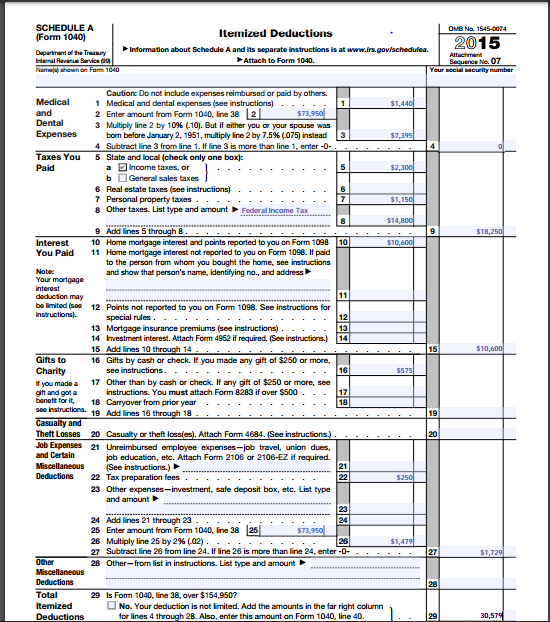

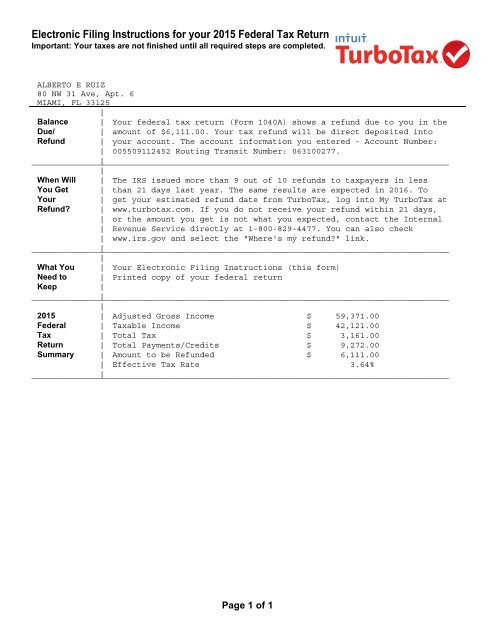

43 itemized deduction worksheet 2015

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance PDF Full-year New York State residents only 272002150094 IT-272 (2015) (back) Part 3 - Complete Part 3 if your total qualified college tuition expenses on line 3 are $5,000 or more. If you itemized your deductions on your federal return, you may elect to claim the college tuition itemized deduction instead of the college tuition credit. To compute your college tuition itemized deduction,

42 itemized deduction worksheet 2015 - Worksheet Was Here The Standard Mileage Rate for operating expenses of a vehicle for medical reasons is 23 cents per mile. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. The amounts will be reported on the Schedule KPI KS or KF you received from the entity.

Itemized deduction worksheet 2015

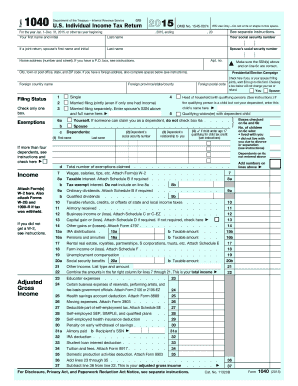

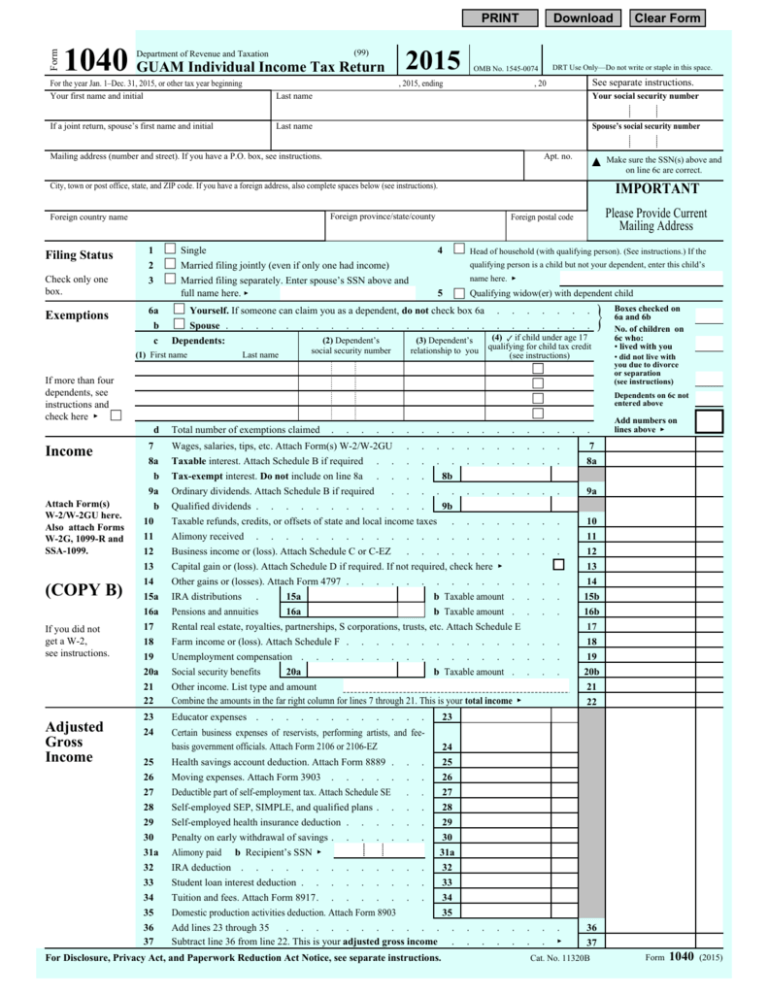

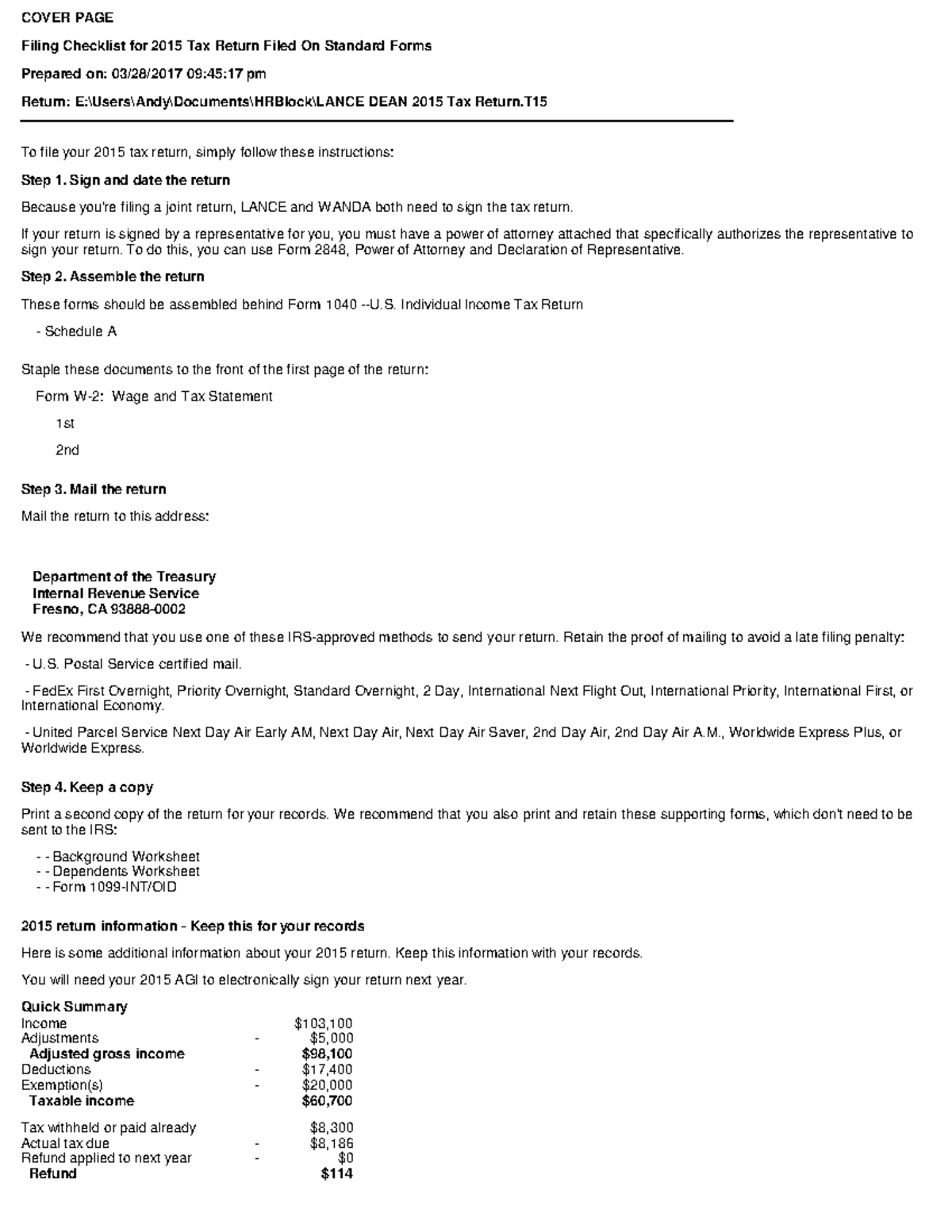

PDF MO-A Individual Income Tax Adjustments NOTE: IF LINE 12 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INFORMATION ON PAGE 7. PART 2 — MISSOURI ITEMIZED DEDUCTIONS — Complete this section only if you itemize deductions on your federal return. Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A. Form MO-A (Revised 12-2015) ADDITIONS 1. PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to: PDF QPE Table of Contents - static.store.tax.thomsonreuters.com Itemized Deductions Worksheet 2015 State and Local Sales Tax Deduction Health Coverage Exemptions Where to File 2015 Form 1040, 1040A, 1040EZ Where to File Form 1040-ES for 2016 Where to File Form 4868 for 2015 Return Tab 4 2015 Form 1040—Line-By-Line Line-By-Line Quick Reference to 2015 Form 1040

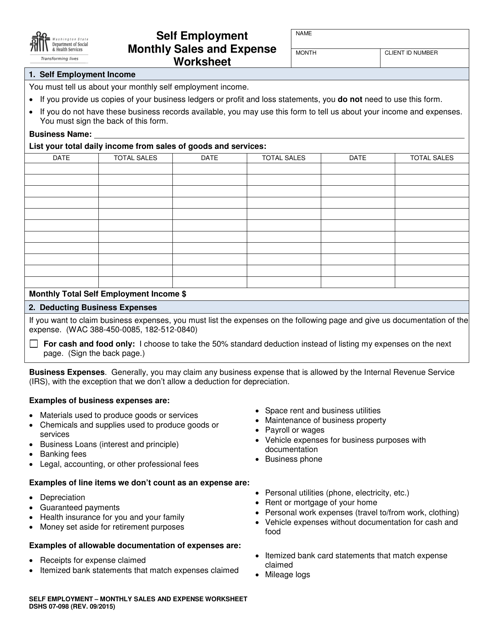

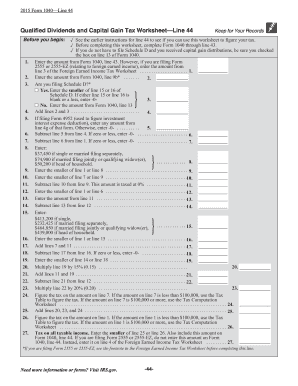

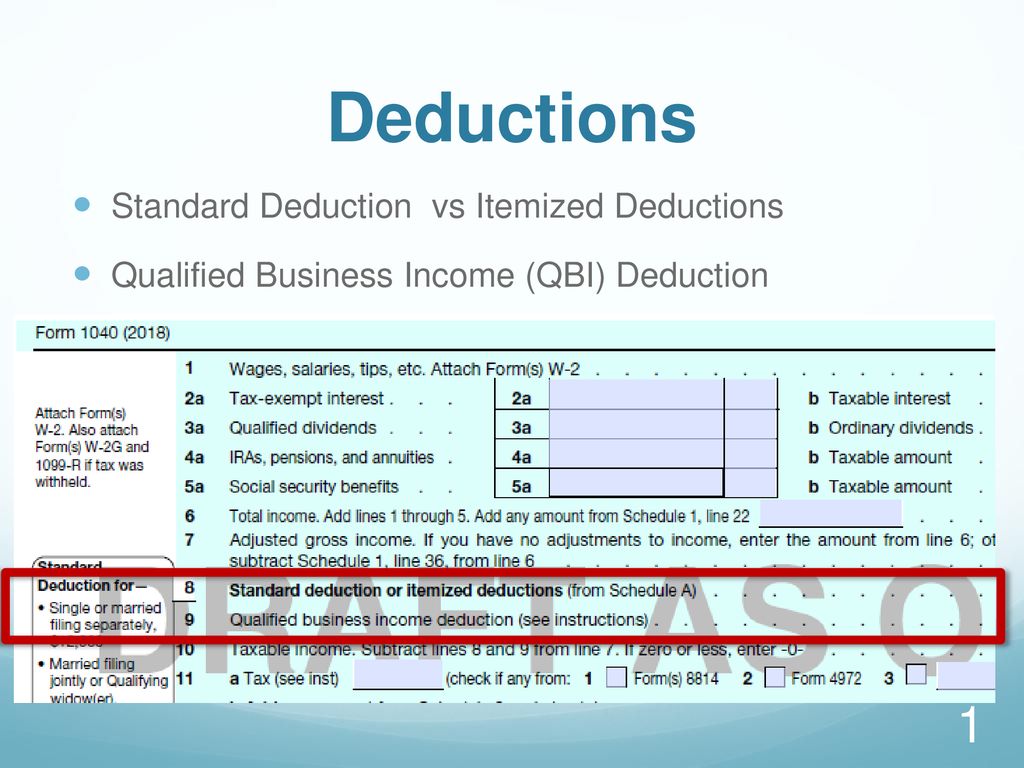

Itemized deduction worksheet 2015. PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. PDF Itemized Deductions Checklist - Affordable Tax Itemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees About Schedule A (Form 1040), Itemized Deductions ... About Schedule A (Form 1040), Itemized Deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. PDF 2015 737 Worksheet -- California RDP Adjustments Worksheet ... There are other itemized deductions that are also subject to the 2% limitation rule and some itemized deductions are subject to an overall limitation rule . Get federal Publication 17, Your Federal Income Tax, Part Five, Standard Deduction and Itemized Deductions . ... 2015 737 Worksheet -- California RDP Adjustments Worksheet Recalculated ...

PDF Itemized Deduction Worksheet TAX YEAR - Maceyko Tax Itemized Deduction Worksheet Medical Expenses. Must exceed 7.5% of income to be a benefit. Include cost for dependents-do not include any expenses that were reimbursed by insurance Dentists $ Hospitals $ Doctors $ Insurance $ Equipment $ Prescriptions $ Eyeglasses $ Other $ Medical Miles _____ PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) Select for mortgage interest reported on Form 1098. Enter amount from Form 1098F, box 1 (and box 2, if applicable). See Tab EXT, Legislative Extenders for Private Mortgage Insurance (if extended) Note: The deduction for home equity debt is dis-allowed as a mortgage interest deduction unless PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

42 itemized deduction worksheet 2015 - Worksheet Master Itemized deduction worksheet 2015. Itemized deductions also reduce your taxable income. PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. Deduction | Iowa Department Of Revenue For tax year 2015, the itemized deduction for state sales and use tax is allowed on the Iowa Schedule A. If a taxpayer claimed an itemized deduction for state sales and use tax paid on the Federal return, the taxpayer must claim the itemized deduction for state sales and use tax paid on the Iowa return. PDF Itemized Deductions Worksheet - integrityintaxllc.com Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. PDF TAXABLE YEAR California Adjustments — Nonresidents or Part ... 2015 California Adjustments — Nonresidents or Part-Year Residents SCHEDULE CA (540NR) Important: Attach this schedule behind Long Form 540NR, Side 3 as a supporting California schedule. Name(s) as shown on tax return . SSN or ITIN. Part I Residency Information Complete all lines that apply to you and your spouse/RDP for taxable year 2015 ...

PDF Attach to Form 1040. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

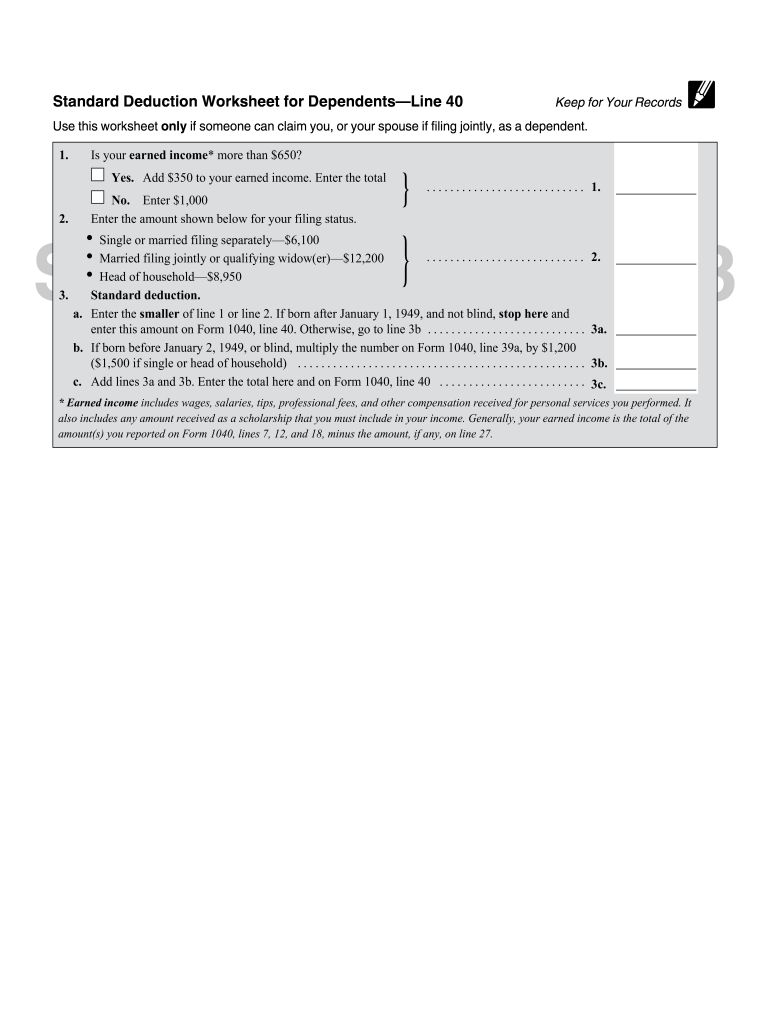

PDF Forms & Instructions California 540 2015 Personal Income ... Last day to file or e-file your 2015 tax return to avoid a late filing penalty and interest computed from the original due date : ... deduction or itemized deductions you can claim . Computing your tax: ... (Use the California Standard Deduction Worksheet for Dependents on page 11 to figure your standard deduction.)

PDF 2015 Form MO-1040A Individual Income Tax Return Single ... Worksheet For Net State Income Taxes, Line 9 of Missouri Itemized Deductions 2015 TAX CHART If Missouri taxable income from Form MO-1040A, Line 10, is less than $9,000, use the chart to figure tax;

Prior Year Products - IRS tax forms 2021. Form 1040 (Schedule A) Itemized Deductions. 2021. Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions. 2020. Form 1040 (Schedule A) Itemized Deductions.

FREE 2015 Printable Tax Forms | Income Tax Pro Social Security Benefits Worksheet Standard Deduction Worksheet for Dependents Student Loan Interest Deduction Worksheet. All of the 2015 federal income tax forms listed above are in the PDF file format. The IRS expects your 2015 income tax forms to be printed on high quality printers. Most of today's laser and ink jet printers are generally ...

42 itemized deductions worksheet 2015 - Worksheet Information Itemized deductions worksheet 2015. 2015 Instructions for Schedule A (Form 1040) - Internal ... Jan 11, 2016 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you ... IT-203-D - Tax.ny.gov Itemized Deduction Schedule. IT-203-D. Submit this form with Form IT-203.

PDF 2015 Instructions for Form 6251 - IRS tax forms AMT tax brackets. For 2015, the 26% tax rate applies to the first $185,400 ($92,700 if married filing separately) of taxable excess (the amount on line 30). This change is reflected in lines 31, 42, and 63. Limit on itemized deductions. You cannot deduct all of your itemized deductions for regular tax purposes if your adjusted gross income is more

PDF 2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount .

PDF Iowa Department of Revenue 2015 IA 104 This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A. Step 1 Complete the IA Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1. Enter the sum of lines 3, 8, 13, 17, 18, 24, and 25 from the IA Schedule A .................1. 2.

PDF Form IT-203-B:2015:Nonresident and Part-Year Resident ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a:

federal tax deductions worksheet | eurekaconsumer.com 2015 ITEMIZED DEDUCTIONS WORKSHEET - saralandtax.com. saralandtax.com. ACCOUNTING & INCOME TAX SOLUTIONS, INC. 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250...

PDF Form W-4 (2015) - SharpSchool Deductions and Adjustments Worksheet. Note. Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to Income. 1 Enter an estimate of your 2015 itemized deductions. These include quaTifying home mortgage Interest, charitable contributions, state. and local taxes, medical expenses In excess of 10% (7.5% ...

PDF QPE Table of Contents - static.store.tax.thomsonreuters.com Itemized Deductions Worksheet 2015 State and Local Sales Tax Deduction Health Coverage Exemptions Where to File 2015 Form 1040, 1040A, 1040EZ Where to File Form 1040-ES for 2016 Where to File Form 4868 for 2015 Return Tab 4 2015 Form 1040—Line-By-Line Line-By-Line Quick Reference to 2015 Form 1040

PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

PDF MO-A Individual Income Tax Adjustments NOTE: IF LINE 12 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INFORMATION ON PAGE 7. PART 2 — MISSOURI ITEMIZED DEDUCTIONS — Complete this section only if you itemize deductions on your federal return. Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A. Form MO-A (Revised 12-2015) ADDITIONS 1.

0 Response to "43 itemized deduction worksheet 2015"

Post a Comment