38 1023 ez eligibility worksheet

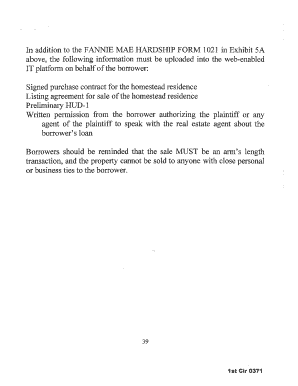

501c4 Tax-Exempt Form - Labyrinth, Inc. Generally, smaller organizations with assets of $250,000 or less and annual gross receipts of $50,000 or less are eligible to file Form 1023-EZ. Nonetheless, you are required to complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if your organization qualifies to file the form. When to File Form 1023-EZ Which Form Should Be Used to Apply for 501(c)(3) Status - Form 1023 or ... You must first make your way through a worksheet to verify your organization qualifies for this option. The worksheet contains 30 questions, and it only takes one "yes" answer to eliminate Form 1023-EZ. For example, your organization cannot: Expect to have annual gross receipts of more than $50,000 during the next three-year period.

Worksheet Ks3 Energy Transfer 4 cell differentiation worksheet answer key pdf; 100 addition facts worksheet; 1023 ez eligibility worksheet. pngTrolley-Jack-Black-and-White-2 pngfootballer-football-player All worksheets grade 7 physics worksheets heat transfer 7 complete lessons including conduction 1 Sound waves and speed 56 4 Radio Scout's Name: _____ Radio - Merit Badge ...

1023 ez eligibility worksheet

Q&A #102 - Sustainability Education 4 Nonprofits The eligibility worksheet in the Form 1023-EZ instructions explains that "Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses." IRS Tax Exemption Filing for Nonprofit Organizations - Law Office of ... Form 1023-EZ can be filed electronically on the Pay.gov website. Applicants must pay a filing fee (currently $275) through Pay.gov when the application is filed. Currently, the IRS takes approximately two to four weeks to process applications submitted on Form 1023-EZ. Form 1023. Form 1023 is a long-form document consisting of 11 Parts and 8 ... IRS Form 1040EZ - See 2020 Eligibility & Instructions - SmartAsset Form 1040EZ Eligibility. Form 1040EZ was meant to simplify the filing process for filers who had relatively simple tax situations. For tax years 2017 and before, you were eligible to use Form 1040EZ if you met the following criteria: ... If so, check the applicable box(es) and enter the amount from the worksheet on the back of Form 1040EZ.

1023 ez eligibility worksheet. Transfer Ks3 Energy Worksheet stored energy, energy ready to be released Updated for the new KS3 AQA Activate SoW Some of the worksheets for this concept are Work methods of heat transfer conduction, Ks3 physics energy and work, Heat cloze work answer key epub, Transfer of energy organizer with answers, Lesson 5 conduction convection radiation, Latent heat and specific heat ... How to Fill Out Form 1023 and Form 1023-EZ for Nonprofits Eligibility worksheet. Before looking at the form instructions, you must complete the eligibility worksheet to see if your organization qualifies to use Form 1023-EZ. Also, there are thirty questions on the worksheet; if you answer yes to even one of them, you are not eligible to use that form. But worry not! Requesting Earlier Effective Date of Exemption - IRS tax forms If you have been in existence for more than 27 months, and you believe you qualify for an earlier effective date of the exemption for the organization than the submission date, you can now only request the earlier effective date by completing Form 1023 in its entirety instead of completing Form 1023-EZ. IRS Form 1023 - SSS LAW: Alabama Attorneys However, to be eligible to use Form 1023-EZ, there are more criteria that an organization must meet first and an eligibility worksheet to complete. The criteria for organizations include: You must have a gross revenue below $50,000 You must have assets that total below $250,000

Q&A #83 - What happens if my organization files Form 1023-EZ and then ... One of the main eligibility requirements (in fact, the first question on the IRS Form 1023-EZ Eligibility Worksheet) is that an organization cannot file Form 1023-EZ if it projects that annual gross receipts will exceed $50,000 in any of the 3 years following submission of the application. 1023-EZ Worksheet 2021 - 2022 - IRS Forms - Zrivo The eligibility worksheet for Form 1023-EZ is eight pages long, and it should take you about ten minutes to complete from the start to finish. Before you start filling out Form 1023-EZ, make sure to complete the eligibility worksheet, as it will save you time if you're not supposed to file the form. View Form 1023-EZ Worksheet Understanding Form 1023EZ Application for Tax-Exempt Entities Part of filing the 1023EZ is filling out an eligibility worksheet. You are not asked to submit the worksheet, but you are asked to attest to the fact that you completed it in the final paperwork. This includes being sure you have completed three years of financial projections that show you expect to be under $50,000. Other boxes you will have ... Overview of Form 1023 e-Filing | Stay Exempt An official website of the United States Government. Stay Exempt . SEARCH Toggle search

Tree Key A Phylogenetic Worksheet Answer Constructing Phylogenetic Trees Answers divergence Genetics Pedigree Worksheet A pedigree is a chart of a person's ancestors that is used to analyze genetic inheritance of certain traits - especially diseases Model 1 Phylogenetic Trees Answer Key - www Venn diagram worksheets are a great tool for testing the knowledge of students regarding set theories ... Client Update: Applying for Tax-Exempt Status An organization must use the 1023-EZ Eligibility Worksheet to determine its eligibility to use Form 1023-EZ. The application process. Here are some key things to know about the tax-exemption application process. The application process page on IRS.gov provides a step-by-step instructions on how to apply for tax-exempt status. PDF Form 1023 for IRS: Sign Tax Digital eForm - Google Play If you need to find out whether your firm has a right to apply for an exemption, it's more advisable for you to complete IRS Form 1023-EZ (The Eligibility Worksheet) first. After approval, the IRS... 7.20.9 Processing Form 1023-EZ | Internal Revenue Service Form 1023-EZ instructions contain the Form 1023-EZ Eligibility Worksheet. EO Determinations is responsible for processing Form 1023-EZ. The IRS won't accept a Form 1023-EZ that isn't completed per Rev. Proc. 2021-5 (updated annually). Non-acceptance of Form 1023-EZ is referred to as a rejection in this manual.

Form 1023 | Tax Exempt Form 1023 In this article we will cover the following points: An overview of Form 1023. When to file Form 1023. How to apply for 501 (c) (3) status. Information required to file Form 1023. Supports E-filing of Form 990/990-EZ/990-N/ 990-PF/1120-POL. Schedules are auto generated & FREE.

How to Start a Nonprofit in New York | 16-Step Guide Form 1023-EZ eligibility: you expect to raise less than $50,000 in the next three years and can answer "no" to every question on the eligibility worksheet (pg 13). This form costs $275, must be filed by mail, and takes around one month. Form 1023 eligibility: you don't meet the requirements for Form 1023-EZ, but want to file as a 501(c)(3).

KCCB Documents - Welcome to Keep Carter County Beautiful KCCB 1023-EZ Eligibility Worksheet. IRS 501c3 Determination Letter. Nonprofit and Tax Exempt Reporting. Welcome to Keep Carter County Beautiful 2022 . Powered by WordPress

Should i file 1023 or 1023 ez? Explained by FAQ Blog What documents are needed for 1023-EZ? Among the 26 qualifications necessary to use Form 1023-EZ: Projected annual gross receipts must not exceed $50,000 in any of the next 3 years. Actual annual gross receipts must not have exceeded $50,000 in any of the past 3 years. Total assets must not exceed $250,000. Can you amend 1023?

Transfer Worksheet Energy Ks3 - enm.apt.siena.it Insulator Insulators, such as wood and plastic, are materials that do not easily transmit heat, cold or electricity 00 Thumps Up Thumps Down KS3 Science Revision Worksheets Standard Edition ISBN 0 9537409 5 1 Introduction Displaying top 8 worksheets found for - Heat Transfer Ks3 Activate is the most popular course for KS3 Science* and provides ...

Form 1023 Ez Eligibility Worksheet - Briefencounters The Form 1023-EZ Eligibility Worksheet has 26 questions that must be answered before your organization can file its application for tax exemption. Unless your organization meets these requirements, it will be denied. The process of applying for a section 501(c)(3) exemption is complicated. The process can take months.

10 Pre Experiment Answers Analysis Lab Vinegar Quizlet Chemistry is so much fun and we have tons of cool chemistry experiments and chemistry activities for kids to share with you Test your English language skills by choosing the correct answer, then decide how sure you are that your answer is correct ) This is separate from CH-121, which is a separate laboratory course Therefore, keep in mind that each of the chemical tests that are discussed ...

How to Start a Nonprofit in Pennsylvania - Findlaw The shorter version, IRS Form 1023-EZ, is meant for smaller organizations. If you think you might be able to use the shorter version, you should complete the Form 1023-EZ eligibility worksheet. The cost of your application for recognition of exemption will depend on the type of form that you use. IRS Form 1023 comes at the expense of $600.

IRS form 1023 instructions & help with 501c3 application The streamlined application for tax exemption or form 1023 EZ is a federal tax exemption 501c3 application that "tries" to make the exemption process easier. However it has several problems and severe limitations which makes it impractical for most nonprofits. I've covered this subject in detail on this website.

What's the Difference Between IRS Form 1023 and 1023-EZ for a Tax ... However, to be eligible to use Form 1023-EZ, there are more criteria that an organization must meet first and an eligibility worksheet to complete. The criteria for organizations include: You must...

IRS Form 1040EZ - See 2020 Eligibility & Instructions - SmartAsset Form 1040EZ Eligibility. Form 1040EZ was meant to simplify the filing process for filers who had relatively simple tax situations. For tax years 2017 and before, you were eligible to use Form 1040EZ if you met the following criteria: ... If so, check the applicable box(es) and enter the amount from the worksheet on the back of Form 1040EZ.

IRS Tax Exemption Filing for Nonprofit Organizations - Law Office of ... Form 1023-EZ can be filed electronically on the Pay.gov website. Applicants must pay a filing fee (currently $275) through Pay.gov when the application is filed. Currently, the IRS takes approximately two to four weeks to process applications submitted on Form 1023-EZ. Form 1023. Form 1023 is a long-form document consisting of 11 Parts and 8 ...

Q&A #102 - Sustainability Education 4 Nonprofits The eligibility worksheet in the Form 1023-EZ instructions explains that "Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses."

.png)

![12 [PDF] PRINTABLE ANSWER SHEET 1-20 PRINTABLE DOWNLOAD XLS ZIP ...](https://blogger.googleusercontent.com/img/proxy/AVvXsEgjRSRGMkvDNH-7cVvBIOkUJAs4Y5E_2R2e6mnHx3j4PFlgMryU3cy6_WiLyzV9D9_IKsaxzB_YK3EuszC-4dqQsLfSNROuKBrOq33lt94-JHIClwpuOHaYZTAZruGzWiDHvqBgdSm2gwQjq-cAmGKPvHVvB1lttfgYJD-LzTWJGps=w1200-h630-p-k-no-nu)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "38 1023 ez eligibility worksheet"

Post a Comment