41 sec 1031 exchange worksheet

PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 Replacement Property received.....(=)$ _____ 4.2 Allocation of basis between two or more §1031 Replacement Properties: a.Identification: _____ 1031worksheet - Learn more about 1031 Worksheet In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property). The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property ...

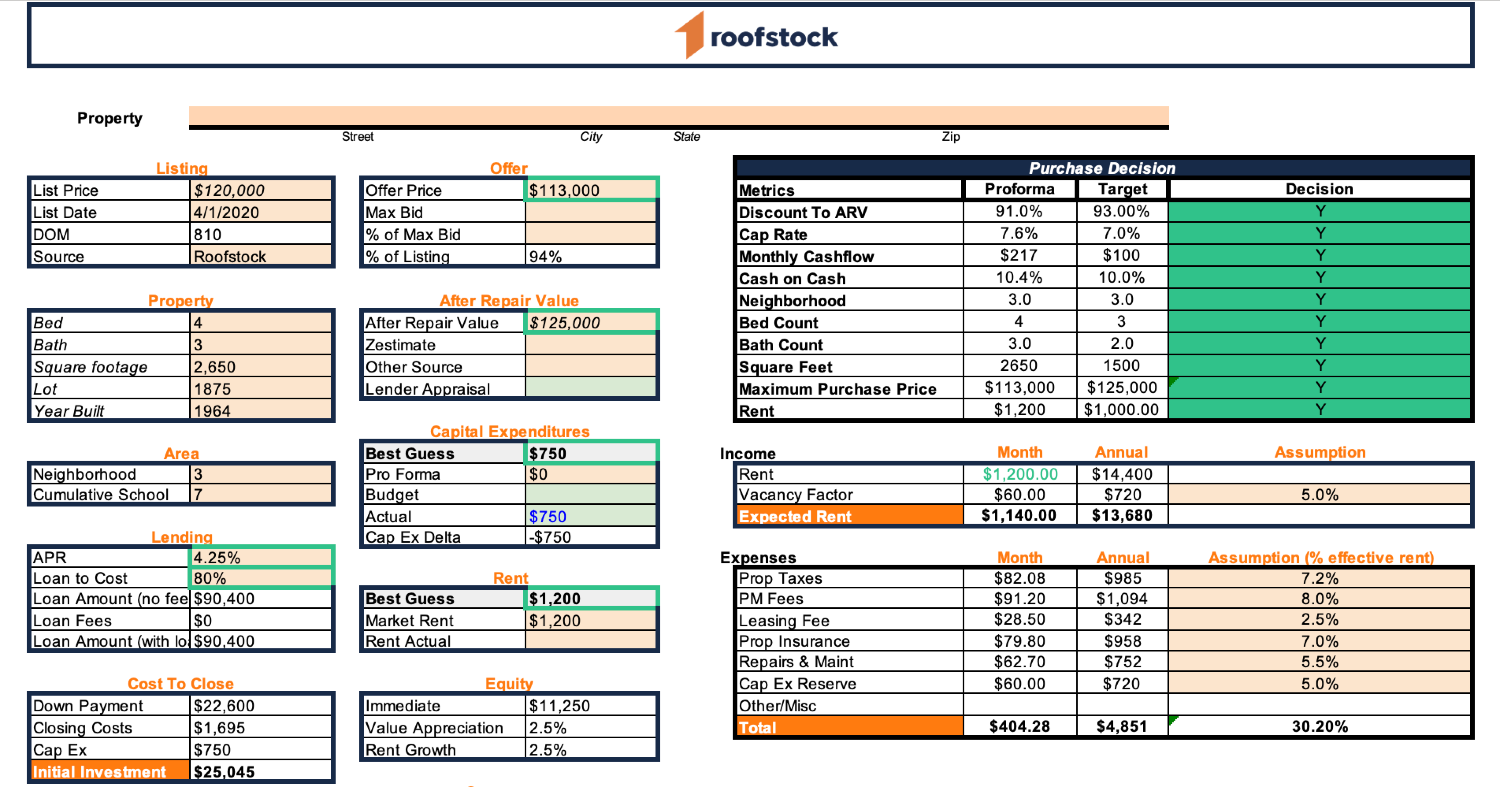

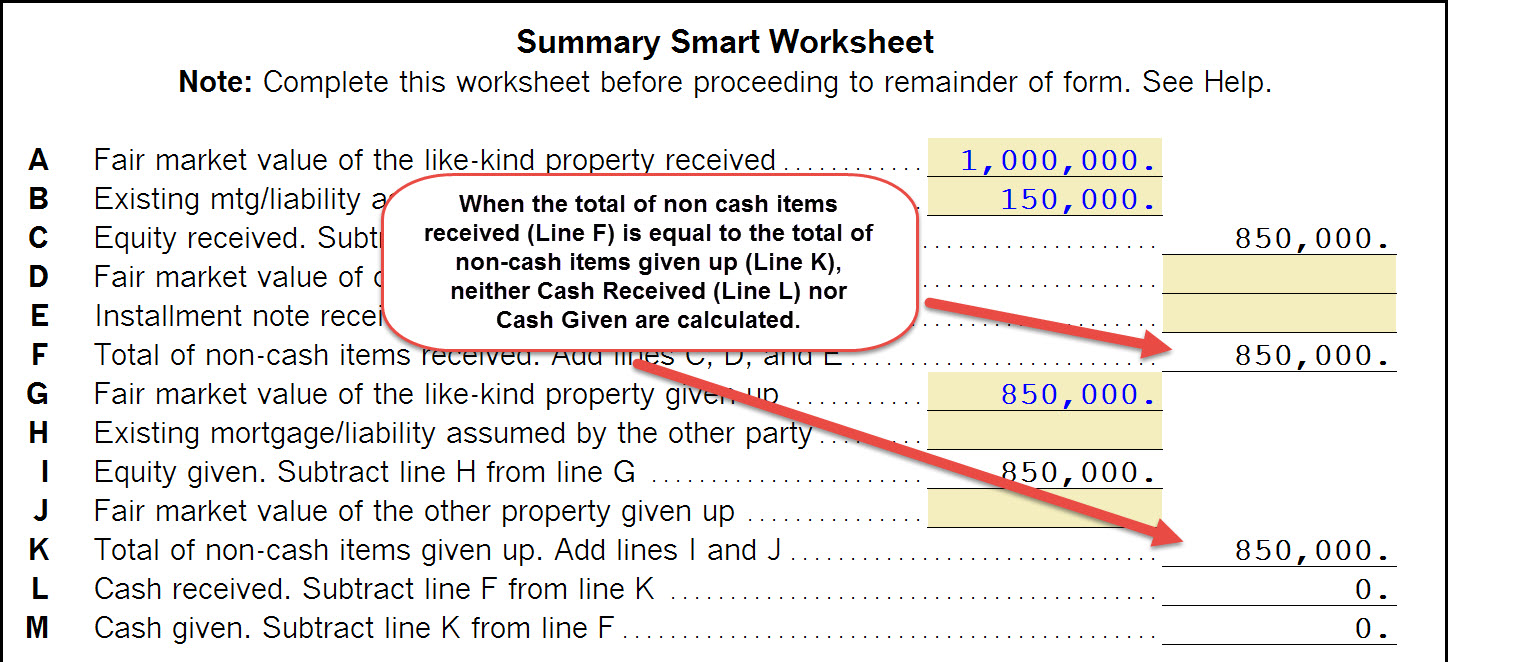

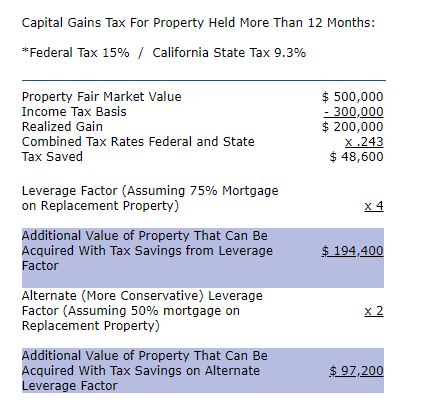

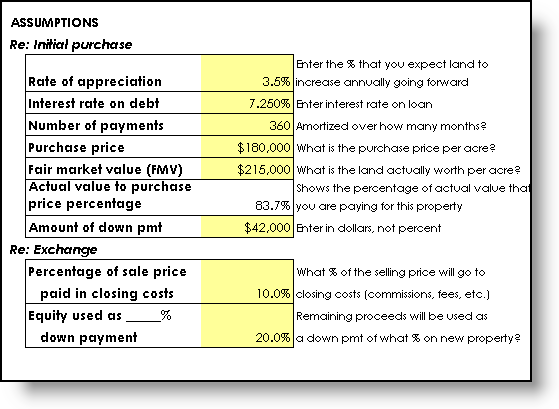

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

Sec 1031 exchange worksheet

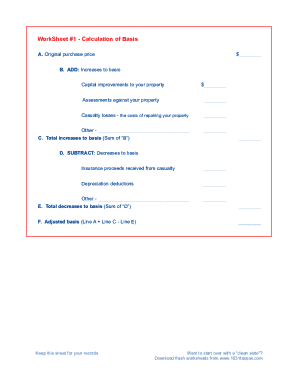

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary 1031 Exchange Calculation Worksheet And Sec 1031 ... - Pruneyardinn We always attempt to reveal a picture with high resolution or with perfect images. 1031 Exchange Calculation Worksheet And Sec 1031 Exchange Worksheet can be beneficial inspiration for those who seek an image according specific topic, you can find it in this site. Finally all pictures we have been displayed in this site will inspire you all.

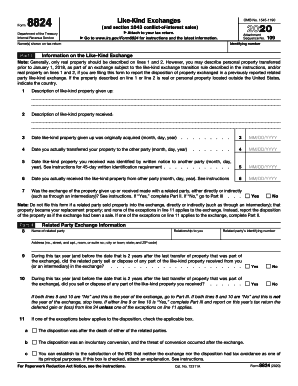

Sec 1031 exchange worksheet. 1031 Exchange Calculator | Calculate Your Capital Gains Restart & Clear Fields (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031 Corporation Exchange Professionals - Qualified Intermediary for ... Exchanges Under Code Section 1031 - American Bar Association What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings. Instructions for Form 8824 (2022) | Internal Revenue Service Exchanges limited to real property. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Definition of real property, later, for more details.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheets 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheets 4, 5 & 6 ... Lines 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 IRS 1031 Exchange Worksheet And Section 1031 Exchange ... - Pruneyardinn IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet can be beneficial inspiration for those who seek an image according specific categories, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all. Thank you for visiting. sec 1031 exchange worksheet 29 Sec 1031 Exchange Worksheet - Notutahituq Worksheet Information notutahituq.blogspot.com. 1031 tax. 1031 Like Kind Exchange Worksheet - Ivuyteq ivuyteq.blogspot.com. exchange 1031 kind worksheet entering wizard using. The Weaver CPA Firm, Folsom, CA| Real Estate Tax And Consulting Page | X PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

26 U.S. Code § 1031 - Exchange of real property held for productive use ... Paragraph (2)(D) of section 1031(a) of the Internal Revenue Code of 1986 [formerly I.R.C. 1954] (as amended by subsection (a)) shall not apply in the case of any exchange pursuant to a binding contract in effect on March 1, 1984, and at all times thereafter before the exchange. PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms taxpayer exchanges for like-kind property of lesser value. This fact sheet, the 21. st in the Tax Gap series, provides additional guidance to taxpayers regarding the rules and regulations governing deferred like-kind exchanges. Who qualifies for the Section 1031 exchange? Owners of investment and business property may qualify for a Section 1031 ... The Treasury Department and IRS issue final regulations regarding like ... IR-2020-262, November 23, 2020. WASHINGTON —- Today the Treasury Department and Internal Revenue Service issued final regulations relating to section 1031 like-kind exchanges. These final regulations address the definition of real property under section 1031 and also provide a rule addressing the receipt of personal property that is incidental to real property received in a like-kind exchange. 1031 Exchange Examples | 2022 Like Kind Exchange Example Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this:

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

️1031 Exchange Worksheet Excel Free Download| Qstion.co 1031 Exchange Worksheet Excel Master Of This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 replacement property received. (=)$ _____ 4.2 allocation of basis between two or more §1031 replacement properties:

1031 Exchange Calculation Worksheet And Sec 1031 ... - Pruneyardinn We always attempt to reveal a picture with high resolution or with perfect images. 1031 Exchange Calculation Worksheet And Sec 1031 Exchange Worksheet can be beneficial inspiration for those who seek an image according specific topic, you can find it in this site. Finally all pictures we have been displayed in this site will inspire you all.

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

0 Response to "41 sec 1031 exchange worksheet"

Post a Comment