45 worksheet for foreclosures and repossessions

Forms And Worksheets - Schwartz Bankruptcy Law Center Forms And Worksheets Client Pre-Interview Questionnaire Client Worksheet Documents Needed to File Chapter 7 Initial Documents for Consultation Call for a free bankruptcy consultation Louisville | 502-485-9200 New Albany | 812-945-9200 Get Publication 4681 Worksheet 2010 Form - US Legal Forms Worksheet for Foreclosures and Repossessions Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise,. ... Completing Publication 4681 Worksheet 2010 Form does not have to be perplexing anymore. From now on comfortably get through it from your home or at ...

PDF Real Estate Owned and Repossessed Assets - occ.treas.gov A rapid rise in foreclosures, like that experienced during the 2008-2009 global financial crisis with extensive weakness in the housing market, increases the potential for higher levels of real estate owned ... foreclosure or repossession, management should check with the proper authorities to verify the existence of a valid recorded lien. At ...

Worksheet for foreclosures and repossessions

Form 1099-A - Foreclosure/Repossession - TaxAct Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim. Where you enter your 1099-A information depends on whether the form you received is for your main home, business property, or investment property. Main Home Bankruptcy Resources - Austin, TX - Hickson Law PC call (512) 346-8597 - Bankruptcy attorney office; Chapter 7 Bankruptcy; Chapter 13 Bankruptcy; Bankruptcy Resources; Debt Negotiation / Collection in Austin Texas 2019 Publication 4681 - Internal Revenue Service Feb 7, 2020 — Worksheet for Foreclosures and ... Foreclosure and repossession are remedies ... foreclosed upon or repossessed and sold, you.

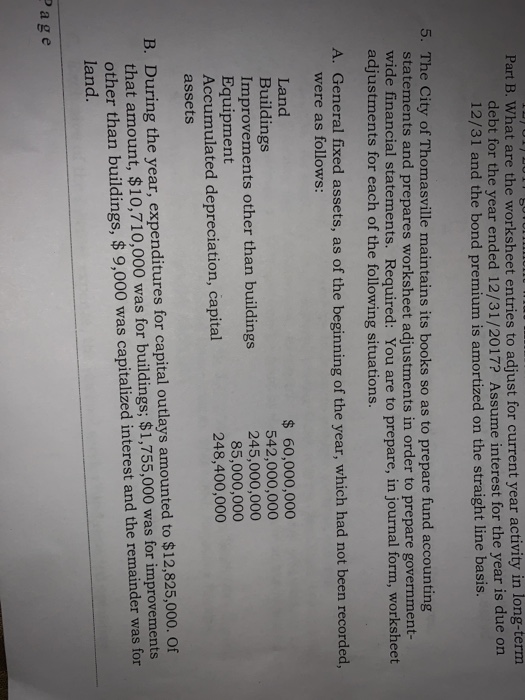

Worksheet for foreclosures and repossessions. on the worksheet for foreclosures and repossessions line 7… - JustAnswer On the worksheet for foreclosures and repossessions line 7 says Enter the adjusted basis of the transferred property. - Answered by a verified Tax Professional. We use cookies to give you the best possible experience on our website. Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim. PDF 2013 Publication 4681 - IRS tax forms of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. 1. 2018 Publication 4681 - Internal Revenue Service Jan 14, 2019 — Worksheet for Foreclosures and ... Foreclosure and repossession are remedies ... foreclosure or repossession is discussed later.

2021 Publication 4681 - IRS Worksheet for Foreclosures and Reposessions Chapter 3. Abandonments Chapter 4. How To Get Tax Help Student Loans Discharge of qualified principal residence indebtedness before 2026. Qualified princi- pal residence indebtedness can be excluded from income for discharges before January 1, 2026. Reminder Photographs of missing children. Bankruptcy Worksheet - Keegan & Co Attorneys, LLC Bankruptcy Worksheet It is not required that you complete the Bankruptcy Worksheet prior to your free consultation. However, it will expedite your consultation and case. Don't worry if you are not sure of an answer or do not have a requested document. Just fill out the worksheet as best you can and bring it with you to your appointment. Debt Collection and Repossession Rights - Quiz & Worksheet Repossession Commercial real estate loan Next Worksheet Print Worksheet 1. Rick loses his job and is unable to make house payments for several months. His bank moves to seize the house by _____.... Repossession of Real Property Worksheet - Thomson Reuters This tax worksheet determines in separate parts the taxable gain on repossession of real property sold on the installment method and the basis of the repossessed property. The rules for figuring these amounts depend on the kind of property the taxpayer repossess. The rules for repossessions of personal property differ from those for real property.

Cancellation of Debt Insolvency Worksheet - Thomson Reuters This tax worksheet calculates a taxpayer's insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. ... Cancellation of all or part of a debt that is secured by property may occur because of a foreclosure, a repossession, a voluntary return of the property to the lender, abandonment of the property, or a principal ... DOCX SCRA Risk Assessment Tool Fillable Worksheet - Office of the ... This worksheet includes the SCRA risk indicators from version 1.0 of the "Servicemembers Civil Relief Act" booklet of the ... Examiners should also consider the number of SCRA protection requests and the volume of mortgage loan foreclosures and automobile repossessions. The volume of loans, leases, and accounts subject to the SCRA is low ... Publication 4681 (2021), Canceled Debts, Foreclosures ... - IRS Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan. Individual 1099-A 1099-C Foreclosure Repossession Quitclaim ... - Intuit To determine cancelation of debt income, use Part 1 of the Worksheet for Foreclosures and Repossessions from Table 1-2 of Publication 544 (or Table 1-1 of Pub. 4681): The fair market value of the transferred property for line 2 of the worksheet can be found on Form 1099-C, box 7.

Publication 4681 (2007), Canceled Debts, Foreclosures, Repossessions ... John and Mary complete Table 1-1 and find that they have a $45,000 loss from the foreclosure. Because this loss relates to their personal residence, it is a nondeductible loss. Following are John and Mary's sample forms and worksheet. Example 3—Mortgage loan foreclosure with debt exceeding $2 million limit.

Get and Sign Publication 4681 Canceled Debts, Foreclosures ... Follow the step-by-step instructions below to design your 2020 publication 4681 canceled debts foreclosures repossessions and abandonment for individuals: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature.

Worksheet: If You Are Considering Bankruptcy - Eric Ollason Foreclosures & Repossessions; Second Mortgages/HELOC; Short Sales; Property You Can Keep; Dischargeable and Non-Dischargeable Debts; Family Debt; Small Business Debt; Small Business Bankruptcy; Evictions and Foreclosures On Moratorium End

Publication 4681 (2017), Canceled Debts, Foreclosures, Repossessions ... Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan.

Foreclosures - Uncle Fed Complete Table 1-2, Worksheet for Foreclosure & Repossessions to determine if there is income from cancellation of debt or gain or loss from foreclosure or repossession. You may be able to exclude all or part of the cancelled debt income if all or part of the debt was discharged in bankruptcy; if you were insolvent immediately before the ...

About Publication 4681, Canceled Debts, Foreclosures ... - IRS Information about Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments, including recent updates and related forms.

2016 Publication 4681 - Internal Revenue Service Feb 1, 2017 — Worksheet for Foreclosures and ... Foreclosure and repossession are remedies ... foreclosed upon or repossessed and sold, you.

Foreclosures and Capital Gain or Loss - IRS Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or repossession. A loss on the sale or disposition of a personal residence is not deductible.

PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These rem- edies allow the lender to seize or sell the prop- erty securing the loan.

PDF 2015 Publication 4681 - trp.tax Insolvency Worksheet. Keep for Your Records: Date debt was canceled (mm/dd/yy) Part I. Total liabilities immediately before the cancellation (don't include the same liability in more than one category) ... Canceled Debts, Foreclosures, Repossessions, and Abandonments, \(for Individuals\)

Solved: I received a 1099-C, how can I claim insolvency? I cannot ... In this situation, your 1099-C mentions the date, and you need to go back to that date and fill out an insolvency worksheet. See the following link: Insolvency Worksheet - Publication 4681--Canceled Debts, Foreclosures, Repossessions, and Abandonmen... (The link opens a PDF file. Once open, go to page 6 for the worksheet).

Entering canceled debt in ProSeries - Intuit Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals)

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 12 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

2017 Publication 4681 - IRS Jan 25, 2018 — Worksheet for Foreclosures and ... Foreclosure and repossession are remedies ... foreclosed upon or repossessed and sold, you.

2011 Publication 4681 - Internal Revenue Service Dec 26, 2011 — In 2011, Greg was re- separate insolvency worksheet and determines ... Worksheet for Foreclosures and Repossessions (for John and Mary Elm).

0 Response to "45 worksheet for foreclosures and repossessions"

Post a Comment