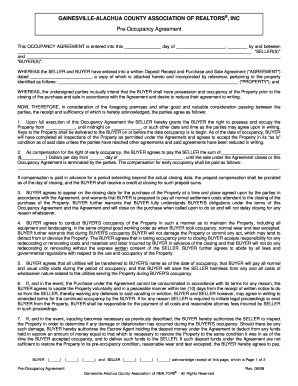

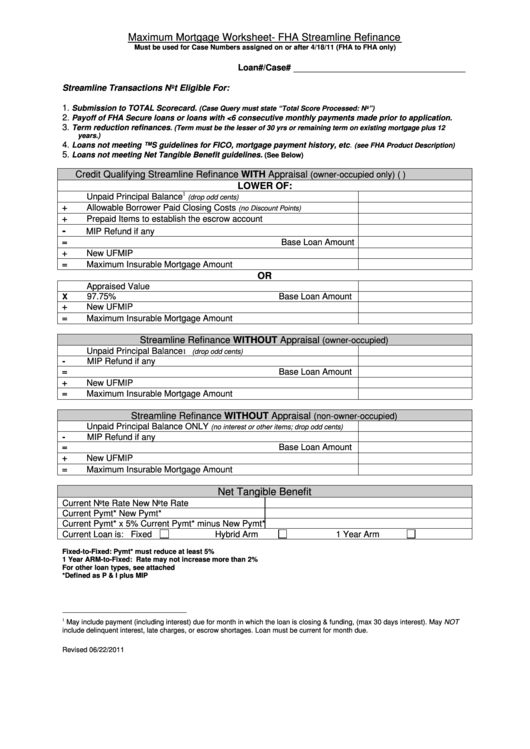

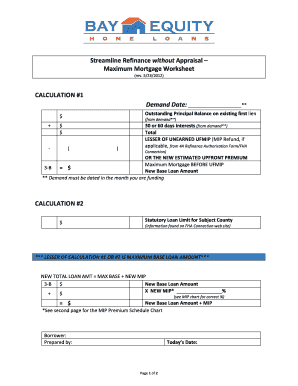

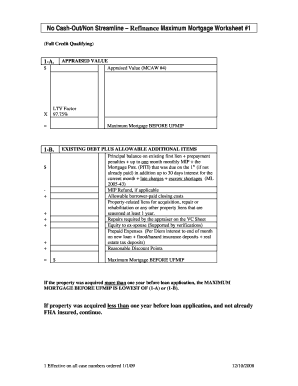

39 fha streamline with appraisal worksheet

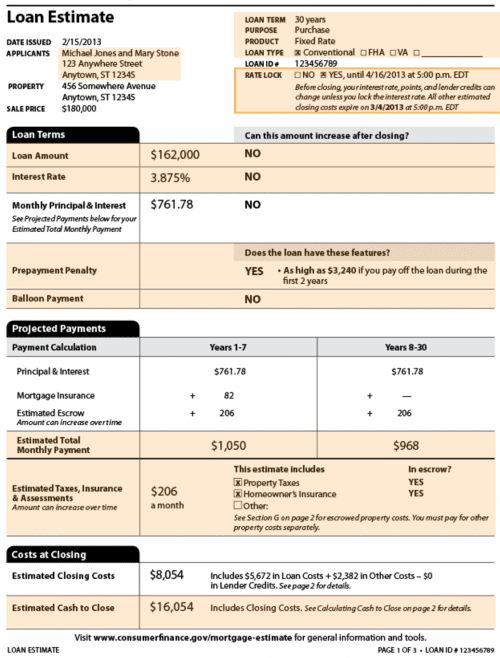

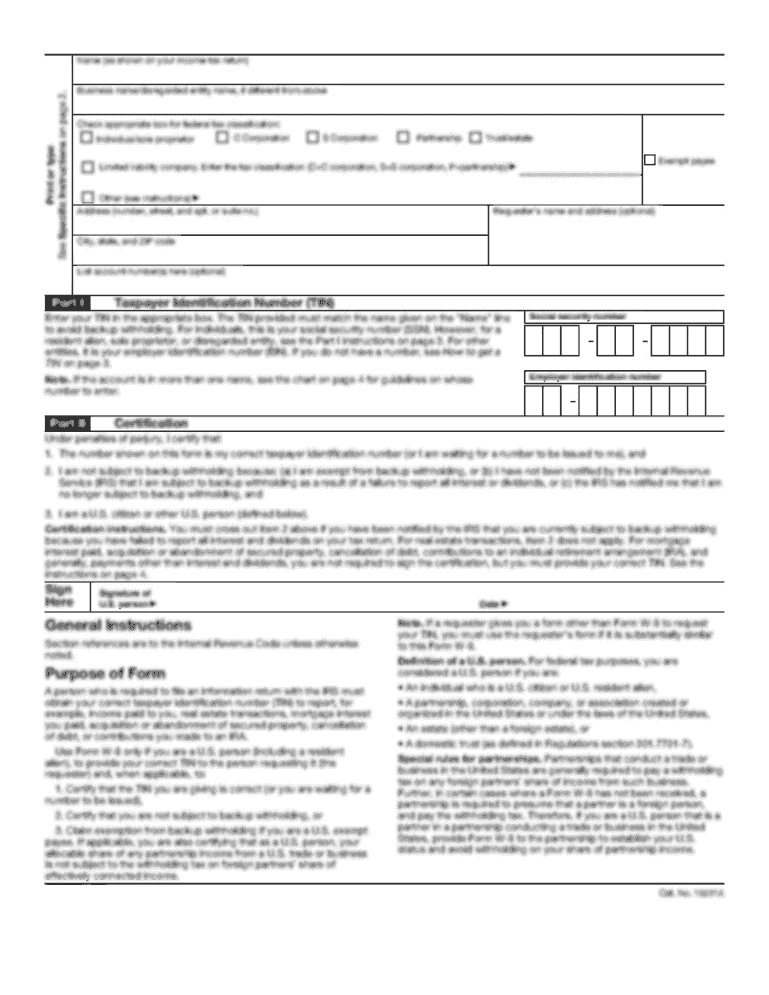

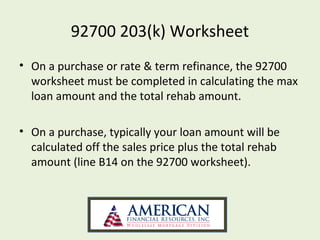

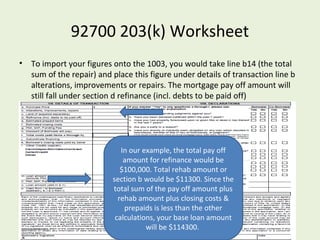

FHA 203k Loans: How Does It Work? | Requirements 2022 If the appraisal states the home will only be worth $105,000 after all repairs are done, the maximum loan amount is based on 110% of the future appraised value: The HUD-92700 “203k Worksheet” As part of the 203k process, you will need to sign the FHA 203k Worksheet, also called the HUD-92700. This form is a breakdown of all loan costs, 203k ... Streamline Refinance Your Mortgage | HUD.gov / U.S ... U.S. Department of Housing and Urban Development. U.S. Department of Housing and Urban Development 451 7th Street, S.W., Washington, DC 20410 T: 202-708-1112

Resource Center | CMG Financial 04-01-20 CMG Bulletin 2020-19 VVOE Clarifications- GSE Investor Designation Appraisal Flexibility-Fanne and Freddie UW guidelines COVID-19: 03-31-20 CMG Bulletin 2020-18 FHA Re-verification of Employment- FHA Exterior-Only and Desktop-Only COVID-19

Fha streamline with appraisal worksheet

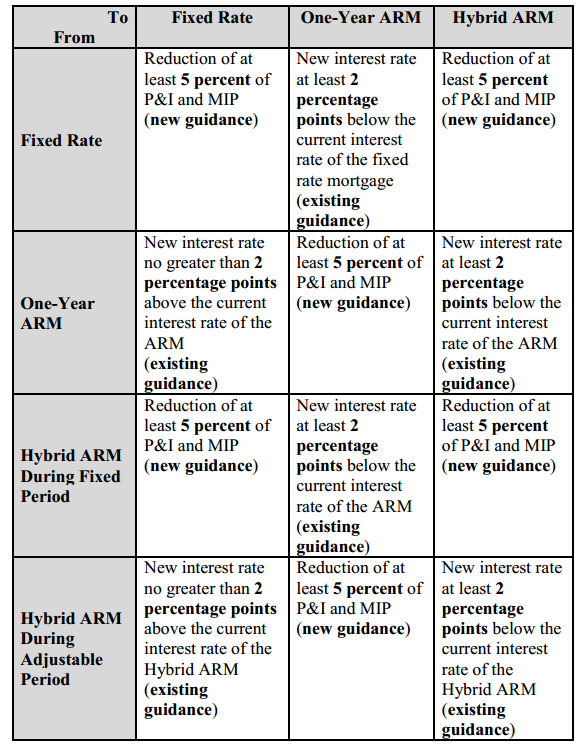

Loan Modification Vs. Refinance | Rocket Mortgage Sep 16, 2022 · It might be beneficial to refinance to a new loan type if you have more than 20% equity in your home. For example, if you have an FHA loan, you’ll pay for mortgage insurance throughout the life of the loan if you put less than 10% down. However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity. What Is A Tangible Net Benefit? | Rocket Mortgage Aug 22, 2022 · FHA Streamline refinances come with lower mortgage insurance rates. When you do an FHA streamline, your existing FHA loan is paid off and you move forward under a new mortgage with a different term. To have the term reduced on an FHA Streamline, three things have to occur: The term needs to be at least 3 years shorter than the previous one. FHA Refinance With a Cash-out Option in 2022 To be eligible for an FHA cash-out refinance, borrowers will need at least 20 percent equity in the property based on a new appraisal. Equity is the difference between the current value of a property and the amount owed on the mortgage. In the following example, a borrower obtained an FHA loan of $275,000 to purchase a home.

Fha streamline with appraisal worksheet. Mortgage Learning Center - Zillow FHA Loan Limits. See all → Mortgage Learning Center. Featured. Earnest Money vs Down Payment: Is Earnest Money Part of the Down Payment? FHA Refinance With a Cash-out Option in 2022 To be eligible for an FHA cash-out refinance, borrowers will need at least 20 percent equity in the property based on a new appraisal. Equity is the difference between the current value of a property and the amount owed on the mortgage. In the following example, a borrower obtained an FHA loan of $275,000 to purchase a home. What Is A Tangible Net Benefit? | Rocket Mortgage Aug 22, 2022 · FHA Streamline refinances come with lower mortgage insurance rates. When you do an FHA streamline, your existing FHA loan is paid off and you move forward under a new mortgage with a different term. To have the term reduced on an FHA Streamline, three things have to occur: The term needs to be at least 3 years shorter than the previous one. Loan Modification Vs. Refinance | Rocket Mortgage Sep 16, 2022 · It might be beneficial to refinance to a new loan type if you have more than 20% equity in your home. For example, if you have an FHA loan, you’ll pay for mortgage insurance throughout the life of the loan if you put less than 10% down. However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity.

0 Response to "39 fha streamline with appraisal worksheet"

Post a Comment