Close this dialog Buy life insurance that accumulates a cash value. Fund retirement accounts, such as IRAs and 401ks. ERISA-qualified retirement accounts are typically safe from creditors under federal law. Call (760) 776-1810. ABOUT THE AUTHOR: Sebastian Gibson, Law Offices of R. Sebastian Gibson. 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · 2023 IRMAA Brackets. Source: Medicare Costs, Medicare.gov The standard Medicare Part B premium will be $164.90 in 2023. 2024 IRMAA Brackets. We have one data point out of 12 as of right now for what the IRMAA brackets will be in 2024 (based on 2022 income).

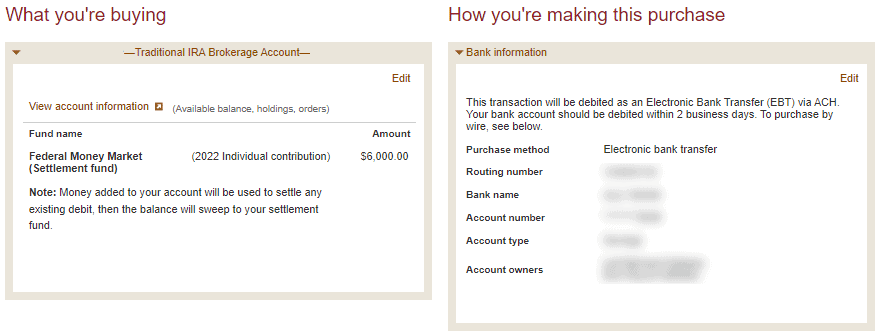

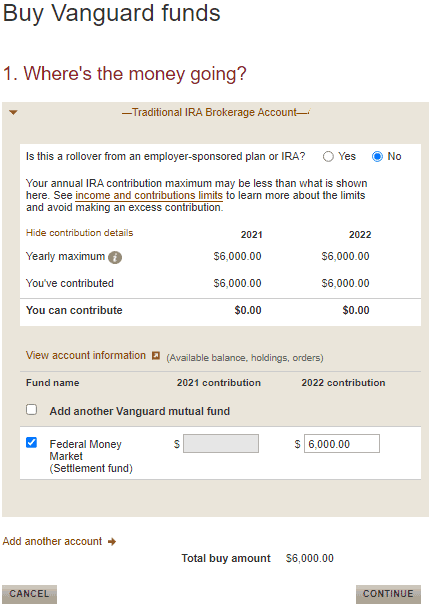

Backdoor Roth IRA 2022: A Step by Step Guide with Vanguard Jan 06, 2022 · Note that inherited IRAs are a non-issue. If the balances in your IRA or IRAs are small and you can afford the taxes on the conversion, you can convert it all to Roth and just pay tax on the conversion. This could be a good idea for those in lower tax brackets — residents and students, for example.

Funding 401ks and iras worksheet answers

Modified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out. Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money ...

Funding 401ks and iras worksheet answers. Modified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out. Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money ...

Our Favorite Solo 401k Calculators

Funding_A_401k_And_Roth_IRA_STUDENT_FILLABLE.docx - NAME ...

How to Report 2021 Backdoor Roth in H&R Block Tax Software

Not Enough Total Earned Income to Contribute to Both a Roth ...

How to invest a solo 401k in a Single Member LLC

Publication 590 (Rev. 2001 )

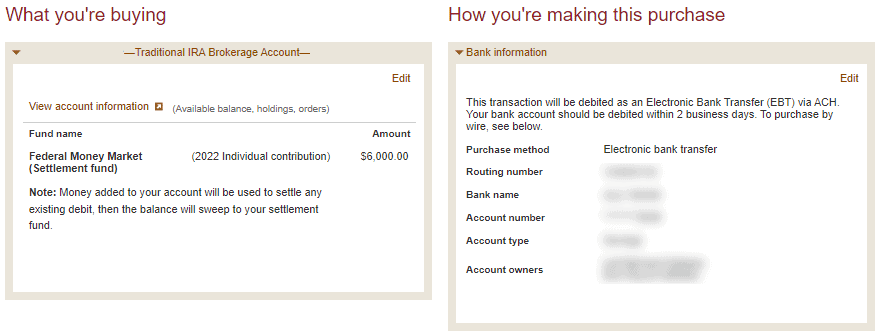

Backdoor Roth IRA 2022: A Step by Step Guide with Vanguard ...

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME ...

Funding 401(k)s & Roth IRAs Chart.docx - Funding 401(k)s ...

How Much Can I Contribute To My Self-Employed 401k Plan?

Funding 401ks and roth iras worksheet answers?

How Much Can I Contribute To My Self-Employed 401k Plan?

401K Plan Booklet - United Petroleum Transports

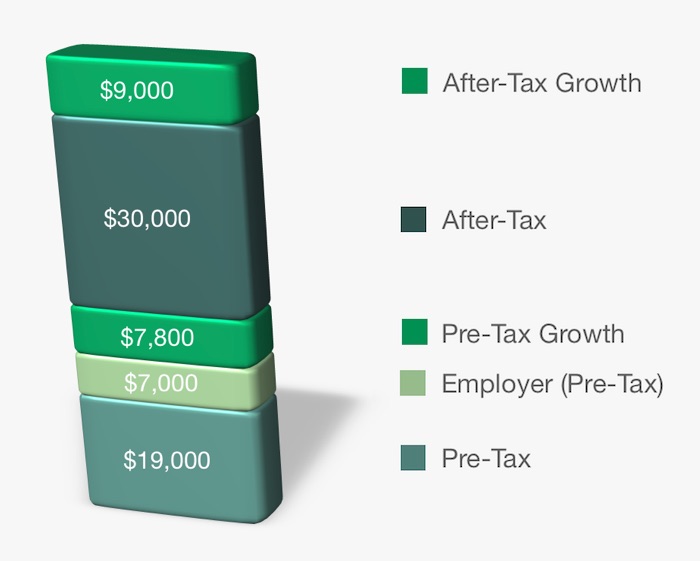

How To Save More Than $100,000 A Year Pre-Tax In Retirement

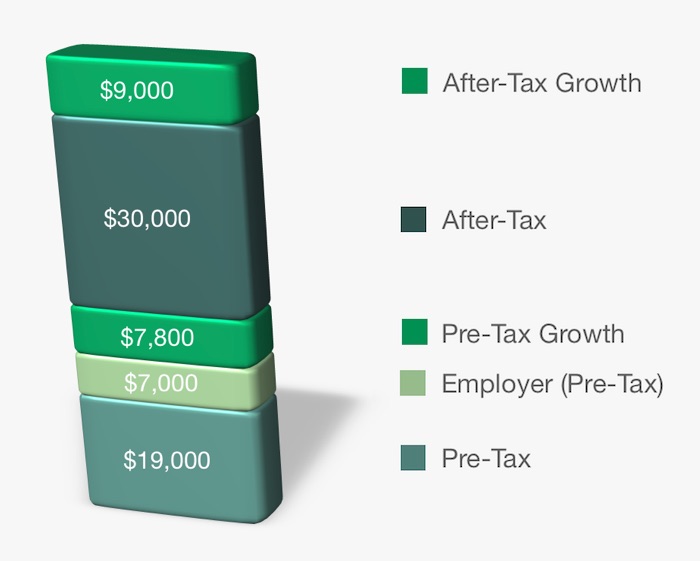

Mega Backdoor Roth

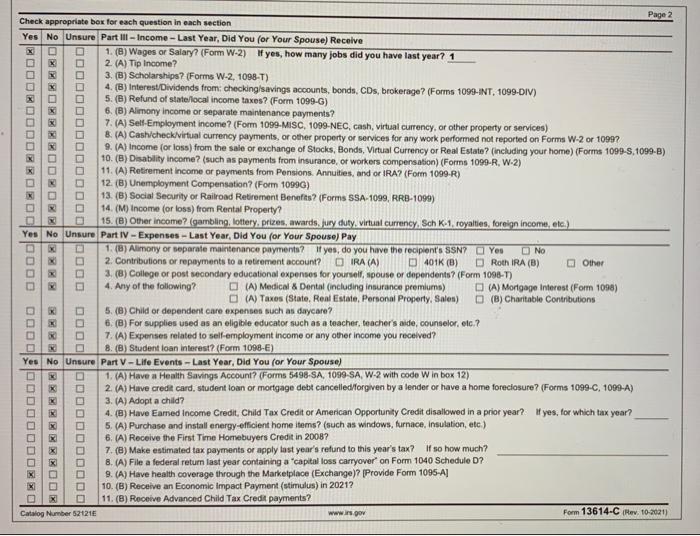

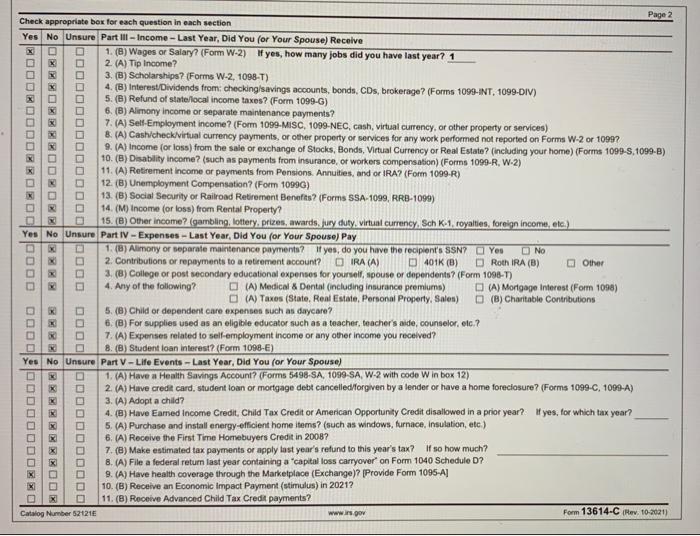

Solved Directions Using the tax software, complete the tax ...

:max_bytes(150000):strip_icc()/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

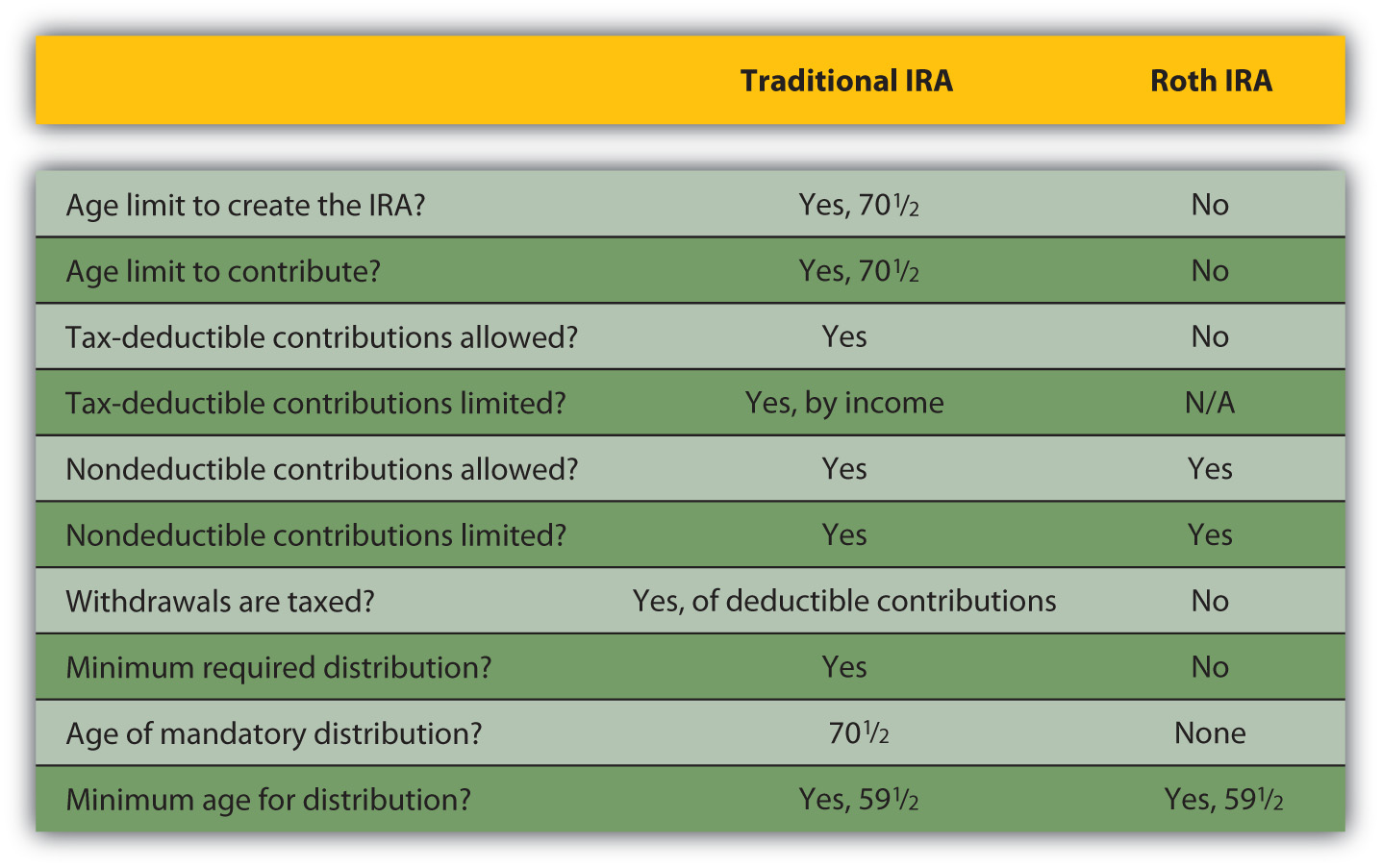

Roth IRA vs. 401(k): What's the Difference?

Backdoor Roth IRA 2022: A Step by Step Guide with Vanguard ...

Funding 401(k)s & Roth IRAs Chart.docx - Funding 401(k)s ...

How Much Can I Contribute To My Self-Employed 401k Plan?

:max_bytes(150000):strip_icc()/istock512752254.kroach.ira.cropped.lowercase-5bfc3077c9e77c0026b5e58b.jpg)

Should You Contribute to a Non-Deductible IRA?

SEP IRA | TD Ameritrade

Backdoor Roth IRA 2022: A Step by Step Guide with Vanguard ...

Funding 401 K S And Roth Iras Worksheet Answers | Money ...

How to Make a Backdoor Roth IRA For Previous Year | White ...

Allocating correctly between 401k and Roth IRA? - Bogleheads.org

How to Rollover Your 401k to a Roth IRA | Good Financial Cents®

Copy of Funding 401(k)s and Roth IRAs - Funding 401(k)s and ...

Basics help! Asset Allocation?/401k/Roth [Confused ...

Funding 401(k)s & Roth IRAs Chart.docx - Funding 401(k)s ...

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-7.44.13-AM.png)

How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...

Retirement Planning: Ways to Save

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...

IRA to HSA Worksheet

Roth IRA vs. 401(k): Which Is Better for You? - Ramsey

What Is a Solo 401(k) and How Does It Work?

2008 Publication 590

Roth IRA vs. 401(k): Which Is Better for You? - Ramsey

CORPORATION: Calculating My Solo 401k contributions for a ...

SEP IRA | TD Ameritrade

Can You Contribute To A 401(k) And An IRA At The Same Time?

Climbing The Roth IRA Conversion Ladder To Fund Early ...

Solo Roth 401k contribution calculation for small business owner (step by step) FULL WALKTHROUGH

:max_bytes(150000):strip_icc()/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

:max_bytes(150000):strip_icc()/istock512752254.kroach.ira.cropped.lowercase-5bfc3077c9e77c0026b5e58b.jpg)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-7.44.13-AM.png)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

0 Response to "43 funding 401ks and iras worksheet answers"

Post a Comment