43 home daycare tax worksheet

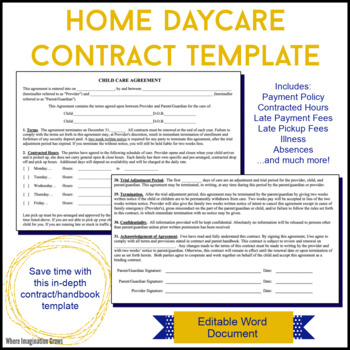

Home Daycare Tax Worksheet in 2022 | Safety checklist, Health and ... Apr 23, 2022 - Home Daycare Tax Worksheet. If you are self-employed, you can affirmation costs anon accompanying to your business. The Internal Revenue Service does not crave you to catalog on your claimed acknowledgment 1040 to affirmation those costs as all self-employment costs and assets are appear on Schedule C, Accumulation and Accident from Business. Any accumulation or accident is ... Daycare Tax Workbook - DaycareAnswers.com The Daycare Tax Workbook e-book helps you gather all the information you need to easily prepare your taxes. Whether you do it yourself or hire a professional tax preparer, this workbook makes it easy. $6.97 INCLUDES: End of Year Checklist Tax Worksheet End-of Year Receipts (W-10) Weekly Receipts Monthly Receipts Easy links to IRS forms

Home Daycare Tax Worksheet - Briefencounters Tax Return Spreadsheet Awesome Tax Worksheet 1040 Line 44 Save from home daycare tax worksheet , source:oregondaysofculture.org For example, if you're caring for two children, each receiving a different level of care, you will need two separate work areas in your home.

Home daycare tax worksheet

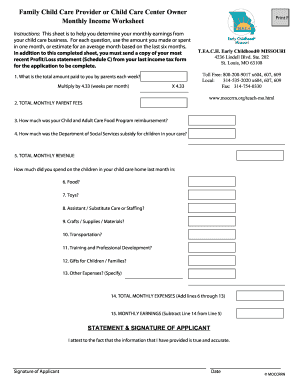

Home Daycare Providers | Income Tax Plus Inc Income Tax Plus has created a number of resources to make this part a little easier! Home Daycare Provider Summary Worksheet. ... Use this workbook to keep track of all of your Home Daycare Income and Expenses in detail. Let this handy excel worksheet do the math for you! Daycare Expense Worksheet - atmTheBottomLine HOME Return Home; TAX BASICS About Your Business. TYPE OF BUSINESS Business or Hobby? SOLE PROPRIETORSHIPS; DEDUCTIONS What you need to know; EXPENSE FORMS Keep Track of Your Expenses. Clergy Expense Worksheet; Daycare Expense Worksheet; Outside Sales Expense Worksheet; Real Estate Professional Expense Worksheet; ABOUT US and Contact Info ... PDF Day Care Tax Organizer DAY CARE TAX ORGANIZER Prepare + Prosper, 2610 University Ave. West, Suite 450, St. Paul MN 55114, ... worksheets, tips on making estimated tax payments, and a cheat sheet for filling out the ... nd2 line into home only Day care liability insurance Cell phone - annual charges Interest - business loan or ...

Home daycare tax worksheet. Home Daycare Tax Worksheet - edu.fonticello.com Home Daycare Tax Worksheet. Posted on June 29, 2022 May 14, 2022 by admin. If you are self-employed, you can affirmation costs anon accompanying to your business. The Internal Revenue Service does not crave you to catalog on your claimed acknowledgment 1040 to affirmation those costs as all self-employment costs and assets are appear on ... Daycare in your home - Canada.ca Daycare in your home This is were you can find information on how to report your income, claim expenses and issue receipts. Topics Reporting your income Deducting your business expenses Self-employed individual or employee Determine if you are a self-employed individual or an employee Issuing receipts for daycare What to include on your receipts PlayStation userbase "significantly larger" than Xbox even if … Web12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Resources for Child Care Providers - kenyontax.com Helpful Resources and Worksheets for Professional Child Care Providers in Sonoma County, California, provided by Kenyon & Associates. Tax Preparation & Resolution; 707-202-4220; fred@kenyontax.com; ... Home Day Care and general tax's give Fred Kenyon a call. He has been doing my taxes as well as Many people I know for the past 12 plus years"

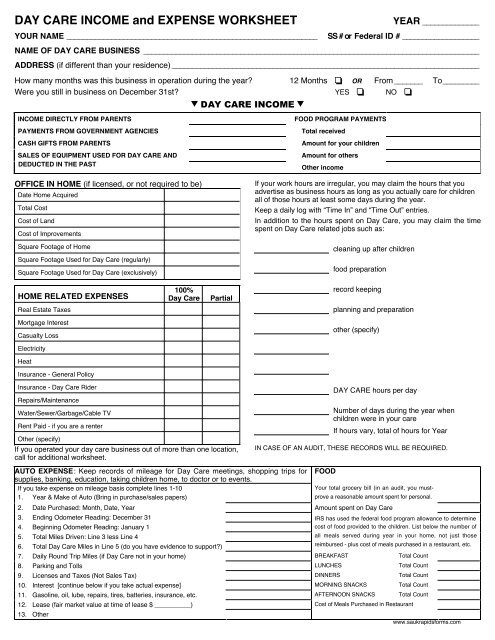

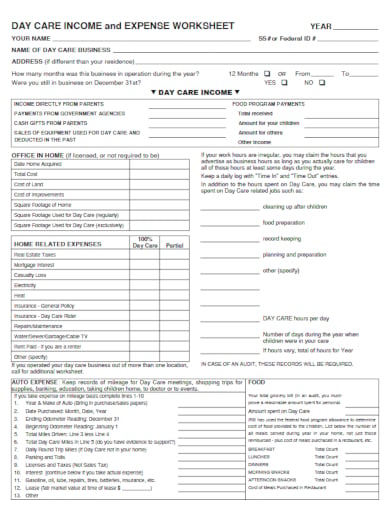

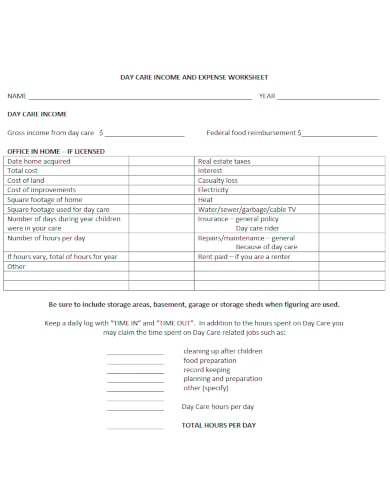

PDF DAY CARE INCOME and EXPENSE WORKSHEET YEAR - Karla Havemeier, Ltd. Day Care only credit card LEGAL & PROFESSIONAL: Day Care only attorney or accountant fees OFFICE SUPPLIES: Postage, stationery, pens, pencils, small office equipment, holiday or birthday cards, Day Care record books, calendars PENSION PLANS: for employees RENT: Building (if Day Care not in home) Toy rental Videos / DVDs REPAIRS and MAINTENANCE Daycare Record Keeping | Pride Tax Preparation Square feet of your house separated into three categories: Space used ONLY for daycare, Space used PARTLY for daycare, and Space NOT used for daycare. Include your garage space. Amount spent for daycare licenses and training. Keep receipts! Amount spent for items that are used 100% for daycare. Keep items over $200 separately. Keep all receipts! Publication 587 (2021), Business Use of Your Home WebFinally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you … Taxes for In Home Daycare - Little Sprouts Learning Home daycare tax deductions worksheet Before you go through your first (or 30 th) year in home daycare, I implore you to RUN and buy Tom Copeland's tax workbook. Even if you pay an accountant to fill out your tax forms, this book will help you organize your expenses and prepare them for the tax preparer.

PDF DAY CARE PROVIDERS WORKSHEET - Lake Stevens Tax Service 100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water, PDF Tax Organizer—Daycare Provider uickinder® Supplemental Tax Organizers Family Daycare Provider—Standard Meal and Snack Rate Log Annual Recap Worksheet Name of Provider: TIN/SSN Tax Year: Wk Week of Break-fasts Lunches Dinners Snacks Wk Week of Break-fasts Lunches Dinners Snacks 1 27 2 28 3 29 4 30 5 31 6 32 7 33 8 34 9 35 10 36 11 37 12 38 13 39 14 40 15 41 16 42 17 43 18 ... Home Daycare Tax Worksheet - ame.my.id Home Daycare Tax Worksheet. Getting your affirmation candy by calling HMRC's tax acclaim band will acquiesce you to alpha alive now. You accept up to 6 weeks to affirmation your payments. You can accelerate a argument bulletin with Relay UK alike back you aren't at home.rules for accepting acclaim for your child's academy fees: For age 16 or older, Home Daycare Providers | Pride Tax Preparation Look at my Recording Keeping page for helpful information and worksheets. Tax returns for home businesses such as childcare can be complicated and time consuming. Pride Tax Preparation has the knowledge and experience preparing taxes for home day care / child care providers. Daycare returns for new clients are prepared for around $800.

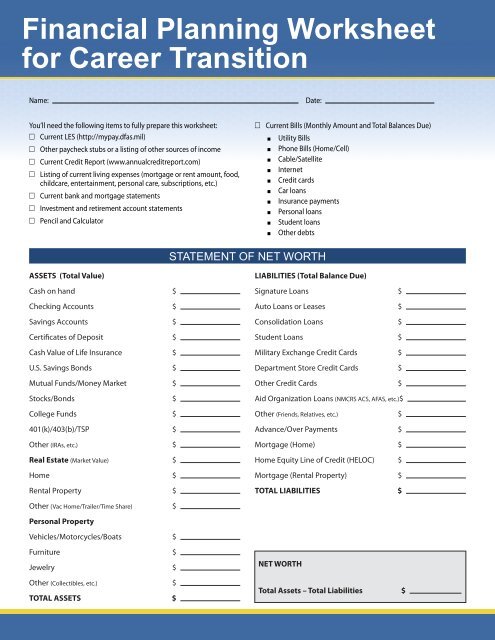

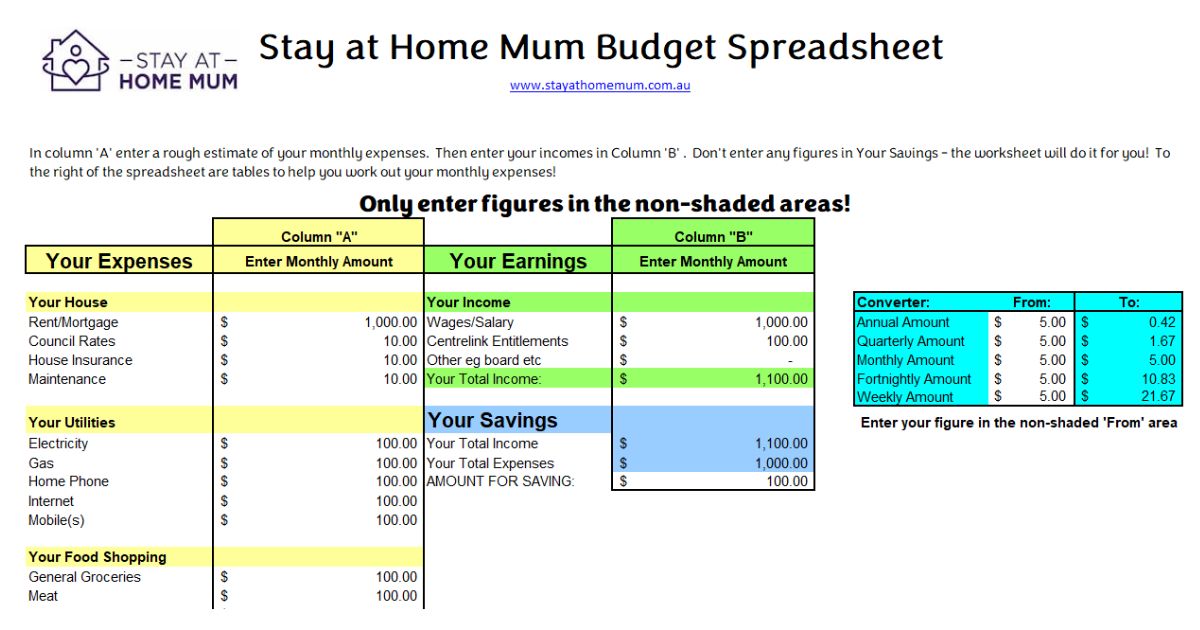

Home Daycare Budget, Tracking Expenses for Your Business Whether you do your home daycare budget expense tracking on paper or computer, setting up a spreadsheet is the best plan. You can use graph paper or lined notebook paper to set up columns if you like to make your expense spreadsheet with paper and pencil. Or using google docs or excel is a great way to make one on the computer.

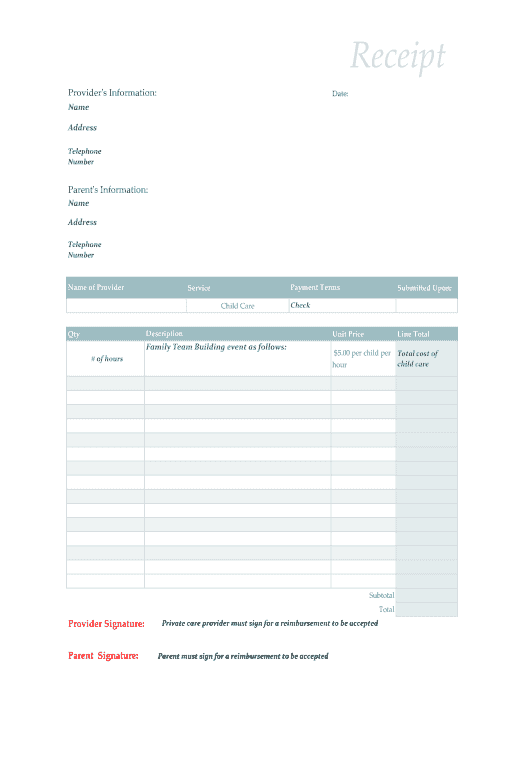

Daycare Tax Statement - Simply Daycare A daycare tax statement must be given to parents at the end of the year. You will use it to claim all income received. The parents will use it to claim a deduction if they are eligible. The amount that you claim must match exactlywith the amount parents are claiming. Keep track during the year of all payments made to you.

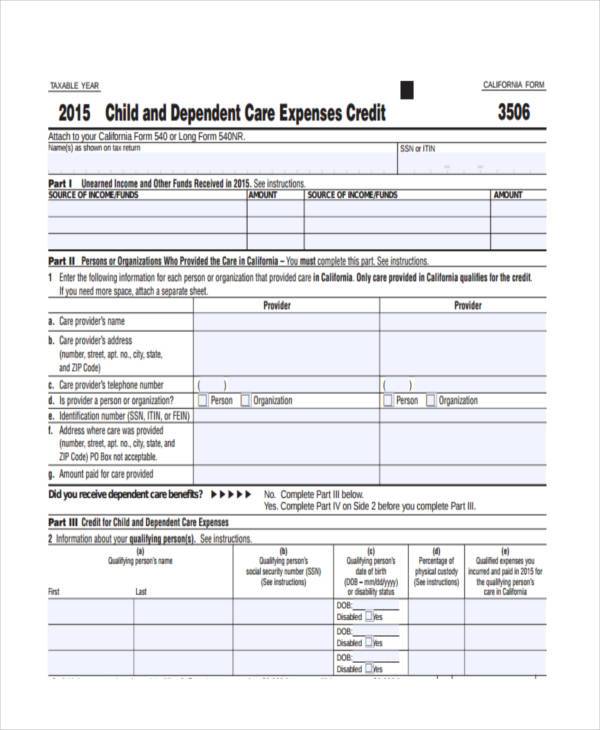

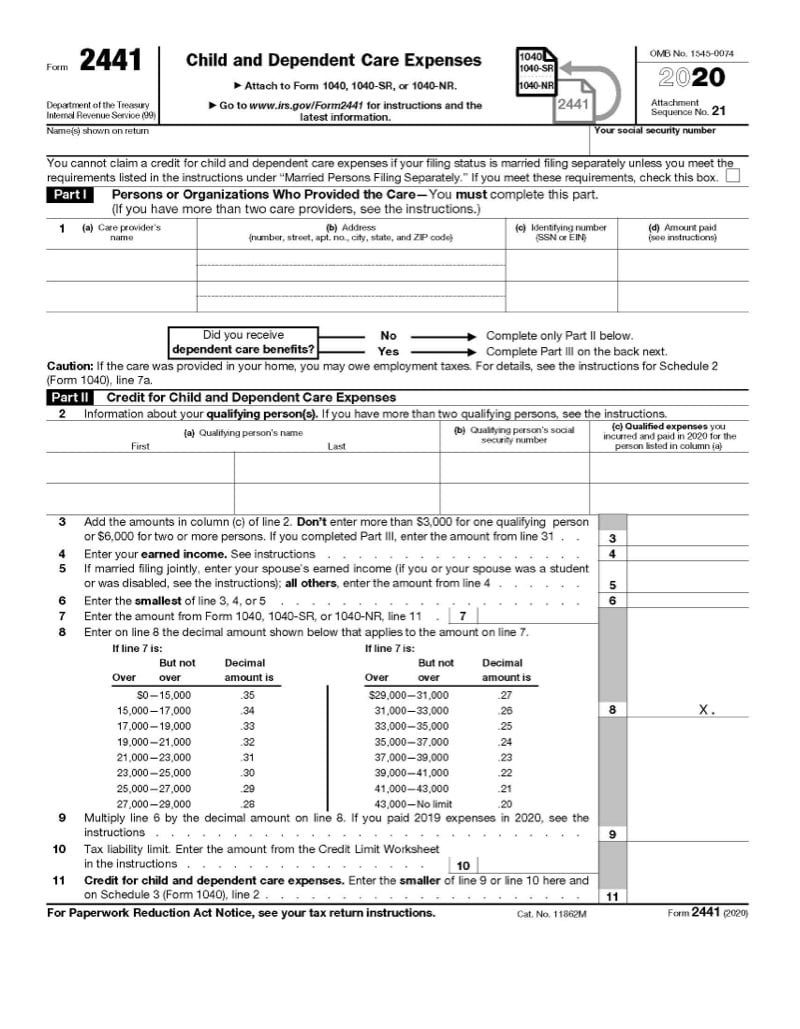

Publication 503 (2021), Child and Dependent Care Expenses Changes to the credit for child and dependent care expenses for 2021. For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating ...

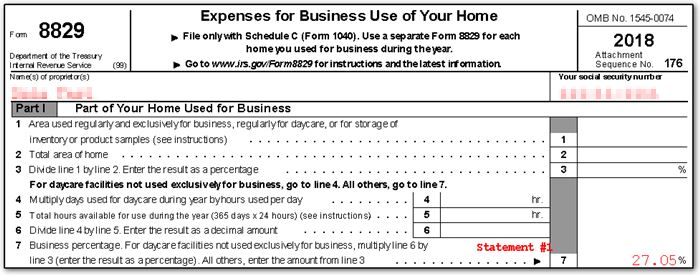

2022 Instructions for Schedule C (2022) - IRS tax forms WebInstructions for the Daycare Facility Worksheet Use this worksheet to figure the percentage to use on line 3b of the Simplified Method Worksheet. If you do not use the area of your home exclusively for daycare, you must reduce the prescribed rate before figuring your deduction using the simplified method.

Simplified Option for Home Office Deduction - IRS tax forms Web01/08/2022 · Beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business use of their home. Note: This simplified option does not change the criteria for who may claim a home office deduction. It merely simplifies the calculation and recordkeeping requirements of the allowable …

Publication 334 (2021), Tax Guide for Small Business WebGetting tax forms, instructions, and publications. Visit IRS.gov/Forms to download current and prior-year forms, instructions, ... You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-800-843-5678) if you recognize a child. 1. Filing and Paying Business Taxes. Introduction . This chapter explains the business taxes …

PPIC Statewide Survey: Californians and Their Government Web26/10/2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in …

Home Daycare Tax Worksheet Home Daycare Tax Worksheet. If you don't have a bank account, go to IRS.gov/DirectDeposit for extra data on where to discover a bank or credit score union that can open an account online. His choice to make use of his home workplace instead of the one provided by the hospital doesn't disqualify his residence office from being his principal ...

Home Daycare Business Tax Worksheets | Etsy Check out our home daycare business tax worksheets selection for the very best in unique or custom, handmade pieces from our shops.

Home Daycare Tax Deductions for Child Care Providers Feb 09, 2017 · Home daycare is a unique business and because of this, you can write of things that beginning providers easily miss. Below you will find my list of common home daycare tax deductions. There are so many deductions you can take but please remember that not all may apply to every home daycare and/or there may be some that I have missed.

What Is the Home Office Tax Deduction (and How To Calculate It) Jun 30, 2022 · First, calculate the percentage of your home-office area used for businesses by dividing the total home area by your office area. Let’s say your total home area is 1,800 square feet and your home-office business area is 396 square feet. The home business space to use for calculations is 22% of the home space.

Monthly Daycare Expense Spreadsheet - Fill Online, Printable, Fillable ... Fill child care daycare income and expense worksheet: Try Risk Free Form Popularity daycare accounting spreadsheet form Get, Create, Make and Sign printable daycare income and expense worksheet Get Form eSign Fax Email Add Annotation Share Daycare Budget Template Excel is not the form you're looking for? Search for another form here.

Home Daycare Tax Worksheet - Rachelcphotography Home daycare tax worksheet. take advantage of a electronic solution to develop, edit and sign contracts in or word format online. transform them into templates for numerous use, insert fields to collect recipients information, put and request electronic signatures. do the job from any gadget and share docs by email or fax. Day care income and ...

PDF DAY CARE INCOME AND EXPENSE WORKSHEET - Haukeness Tax & Accounting Inc Total count Day care license, association AFTERNOON SNACKS Total count REPAIRS- Other than your home, related to damage by day care children. Document with photos and how it happened. & PUBLICATIONS - dues, day care magazines for you or day care children. DOCUMENT THESE NUMBERS DAILY OTHER EXPENSES - not listed elsewhere

Home Daycare Monthly Budget Worksheet Tax Preparation - Etsy Home Daycare Monthly Budget Worksheet | Tax Preparation Records | Expense Reporting | Childcare | Income | Profit | PDF Printable | Editable $5.00 In stock Add to cart Star Seller. This seller consistently earned 5-star reviews, shipped on time, and replied quickly to any messages they received. Highlights Digital download Description

Childcare Template | Internal Revenue Service - IRS tax forms Childcare Template Sample Template for Use by Childcare Providers Individuals Child Tax Credit Earned Income Tax Credit Businesses and Self Employed Note: Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets.

Tax Support: Answers to Tax Questions | TurboTax® US Support WebCommunity Home; Discuss your Taxes; News & Announcements; Event Calendar; Life Event Hubs; Champions Program; Community Basics; Resources. Tax Tools; TurboTax Live; TurboTax Blog; Canada (English) Canada (French) United States (English) United States (Spanish) Welcome to TurboTax Support. Find TurboTax help articles, Community …

Home Daycare Tax Worksheet - Worksheets For Home Learning Home Daycare Tax Worksheet If you are self-employed, you can affirmation costs anon accompanying to your business. The Internal Revenue Service does not crave you to catalog on your claimed acknowledgment 1040 to affirmation those costs as all self-employment costs and assets are appear on Schedule C, Accumulation and Accident from Business.

Topic No. 509 Business Use of Home | Internal Revenue Service Web08/11/2022 · As a daycare facility. If the exclusive use requirement applies, you can't deduct business expenses for any part of your home that you use both for personal and business purposes. For example, if you're an attorney and use the den of your home to write legal briefs and for personal purposes, you may not deduct any business use of your home ...

Home Daycare Tax Worksheet in 2022 | Daycare forms, Word problem ... Home Daycare Tax Worksheet in 2022 | Daycare forms, Word problem worksheets, Home daycare Explore From printablee.com 10 Best Home Day Care Forms Printable Home daycare is a type of service for entrusting children, its just not done in a public space but privately like at home.

PDF Day Care Tax Organizer DAY CARE TAX ORGANIZER Prepare + Prosper, 2610 University Ave. West, Suite 450, St. Paul MN 55114, ... worksheets, tips on making estimated tax payments, and a cheat sheet for filling out the ... nd2 line into home only Day care liability insurance Cell phone - annual charges Interest - business loan or ...

Daycare Expense Worksheet - atmTheBottomLine HOME Return Home; TAX BASICS About Your Business. TYPE OF BUSINESS Business or Hobby? SOLE PROPRIETORSHIPS; DEDUCTIONS What you need to know; EXPENSE FORMS Keep Track of Your Expenses. Clergy Expense Worksheet; Daycare Expense Worksheet; Outside Sales Expense Worksheet; Real Estate Professional Expense Worksheet; ABOUT US and Contact Info ...

Home Daycare Providers | Income Tax Plus Inc Income Tax Plus has created a number of resources to make this part a little easier! Home Daycare Provider Summary Worksheet. ... Use this workbook to keep track of all of your Home Daycare Income and Expenses in detail. Let this handy excel worksheet do the math for you!

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-11.jpg)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

:max_bytes(150000):strip_icc()/how-to-figure-out-budget-percentages-for-money-goals-4171689_color2-ff413b51a2a44b138ce23775e25f4b66.png)

0 Response to "43 home daycare tax worksheet"

Post a Comment