42 government spending worksheet answers

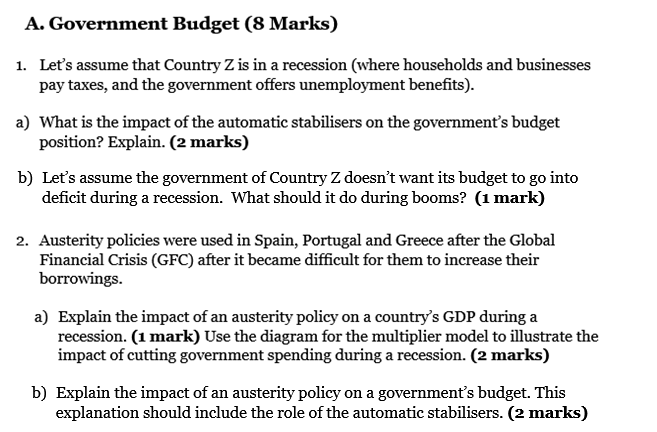

PDF Teacher's Guide - Theodore Roosevelt High School Government Spending _____1. People agree about how the government should spend its money. _____2. By relying on borrowed money, the government is at risk if people stop lending. _____3. There are negative effects if the government operates at a surplus. _____4. "Balancing the budget" means the government borrows more money than it spends. _____5. PDF Lesson 2 Taxing and Spending Bills - Weebly Lesson 2 Taxing and Spending Bills Guided Reading Activity Answer Key I. Making Decisions About Taxes A. The national government gets most of its revenue from taxes, the money that people and businesses pay to support the government. B. According to the Constitution, all revenue bills begin in the House of Representatives, but the

PDF UNIT 3 Macroeconomics LESSON 8 - Denton ISD 3. Government spending goes up while taxes remain the same. Expansionary. Higher government spending without a corresponding rise in tax receipts increases aggregate demand in the economy. 4. The government reduces the wages of its employees while raising taxes on consumers and businesses. Other government spending remains the same. Contractionary.

Government spending worksheet answers

PDF Mathematics Capstone Course Government Spending spending. The students will create graphs and answer questions on the worksheet based on the survey data. The students will draw their own conclusions from the data. The assessment for the percent change lesson is a worksheet. The students will be given data about Department of Defense spending and calculate the percent of change for the data. Make a Budget - Worksheet | FTC Bulkorder Publications This one-page budget worksheet helps you plan and track your spending. Get a tear-off pad of the worksheet and supplement it with other related topics from Consumer.gov. You can order this print publication in quantities from 50 - 200. All publications and shipping are free. If you need more than 200 copies, submit this form. PDF UNIT 3 Macroeconomics Key - Denton ISD Econoland has the following values for income and consumption. Use this data to answer questions 7, 8 and 9. Income Consumption 100 150 200 225 300 300 400 375 500 450 600 525 7. The government spending multiplier in Econoland is (A) 3 (B) 4 (C) 5 (D) 10 (E) 30 8. If there is an increase in taxes of $200 in Econoland, the decrease in GDP will ...

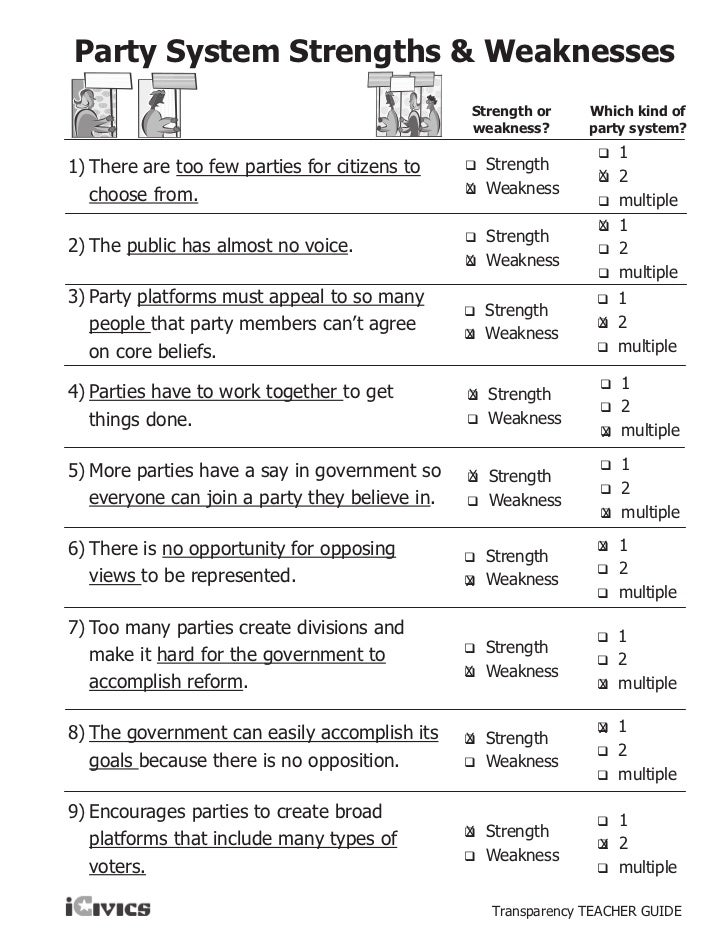

Government spending worksheet answers. Government Spending - Fiscal Policy Lesson Plan | iCivics This lesson tackles a variety of topics related to government spending, including the federal budget, mandatory versus discretionary spending, and government debt. Students learn the difference between a surplus and deficit, the basics of federal budgeting, and the method the government uses to borrow money. Federal Budget Teaching Resources | Teachers Pay Teachers 15. $2.50. PDF. This engaging simulation lesson plan has your students balancing the US federal budget by analyzing actual budget requests and government spending. A lesson plan page explains exactly how to conduct each part of the 90-minute activity and also includes links to online resources and a video to use. 5.04 Government Spending Worksheet.docx - Name Government ... government should spend money. Disagree Disagree T 2. By relying on borrowed money, the government is at risk if people stop lending. F 3. There arenegative effects if the government F operates at a surplus. Positive Positive F 4. "Balancing the budget" means the government borrows more money than it spends. Brings in. F 5. AP Macro - Unit 5. 5-1 Tools of Fiscal Policy - Quizlet C. Action on government spending D. Effect on federal budget (towards deficit or surplus) E. Effect on national debt Contractionary efforts 1. try to decrease AD 2. Increase taxes 3. Decrease government spending 4. Bring federal budget toward surplus 5. Decrease national debt Inflation persists while unemployment stays high. Effect on:

PDF Government Spending and Taxes - stlouisfed.org Government Spending and Taxes Lesson Author Barbara Flowers, Federal Reserve Bank of St. Louis Standards and Benchmarks (see page 11) Lesson Description In this lesson, students engage in an activity that matches programs for low-income Taxes And Government Spending Worksheets & Teaching ... HelpingHistory. $1.75. Zip. High School Economics Taxes & Government Spending Study Guide & Test with KEY includes a study guide with 40 questions and answer key and a 20 question test with answer key. Both are fully editable to suit your needs.Please email me with any questions at HelpingHistory@yahoo.comTERMS OF USE. Study 15 Terms | ECON - Worksheet -... Flashcards | Quizlet ECON - Worksheet - Chapter 14.1 - Government Revenue & Spending - Section 1 - How Taxes Work Terms in this set (15) Tax is a mandatory payment to a government. Revenue is a government income from taxes and other sources. Tax base is a form of wealth - such as income, property, goods, or services - that is subject to taxes. Individual income tax Quiz & Worksheet - Government Spending and Taxes as Fiscal ... Government spending Recession Fiscal policy Skills Practiced This quiz and worksheet allow students to test the following skills: Making connections - use understanding of the concept of aggregate...

PDF Federal Budget Simulation Lesson Plan - John F. Kennedy ... Supply each group with: (a) a game board and poker chips (b) Functional Areas with Budget Detailshandout (c) National Defense Spendinghandout (d) Special Interest Groups Requests (e) Tally Sheet 7. Ask students to consider first how the funds were allocated for President Trump's proposed FY 2018 budget. Do they agree with his priorities? 5.04 Government Spending Worksheet.docx - Name Government ... The government sells IOUs calledcupcakes. securities f f8. The government can meet all its spending needs by collecting taxes. cannot f9. Mandatory spending is spending that Congress decides on each year. Discretionary Discretionary D A B E c Worksheet p.1t10. Social Security and Medicare spending are both required by law. PDF Worksheet Solutions Government Spending 1. In what years did the government spend more than it collected? 1950, 1970, 1980, 1990 2. Use a calculator to find out how many times larger revenue was in 2000 than in 1950. about 52 times larger 3. Use a calculator to find out how many times greater spending was in 2000 than in 1950. about 42 times greater 4. Chapter 14: Taxes and Government Spending Section 4 The federal government has one budget while state governments have two budgets. An operating budget is a budget for day-to-day spending needs. A capital budget is spending on major investments. Unlike the federal government, 49 states require balanced budgets—budgets in which revenues are equal to spending.

PDF CHAPTER 14 Government Revenue and Spending KEY CONCEPTS Governments provide certain public goods that generally are not provided by the market, such as street lighting, highways, law enforcement, and the court system. Government also provides aid for people in need. Where does the money come from to pay for such goods and services? The most important source is taxes.

Declining dollars for education: UC instructional spending drops 30 percent | News | newsrecord.org

Make a Budget - Worksheet - Consumer.gov Make a Budget - Worksheet. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. File. pdf-1020-make-budget-worksheet_form.pdf (507.72 KB)

PDF Teacher's Guide - ISTE and spending. The budget identifies the amount of revenue that needs to be brought in through taxes, fees, and grants. Like the weather, revenues are forecasted based on planned tax rates, previous year data, and other anticipated funding. The budget also directs the ways in which the county's money will be spent on services and programs.

PDF Answer Key - Federal Reserve Bank of Atlanta Government spending A local library purchases new audio books . 4. Net exports or imports A retailer purchases tennis shoes from a manufacturer in China and sells them . 5. Consumption Mother purchases those tennis shoes from the retailer . Write one more example of each of the four components. 6. Answers will vary Consumption . 7. Answers will ...

30.1 Government Spending - Principles of Economics Government spending covers a range of services provided by the federal, state, and local governments. When the federal government spends more money than it receives in taxes in a given year, it runs a budget deficit.Conversely, when the government receives more money in taxes than it spends in a year, it runs a budget surplus.If government spending and taxes are equal, it is said to have a ...

Quiz & Worksheet - Federal Budget Spending | Study.com You will receive your score and answers at the end. question 1 of 3 About what percentage of federal spending is spent on interest on debt? 7% 3% 15% 20% Worksheet Print Worksheet 1. What is the...

PDF Worksheet - IRS tax forms Name _____ Date _____ Worksheet Government Spending Theme 1: Your Role as a Taxpayer Lesson 1: Why Pay Taxes? Key Terms public goods and services—Benefits that cannot be withheld from those who don't pay for them, and benefits that may be "consumed" by one person without reducing the amount of the product

PDF Monetary and Fiscal Policy Worksheet 1 With Answers Monetary and Fiscal Policy Worksheet #1 Name _____ Hour _____ 1. The rate of inflation has increased by 6.8% over the last year. ... Decrease Government Spending . Increase taxes . 2. The Consumer Price Index has gone up by 6.8% over the last year. The Federal Reserve wonders what it can do to help improve this situation. a.

Notes and worksheets - Mrs. Cooper's Economics and Finance ... Mrs. Cooper's Economics and Finance Classes. Unit 1. 8/11 Intro to Econ notes (fill ins); 4 Factors of Production foldable (ask a friend for help) 8/12 Modeling an Economic Decision (break down a product you use into the 4 Factors of Production; turn in for classwork grade) 8/15 Finish Friday's work of Modeling an Economics Decision; incentive ...

PDF UNIT 3 Macroeconomics Key - Denton ISD Econoland has the following values for income and consumption. Use this data to answer questions 7, 8 and 9. Income Consumption 100 150 200 225 300 300 400 375 500 450 600 525 7. The government spending multiplier in Econoland is (A) 3 (B) 4 (C) 5 (D) 10 (E) 30 8. If there is an increase in taxes of $200 in Econoland, the decrease in GDP will ...

Make a Budget - Worksheet | FTC Bulkorder Publications This one-page budget worksheet helps you plan and track your spending. Get a tear-off pad of the worksheet and supplement it with other related topics from Consumer.gov. You can order this print publication in quantities from 50 - 200. All publications and shipping are free. If you need more than 200 copies, submit this form.

PDF Mathematics Capstone Course Government Spending spending. The students will create graphs and answer questions on the worksheet based on the survey data. The students will draw their own conclusions from the data. The assessment for the percent change lesson is a worksheet. The students will be given data about Department of Defense spending and calculate the percent of change for the data.

![Taxonomy Classification, and Dichotomous Keys, [doc] taxonomy classification dichotomous keys ...](https://donnezver.com/macb/_37hX8IReSSfWsr4_aQy1gHaFj.jpg)

0 Response to "42 government spending worksheet answers"

Post a Comment