44 realtor tax deduction worksheet

Realtor Tax Deductions And Tips You Must Know - Easy Agent PRO If a Realtor uses part of their home exclusively and regularly for business, some mortgage, utility, tax and insurance expenses may also be deductible. For the second year, taxpayers can use a new and simpler calculation of $5 per square foot for a maximum of 300 square feet. 115 Popular Tax Deductions For Real Estate Agents For 2022 - Kyle Handy Meal Tax Deductions For Real Estate Agents If you discuss work with a coworker, client, or friend while purchasing a meal, it's a write-off of 50%. Be sure to document who you ate the meal with and a sentence or two about what you discussed. Meals (50%) Home Office Deduction

Microsoft takes the gloves off as it battles Sony for its Activision ... 12. Okt. 2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

Realtor tax deduction worksheet

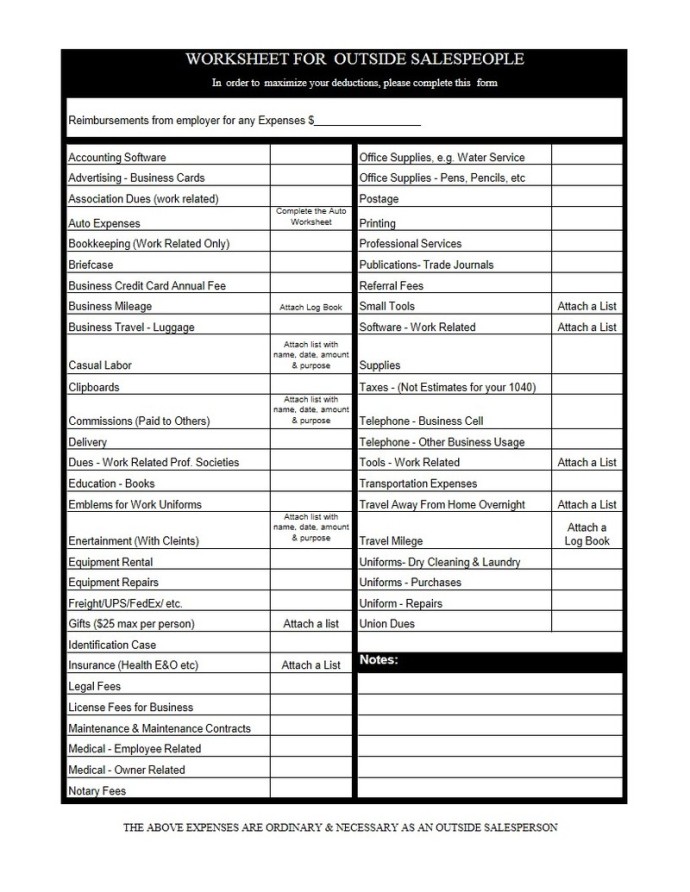

PDF Realtors Tax Deduction Worksheet - FormsPal Realtors Tax Deduction Worksheet Due to the overwhelming response to last month's Realtor "tax tip" article, Daszkal Bolton LLP has created this Realtors' ... If you have any questions or need specific advice on a particular Real Estate issue, please contact Jeff Bolton, CPA at 561-367-1040. Advertising, Signs, Flag & Banners Appraisal ... Real Estate Professional Expense Worksheet - atmTheBottomLine Below are forms and worksheets to help you keep track of your expenses: Real Estate Professional Expense Worksheet (.xls) Real Estate Professional Expense Worksheet (.pdf) Real Estate Professional Expenses Spreadsheet (.xls) Copyright © 2022. atmTheBottomLine.com Desktop Version 16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr 15. Apr. 2022 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction. For Example. Annie Agent, a single Washington D.C. based realtor, took home $400,000 in commissions last year net of all business ...

Realtor tax deduction worksheet. › newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. Cheat Sheet Of 100+ Legal Tax Deductions For Real Estate Agents Such a cheat sheet is exactly what's below, thanks to two folks: 1) Fred Podris of Podris Tax Service who compiled the list, and REALTOR® Brenda Douglas who kindly posted it to Facebook for all to benefit from. One problem, though. This cheat sheet, which was originally intended as a print-out, isn't legible in digital format (see below). tax deduction worksheet for realtors: Fill out & sign online | DocHub Real estate agent tax deductions worksheet 2021. Get the up-to-date real estate agent tax deductions worksheet 2021-2022 now Get Form. 4.6 out of 5. 54 votes. DocHub Reviews. 44 reviews. DocHub Reviews. 23 ratings. 15,005. 10,000,000+ 303. 100,000+ users . Here's how it works. 01. Edit your checklist texas realtor tax deductions tax forms online › taxes › sales-tax-deductionSales Tax Deduction: What It Is, How To Take Advantage - Bankrate Sep 22, 2021 · The sales tax deduction gives taxpayers the opportunity to reduce their tax liability when they deduct state and local sales taxes or state and local income taxes that they paid in 2021 — but ...

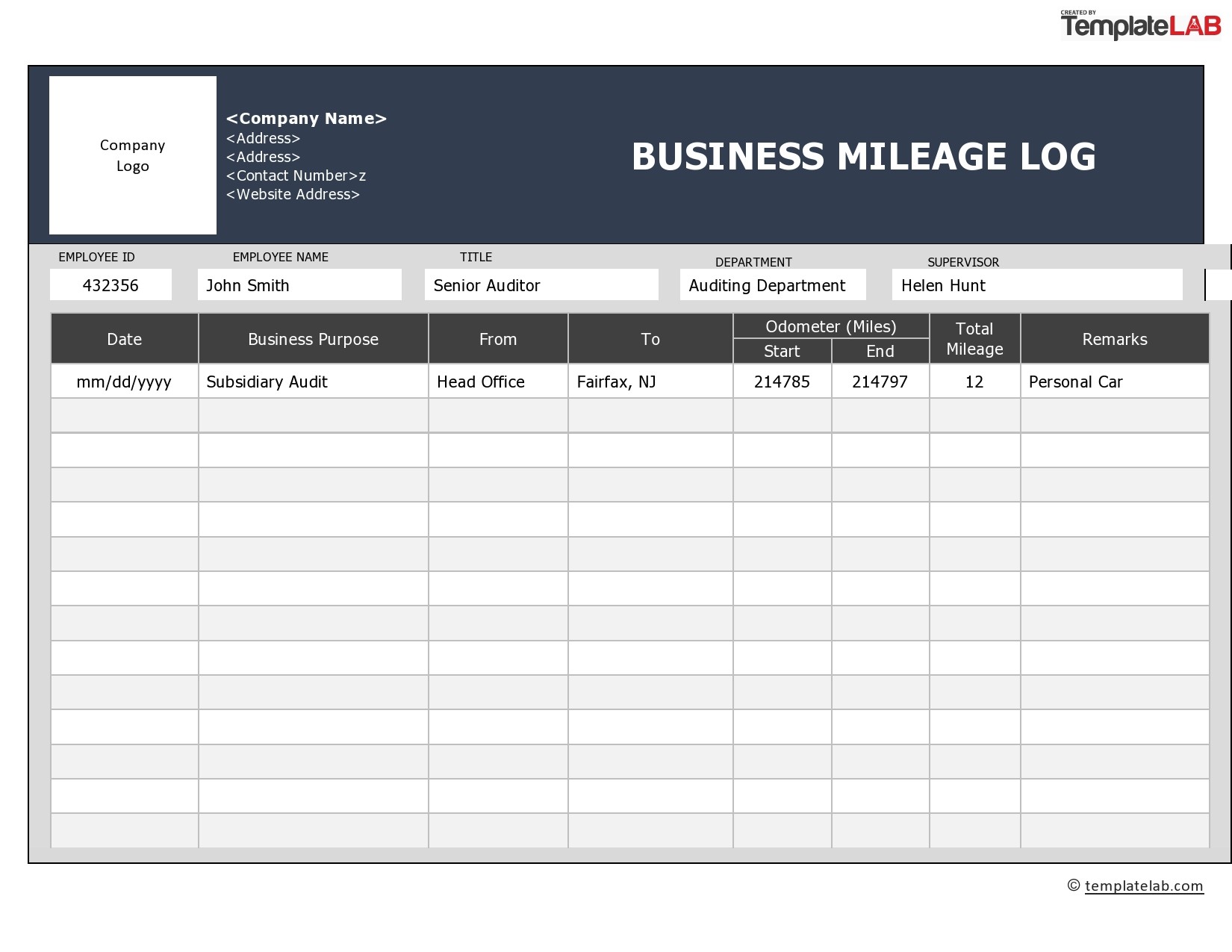

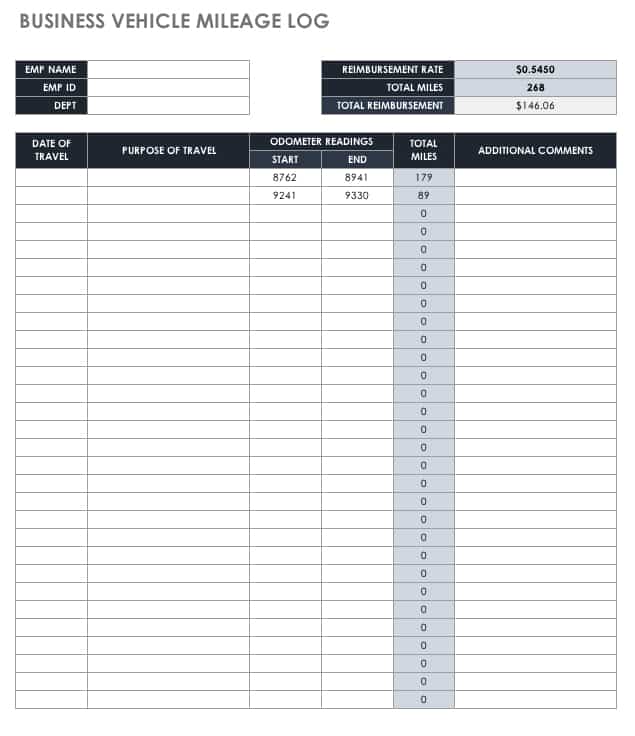

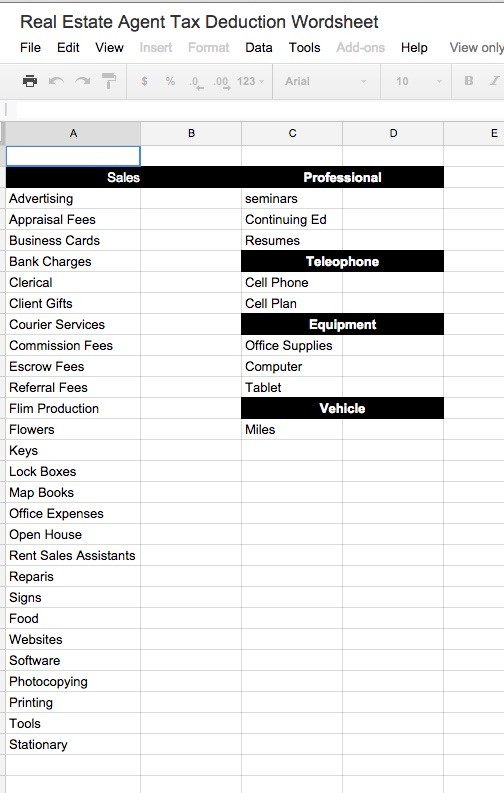

Real Estate Agent Tax Deductions PDF Form - FormsPal real estate agent tax deduction spreadsheet, real estate agent tax deductions worksheet 2020, real estate agent tax deductions worksheet excel, realtor deductions worksheet: 1 2. Form Preview Example. Realtors Tax Deductions Worksheet. AUTO TRAVEL. Your auto expense is based on the number of qualified business miles you drive. Expenses for ... Get Daszkal Bolton Realtors Tax Deduction Worksheet - US Legal Forms Ensure that the info you fill in Daszkal Bolton Realtors Tax Deduction Worksheet is updated and correct. Include the date to the record with the Date feature. Select the Sign icon and create an e-signature. You will find three available alternatives; typing, drawing, or uploading one. Be sure that every field has been filled in properly. PDF Realtor - Tax Deduction Worksheet This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax & Accounting (480) 831-6565 with any specific questions or to book your tax appointment. Other: Other: Rent Repairs to Sell Listed Property Shipping Stationery FAX Machine. Title: Realtor - Tax Deduction Worksheet.xls 51 Real Estate Agent Tax Deductions You Should Know 28. General Business Insurance - General business insurance is typically required for real estate agents to be able to cover the costs of liability and property damages. 29. Business Mileage: If you're driving your own vehicle as an agent, mileage can qualify as a realtor tax deduction.

DOC Income Tax Deduction Checklist --- REALTORS Business Tax Deduction Checklist . Title: Income Tax Deduction Checklist --- REALTORS Author: Joseph J. Gawalis Jr., MBA, CPA-NJ Last modified by: Joseph J. Gawalis Jr., MBA, CPA-NJ Created Date: 6/25/2004 2:27:00 PM Company: Accountancy Consultants of New Jersey, LLC Other titles: Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes. 10 Tax Deductions for Real Estate Agents & Realtors in 2022 As long as it's truly for business purposes, breaking bread is a tax deductions for real estate agents up to 50% of your bill, including tax and tips. 10. Business Items, Tools, and Stationary Expenses. Any material items you use to perform the day-to-day tasks of your job may be deductible or depreciable, such as office supplies, copies and ... Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14. Okt. 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Deduction #4 Show Detail Advertising Expense The IRS allows you to deduct reasonable advertising expenses that are directly related to your business activities. Deduction #5 Show Detail Home Office Deduction

A Free Home Office Deduction Worksheet to Automate Your Tax Savings The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage.

Tax Deductions for Real Estate Agents 2022: Ultimate Guide 6 Real Estate Agent Car Tax Deduction 6.1 Simple Method (Standard Mileage Deduction) 6.2 Actual Method 7 Business Travel & Meals 8 Home Office Deduction 8.1 Simplified Method for Realtors 8.2 Detailed Method for Realtors 9 Office Rent And Utilities 10 Business Gifts ($25 Deduction Limit) 11 Expenses Paid on Clients Behalf

› overwatch-2-reaches-25-millionOverwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

themortgagereports.com › 63473 › how-to-claim-seniorHow to claim your senior property tax exemption Apr 15, 2020 · For those who qualify, tax exemptions generally come in four different categories: - Seniors: You may be eligible if you have a limited income and you are at or above a certain age - People with ...

Get the free tax deduction worksheet realtors form - pdfFiller We encourage you to go through and watch the videos in order to learn more about your options. Also, you will be able to print out our 2012 Tax Deductible and Adjusted Gross Income Worksheets which will help you to determine your taxable income. Сomplete the tax deduction worksheet realtors for free Get started! 4.0 Satisfied

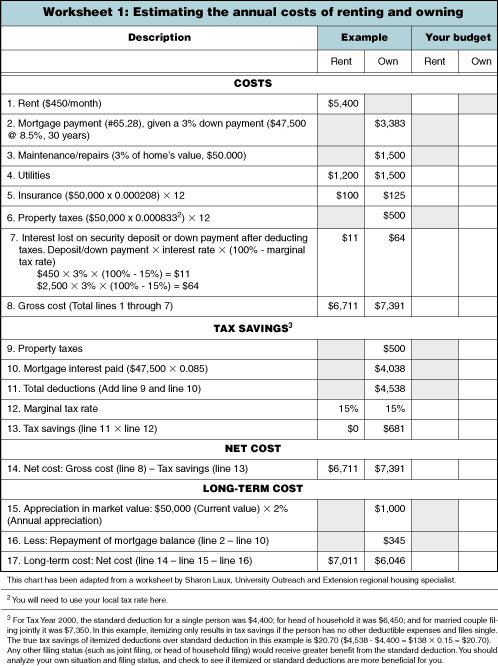

18 Real Estate Agent Tax Deductions to Save Money (+ Tips & Free Download) Real estate professionals who use a part of their home for business-related activity are allowed to write off rent, utilities, taxes, repairs, and maintenance. There are two ways of calculating the tax deduction: Simple method: Multiply the square footage of the room by $5, with a maximum amount of $1,500.

Create a Realtor Expense Spreadsheet (+Template) | Kyle Handy In addition to tax deductions and expenses, there are also spreadsheets for real estate investing, house flipping, rental properties, and more. The type of expense spreadsheet you need depends on the type of expenses that you're tracking. Here are a few types of spreadsheets you might need: Real estate investment.

Free pay stub template with calculator no watermark Our pay stub template with calculator, calculates all the taxes and deductions automatically.It includes everything such as federal tax, state tax, social security, medicare, state taxes and has a free preview. The idea is to have a pay stub template that does everything for you so you can focus on doing your job. View Pay Stub Templates.. tmobile stores locator

Are Social Security Benefits Taxable at Age 62? - Investopedia 15. Nov. 2022 · New Mexico allows people 65 and older to take an $8,000 deduction on their taxable income, which of course may include Social Security benefits. How Much Tax Do You Pay on Social Security at Age 62?

› ask › answersAre Social Security Benefits Taxable at Age 62? - Investopedia Nov 15, 2022 · The number of states that tax Social Security benefits has been reduced in recent years. Iowa phased out the taxes in 2014. North Dakota ended the practice in 2021, and Colorado has stopped it ...

5 Tax Deductions When Selling a Home: Did You Take Them All? - realtor… 27. März 2022 · This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ...

Donation Value Guide For 2021 | Bankrate 29. Sept. 2021 · This list of some common items offers an idea of what your donated clothing and household goods are worth, as suggested in the Salvation Army’s valuation guide.

PDF REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET - Tax Goddess REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ...

› fill-and-sign-pdf-form › 29895Realtor Tax Deduction Worksheet Form - signNow How to create an electronic signature for the REvaltor Tax Deduction Worksheet Form on iOS devices real estate agent tax deductions worksheet21iPhone or iPad, easily create electronic signatures for signing a rEvaltor tax deduction worksheet form in PDF format. signNow has paid close attention to iOS users and developed an application just for ...

› advice › sell5 Tax Deductions When Selling a Home: Did You Take Them All? Mar 27, 2022 · This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ...

Tax Deductions Worksheets - K12 Workbook Worksheets are Tax deduction work, Truckers work on what you can deduct, Realtors tax deductions work, Realtor, Schedule a tax deduction work, Rental property tax deduction work, Day care income and expense work year, Work to estimate federal tax withholding year 2019. *Click on Open button to open and print to worksheet. 1. Tax Deduction Worksheet

Realtor Deduction Worksheets - Printable Worksheets Showing top 8 worksheets in the category - Realtor Deduction. Some of the worksheets displayed are Realtor, Realtors tax deductions work, Realtor deductions, Real estate income expense work, Rental property work, Cheat for real estate investors, Tax work for self employed independent contractors, 2020 deductions work small business tax.

PDF Realtors Tax Deductions Worksheet Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

PDF Real Estate Agent/Broker - Finesse Tax Reduce your taxes by tracking your tax deductions ... Finesse Tax Accounting, LLC Real Estate Agent/Broker Do Your Taxes With Finesse 2035 2nd St. NW Suite G-102 Washington, DC 20001 Office: 240.417.7234 Mobile: 202.664.2490 Fax: 240.559.0990 Email: finessetax@gmail.com

Real Estate Agent Tax Deductions Worksheet 2021 - Fill Online ... document the costs you claim for all of these items using a specific, detailed statement in your records (using a mileage or other rate or rate-period basis) indicating the dates of the deductions (for each item), the purpose for which the deduction is made, and the total of all deductions (including any adjustments), whether made directly from …

Achiever Papers - We help students improve their academic standing All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism.

Fafsa parent login save key - dek.centstuff.shop 2. Aug. 2017 · Much of the information for the FAFSA can be automatically transferred from federal tax returns. tennessee board of nursing. how to set path in termux. Income on FAFSA $45,830 While the lowest rate of 22% is applied only to income under $16,400, the highest graduated rate of 47% kicks in at $33,100. The contribution that our hypothetical family ...

can a psychologist spot a narcissist Area of operation.Find out which states do not tax retirement income, including pensions, 401k, IRA, and Social Security Benefits. So it doesn't matter how much money you make or where in the United States you live - if your state is one of these states, then your retirement income will be free of taxation.Go to the ATM and withdraw the $60 total from your card or spend the funds …

Real Estate Agent Tax Deduction Wordsheet - Google Sheets Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers

Real Estate Agent Tax Deductions Worksheet Excel - Fill Online ... For each item that you do not claim as an expense on the regular line of the Realtors Tax Deduction Worksheet, use the line beginning on your Form 1040, line 22 for information on the tax deductions you can claim on the owner's 1040 tax return. If you are not sure which line to use, check the box for "Include."

Tax Deduction Worksheet for Realtors Form - Fill Out and Sign Printable ... Follow the step-by-step instructions below to design your tax deductions for a rEvaltor form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr 15. Apr. 2022 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction. For Example. Annie Agent, a single Washington D.C. based realtor, took home $400,000 in commissions last year net of all business ...

Real Estate Professional Expense Worksheet - atmTheBottomLine Below are forms and worksheets to help you keep track of your expenses: Real Estate Professional Expense Worksheet (.xls) Real Estate Professional Expense Worksheet (.pdf) Real Estate Professional Expenses Spreadsheet (.xls) Copyright © 2022. atmTheBottomLine.com Desktop Version

PDF Realtors Tax Deduction Worksheet - FormsPal Realtors Tax Deduction Worksheet Due to the overwhelming response to last month's Realtor "tax tip" article, Daszkal Bolton LLP has created this Realtors' ... If you have any questions or need specific advice on a particular Real Estate issue, please contact Jeff Bolton, CPA at 561-367-1040. Advertising, Signs, Flag & Banners Appraisal ...

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

0 Response to "44 realtor tax deduction worksheet"

Post a Comment