40 2015 tax computation worksheet

PDF 2020 Tax Computation Worksheet—Line 16 - H&R Block appropriate line of the form or worksheet that you are completing. Section A— Use if your filing status is Single. Complete the row below that applies to you. Taxable income. If line 15 is— (a) Enter the amount from line 15 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount. Tax. Subtract (d) from (c). Enter Publication 590-A (2021), Contributions to Individual Retirement ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

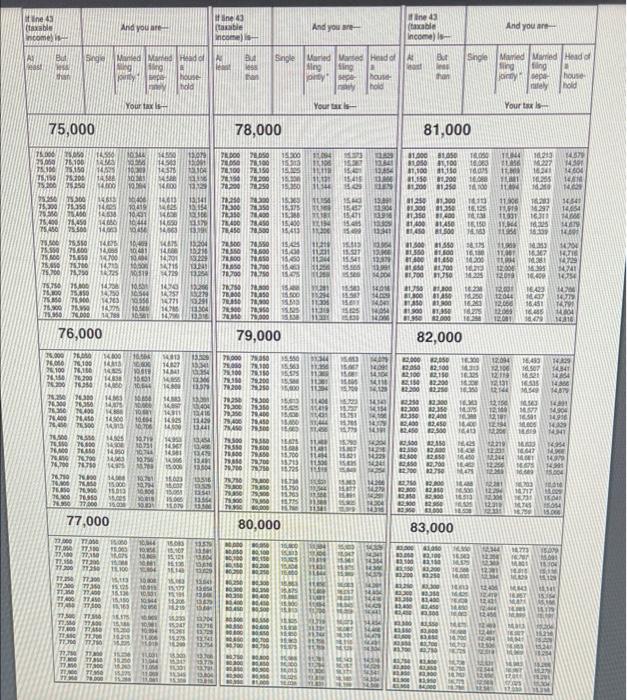

Forms and Instructions (PDF) - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Form 1040-C: U.S. Departing Alien Income Tax Return 2022 01/14/2022 Inst 1040-C: Instructions for Form 1040-C, U.S. Departing Alien Income Tax Return ... Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico 2022 02/16/2022 Form ...

2015 tax computation worksheet

2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation In 2015, the income limits for all brackets and all filers will be adjusted for inflation and will be as seen in Table 1. The top marginal income tax rate of 39.6 percent will hit taxpayers with taxable income of $413,200 and higher for single filers and $464,850 and higher for married filers. Standard Deduction and Personal Exemption Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2015 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) ... 1040 Tax Computation Worksheet 2015 Pdf .pdf - vendors.metro 1040-tax-computation-worksheet-2015-pdf 1/12 Downloaded from vendors.metro.net on September 23, 2022 by guest 1040 Tax Computation Worksheet 2015 Pdf When people should go to the books stores, search initiation by shop, shelf by shelf, it is essentially problematic. This is why we offer the ebook compilations in this website. It will

2015 tax computation worksheet. PDF 2015 Effective Tax Rate Worksheet - Caldwell CAD the Effective Tax Rate Worksheet. $132,238,288 6.2015 effective tax rate. Enter line 24 of the Effective Tax Rate Worksheet or Line 47 of the Additional Sales Tax Rate Worksheet. 1.223400 7.2015 taxes if a tax rate equal to the effective tax rate is adopted. Multiply Line 5 times Line 6 and divide by 100. $1,617,803 8.Last year's total levy ... Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. tax computation worksheet 2022 Tax Computation Worksheet 2015. 9 Images about Tax Computation Worksheet 2015 : Tax Computation Worksheet 2020 - 2021 - Federal Income Tax, Printables. Tax Computation Worksheet 2014. Messygracebook Thousands of and also Tax Computation Worksheet - Free Worksheet. Form 1040 Tax Computation Worksheet 2018 - Fill Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Tax Computation Worksheet 2018 (Line 11a) On average this form takes 13 minutes to complete. The Form 1040 Tax Computation Worksheet 2018 form is 1 page long and contains:

2015 Individual Income Tax Forms - Marylandtaxes.gov Maryland long form for full- or part-year residents claiming dependents. 502. Maryland Resident Income Tax Return. Maryland long form for full- or part-year residents. 502B. Maryland Dependents Information. Form to be used when claiming dependents. 502AC. Maryland Subtraction for Contribution of Artwork. PDF QPE Table of Contents - Thomson Reuters 2015 Tax Computation Worksheet 2015 EIC Table Tab 2 2015 States Quick Reference State Individual Income Tax Quick Reference Chart (2015) General Alabama Alaska Arizona Arkansas ... Child Tax Credit Worksheet (2015) Donations—Noncash Donated Goods Valuation Guide Donations Substantiation Guide Earned Income Credit (EIC) Worksheet (2015) Publication 3 (2021), Armed Forces' Tax Guide Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in … Publication 17 (2021), Your Federal Income Tax | Internal ... If you haven't used your ITIN on a U.S. tax return at least once for tax years 2018, 2019, or 2020, it expired at the end of 2021 and must be renewed if you need to file a U.S. federal tax return in 2022.

PDF 2015 State and Local Income Tax Refund Worksheet 2016 Worksheet 2 - 2015 Sch. A worksheet recomputed using original Sch. A line 5 less state and local refunds Worksheet 3 - Difference Worksheet 4 - State and Local Income Tax Refund Worksheet Worksheet 5 - State and Local Income Tax and General State Sales Tax Computation (Keep for your records) 1 Enter the total amount from Schedule A, line 5 1 1 ... Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Instructions for Form 5471 (01/2022) | Internal Revenue Service "37.Current E&P limitation computation:" field "37a.Current E&P"field "37b.Tested loss (enter as a positive number—see instructions)"field "37c.Total of line 37a and line 37b"field "38.Enter the smaller of line 36 or line 37c" field PDF RI-1041 TAX COMPUTATION WORKSHEET 2015 - Rhode Island Bankruptcy Estate tax computation worksheet above. 6. Attach Form RI-1040 or Form RI-1040NR to RI-1041. 7. ... RI-1041 TAX COMPUTATION WORKSHEET 2015 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b)

1040 (2021) | Internal Revenue Service - IRS tax forms Form 1040 and 1040-SR Helpful Hints. Form 1040 and 1040-SR Helpful Hints. For 2021, you will use Form 1040 or, if you were born before January 2, 1957, you have the option to use Form 1040-SR.

FREE 2015 Printable Tax Forms | Income Tax Pro 2015 Form 1040EZ - Easy Form File federal Form 1040EZ if you met these requirements for 2015: Filing status is single or married filing jointly. No dependents to claim (children, adults you support). You and your spouse were under age 65 and not blind. Taxable interest income of $1,500 or less. Taxable income is less than $100,000.

PDF WORKSHEETS A, B and C These are worksheets only. 2015 NET PROFITS TAX ... WORKSHEET C: Computation of Estimated Tax Base If the amount on Line 3 is $100 or less, estimated payments are not required. If the amount on Line 3 is greater than $100, enter 25% of the amount on ... WORKSHEET NR-3 2015 NET PROFITS TAX RETURN Computation of apportionment factors to be applied to apportionable net income of certain ...

PDF TAX INFORMATION 2015 - sbr-sabine.com 2015 and held until December 31, 2015, a Unit holder would choose May from the left-hand side of the table and then choose the factor located under ''December'' from that row. For a worksheet approach to computing a Unit holder's income and expense amounts, see the Tax Computation Worksheet on page 21. (SRT 2015 TAX) 1

Publication 721 (2021), Tax Guide to U.S. Civil Service ... If you received contributions tax free before 2021, the amount previously recovered tax free that you must enter on line 6 is the total amount from line 10 of last year's worksheet. If your annuity starting date is before November 19, 1996, and you chose the alternative annuity option, this amount includes the tax-free part of the lump-sum ...

10+ Elegant Tax Computation Worksheet 2015 Malaysia Tax Computation Worksheet 2015 Malaysia - Fun for my own blog, on this occasion I will explain to you in connection with Tax Computation Worksheet 2015 Malaysia.So, if you want to get great shots related to Tax Computation Worksheet 2015 Malaysia, just click on the save icon to save the photo to your computer.They are ready to download, if you like and want to have them, click save logo in the ...

PDF 2019 Tax Computation Worksheet - cchcpelink.com 2019 Tax Computation Worksheet—Line 12a k! See the instructions for line 12a to see if you must use the worksheet below to figure your tax. Note. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends

Publication 550 (2021), Investment Income and Expenses - IRS tax … Tax computation using maximum capital gain rates. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Alternative minimum tax. Special Rules for Traders in Securities or Commodities. How To Report. Mark-to-market election made. Expenses. Self-employment tax. How To Make the Mark-to-Market Election; How To Get Tax Help

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet ... The IRS calculated this from the start of the bracket times the rate of the bracket minus the amount of tax actually owed by moving through the lower brackets or in this case $80,250 * 0.22 - $9,234.9 = $8,420.10. So $33,000 minus $8,420 = $24,580 for your tax owed.

PDF 2015 Publication 17 - SFA Financial Aid Help 2015 Publication 17 - SFA Financial Aid Help ... return.!

How do I display the Tax Computation Worksheet? - Intuit The Tax Computation Worksheet does not appear as a form or worksheet in TurboTax. The calculation is done internally. You can see the Tax Computation Worksheet on page 89 of the IRS instructions for Form 1040. Be sure to read the paragraph at the top of the worksheet regarding what amount to enter in column (a).

PDF 2010 Tax Computation Worksheet—Line 44 2010 Tax Computation Worksheet—Line 44 See the instructions for line 44 on page 35 to see if you must use the worksheet below to figure your tax. ... and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter the amount from that form or worksheet in column (a) of the ...

2021 Instructions for Schedule D (2021) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16 (or in the instructions …

1040 Tax Computation Worksheet 2015 - vendors.metro.net 1040 Tax Computation Worksheet 2015 1/6 [EPUB] 1040 Tax Computation Worksheet 2015 Self-employment Tax- 1988 Tele-tax-United States. Internal Revenue Service 1988 Tax Withholding and Estimated Tax- 1992 Learning to Love Form 1040-Lawrence Zelenak 2013-03-29 No one likes paying taxes, much less the process of filing tax returns. For

2015 Federal Income Tax Brackets 2015 Federal Income Tax Brackets Find out your 2015 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts. 1 Married Individuals Filing Joint Returns, & Surviving Spouses

Tax Computation Worksheet 2022 - 2023 - TaxUni The tax computation worksheet is for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax. However, not everyone needs to use the tax computation worksheet or the tax tables.

Publication 560 (2021), Retirement Plans for Small Business For tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup costs, up to the greater of (a) $500; or (b) the lesser of (i) $250 for each employee who is not a “highly compensated employee” eligible to participate in the employer …

PDF 2015 Federal Withholding Computation—Quick Tax Method - Thomson Reuters 2015 Federal Withholding Computation—Quick Tax Method1, 2 Use this worksheet instead of the withholding tables from IRS Notice 1036 or Pub. 15 to compute federal withholding for an employee. Note: This method is based on the 2015 percentage method from IRS Notice 1036 and Pub. 15. This worksheet and the following tables are for use in 2015

Publication 463 (2021), Travel, Gift, and Car Expenses - IRS tax … If you satisfy all three factors, your tax home is the home where you regularly live. If you satisfy only two factors, you may have a tax home depending on all the facts and circumstances. If you satisfy only one factor, you are an itinerant; your tax home is wherever you work and you can’t deduct travel expenses.

PDF 2015 Effective Tax Rate Worksheet Lone Star College 2015 Rollback Tax Rate Worksheet Lone Star College Date: 08/28/2015 26. 2014 maintenance and operations (M&O) tax rate. $0.0765/$100 27. 2014 adjusted taxable value. Enter the amount from Line 11. $140,268,789,661 28. 2014 M&O taxes. A. Multiply Line 26 by Line 27 and divide by $100.

What is the tax computation worksheet? [Solved] (2022) The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified DividendsQualified DividendsQualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather ...

PDF IRS tax forms IRS tax forms

Progressive tax - Wikipedia A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ... states that the average top income tax rate for OECD member countries fell from 62 percent in 1981 to 35 percent in 2015, and that in addition, tax systems are less progressive than indicated by the statutory ... Computation The ...

Instructions for Form 706 (09/2022) | Internal Revenue Service Worksheet TG—Taxable Gifts Reconciliation (To be used for lines 4 and 7 of the Tax Computation) Gifts made after June 6, 1932, and before 1977: a. Calendar year or calendar quarter: b. Total taxable gifts for period (see Note) Note. For the definition of a taxable gift, see section 2503. Follow Form 709.

1040 Tax Computation Worksheet 2015 Pdf .pdf - vendors.metro 1040-tax-computation-worksheet-2015-pdf 1/12 Downloaded from vendors.metro.net on September 23, 2022 by guest 1040 Tax Computation Worksheet 2015 Pdf When people should go to the books stores, search initiation by shop, shelf by shelf, it is essentially problematic. This is why we offer the ebook compilations in this website. It will

Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2015 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) ...

2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation In 2015, the income limits for all brackets and all filers will be adjusted for inflation and will be as seen in Table 1. The top marginal income tax rate of 39.6 percent will hit taxpayers with taxable income of $413,200 and higher for single filers and $464,850 and higher for married filers. Standard Deduction and Personal Exemption

0 Response to "40 2015 tax computation worksheet"

Post a Comment