44 2014 tax computation worksheet

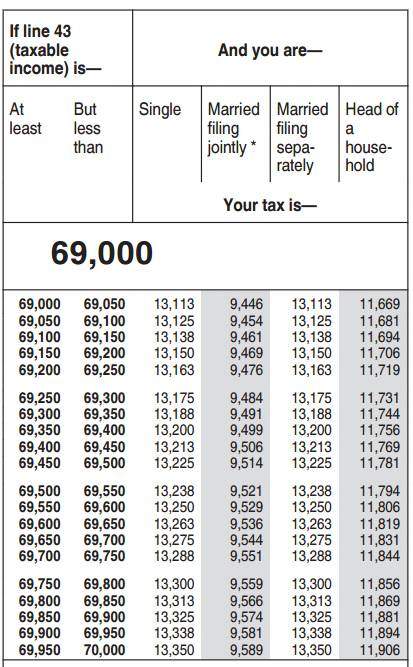

Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current ... Attach a computation of your NOL using Form 1045, Schedule A, and, if it ... Use Worksheet 2 to figure your carryover to 2022 if you had an NOL deduction from a year before 2018 that resulted in your having taxable income on your 2021 return of ... PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms 2014 Tax Table — Continued If line 43 (taxable income) is— And you are— At least But less than Single Married filing jointly * Married filing sepa- rately Head of a house- hold Your tax is— 3,000 3,000 3,050 303 303 303 303 3,050 3,100 308 308 308 308 3,100 3,150 313 313 313 313 3,150 3,200 318 318 318 318 3,200 3,250 323 323 323 323

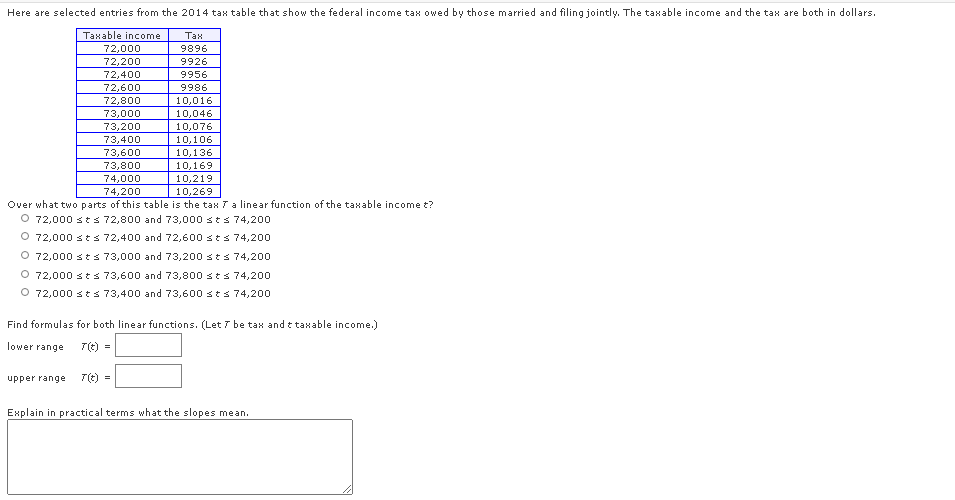

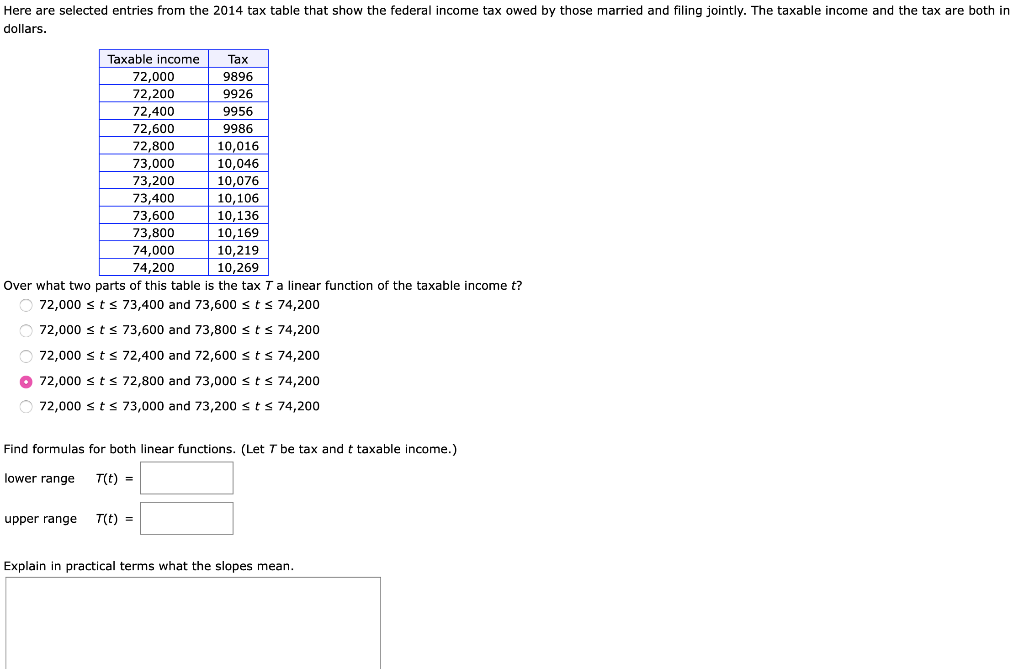

2014 Tax Tables: What They Mean for Your Taxes - The Motley Fool Here are some 2014 tax tables you can use to calculate your projected tax for your estimated 2014 income, based on IRS-provided numbers. Single filers If you're unmarried and not a...

2014 tax computation worksheet

PDF 2020 Tax Computation Worksheet—Line 16 - H&R Block appropriate line of the form or worksheet that you are completing. Section A— Use if your filing status is Single. Complete the row below that applies to you. Taxable income. If line 15 is— (a) Enter the amount from line 15 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount. Tax. Subtract (d) from (c). Enter Where is the tax computation worksheet in TurboTax? Step 1: Visit the official website for income tax filing. Step 2: Log in to your account by entering PAN details and password. Step 3: Select e-File 'Response to Outstanding Tax Demand' after logging in. What is a tax computation sheet? The Computation Report displays the Employee wise Income Tax Computation details in the Form 16 format. Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ...

2014 tax computation worksheet. Tax Computation Worksheet 2022 - 2023 - TaxUni The tax computation worksheet is for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax. However, not everyone needs to use the tax computation worksheet or the tax tables. Income Limits | HUD USER The Department of Housing and Urban Development (HUD) sets income limits that determine eligibility for assisted housing programs including the Public Housing, Section 8 project-based, Section 8 Housing Choice Voucher, Section 202 housing for the elderly, and Section 811 housing for persons with disabilities programs. Get 2019 Tax Computation Worksheet - US Legal Forms Now, working with a 2019 Tax Computation Worksheet takes at most 5 minutes. Our state-specific web-based samples and complete guidelines remove human-prone faults. Adhere to our simple steps to have your 2019 Tax Computation Worksheet well prepared rapidly: Find the template from the catalogue. Type all necessary information in the necessary ... Forms and Instructions (PDF) - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Form 1040-C: U.S. Departing Alien Income Tax Return 2022 01/14/2022 Inst 1040-C: Instructions for Form 1040-C, U.S. Departing Alien Income Tax Return ... Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico 2022 02/16/2022 Form ...

PDF 2019 Tax Computation Worksheet—Line 12a - cchcpelink.com appropriate line of the form or worksheet that you are completing. Section A—Taxable income.Use if your filing status is Single. Complete the row below that applies to you. If line 11b is— (a) Enter the amount from line 11b (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount Tax. Subtract (d) from (c). Enter Publication 970 (2021), Tax Benefits for Education | Internal ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your ... provided by an educational program described in Revenue Procedure 2014-35, section 5.02 ... Form 1040 Tax Computation Worksheet 2018 - Fill Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Tax Computation Worksheet 2018 (Line 11a) On average this form takes 13 minutes to complete. The Form 1040 Tax Computation Worksheet 2018 form is 1 page long and contains: Publication 17 (2021), Your Federal Income Tax | Internal ... If you haven't used your ITIN on a U.S. tax return at least once for tax years 2018, 2019, or 2020, it expired at the end of 2021 and must be renewed if you need to file a U.S. federal tax return in 2022.

Publication 3 (2021), Armed Forces' Tax Guide Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. 2014 Tax Computation Worksheet | Welcome Bonus! 2014 Tax Computation Worksheet - © | Contact Us: 22 Planting Field Road, Roslyn Heights 11577 | Phone: 516-307-1045 | Fax: 516-307-1046 2014 Individual Income Tax Forms - Marylandtaxes.gov Form used by individual taxpayers to request certification of Maryland income tax filing for the purpose of obtaining a Maryland driver's license, ID card or moped operator's permit from the MVA. Form 106. Stop Payment Request. Form to request a stop payment on refund check and issue a replacement check. Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ...

️Tax Calculation Worksheet 2014 Free Download| Qstion.co *income calculation worksheet is intended for information purposes only. Tax year 2014/2015 (from 6th april 2014 to 5th april 2015) excel version. The tax computation worksheet does not appear as a form or worksheet in turbotax. Section a— use if your filing status is single. When an adjustment needs to be made for gst previously claimed or paid.

PDF RI-1041 TAX COMPUTATION WORKSHEET 2014 - Rhode Island Bankruptcy Estate tax computation worksheet above. 6. Attach Form RI-1040 or Form RI-1040NR to RI-1041. 7. ... RI-1041 TAX COMPUTATION WORKSHEET 2014 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b)

Solved: Foreign Tax Credit Computation Worksheet - Intuit Here is the technique. Go thru the foreign tax credit interview. Then open the Federal Information Worksheet . Scroll down to Part 6. The fifth paragraph is labeled "Foreign Tax Credit (Form 1116). Checkmark the box to file form 1116. Then bring up the foreign tax credit comp. worksheet.

FREE 2014 Printable Tax Forms | Income Tax Pro Request and application forms: 4506 - Request for Copy of Tax Return. 4506-T - Request for Transcript of Tax Return (free copy) 8822 - Change of Address. 8857 instructions - Request for Innocent Spouse Relief. Click any of the 2014 1040A form links above to view, print, save.

2014 Individual Income Tax Forms - Income Tax Forms - Illinois Instr. Amended Individual Income Tax Return. IL-1040-X-V. Payment Voucher for Amended Individual Income Tax. IL-1310. Statement of Person Claiming Refund Due a Deceased Taxpayer. IL-2210. Instr. Computation of Penalties for Individuals.

Publication 929 (2021), Tax Rules for Children and Dependents If the child, the parent, or any other child has unrecaptured section 1250 gain, reduce the amount you would otherwise enter on line 8 of Worksheet 2 for Line 11 of the Schedule D Tax Worksheet—Unrecaptured Section 1250 Gain (Line 9 Tax) (but not below zero) by the line 8 capital gain excess not used in step 12c above, and refigure the amount on line 11 of this …

Forms and Instructions (PDF) - IRS tax forms Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico 2022 02/16/2022 Form 1040-ES (NR) U.S. Estimated Tax for Nonresident Alien Individuals ... Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Inst 1040 (sp) Instructions for Form 1040 and Form 1040-SR (Spanish version) 2021 02/09 ...

2014 Federal Income Tax Forms: Complete, Sign, Print, Mail - e-File Complete and sign the 2014 IRS Tax Return forms and then download, print, and mail them to the IRS; the address is on the Form 1040. Select your state (s) and download, complete, print, and sign your 2014 State Tax Return income forms. You can no longer claim a Tax Year 2014 refund. Don't let your money go to the IRS; file your return on time ...

Use Excel to File Your 2014 Form 1040 and Related Schedules The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss.

Publication 590-A (2021), Contributions to Individual Retirement ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

Instructions for Form 709 (2022) | Internal Revenue Service If you gave gifts to someone in 2022 totaling more than $16,000 (other than to your spouse), you probably must file Form 709. But see Transfers Not Subject to the Gift Tax and Gifts to Your Spouse, later, for more information on specific gifts that are not taxable.. Certain gifts, called future interests, are not subject to the $16,000 annual exclusion and you must file Form 709 even if …

RI-1041 TAX COMPUTATION WORKSHEET 2021 - Rhode Island Compute the tax on Form RI-1040 or Form RI-1040NR using the Bankruptcy Estate tax computation worksheet above. 6. Attach Form RI-1040 or Form RI-1040NR to RI-1041. 7. Complete only the identification area at the top of Form RI-1041. 8. Enter the name of the individual in the following format: "John Q. Public Bankruptcy Estate." 9.

Tax Computation Worksheet: Fill & Download for Free First of all, seek the "Get Form" button and tap it. Wait until Tax Computation Worksheet is ready to use. Customize your document by using the toolbar on the top. Download your finished form and share it as you needed. The Easiest Editing Tool for Modifying Tax Computation Worksheet on Your Way Open Your Tax Computation Worksheet Immediately

Publication 560 (2021), Retirement Plans for Small Business For tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup costs, up to the greater of (a) $500; or (b) the lesser of (i) $250 for each employee who is not a “highly compensated employee” eligible to participate in the employer …

How do I display the Tax Computation Worksheet? - Intuit The Tax Computation Worksheet does not appear as a form or worksheet in TurboTax. The calculation is done internally. You can see the Tax Computation Worksheet on page 89 of the IRS instructions for Form 1040. Be sure to read the paragraph at the top of the worksheet regarding what amount to enter in column (a).

Publication 550 (2021), Investment Income and Expenses - IRS tax … Tax computation using maximum capital gain rates. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Alternative minimum tax. Special Rules for Traders in Securities or Commodities. How To Report. Mark-to-market election made. Expenses. Self-employment tax. How To Make the Mark-to-Market Election; How To Get Tax Help

USA Tax Calculator 2014 | US iCalculator™ The 2014 Tax Calculator uses the 2014 Federal Tax Tables and 2014 Federal Tax Tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.. iCalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

What is the tax computation worksheet? - Best Tax Service A federal income tax computation worksheet is a form used by individuals to calculate their taxable income and determine the amount of taxes owed. It is also used by businesses to see how much they owe on their taxable income. The Federal Income Tax computation worksheet is a form that helps taxpayers determine liability, claim refunds and other income tax-related questions.

Fillable 2019 Tax Computation Worksheet—Line 12a The 2019 Tax Computation Worksheet—Line 12a form is 1 page long and contains: 0 signatures 0 check-boxes 52 other fields Country of origin: OTHERS File type: PDF BROWSE OTHERS FORMS Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Fill in your chosen form Sign the form using our drawing tool

Microsoft takes the gloves off as it battles Sony for its Activision ... 12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet ... First, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which separates your total qualified income (line 4) from your total ordinary income (line 5), so they can be taxed at their different rates. The second worksheet is called the "Tax Computation Worksheet."

Preparing a Tax Computation A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Tax adjustments include non-deductible expenses, non-taxable receipts, further deductions and capital allowances. Your company should prepare its tax computation annually before completing its Form C-S/ Form C ...

Publication 3920 (09/2014), Tax Relief for Victims of Terrorist … She also completes Worksheet C because the forgiven tax liabilities for 2011, 2012, 2013, and 2014 (line 16 of Worksheet B) total less than $10,000. To claim tax relief for 2011, 2012, and 2013, Sarah files Form 1040X and attaches a copy of Worksheet B. To claim tax relief for 2014, she files Form 1040 and attaches copies of Worksheets B and C.

Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ...

Where is the tax computation worksheet in TurboTax? Step 1: Visit the official website for income tax filing. Step 2: Log in to your account by entering PAN details and password. Step 3: Select e-File 'Response to Outstanding Tax Demand' after logging in. What is a tax computation sheet? The Computation Report displays the Employee wise Income Tax Computation details in the Form 16 format.

PDF 2020 Tax Computation Worksheet—Line 16 - H&R Block appropriate line of the form or worksheet that you are completing. Section A— Use if your filing status is Single. Complete the row below that applies to you. Taxable income. If line 15 is— (a) Enter the amount from line 15 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount. Tax. Subtract (d) from (c). Enter

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

0 Response to "44 2014 tax computation worksheet"

Post a Comment