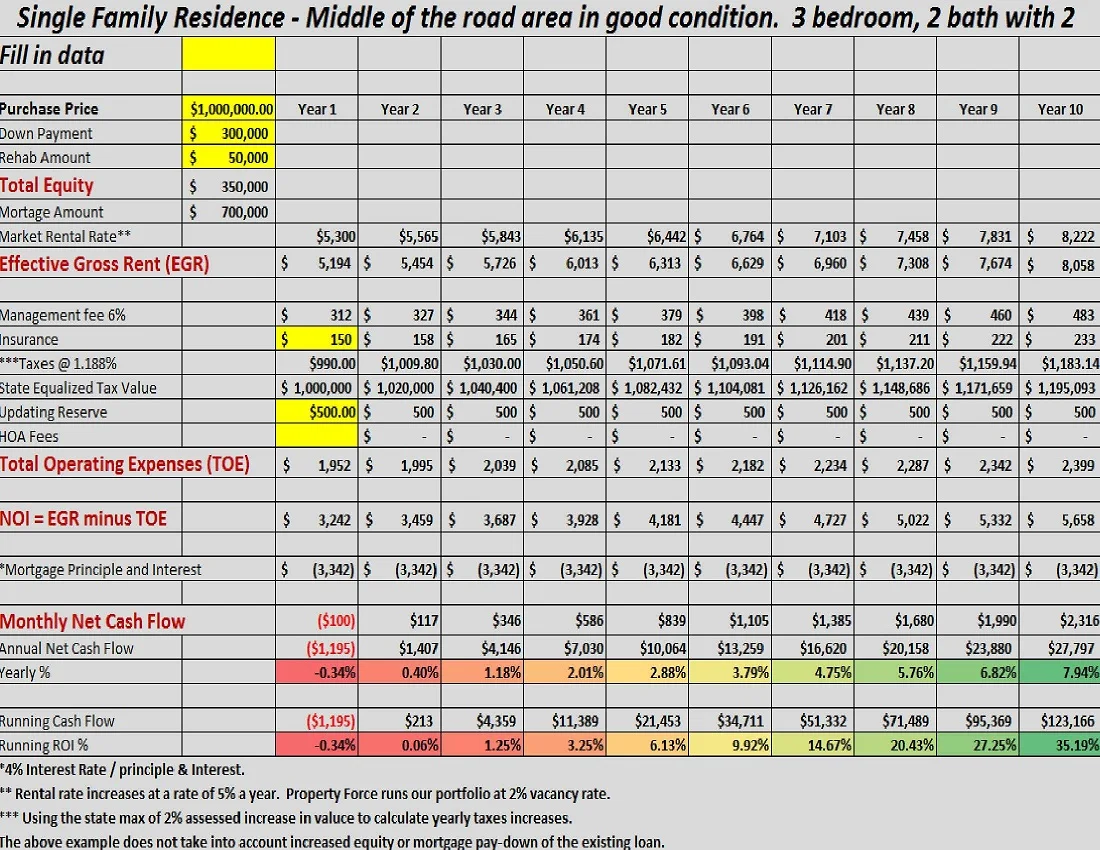

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

Like-kind exchanges of real property - Journal of Accountancy If the changes proposed under the American Families Plan are assumed in this example to have been enacted, we can observe that the tax benefits of exercising a like-kind exchange are drastically diminished. The taxpayer pays $198,000 less in tax using a Sec. 1031 exchange versus an outright sale, a significant reduction from the $378,870 in tax savings that would accrue from using a like-kind ...

1031 Exchange Calculator | Calculate Your Capital Gains 1031 Exchange Calculator | Calculate Your Capital Gains Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange.

Accounting for 1031 Like-Kind Exchange - BKPR A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment. Personal Property Not Qualified for Like-Kind Exchange

Capital gains tax in the United States - Wikipedia The Commission's final report took the same approach as the 1986 reform: eliminate the preferential tax rate for long-term capital gains in exchange for a lower top rate on ordinary income. The tax change proposals made by the National Commission on Fiscal Responsibility and Reform were never introduced.

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Explained In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property).

IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ...

What Expenses Are Deductible in a 1031 Exchange? Total Allowable Exchange Expenses $137,915.00 REPLACEMENT PROPERTY $ AMOUNT IF TAXPAYER WANTS TO DEFER ALL TAXES IS: $2,162,085.00. How did we arrive at that figure? Sales Price of $2,300,000.00 less $137,915.00 in allowable exchange expenses = $2,162,085.00. Non-Allowed Exchange Expenses: Real Estate Taxes $ 26,500.00 Loan Payoff $ 455,000.00

PPIC Statewide Survey: Californians and Their Government 26/10/2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in ten likely voters are …

U.S. appeals court says CFPB funding is unconstitutional - Protocol 20/10/2022 · The 5th Circuit Court of Appeals ruling sets up a major legal battle and could create uncertainty for fintechs.

Privacy Impact Assessments - PIA | Internal Revenue Service Jan 24, 2022 · POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification

Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14/10/2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

1031 Exchange Examples | 2022 Like Kind Exchange Example By utilizing a 1031 exchange, Ron and Maggie may defer 37.3% in taxes and preserve all of the profit from the sale of their property. This means they have more than $600,000 in additional equity to reinvest! How Much Time do I Have? There are two critical deadlines; If you miss either, you will owe taxes.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

May 2021 National Occupational Employment and Wage Estimates 31/03/2022 · Occupation code Occupation title (click on the occupation title to view its profile) Level Employment Employment RSE Employment per 1,000 jobs Median hourly wage

Unbanked American households hit record low numbers in 2021 25/10/2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

1031 Exchange and Depreciation Recapture Explained A-to-Z - PropertyCashin Sold later absent an 1031 Exchange for $585,000, e.g. capital gains and depreciation recapture taxes apply to the $120,000 gain ($585,000 minus $465,000 cost basis). [2] Depreciation to be recapture is the amount expensed annually in total, say $25,000 over two full years ($490,000 ÷ 39-year property times 2 years).

Microsoft is building an Xbox mobile gaming store to take on … 19/10/2022 · Microsoft is quietly building an Xbox mobile platform and store. The $68.7 billion Activision Blizzard acquisition is key to Microsoft’s mobile gaming plans.

Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200.

Calculating Basis of New Property in a 1031 Exchange - Sera Capital You complete the exchange by purchasing a $500,000 property with a mortgage of $250,000. In this case, you calculate your new basis by taking the original property's adjusted basis ($170,000), adding your new mortgage ($250,000), and subtracting the original property's outstanding mortgage ($150,000). This gives you a new tax basis of $270,000.

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) The new property you've targeted is only priced at $750,000. You're now undertaking a partial 1031 exchange, since you're not reinvesting all the proceeds from the sale of your relinquished property. That excess $250,000 is considered cash boot, and is subject to capital gains taxes as well as depreciation recapture.

Exchanges Under Code Section 1031 - American Bar Association Exchanges Under Code Section 1031 What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings.

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

0 Response to "44 sec 1031 exchange worksheet"

Post a Comment