39 irs form 886 a worksheet

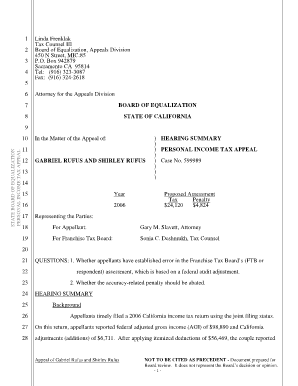

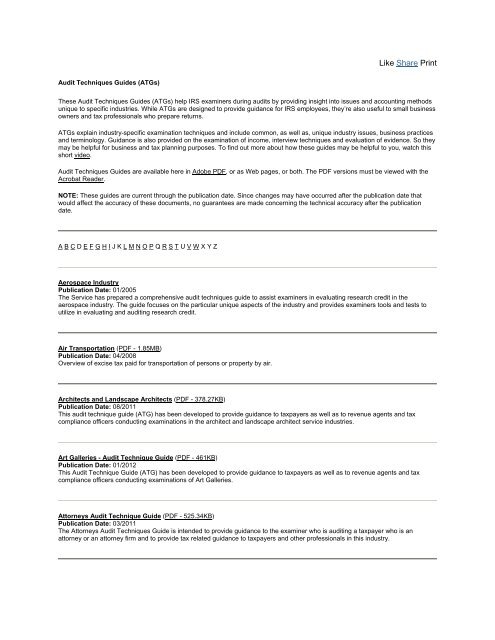

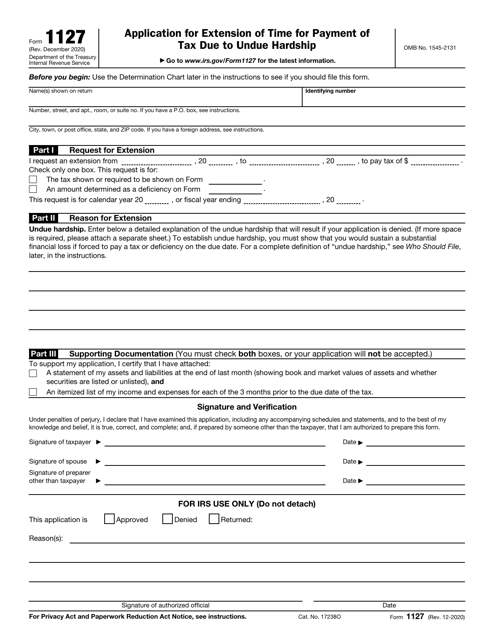

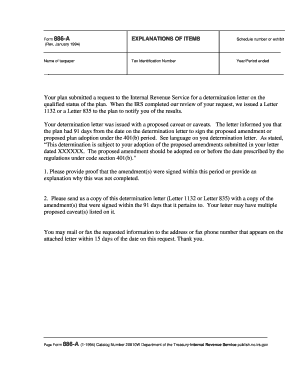

Section 9. Statutory Notices of Deficiency - IRS tax forms WebJul 04, 2015 · Standard paragraphs are used to explain the adjustments, including statutory adjustments, on the Form 886-A, Explanation of Items, (or equivalent), whenever possible. For a delinquent tax return, the TC 160/166 (Failure to File penalty), the prepayment credits and the date the return was received agree with the RGS penalty schedule. Section 6. Specific Claims and Other Issues - IRS tax forms Jill Maple files a Form 1040-X as a partner (directly or indirectly) in TEFRA Partnership ABC and received amended Schedule K-1 for tax year 2010. The amended Schedule K-1 reflects a credit or loss. The Form 1040-X amended return for Jill has Letter "4505-A/AAR" or "Letter 4505-E" written on the top of the return and a copy of the letter attached.

Publication 559 (2021), Survivors, Executors, and Administrators WebA worksheet to reconcile amounts reported in the decedent's name on information returns including Forms W-2, Wage and Tax Statement; 1099-INT, Interest Income; 1099-DIV, Dividends and Distributions; etc. ... and the court certificate has already been filed with the IRS, attach Form 1310 and write “Certificate Previously Filed” at the bottom ...

Irs form 886 a worksheet

va state employee salaries 2022 WebAnd now, for fiscal year 2022, which began July 1, we’ve added new information for almost 50,000 state employees . Still to come: 2022 salary information for the City and County of Honolulu and. U. Va.Faculty & Staff Salaries 2021. Data is as of August 2021,. The Law Enforcement(LEO) payscale for Virginia, updated for year 2022.Toggle navigation … Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; 4.61.13 Dual Consolidated Losses | Internal Revenue Service - IRS tax forms WebJul 23, 2020 · The issue team should prepare a Form 886–A in addition to the Form 5701. The Form 886–A attached to the Form 5701 should: Reference the recapture of the DCL as reported on the return.

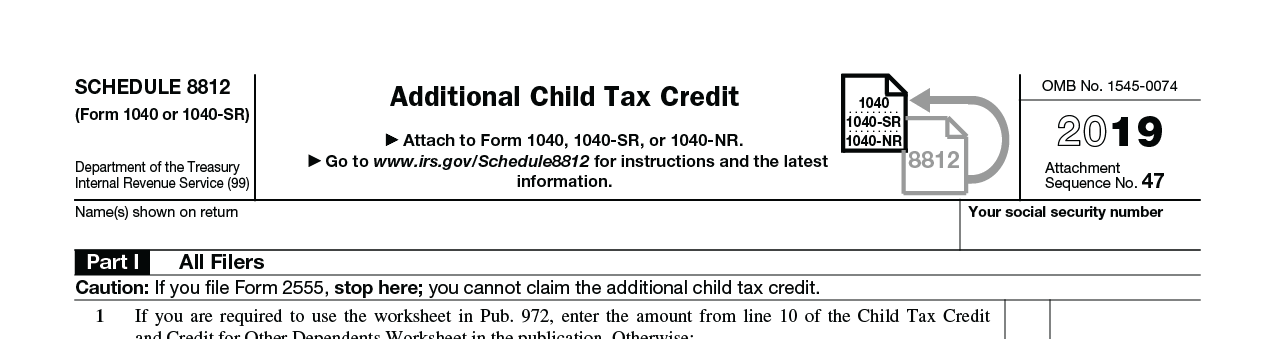

Irs form 886 a worksheet. Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... 21.6.1 Filing Status and Exemption/Dependent Adjustments - IRS tax forms WebOct 18, 2021 · Joe, Jr. must file a Form 1040X to amend his original return. He uses the Standard Deduction Worksheet for Dependents that is included in the instructions for the Form 1040 to compute his standard deduction. To process his Form 1040X, input a TC 290 for the amount of tax change and IRN 886 for the amount of taxable income change with … Part 20. Penalty and Interest - IRS tax forms WebFeb 07, 2012 · Form 886-A, which references each adjustment and gives the reason(s) for each adjustment; or ... A 1999 tax return is filed on April 15, 2000. The IRS received a Form 1040X on May 3, 2002, with a liability of $998, due to unreported income. ... Worksheet and refer to instructions in IRM 8.20.6.17.3(10) (b). The following "if and then" table ... Letter or Audit for EITC | Internal Revenue Service Mar 28, 2022 · An incorrect information from a tax table, worksheet, schedule or form; Note: If you are or were required to file Form 8862 PDF or Form 8862-SP PDF or your EITC, CTC/ACTC or AOTC was previously disallowed and now you want to claim the credit(s), see My EITC, CTC/ACTC or AOTC was Disallowed Previously and Now I Want To Claim the Credit.

Pa department of revenue payment - boxbabes.shop WebFeb 15, 2022 · Web. Electronic payment using Revenue Online . Choose to pay directly from your bank account or by credit card. Mail a check or money order to: Oregon Department of Revenue PO Box 14725 Salem OR 97309-5018; By phone with credit, debit, or prepaid card (American Express not accepted): (503) 945-8199 or (877) 222-2346 TTY: (800) 886 … Operational Research - Winston Wayne - Academia.edu WebEnter the email address you signed up with and we'll email you a reset link. 2021 Instructions for Schedule A (2021) | Internal Revenue ... WebSee the instructions for line 1 of the worksheet to figure your 2021 income. The family size column refers to the number of dependents listed on page 1 of Form 1040 or Form 1040-SR (and any continuation sheets) plus you and, if you are filing a joint return, your spouse. 4.61.13 Dual Consolidated Losses | Internal Revenue Service - IRS tax forms WebJul 23, 2020 · The issue team should prepare a Form 886–A in addition to the Form 5701. The Form 886–A attached to the Form 5701 should: Reference the recapture of the DCL as reported on the return.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; va state employee salaries 2022 WebAnd now, for fiscal year 2022, which began July 1, we’ve added new information for almost 50,000 state employees . Still to come: 2022 salary information for the City and County of Honolulu and. U. Va.Faculty & Staff Salaries 2021. Data is as of August 2021,. The Law Enforcement(LEO) payscale for Virginia, updated for year 2022.Toggle navigation …

0 Response to "39 irs form 886 a worksheet"

Post a Comment