41 1031 exchange worksheet excel

1031 Exchange Calculator | Calculate Your Capital Gains (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. 1031 Tool Kit - TM 1031 Exchange Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault. Easily Compare Selected Properties.

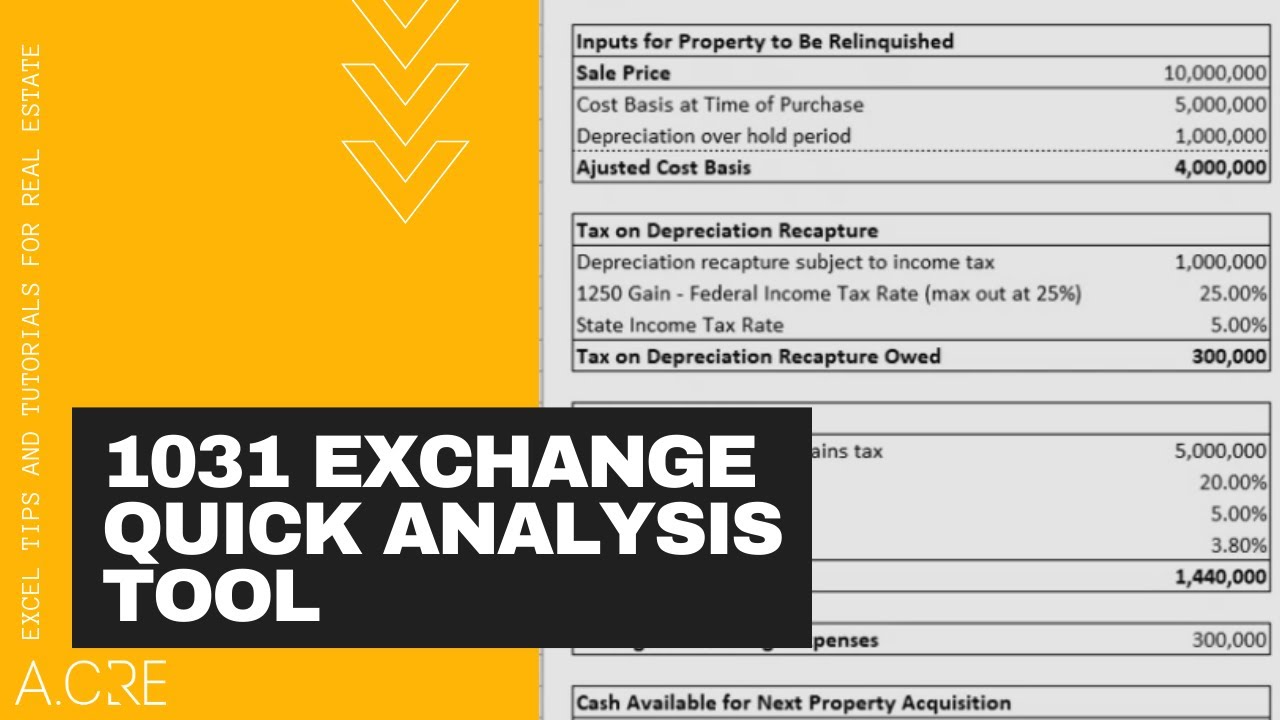

1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator

1031 exchange worksheet excel

Real Estate: 1031 Exchange Examples - SmartAsset 1031 Exchange Examples. A 1031 exchange requires you to fulfill two crucial rules. First, there is a minimum value requirement. The new property, or properties, must have a purchase price equal to or more than the amount you sold your real estate for. So, if you sell your property for $600,000, then you must buy a replacement property worth at ... How Rental Income Is Taxed - Property Owner’s Guide for 2022 Rental income also consists of non-cash receipts, such as work done by a tenant in exchange for free rent or utilities paid by the tenant that are normally a landlord expense. Fees received by a landlord from the tenant for canceling a lease are also treated as real estate income. Library of 1031 Exchange Forms Visit our library of important 1031 exchange forms. The pros at Equity Advantage have provided everything you need in easily downloadable PDF files. 800-735-1031 info@1031exchange.com

1031 exchange worksheet excel. Use Event1644Reader.ps1 to analyze LDAP query performance ... Mar 23, 2022 · Event1644Reader.ps1 is a PowerShell script that extracts 1644 events from saved Directory Service event logs and imports them into predefined views in an Excel spreadsheet for analysis. Event1644Reader.ps1 can be used on event logs generated by Windows Server 2012 R2 domain controllers or Windows Server 2008 R2 and Windows Server 2012 domain controllers that have hotfix 2800945 installed. 1031 exchange worksheet exchange 1031 worksheet kind excel calculator capital realized gains tax gain state rate laptop section rates experts. 30 1031 Exchange Calculation Worksheet - Support Worksheet martindxmguide.blogspot.com. 1031 lantrip wrote. Season Investments :: The Power Of A 1031 Exchange Form 8824 - 1031 Corporation Exchange Professionals We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges. However, we recognize that almost all Exchanges are different and that this worksheet might or might not work for any given Exchange. It is offered as a possible tool for the use of our clients and their tax professionals. Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824, THE 1031 EXCHANGE FORM The combination of the HUD-1 and the information on our Capital Gains Tax page will be all that you need for the completion of the form. For review, we are dealing with the following scenario. FORM 8824 EXAMPLE Alan Adams bought a Duplex ten years ago for $200,000 cash. He assigned a value of $20,000 to the land.

1031 Exchange Calculator - The 1031 Investor 1031 Exchange Calculator This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). 1031 Exchange Worksheet Excel And Example Of Form … 17.04.2018 · We always effort to show a picture with high resolution or with perfect images. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out can be beneficial inspiration … 1031 Exchange Real Estate | 1031 Tax Deferred Properties The name 1031 exchange comes from Title 26, Section 1031 of the Internal Revenue Code. The IRS first allowed farmers to exchange land in 1921, but today's exchanges are limited to real property assets purchased and held for investment purposes. Investors can use 1031 exchanges to defer tax liabilities indefinitely so long as they keep ... Reporting the Like-Kind Exchange of Real Estate Using … The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis.

WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet. What Expenses Are Deductible in a 1031 Exchange? Deductible Exchange Expenses. There are a number of closing costs that can be deemed to be "exchange expenses" which should be subtracted from the consideration received by the taxpayer, thereby reducing the realized gain on the transaction. They are: The taxpayer's attorney's fees, sales and transfer fees, shipping costs, bidding costs ...

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet ... Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator. 1031 Exchange Form Irs. Like Kind Exchange Forms. 1031 Exchange Form. 1031 Exchange Forms Irs. 1031 Exchange Forms. Irs Form 1031 Exchange. Reverse 1031 Exchange Forms. Irs Form To Report 1031 Exchange.

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) In a partial 1031 exchange, "boot" refers to any leftover sale proceeds subject to tax. Boot results from a difference in value between the original property, known as the relinquished property, and the replacement property. When the replacement property has a lower value than the sale price of the relinquished property, that difference is ...

c# - How to export DataTable to Excel - Stack Overflow Nov 21, 2011 · // single worksheet Excel._Worksheet workSheet = (Excel._Worksheet)excelApp.ActiveSheet; Update: I have achieved UK formatting of the dates by converting to LongDateTime format, its only a work around though.

10+ free rental property Excel spreadsheet templates - Stessa It’s feasible to make a worksheet template detailing each rental property improvement and expenditure. The difficulty, however, is keeping track of depreciation since some improvements have varying depreciation rules. Stessa is a much more efficient way to track the useful life of CapEx. Stessa will automatically prompt you to enter a date ...

Philippines - Wikipedia The Philippines (/ ˈ f ɪ l ɪ p iː n z / (); Filipino: Pilipinas), officially the Republic of the Philippines (Filipino: Republika ng Pilipinas), is an archipelagic country in Southeast Asia.

FORM 8824 WORKSHEET Worksheet 1 Tax Deferred … Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Boydton mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates

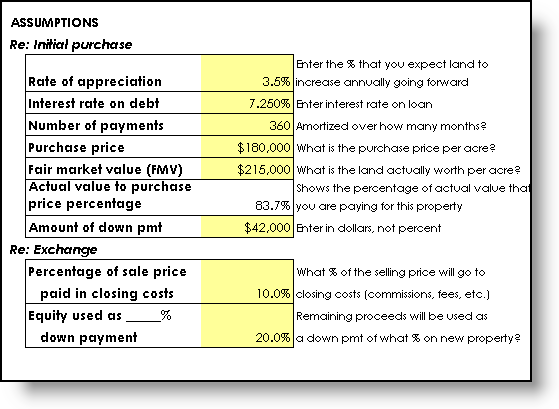

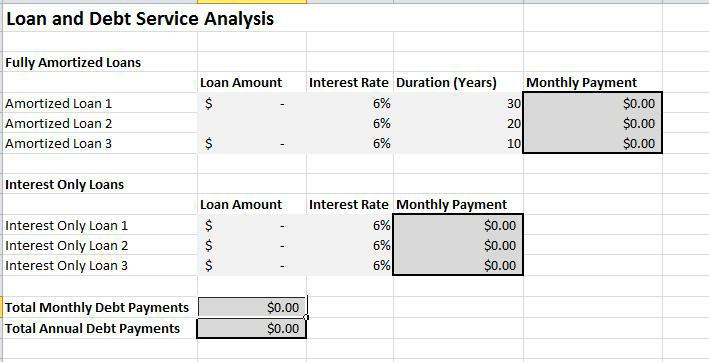

Excel 1031 Property Exchange - Business Spreadsheets Excel 1031 property exchange for real estate and loan Browse Main Excel Solution Categories Additional Excel business solutions are categorized as Free Excel solutions and the most popular. Further solutions proposed for specific user requirements can be either found in the Excel Help Forum .

Instructions for Form 8824 (2021) | Internal Revenue Service Fill out only lines 15 through 25 of each worksheet Form 8824. On the worksheet Form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19 on line 20.

(PDF) Excel ® 2019 BIBLE | Cristi Etegan - Academia.edu Excel ® 2019 BIBLE. Excel ® 2019 BIBLE. Cristi Etegan. Continue Reading. Download Free PDF. Download. Related Papers. Excel Data Analysis - Your visual blueprint ...

1031 Exchange Calculator Excel - CUALACT 1031 Property Exchange For Excel Provides The Input And Calculations In Order To Evaluation Section 1031 Tax Deferred Real Estate Exchanges. Tax deferred exchanges under irc § 1031 date closed taxpayer exchange property replacement property form 8824 line 15 cash and other property received and net debt.

Real Estate Investment Software Product Comparison ... - RealData Software View all Excel-based real estate investment and development software products for commercial and residential income property analysis. We've been hiding our bundles under a bushel! Find out more >> 800-899-6060 Sign in Email us Software customers - Download your software, get updates and serial numbers. Sign In ...

1031 Exchange – Overview and Analysis Tool (Updated … However, the 1031 Exchange, which has been around since 1921, has survived the recent tax overhaul and appears to be secure in the near term. Compatibility This version of the tool is only compatible with Excel 2013, Excel 2016, and Excel 365. Download the Tool Source File

1031 Tax Deferred Exchange Worksheet And 1031 … We hope you can find what you need here. We constantly effort to reveal a picture with high resolution or with perfect images. 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet can be valuable inspiration for people who seek an image according specific categories, you will find it in this website.

1031 Like Kind Exchange Calculator - Excel Worksheet - Pinterest This monthly budget spreadsheet is a wonderful tool for you to organize all of your finances. The workbook contains several tabs/worksheets that are all linked together in the main summary worksheet. This saves you time by only having to enter an expense once. Another feature that will save you time, is when you have a standard expense that is ...

PDF 2019 Exchange Reporting Guide - 1031 Corp We realize the form used to report your 1031 exchange is not the easiest form to complete so we have included line by line instructions to assist you. Additionally, we have developed a Microsoft Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges."

1031 Exchange Calculator - Penn's Grant Realty Corporation 1031 Exchange Calculator We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800.

Library of 1031 Exchange Forms Visit our library of important 1031 exchange forms. The pros at Equity Advantage have provided everything you need in easily downloadable PDF files. 800-735-1031 info@1031exchange.com

How Rental Income Is Taxed - Property Owner’s Guide for 2022 Rental income also consists of non-cash receipts, such as work done by a tenant in exchange for free rent or utilities paid by the tenant that are normally a landlord expense. Fees received by a landlord from the tenant for canceling a lease are also treated as real estate income.

Real Estate: 1031 Exchange Examples - SmartAsset 1031 Exchange Examples. A 1031 exchange requires you to fulfill two crucial rules. First, there is a minimum value requirement. The new property, or properties, must have a purchase price equal to or more than the amount you sold your real estate for. So, if you sell your property for $600,000, then you must buy a replacement property worth at ...

0 Response to "41 1031 exchange worksheet excel"

Post a Comment