45 like kind exchange worksheet excel

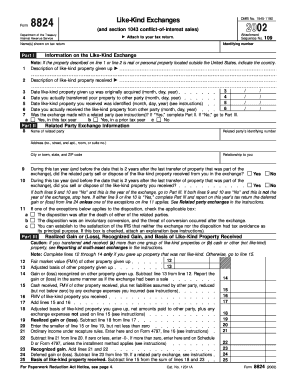

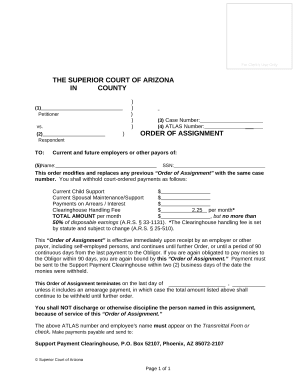

Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #7 &8 - Calculation of Form 8824, Line 15

Teaching Tools | Resources for Teachers from Scholastic Book List. Favorite Snow and Snowmen Stories to Celebrate the Joys of Winter. Grades PreK - 4

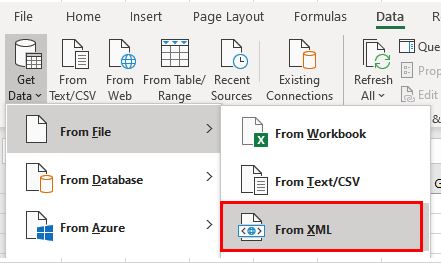

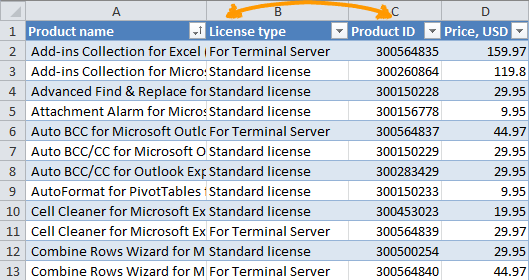

Like kind exchange worksheet excel

IA 8824 Like Kind Exchange Worksheet 45-017 | Iowa Department Of Revenue IA 8824 Like Kind Exchange Worksheet 45-017 Breadcrumb Home Forms Form IA8824(45017).pdf Tax Type Corporation Income Tax Fiduciary Tax Franchise Income Tax Individual Income Tax Partnership Income Tax Print Stay informed, subscribe to receive updates. Subscribe to Updates Footer menu About Contact Us Taxpayer Rights Website Policies Intern Program 1031 Tool Kit - TM 1031 Exchange Exchange Basics & Requirements Exchange Variations Like Kind Property Issues Tax Law Updates Additional 1031 Exchange Issues Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Like kind exchange worksheet excel. 1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template Worksheet April 17, 2018 We tried to get some great references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here. Like Kind Exchange — Examples of "Boot" - 1031x Cash Boot Example #2. A taxpayer will also trigger taxes if they opt to receive some cash out at the closing of their relinquished property. This is also Cash Boot. Jen owns a $300,000 investment property free and clear. She wants to do a 1031 exchange into a $325,000 condo. 1031 Exchange Excel Spreadsheet - UpdateTrader List the best pages for the search, 1031 Exchange Excel Spreadsheet. All the things about 1031 Exchange Excel Spreadsheet and its related information will be in your hands in just a few seconds. 1031 Exchange Excel Spreadsheet: Optimal Resolution List - UpdateTrader Like Kind Exchange Worksheet — db-excel.com Dec 13, 2019 - Like Kind Exchange Worksheet in a learning moderate can be utilized to test students talents and knowledge by addressing questions. Because in the Student. Pinterest. Today. Watch. Explore. ... db-excel.com. Like Kind Exchange Worksheet — db-excel.com.

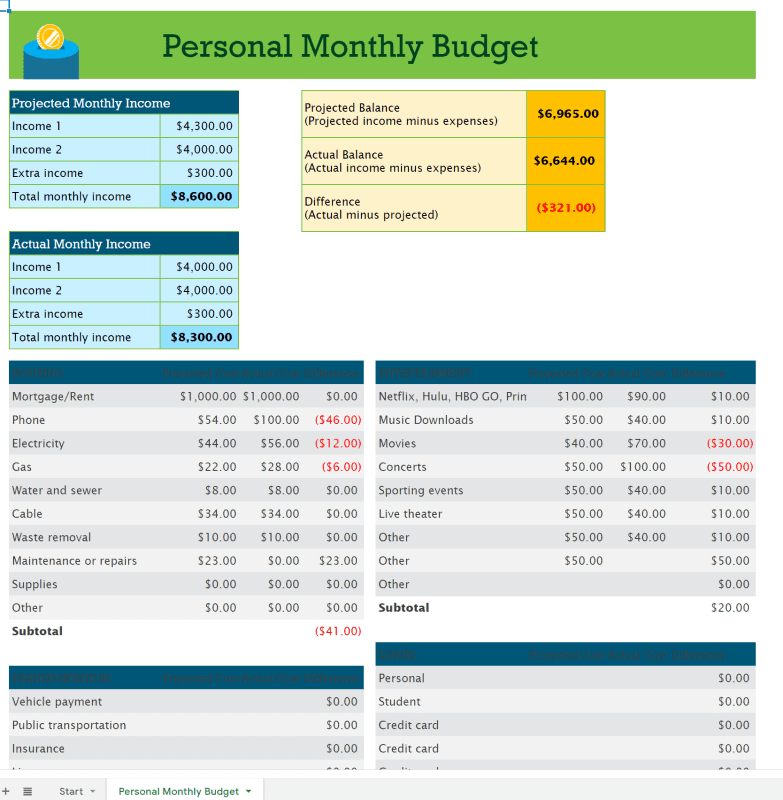

1031 Exchange Calculator | Calculate Your Capital Gains Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements 1031 Exchange Examples | 2022 Like Kind Exchange Example 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this: Realized Gain Like-Kind Exchange: Definition, Example, Pros & Cons - Investopedia A like-kind exchange is used when someone wants to sell an asset and acquire a similar one while avoiding the capital gains tax. Like-kind exchanges are heavily monitored by the IRS and... Like Kind Exchange Vehicle Worksheet And Like Kind ... - Pruneyardinn Worksheet April 17, 2018. We tried to find some amazing references about Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here.

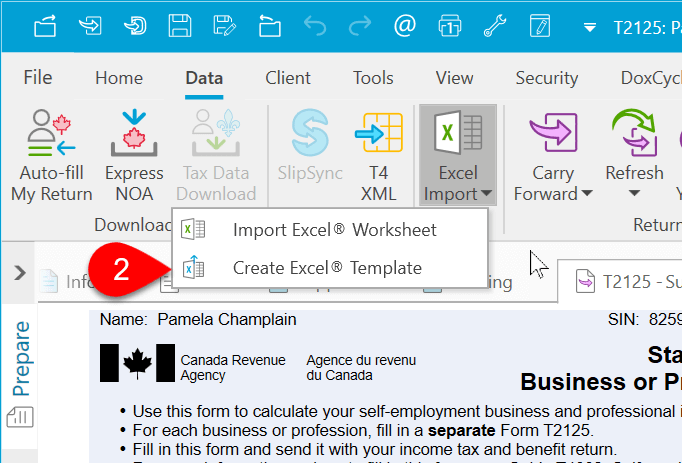

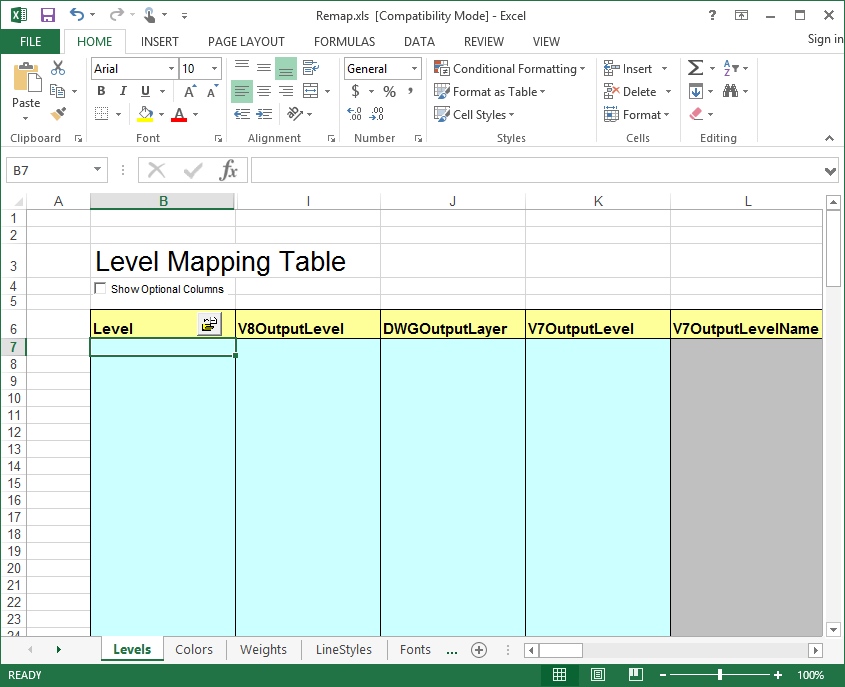

IRC 1031 Like-Kind Exchange Calculator Under Section 1031, taxpayers can postpone paying this tax if they reinvest the profit in similar property. Doing so is known as a like-kind exchange, which allows taxpayers to grow their investment on a tax-deferred basis. Considering that long-term capital gains taxes are either 15 or 20 percent, and short-term capital gains rates range from ... About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales. 1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Like-Kind Exchanges - Real Estate Tax Tips | Internal Revenue Service Like-kind exchanges -- when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or "like-kind" -- have long been permitted under the Internal Revenue Code.

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet ... First Midwest Bank 1031 Exchange Forms. Expense Worksheet Template Excel. Eap Tls Certificate Exchange. Exchange Tls Wildcard Certificate. Exchange 2007 Ssl Certificate Gui. Topographic Map Worksheet Pdf. Kpi Worksheet Template. Exchange 2016 Visio Diagram. Exchange 2007 Manage Certificates Gui.

Hit the Button - Quick fire maths practise for 6-11 year olds Hit the Button is an interactive maths game with quick fire questions on number bonds, times tables, doubling and halving, multiples, division facts and square numbers.

8824 - Like-Kind Exchange - Drake Software A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive.

How to Calculate Basis on Like Kind Exchange | Pocketsense Finding the New Cost Basis. Subtract the amount realized from the cost basis of the new property and add the depreciated basis back in. In this example, you'd subtract $149,080 from $197,150 to find out that you put $48,070 of new value in, then add back the old property's depreciated value of $71,625 to find a new basis of $119,695.

Like-kind exchanges of real property - Journal of Accountancy Generally, a like - kind exchange would more likely take place in stages: relinquishment of appreciated property or properties, identification of replacement property or properties, and acquisition of replacement property or properties and transfer of the property or properties to the taxpayer.

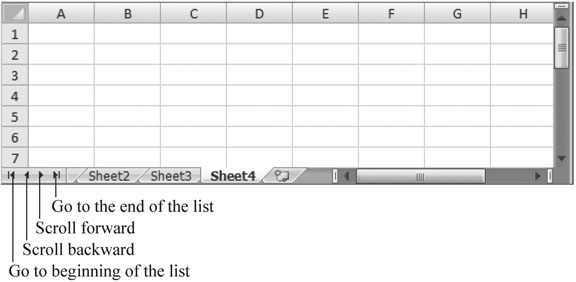

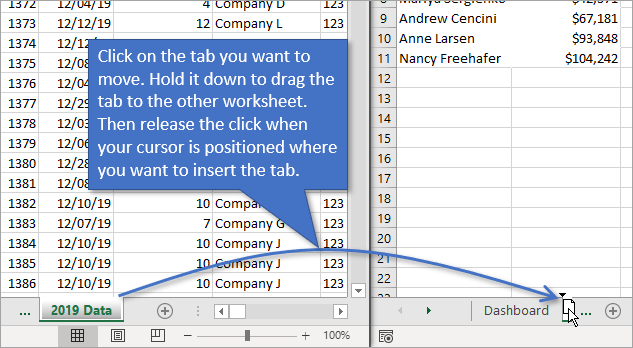

Collapse and Expanding Worksheet Tabs - Microsoft Community Hub Mar 12, 2018 · Dear Excel Community, Is there a way that i can combine worksheets into expandable and collapse-able tab. i.e. i have a total of 12 tabs one for each month and its too many tab so i would like to collapse the first three tab, january, february, and march into a tab called quarter 1, then i do th...

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? - WallStreetMojo Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset. Table of contents What is the Like-Kind Exchange? Explanation Features

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

IRC 1031 Like-Kind Exchange Calculator Like-kind properties are those considered to have similar business or investment uses. Examples are: Trading up from an unimproved property to an improved one Trading up from vacant land to a commercial building Trading up from a single family unit to a small apartment building Time Limits of a Delayed Exchange

Like Kind Exchange Calculator - Considine & Considine Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property.

1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) A 1031 Exchange, or Like-kind Exchange, is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money, which has not been taxed, to purchase a like-kind property. Important Note: This material has been prepared for informational purposes only, and is ...

Home | ExploreLearning Solve the math fact fluency problem. Adaptive and individualized, Reflex is the most effective and fun system for mastering basic facts in addition, subtraction, multiplication and division for grades 2+.

Get the free 1031 exchange worksheet 2019 form - pdfFiller Get, Create, Make and Sign 1031 exchange excel spreadsheet download Get Form eSign Fax Email Add Annotation 1031 Exchange Worksheet Excel is not the form you're looking for? Search for another form here. Comments and Help with sec 1031 exchange worksheet . ... ... ... Taxpayer. Replacement Property. Date or Date of Return. 10.

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Unless Microsoft is able to satisfy Sony’s aggressive demands and appease the CMA, it now looks like the U.K. has the power to doom this deal like it did Meta’s acquisition of Giphy. The CMA is focusing on three key areas: the console market, the game subscription market, and the cloud gaming market. The regulator’s report, which it ...

Classroom Resources - National Council of Teachers of Mathematics These stories and lesson sketches, focused in the middle and high school grades, are meant to help your students extend their view of the world a little bit by using math to make sense of experiences in daily life.

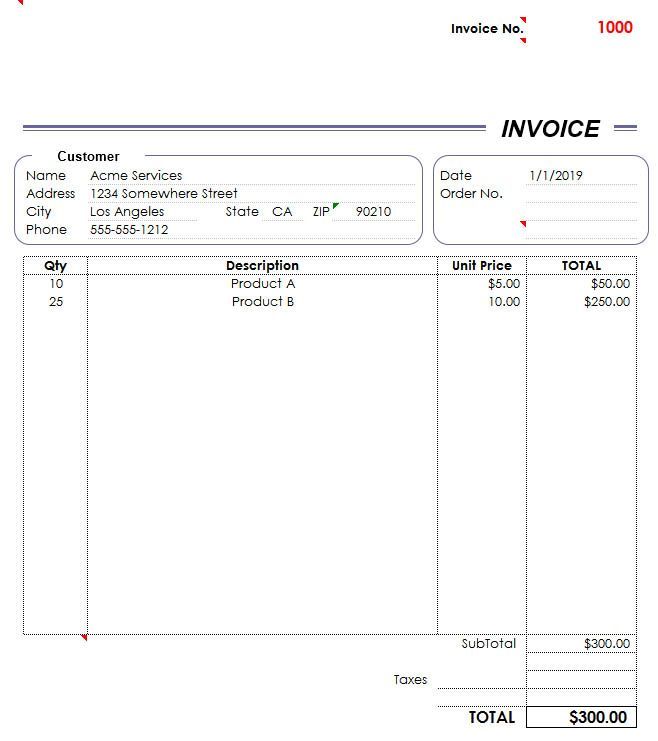

Like Kind Exchange Worksheet - The Math Worksheets The Form 8824 is divided into four parts. Like kind exchange worksheet 1031 exchange calculator excel. Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

1031 Tool Kit - TM 1031 Exchange Exchange Basics & Requirements Exchange Variations Like Kind Property Issues Tax Law Updates Additional 1031 Exchange Issues Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail.

IA 8824 Like Kind Exchange Worksheet 45-017 | Iowa Department Of Revenue IA 8824 Like Kind Exchange Worksheet 45-017 Breadcrumb Home Forms Form IA8824(45017).pdf Tax Type Corporation Income Tax Fiduciary Tax Franchise Income Tax Individual Income Tax Partnership Income Tax Print Stay informed, subscribe to receive updates. Subscribe to Updates Footer menu About Contact Us Taxpayer Rights Website Policies Intern Program

/cdn.vox-cdn.com/uploads/chorus_asset/file/20036974/moneyinexcel.jpg)

![How to Create Workbooks in Excel [2023 Edition]](https://www.simplilearn.com/ice9/free_resources_article_thumb/Create_Workbooks_in_excel.jpg)

0 Response to "45 like kind exchange worksheet excel"

Post a Comment