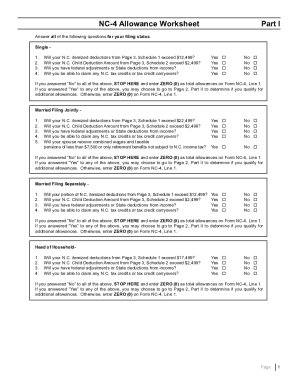

41 nc 4 allowance worksheet

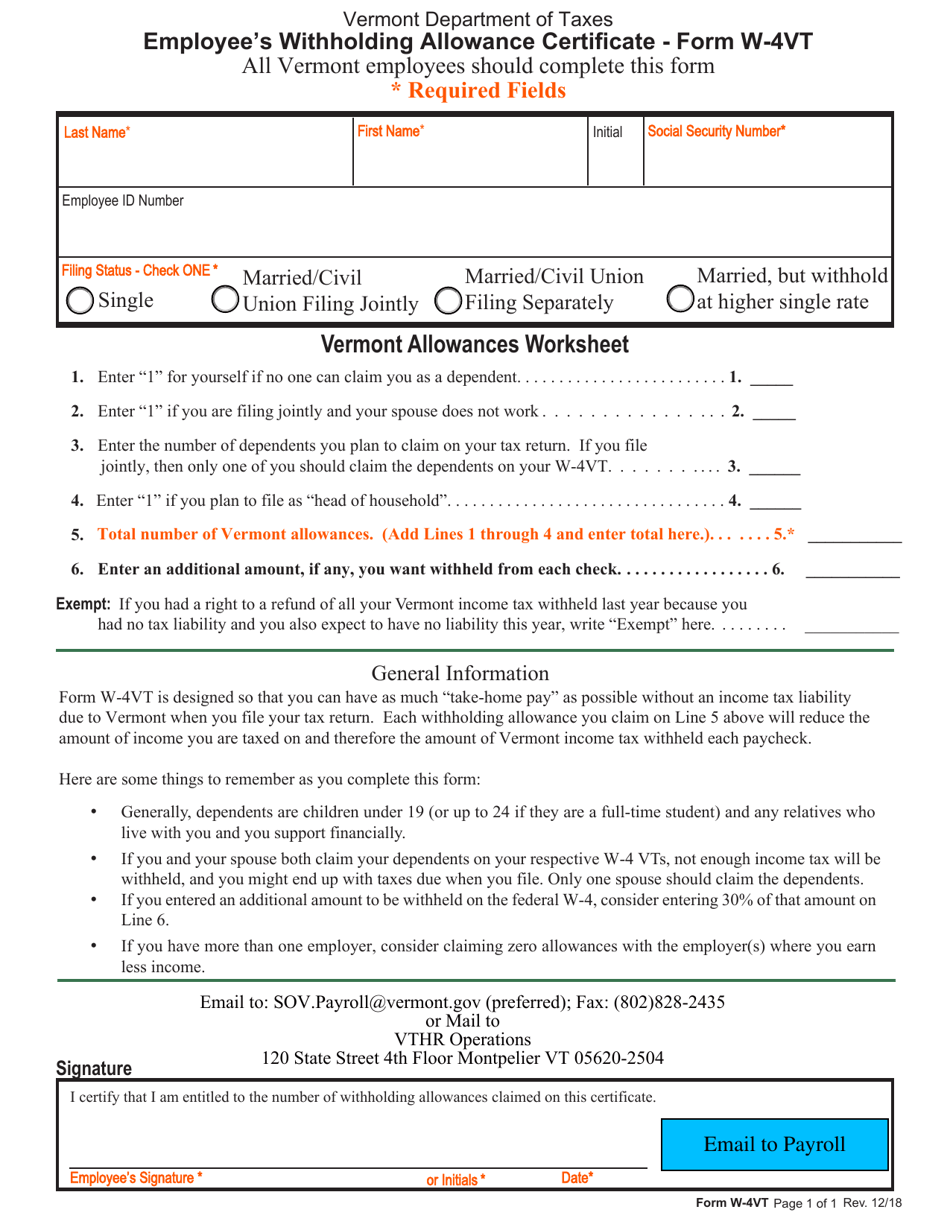

NC-4 Employee's Withholding FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than Employee's Withholding Allowance Certificate NC-4 | NCDOR Employee's Withholding Allowance Certificate NC-4 | NCDOR. Business Recovery Grant Program Businesses that suffered economic loss during the pandemic may be eligible for a one-time payment from the Business Recovery Grant Program. Apply now through 1/31/22. Learn More.

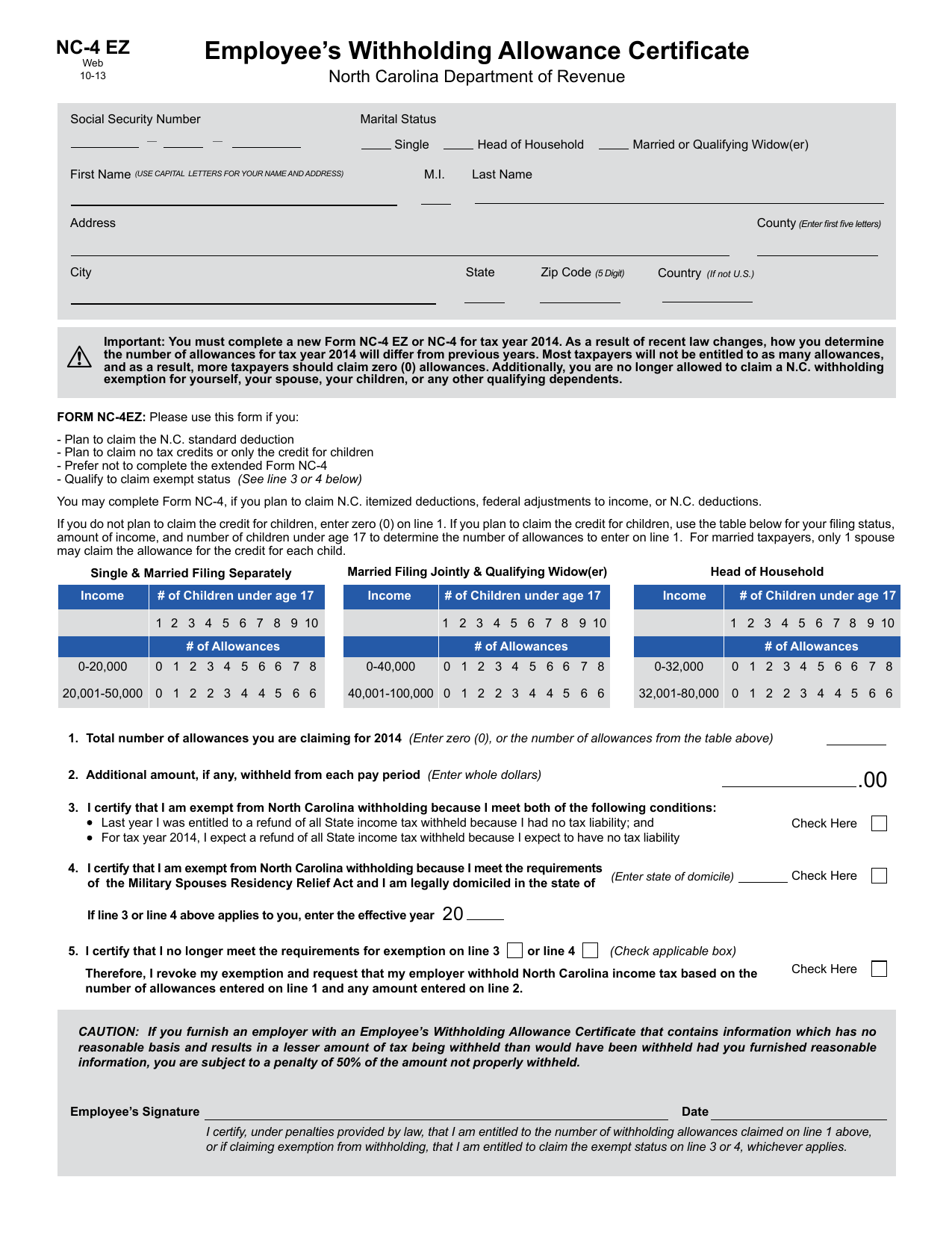

NC-4 horas de Employee's Withholding Allowance Certificate Important: You must complete a new Form NC-4 EZ or NC-4 for tax year 2014. As a result of recent law changes, how you determine the number of allowances for ...1 page

Nc 4 allowance worksheet

PDF NC-4 Employee's Withholding - ComplyRight NC-4 Allowance Worksheet. Your withholding will usually be most accurate and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). NONWAGE INCOME - If you have a large amount of nonwage income, PDF NC-4 NRA Web Nonresident Alien Employee's Withholding ... NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o Noo 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o Noo 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3? PDF Form NC-4 Instructions for Completing Form NC-4 Employee's ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

Nc 4 allowance worksheet. NC-4-11-19.pdf FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance. Worksheet. The worksheet will help you determine your withholding allowances based on federal ... NC-4EZ Total number of allowances you are claiming (Enter zero (0), or the number of ... You may complete Form NC-4, if you plan to claim N.C. itemized deductions, ...1 page NC-4 - Employee's Withholding | Allowance Certificate Married taxpayers who complete the worksheet based on the filing status, "Married Filing Separately" should consider only his or her portion of income, federal ...6 pages EOF

NC-4 Employee's Withholding - University of Colorado FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. PDF NC-4 Employee's Withholding 10-17 Allowance Certicate FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. PDF NC-4 - iCIMS NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status Nc 4 Allowance Worksheet - Fill Out and Sign Printable PDF ... Use a nc 4 allowance worksheet template to make your document workflow more streamlined. Show details How it works Open the nc 4 form and follow the instructions Easily sign the nc 4 form 2020 printable with your finger Send filled & signed form nc 4 or save Rate the w4 form nevada 4.8 Satisfied 34 votes be ready to get more

Employee's Withholding Allowance Certificate NC-4 | NCDOR Employee's Withholding Allowance Certificate NC-4 Form NC-4 Employee's Withholding Allowance Certificate Files NC-4_Final.pdf PDF • 488.48 KB - December 17, 2021 Taxes & Forms Individual Income Tax Sales and Use Tax Withholding Tax Withholding Tax Forms and Instructions eNC3 - Web File Upload eNC3 eNC3 Waiver Information eNC5Q PDF Nc-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). PDF NC-4 Employee's Withholding - Hyde County, North Carolina NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5). NC-4 - Employee's Withholding Allowance Certificate The worksheet is provided for employees to adjust their withholding allowances based on N.C. itemized deductions, federal adjustments to income, N.C. additions ...6 pages

Diy Nc 4 Allowance Worksheet - Goal keeping intelligence Employees Withholding Allowance Certificate NC-4. Deductions Adjustments and Tax Credits Worksheet 1. Your withholding will usually be most accurate when all allowances are claimed on the nc 4 filed for the higher paying job and zero allowances are claimed for the other. However you may claim fewer allowances than.

PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Allowance Worksheet For tax year 2014, answer allof the following questions for your filing status. Because N.C. does not recognize same-sex marriages, same-sex couples who file married for federal purposes must complete this worksheet as single, or if qualified, head of household or qualifying widow(er). Single - 1.

PDF How to fill out the NC-4 - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents.

PDF How to fill out the NC-4 EZ - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Please fill out header Be sure to fill in Marital Status Header 3 Line 1 of NC-4 EZ Enter zero (0) or the number of allowances from the table on the next slide. 4

PDF Form NC-4 Instructions for Completing Form NC-4 Employee's ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

PDF NC-4 NRA Web Nonresident Alien Employee's Withholding ... NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o Noo 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o Noo 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3?

PDF NC-4 Employee's Withholding - ComplyRight NC-4 Allowance Worksheet. Your withholding will usually be most accurate and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). NONWAGE INCOME - If you have a large amount of nonwage income,

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "41 nc 4 allowance worksheet"

Post a Comment