39 income tax worksheet excel

Supplemental Income and Loss (From rental real estate, … WebPart I Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use. Schedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A. Did you make any payments in 2022 that would require you to file Form(s) 1099? Tips on Rental Real Estate Income, Deductions and Recordkeeping WebOct 27, 2022 · All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned. As a cash basis taxpayer you generally deduct your rental expenses …

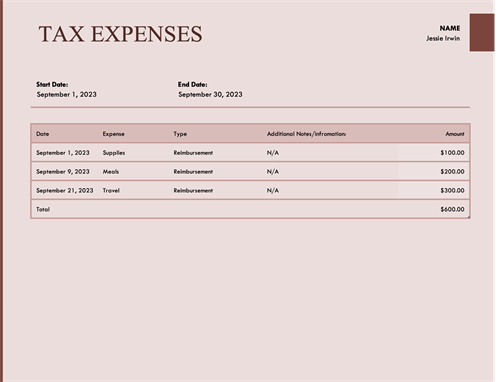

Rental Income and Expense Worksheet - PropertyManagement.com WebRental Income and Expense Worksheet. Between maintaining your properties, communicating with tenants, and bookkeeping, there's no question that being a landlord keeps you busy. ... we’ve created a free Google Sheet / Excel worksheet that you can use to track monthly rental income, expenses, fees, insurance policies, and more.

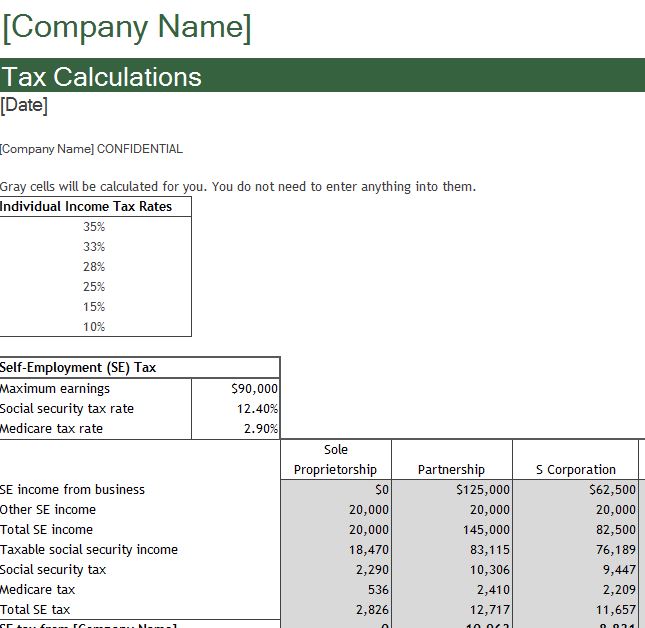

Income tax worksheet excel

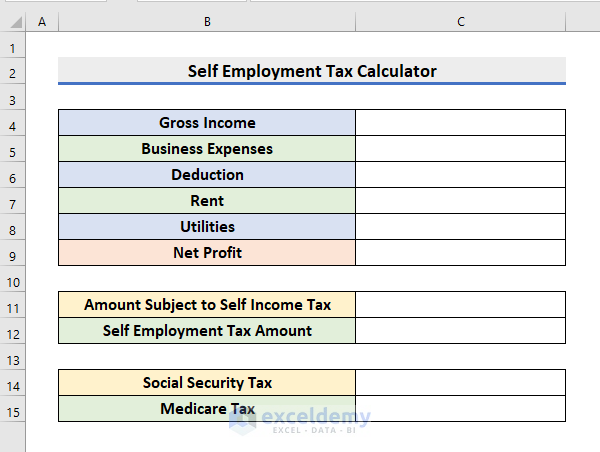

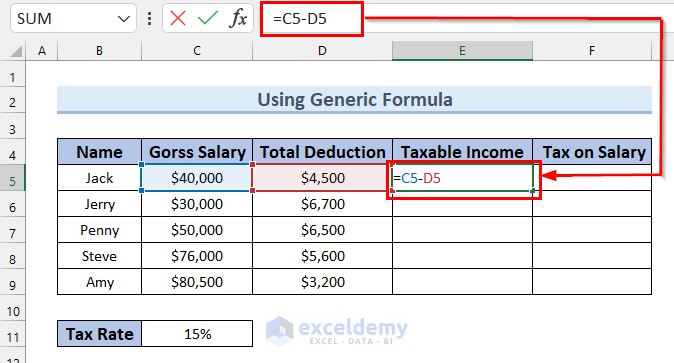

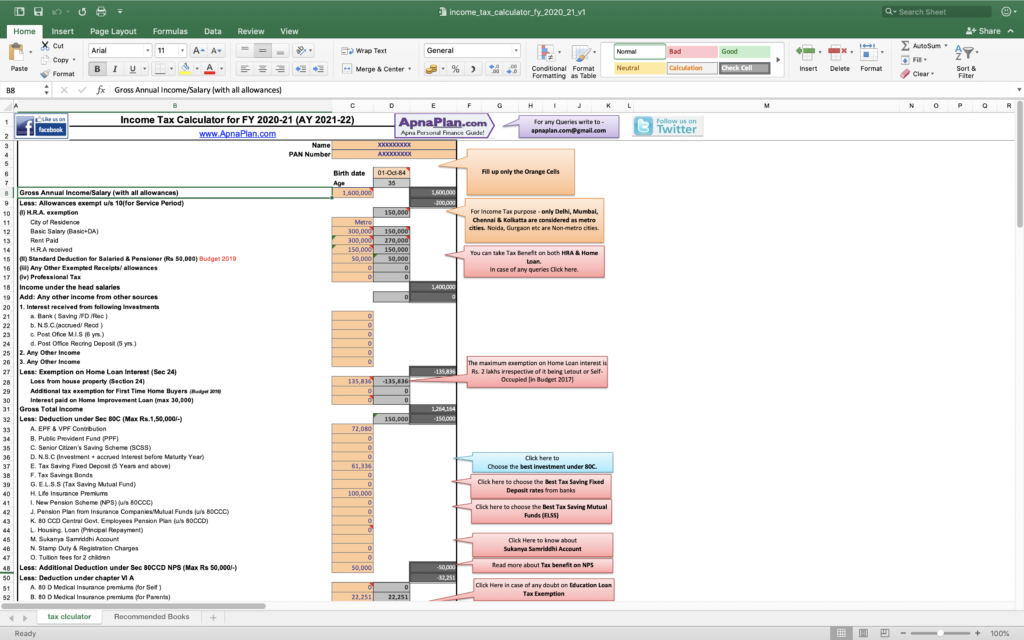

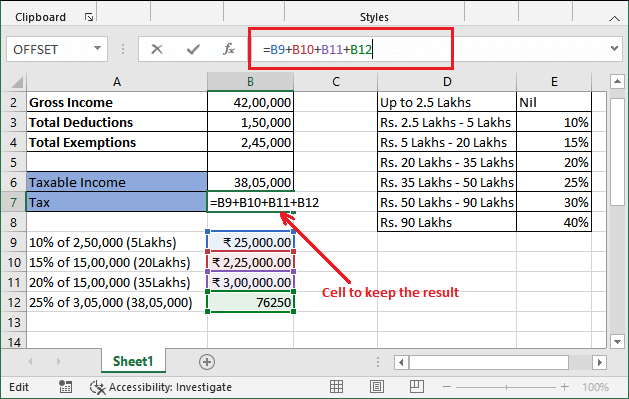

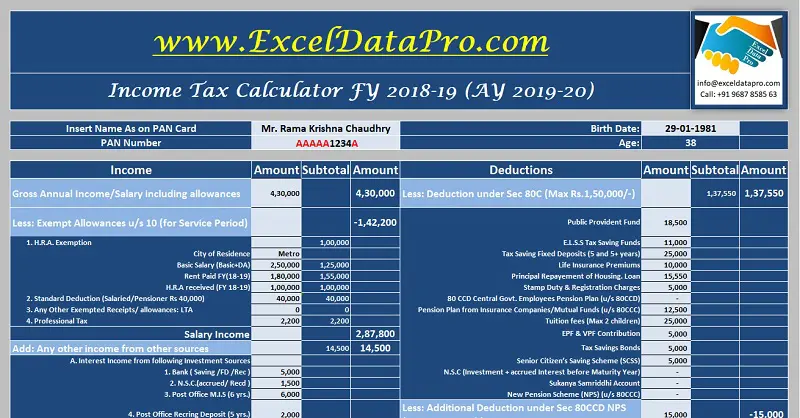

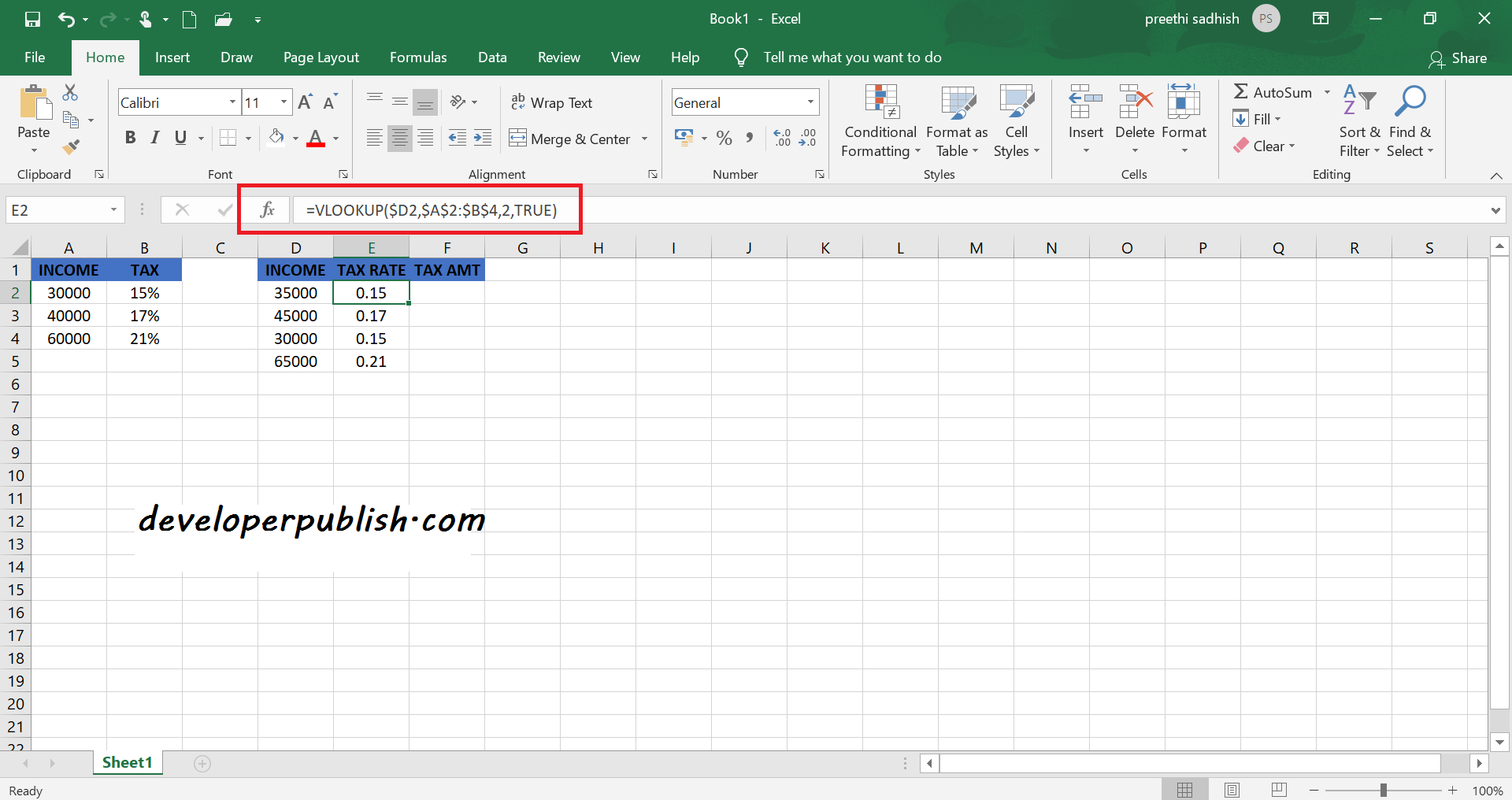

Download Free Federal Income Tax Templates In Excel WebSchedule B Calculator is an excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for federal income tax. Interests and dividend incomes received during a tax year are reported in Schedule B. Income tax calculating formula in Excel - javatpoint WebWe have prepared this Excel worksheet to calculate income tax on different ranges of income. These all given incomes are taxable income. Calculate tax on Martina's Salary: 380000. Step 1: To calculate the tax on Martina's income, select the C10 cell to keep the result and write the following IF formula in the formula bar. Income Tax Formula - Excel University WebDec 31, 2014 · Please kindly help me calculate the Tax Amount this problem with all or one techniques in Excel. Chargeable income is $2473 Tax Table Chargeable income. Tax rate 1st $240. Free Next $240. 5% Next $1200. 10% Exceeding $1200. 17.5%. Best regards.

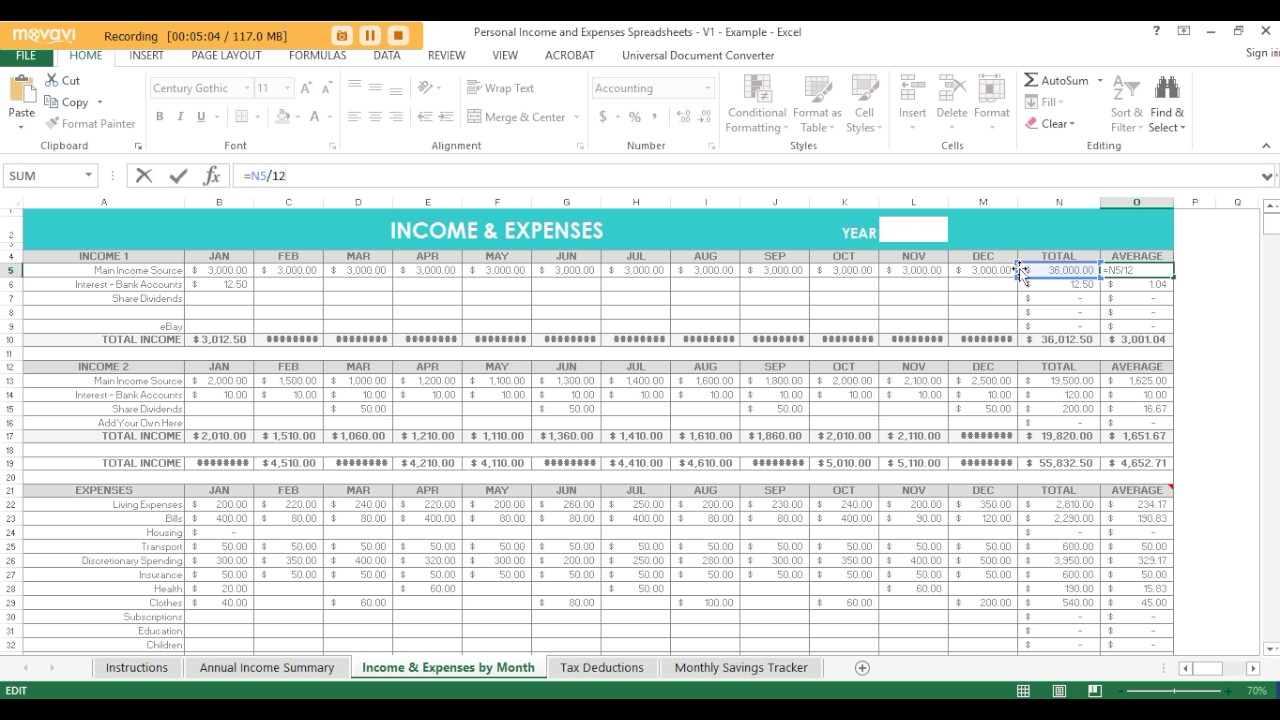

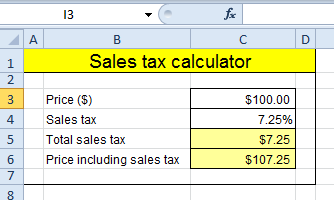

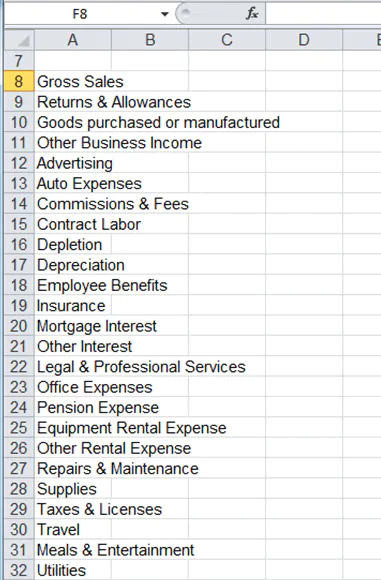

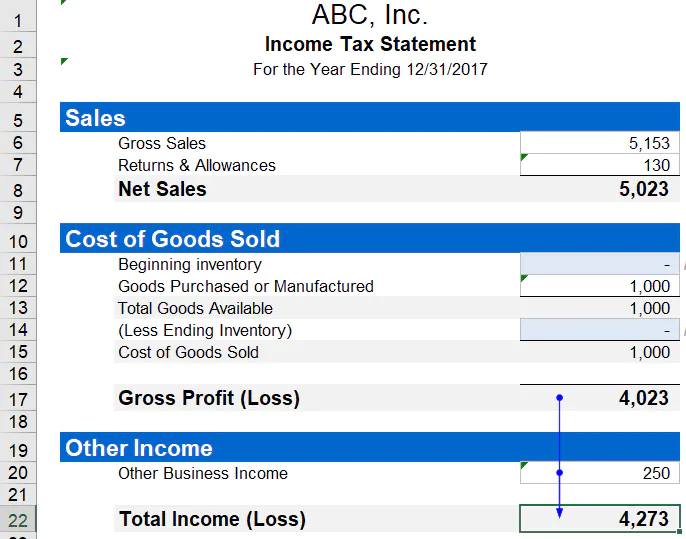

Income tax worksheet excel. NJ Division of Taxation - 2021 Income Tax Returns - State WebAug 03, 2021 · Print and download New Jersey income tax returns, instructions, schedules, and supplemental forms. ... Income Tax Depreciation Adjustment Worksheet: GIT-317: Sheltered Workshop Tax Credit: GIT-327: Income Tax Film and Digital Media Tax Credit: ... Excel Spreadsheet: Record Layout and Description - Lotus 1-2-3 Spreadsheet: Accounting Excel Template | Income Expense Tracker with Sales Tax WebFinally, you get a Sales Tax Report so you can see the total Sales Tax figures for each tax rate on your Income and Expenses. Accounting Excel Template : Example page. This shows you how to enter transactions on a day to day basis and includes payments out, payments in and transfers to and from the other bank account and credit card. Working ... Excel Cash Book for Easy Bookkeeping - Beginner-Bookkeeping… WebA Bank Reconciliation worksheet; A ... Sales Tax Features in the Excel Cash book. Each transaction per row can only have one sales tax rate applied to it. The cash books with sales tax features have these extra sheets: ... Sales Tax Columns – four for the income columns and four for the expense columns. Income Statement Template for Excel - Vertex42.com May 11, 2020 · The two examples provided in the template are meant mainly for small service-oriented businesses or retail companies. (1) The simplified "single-step" income statement groups all of the revenues and expenses, except the income tax expense. (2) The "multi-step" income statement example breaks out the Gross Profit and Operating Income as separate ...

Income Tax Formula - Excel University WebDec 31, 2014 · Please kindly help me calculate the Tax Amount this problem with all or one techniques in Excel. Chargeable income is $2473 Tax Table Chargeable income. Tax rate 1st $240. Free Next $240. 5% Next $1200. 10% Exceeding $1200. 17.5%. Best regards. Income tax calculating formula in Excel - javatpoint WebWe have prepared this Excel worksheet to calculate income tax on different ranges of income. These all given incomes are taxable income. Calculate tax on Martina's Salary: 380000. Step 1: To calculate the tax on Martina's income, select the C10 cell to keep the result and write the following IF formula in the formula bar. Download Free Federal Income Tax Templates In Excel WebSchedule B Calculator is an excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for federal income tax. Interests and dividend incomes received during a tax year are reported in Schedule B.

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png)

0 Response to "39 income tax worksheet excel"

Post a Comment