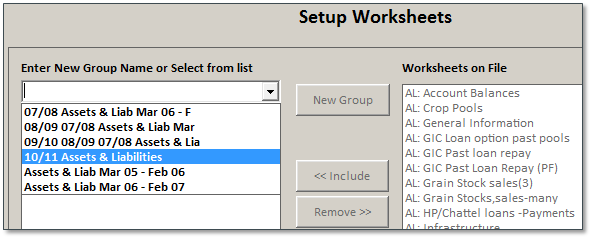

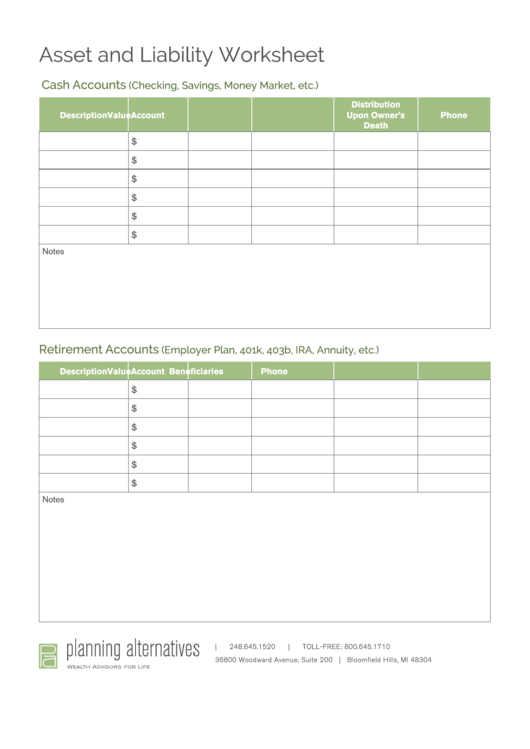

41 assets and liabilities worksheet

Creating and Understanding Your Balance Sheet - FCSAmerica An easy check and balance is to match assets to liabilities. Most assets will match up to a liability. For instance, if a growing crop is listed as an asset, check that accounts payable for associated seed, fertilizer and chemical have been included as liabilities. ... (FCSAmerica), includes a worksheet with current assets and liabilities ... Assets And Liabilities Worksheet 7th Grade Displaying top 8 worksheets found for - Liabilities And Assets. Thank you for visiting Assets And Liabilities Worksheet 7th Grade. We always effort to show a picture with HD resolution or at least with perfect images. These are nothing more than a. C create and organize a financial assets and liabilities record and construct a net worth statement.

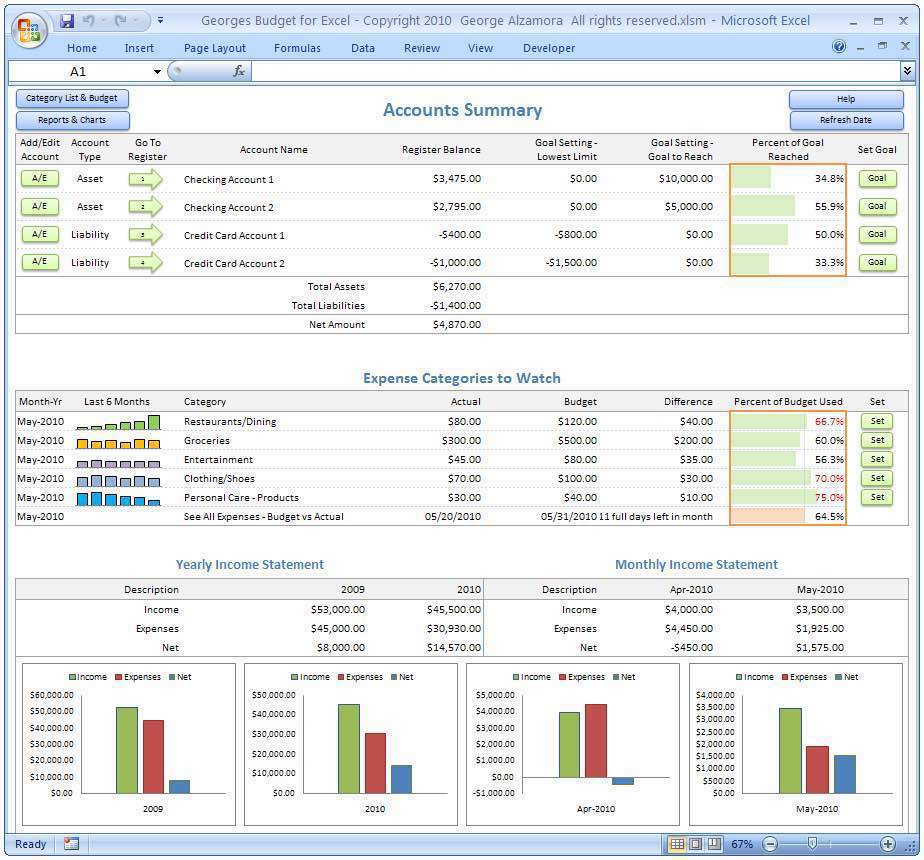

How To Create a Balance Sheet in Excel (With Tips and FAQs) To add the amounts in the cell next to the "Total" label of each asset and liability, type the formula "=SUM" and then select the adjacent cells you want to add. Hit the "Enter" key on your keyboard. Excel adds the sum of these cells automatically in the selected cell.

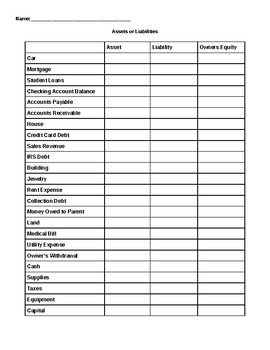

Assets and liabilities worksheet

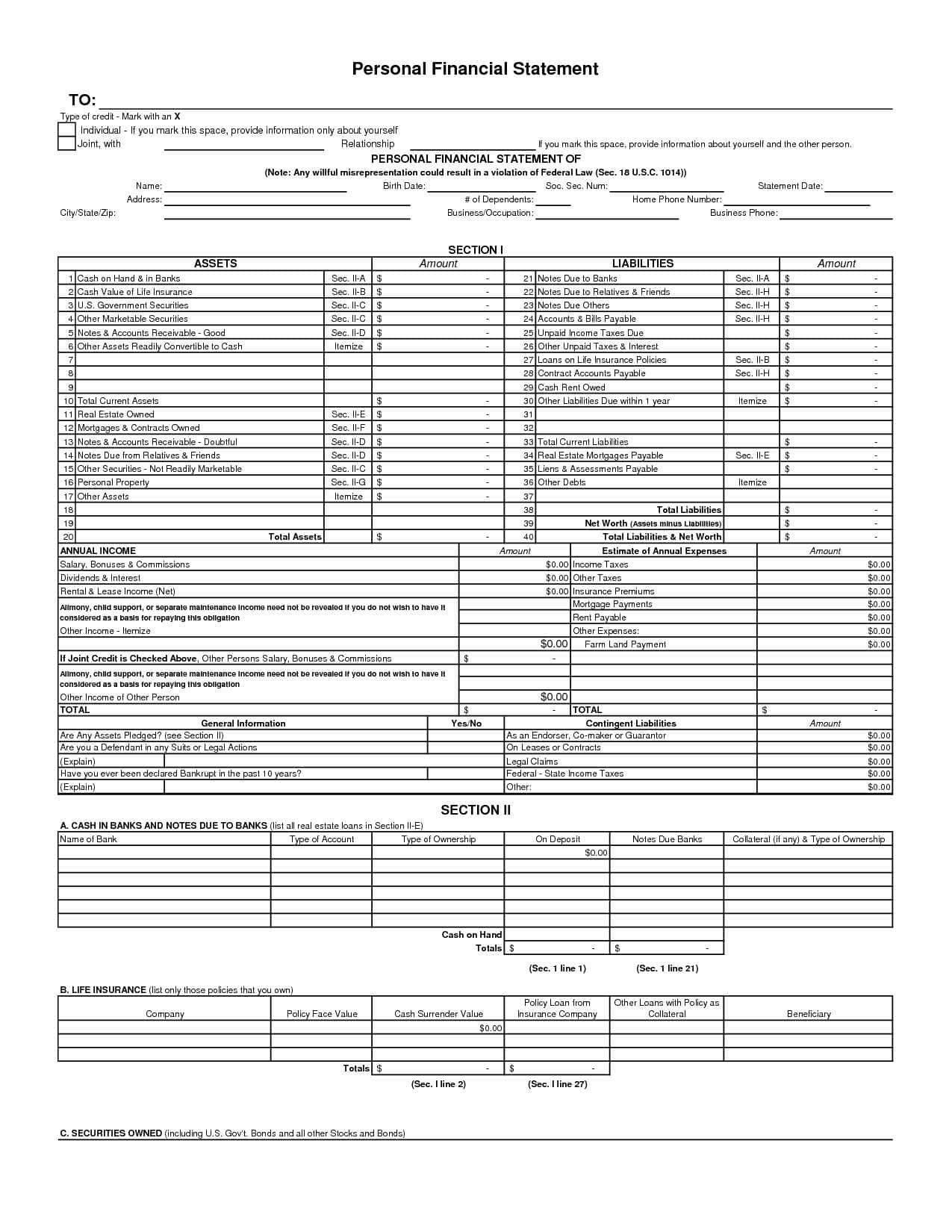

Personal Financial Statement Template - Corporate Finance Institute This personal financial statement template is a great tool to keep track of your personal assets, liabilities, income, and expenses. This is what the personal financial statement template looks like: Enter your name and email in the form below and download the free template now! 6 Best Free Net Worth Spreadsheets - Tiller Tiller Community Solutions has created a free net worth template for Tiller-powered spreadsheets to help you to easily track and visualize net worth progress over time.. Because this template is powered by Tiller Money Feeds, it automatically pulls in your daily bank, credit card, mortgage, loan, brokerage, and other balances.. You'll easily be able to view all your assets and liabilities in ... Assets And Liabilities Worksheet The absolute bulk of liabilities for this business equals $1,275,000. Subtract the absolute liabilities from the absolute assets to get the net account of the business. In this example, this baby business has $1,355,000 in assets and $1,275,000 in liabilities. Subtracting $1,275,000 from $1,355,000 equals $80,000.

Assets and liabilities worksheet. Insolvency Worksheet | SOLVABLE At the same time, your liabilities consist of $220,000 in mortgage loan and $10,000 in credit card debt. Under these facts, your total assets would be $210,000 ($200,000 + $8,000 + $2,000) and your total liabilities would be $230,000 ($220,000 + $10,000). As a result, you would be insolvent by $20,000 ($230,000 - $210,000). Bank Liabilities & Assets | Overview, Differences & Examples - Video ... Bank assets refer to the things owned by a bank that help to bring value. Bank assets different from personal and business assets as they generally include money-related assets. These assets cover ... Assets And Liabilities Worksheet - Maths Worksheets For Grade 3 The assets and liabilities worksheet below can help you with this by showing you both your individual and combined net worth. This simple balance sheet template includes current assets fixed assets equity and current and long-term liabilities. ASSETS AND LIABILITIES WORKSHEET. Click on Set Up. What Are Balance Sheets? - Investopedia The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out: \text {Assets} = \text {Liabilities} +...

Sample Assets And Liabilities Balance Sheet Template Download Sample Assets And Liabilities Balance Sheet ExampleTemplate | FREE Printable Format Download "Sample Assets And Liabilities Balance Sheet" Sample-Assets-And-Liabilities-Balance-Sheet.pdf - Downloaded 3 times - 8 KB Don't worry, we don't spam Written by MTRIT Our picks No posts match the widget criteria Net Worth: Personal Assets & Liabilities - Study.com Once you determine the value, separate the assets into four categories: current, real estate, personal property and investments. Assets are listed on the balance sheet in the order of liquidity.... How To Create a Personal Balance Sheet and Determine Net Worth The sum of all of the money you owe is your liabilities. As you start to pay down your debt, your total liabilities will decrease, which will increase your net worth (even if your assets don't grow). Calculate your net worth As noted earlier, the difference between your assets and your liabilities is your net worth. The formula looks like this: Net Worth Calculator: Find Your Net Worth - NerdWallet For example, if you have a mortgage on a house with a market value of $200,000 and the balance on your loan is $150,000, you can add $50,000 to your net worth. Basically, the formula is: ASSETS ...

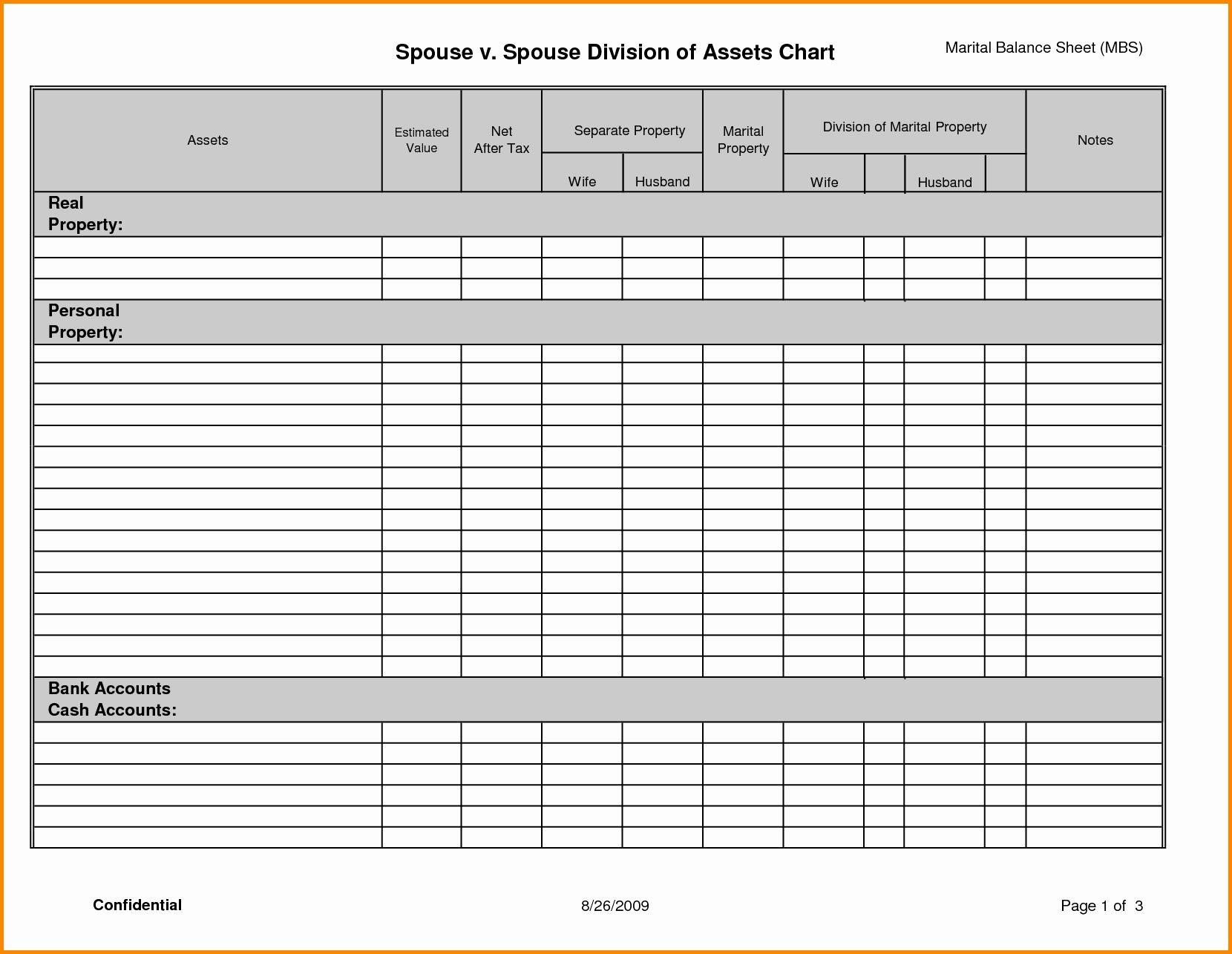

How to Probate an Estate: Inventory, Documents, and Assets This step is important, because most states require that an inventory of the decedent's probate assets, along with their date-of-death values, be filed with the probate court within 30 to 90 days of the date when the probate estate was opened with the court. 2. All financial institutions where the decedent's assets are located must be contacted ... Balance Sheet - Definition & Examples (Assets = Liabilities + Equity) The left side of the balance sheet outlines all of a company's assets. On the right side, the balance sheet outlines the company's liabilities and shareholders' equity. T he assets and liabilities are separated into two categories: current asset/liabilities and non-current (long-term) assets/liabilities. Asset Liabilities Divorce Excel Spreadsheet - Google Groups Minnesota's divorce laws provide upon the division of raise and personal property. 1 Asset and Liability Comparison Worksheet Date Prepared Asset whose Value Client's Asset to Excel Business... Sample Balance Sheet Template for Excel - Vertex42.com The balance sheet is a very important financial statement that summarizes a company's assets (what it owns) and liabilities (what it owes ). A balance sheet is used to gain insight into the financial strength of a company. You can also see how the company resources are distributed and compare the information with similar companies. Advertisement

A Guide to Assets and Liabilities - The Balance Assets and liabilities are terms frequently used in business to state the property owned and the debts incurred, respectively. Assets are the properties or items owned by a business, and they increase the business's value. Liabilities are the amounts owed by the business—in other words, debts that decrease the business's value.

Mint Tool: Calculate Your Net Worth - MintLife Blog If your total assets and liabilities were equal to the example above, then your net worth would be negative: -$7,700, specifically. That's because the total amount that you owe in this example is greater than the total amount you own. What does that mean for your personal financial picture? Using a wealth calculator isn't the end of the story.

Balance Sheet - Format, Explanation and Example - Accounting For Management Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner's equity of a business at a particular date.The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. While the balance sheet can be prepared at any time, it is mostly prepared at the end of ...

Free Current Assets List - PDF | Word - eForms Updated June 01, 2022. A current assets list is a list of all items under an individual's ownership, including but not limited to personal property (household items, jewelry, vehicles, etc.), bank accounts, real estate, investments, life insurance policies, and any other valuables. A current assets list is commonly used when creating a Last Will and Testament or as part of completing an ...

What are Assets & Liabilities in Accounting? Definition & EXAMPLE In this case, your Ferrari would be an example of an asset whereas your mortgage is a liability. Use the worksheet below and list at least 3 assets and 3 liabilities you have in your business or your personal life. Use the checklist to make sure they fit the definition of an asset. Assets Interactivity Enter name of asset: Liability Interactivity

What Is "Fund Balance" On A Balance Sheet? - Aplos Academy A Balance Sheet is one of the financial statements an organization uses to view its assets, liabilities, and equity (sometimes referred to as net assets or fund balances by nonprofits) at a specific point in time. This report is basically a snapshot of an organization's financial position. These statements provide valuable information about ...

Asset And Liability Statement Excel Template - Google Groups The Balance Sheet report displays assets liabilities and heavy The Income Statement report displays income and expenses. It brings together your assets liabilities income expenses and every else...

The basics: Statement of Assets, Liabilities, and Net Worth SALN stands for Statement of Assets, Liabilities, and Net Worth. It is a declaration of assets (i.e., land, vehicles, etc) and liabilities (i.e., loans, debts, etc), including business and financial interests, of an official/employee, of his or her spouse, and of his or her unmarried children under 18 years old still living in their parents ...

Difference Between Assets and Liabilities (with Classification ... Fixed Assets are depreciable, while current assets are not. Liabilities are non-depreciable: Nature of Balance: Every asset has a debit balance: Every liability has a credit balance: Accounting Treatment: An increase in assets is debited, decrease in assets is credited. An increase in liability is credited, decrease in liability is debited.

ASC 842 Balance Sheet Changes, Example, Implementation [2021] | Visual ... Under ASC 842, the total lease expense is the same, but $239,000 is related to amortization, and $108,000 is related to interest expense. For 2018, we've made $324,000 in payments, but only reduced the liability balance by $216,000. Keep in mind that the impact on this balance sheet represents only a single 5-year real estate lease.

Assets And Liabilities Worksheet The absolute bulk of liabilities for this business equals $1,275,000. Subtract the absolute liabilities from the absolute assets to get the net account of the business. In this example, this baby business has $1,355,000 in assets and $1,275,000 in liabilities. Subtracting $1,275,000 from $1,355,000 equals $80,000.

6 Best Free Net Worth Spreadsheets - Tiller Tiller Community Solutions has created a free net worth template for Tiller-powered spreadsheets to help you to easily track and visualize net worth progress over time.. Because this template is powered by Tiller Money Feeds, it automatically pulls in your daily bank, credit card, mortgage, loan, brokerage, and other balances.. You'll easily be able to view all your assets and liabilities in ...

Personal Financial Statement Template - Corporate Finance Institute This personal financial statement template is a great tool to keep track of your personal assets, liabilities, income, and expenses. This is what the personal financial statement template looks like: Enter your name and email in the form below and download the free template now!

0 Response to "41 assets and liabilities worksheet"

Post a Comment