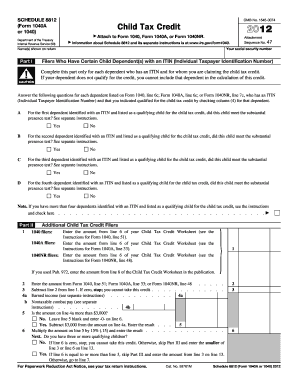

45 2012 child tax credit worksheet

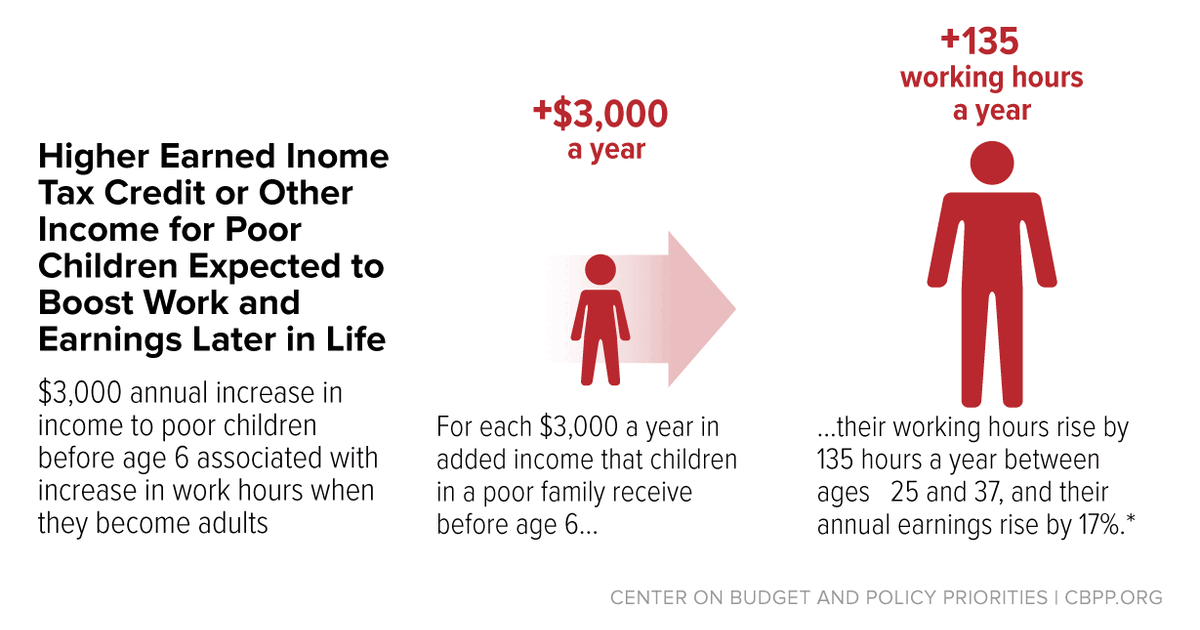

Publication 970 (2021), Tax Benefits for Education | Internal ... She and the college meet all the requirements for the American opportunity credit. Jane has a dependent child, age 10, who is a qualifying child for purposes of receiving the earned income credit (EIC) and the child tax credit. Jane didn't receive any advance child tax credit payments for 2021. Jane's wages are $20,000. Publications Centre - Ministry of Health Publications Centre - Ministry of Health

Numerical list by form number: IT-2 through IT-2664 Sep 11, 2001 · Claim for Empire State Child Credit. IT-213-ATT (Fill-in) IT-213-I (Instructions) Child Information for Empire State Child Credit - Attachment to Form IT-213: IT-214 (Fill-in) IT-214-I (Instructions) Claim for Real Property Tax Credit for Homeowners and Renters: IT-215 (Fill-in) IT-215-I (Instructions) Claim for Earned Income Credit.

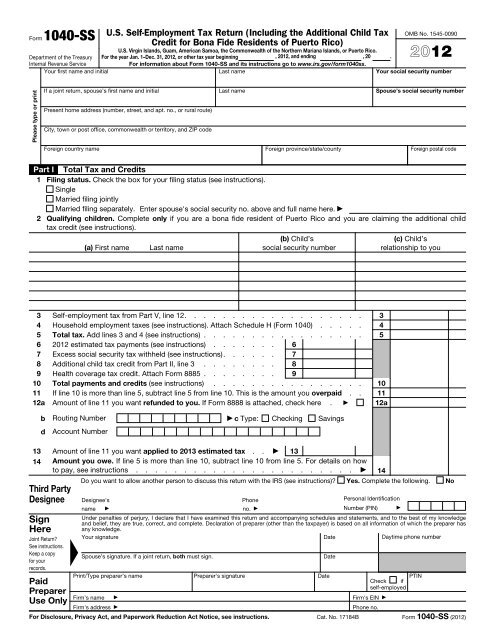

2012 child tax credit worksheet

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Publication 54 (2021), Tax Guide for U.S. Citizens and ... See the Instructions for Form 1040 and complete the Foreign Earned Income Tax Worksheet to figure the amount of tax to enter on Form 1040 or 1040-SR, line 16. If you must attach Form 6251, Alternative Minimum Tax—Individuals, to your return, use the Foreign Earned Income Tax Worksheet provided in the Instructions for Form 6251. Tax Day Deadline April 15 Changed to Due April 18, 2022 - e-File Apr 18, 2022 · Tax Day Deadline 2022 for 2021 Tax Year Returns - see state related tax deadlines and payment information. April 18, 2022 - not April 15 - is the IRS Tax Deadline, or Tax Day, for 2021 Tax Returns. For residents of Maine and Massachusetts, the deadline is April 19, 2022 due to the Patriot's Day holiday in those states.

2012 child tax credit worksheet. American Family News Aug 02, 2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do. Tax Day Deadline April 15 Changed to Due April 18, 2022 - e-File Apr 18, 2022 · Tax Day Deadline 2022 for 2021 Tax Year Returns - see state related tax deadlines and payment information. April 18, 2022 - not April 15 - is the IRS Tax Deadline, or Tax Day, for 2021 Tax Returns. For residents of Maine and Massachusetts, the deadline is April 19, 2022 due to the Patriot's Day holiday in those states. Publication 54 (2021), Tax Guide for U.S. Citizens and ... See the Instructions for Form 1040 and complete the Foreign Earned Income Tax Worksheet to figure the amount of tax to enter on Form 1040 or 1040-SR, line 16. If you must attach Form 6251, Alternative Minimum Tax—Individuals, to your return, use the Foreign Earned Income Tax Worksheet provided in the Instructions for Form 6251. May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-12.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-05.jpg)

0 Response to "45 2012 child tax credit worksheet"

Post a Comment