39 va residual income calculation worksheet

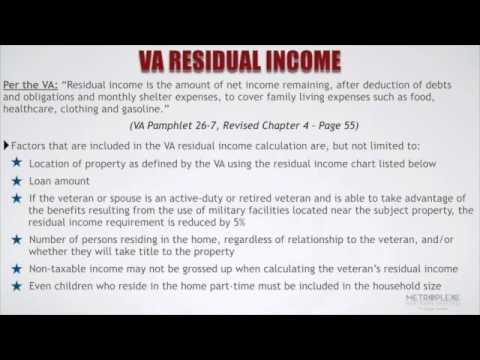

Debt-to-Income Ratio Calculator for Mortgage Approval: DTI … VA: N/A: lender benchmark of 41%; varries by lender: USDA: 29% to 32%, higher with compensating factors : 41%, or 44% with a PITI below 32%: On June 22, 2020 the CFPB announced they were taking steps to address GSE patches which could see the DTI ratio removed as a requirement for qualifying mortgages. They would instead rely on loan pricing … Chapter 4 Credit UnderwritingOverview - Veterans Affairs b. Debt-to Income Ratio. VA’s debt-to-income ratio is a ratio of total monthly debt payments (housing expense, installment debts, and other obligations listed in section D of VA Form 26-6393, Loan Analysis, to gross monthly income. It is a guide and, as an underwriting factor, it is secondary to the residual income. It should not ...

PDF CBC Residual Income Worksheet - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11.

Va residual income calculation worksheet

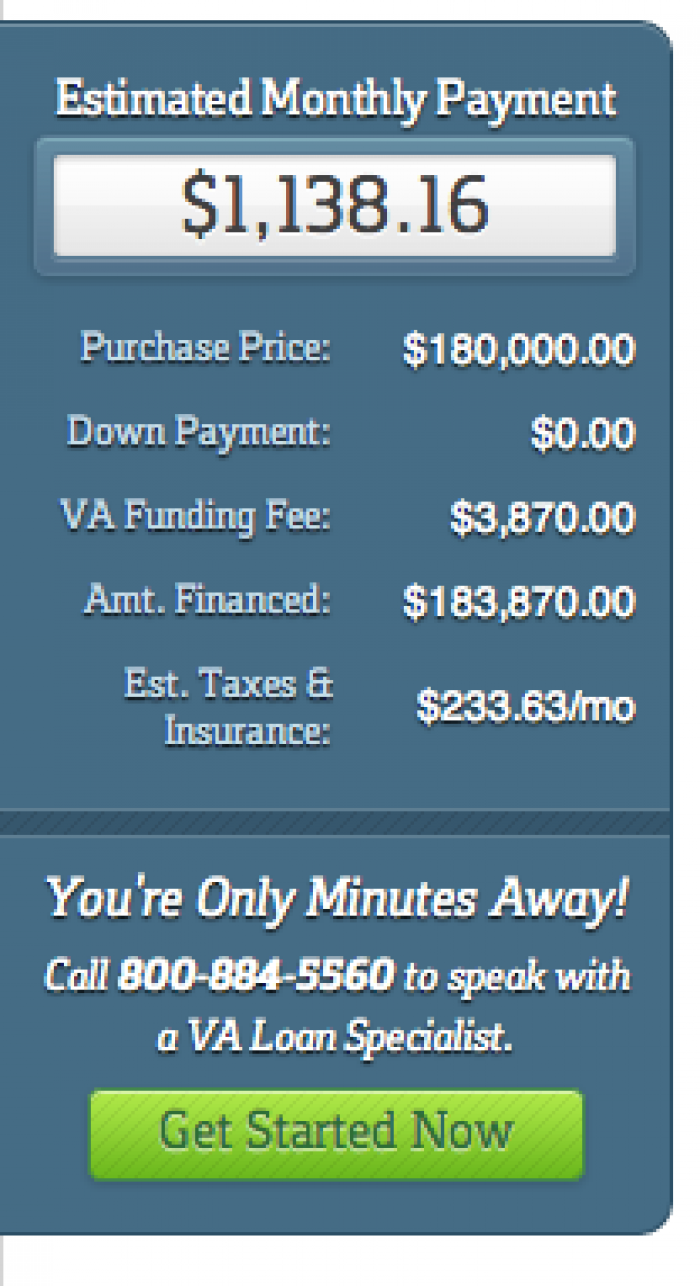

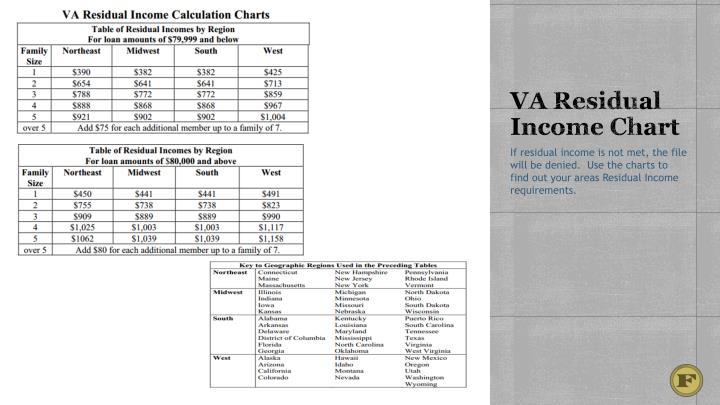

VA Residual Income Calculator and Chart - Loans101.com VA Residual Income Calculator . INCOME Your Gross Monthly Income: $ /month. Co-Applicant Gross Annaul Income: $ /month. TAX Estimated Federal, State & Social Security Taxes: $ /month. EXPENSE Proposed New Housing Payment Principal, Interest, Taxes and Insurance: $ /month. Car Payments: $ /month. Credit Card Payments: $ VA Residual Income Chart And Requirements | Quicken Loans Residual income is simply what's left over after all your expenses are paid. To calculate that number, you simply subtract all the bills mentioned above that make up your DTI ratio. The VA's minimum residual income is considered a guide and should not trigger an approval or rejection of a VA loan on its own. PDF RE: URGENT - VA Residual Incom Calculator Tommy Mach The residual income chart below details VA requirements by loan amount, family size, and region: West $425 $713 $859 $967 $1,004 West $491 $823 $990 $1,117 $1,158 Family Size Over 5 Residual Income: Family Size Over S Northeast Midwest South West Northeast $390 $654 $788 $888 $921 Loan Amounts S $79,999 Midwest $382 $641 $772 $868 $902 South $382

Va residual income calculation worksheet. Guide for the Partnership Information Return (T5013 Forms) The partnership can have income from more than one source, such as business, professional, commission, farming, fishing, rental, and investment. Calculate the income or loss from each source separately, on a working paper as follows: Calculate the partnership's net income or loss for accounting purposes by preparing the financial statements PDF VA Residual Income Calculation Charts VA Residual Income Calculation Charts Table of Residual Incomes by Region For loan amounts of $80,000 and above Family Size Northeast Midwest South West 1 $450 $441 $441 $491 2 $755 $738 $738 $823 3 $909 $889 $889 $990 4 $1,025 $1,003 $1,003 $1,117 ... VA_Residual.pdf Author: susan.bove Get Va Residual Income Calculator - US Legal Forms Adhere to our simple steps to have your Va Residual Income Calculator prepared rapidly: Find the web sample from the library. Type all necessary information in the required fillable areas. The intuitive drag&drop user interface makes it simple to add or relocate fields. Check if everything is filled out properly, with no typos or missing blocks. VA Residual Income Calculator | Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense.

Residual Income (Definition, Formula) | How to Calculate? Residual Income can be calculated using the below formula as, Residual Income = Net Income of the firm - Equity charge: = US$4,700,500 - US$4,800,000 As seen from the negative economic profit, it can be concluded that AEW has not to earn adequate to cover the equity cost of capital. Financial Accounting questions and answers - Essay Help 05.03.2022 · QUESTION 4 – SEPT 2012 The following are the statement of comprehensive income and statement of changes in equity of Jamil Bhd and Jamilah Bhd for the year ended 30 April 2012. Statement of Comprehens… When prices for raw materials and other purchased good are increasing LIFO valuation will result in a higher Cost of […] How To Calculate VA Residual Income | 2022 Charts How do I calculate VA residual income? To find your approximate residual income, add up your regular monthly living expenses and subtract the total — along with your debt payments — from your gross monthly income. The money leftover after paying living expenses and debt is your residual income, which is also known as your discretionary income. Va Residual Income Worksheet Pdf Excel VA Residual Income Calculation Charts. Excel Details: VA Residual Income Calculation Charts Table of Residual Incomes by Region For loan amounts of $80,000 and above Family Size Northeast Midwest South West 1 $450 $441 $441 $491 2 $755 $738 $738 $823 3 $909 $889 $889 $990 4 $1,025 $1,003 $1,003 $1,117 VA_Residual.pdf Author: susan.bove Created Date: va residual income worksheet 2021

Getting A VA Loan Using Self-Employed Income VA Self-Employed Income Calculation If your business made $100,000 last year, but you wrote off $50,000 in losses or expenses, lenders will only count the remaining $50,000 as effective income toward a mortgage. Needless to say, that can come as a shock to many prospective borrowers. VA Residual Income Guidelines - Veteran.com Here are the residual income charts for VA loans under $80,000 and VA loans over $80,000. We've further broken each chart down by family size and location. ... While the VA's residual income calculation measures what you have left after making essential payments each month, the debt-to-income ratio is a percentage that represents how deeply ... PDF LOAN ANALYSIS - Veterans Affairs section e - monthly income and deductions. 44. items. 31. 40. 41. 42. spouse borrower. 43. total. approve application reject application $ $ $ gross salary or earnings from employment. deductions € pension, compensation or other net income€ (specify) € total€ (sum of lines 37 and 38) net take-home pay What Is A Tangible Net Benefit? | Rocket Mortgage 27.01.2022 · If this is the case, you have more residual income after the refinance and it’s considered beneficial. Tangible Net Benefits And FHA Streamline Refinances An FHA Streamline refinance allows those who have an existing Federal Housing Administration (FHA) loan to do a rate/term refinance into another FHA loan for the purposes of a lower interest rate, modified …

PDF FHA Office of Single Family Housing Financial Assessment Worksheet that was included in the HECM Financial Assessment and Property Charge Guide, which was an attachment to Mortgagee Letter 14-22, dated November 10, 2014. ... calculation of Residual Income Shortfall. RESULTS OF FINANCIAL ASSESSMENT Expanded to include a Fully-Funded and Partially-Funded Designation,

How to Calculate Maintenance & Utilities on a VA Loan - sapling The VA appraiser that appraises the home can verify this information for you in an appraisal report. Multiply the square footage by the VA's predetermined allowance of 14 cents per square foot to find maintenance and utilities cost. For example, if your home is 1,600 square feet, your maintenance and utilities cost is $224 per month.

VA Residual Income Chart Shows How Much You Need to be VA Eligible VA residual income chart provides minimum residual income for each region and state. VA debt to income ratio is important but residual income is more. 866-719-1424. ... VA loan underwriters are using this calculation to determine your ability to make your VA loan monthly payment and other expenses. Having a good number can play a huge role in ...

Residual Income Formula | Calculator (Examples With Excel ... - EDUCBA Calculate the residual income of the investment center if the minimum required rate of return is 18%. Solution: Residual Income is calculated using the formula given below Residual Income = Operating Income - Minimum Required Rate of Return * Average Operating Assets Residual Income = $1,000,000 - 18% * $5,000,000 Residual Income = $100,000

DOC Chapter 4 Chapter 4. Credit Underwriting. Overview. In this Chapter This chapter contains the following topics. Topic Topic Name See Page 1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal Government 4-34 7 Credit History 4-40 8 ...

Florida Seller Closing Costs & Net Proceeds Calculator Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if applicable. Click on "Print Column A" to print a nice clean ...

Chapter 4 - Veterans Affairs Chapter 4. Credit Underwriting. Overview. In this Chapter This chapter contains the following topics. Topic Topic Name See Page 1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal …

The United States Social Security Administration VA-21-4182 Application For Dependency HHS-22 Property Act Requesting Supplemental Officer SSA-23-U5 Delivery Receipt SSA-24 Application For Survivors Benefits Payable Under Title 2 SSA-25 Certificate Of Election For Reduced Spouse’s Benefits SSA-26-PC Magnetic Media Reply Postcard SSA-L26 Wage Report Transmittal SSA-27 Non-Receipt Of Electronic Funds …

VA Mortgage: Residual Income Guidelines For All 50 States Northeast Region VA Residual Income Tables. For Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont, the VA residual income tables are ...

References - Nan McKay 16.10.2014 · Contact Us. 1810 Gillespie Way, Suite 202 El Cajon, CA 92020 Phone: 800-783-3100 Fax: 619-258-5791 Email: sales@nanmckay.com

PDF Chapter 4 Credit Underwriting Overview - Veterans Affairs 2 Income - Required Documentation and Analysis 4-7 ... 4-49 8 Automated Underwriting Cases (AUS) 4-56 9 How to Complete VA Form 26-6393, Loan Analysis 4-64 10 How to Analyze the Information on VA Form 26-6393, Loan Analysis 4-70 ... Only verified income can be considered in the repayment calculation. Continued on next page . VA Pamphlet 26-7 ...

PDF VA UNDERWRITING CHECKLIST - uffwholesale.com ___ Deductions through paycheckcity.com included in residual income calculation and uploaded ___ Residual income guideline met (120% required if DTI over 41%) ___ Income worksheet completed and uploaded ** ____ Assets ___ 2 months current consecutive bank statements for all accounts ___ Source and paper trail any and all large deposits

0 Response to "39 va residual income calculation worksheet"

Post a Comment