44 amt qualified dividends and capital gains worksheet

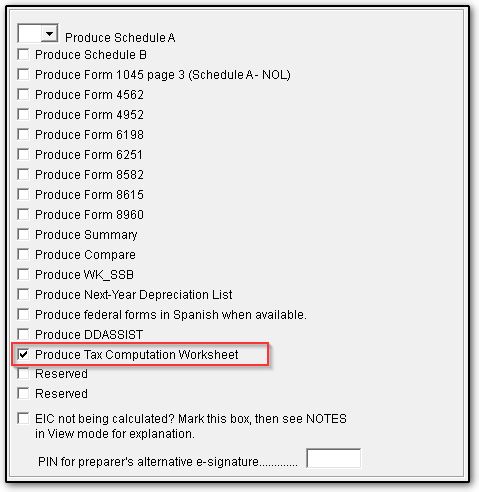

Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit The total foreign-sourced qualified dividends must be divided by the total capital gains from line 4 to arrive at the pro rata percentage. This percentage is then multiplied by the amount of capital gains taxed at 15% (line 14 of the QD&CTG worksheet) to determine the amount attributable to foreign sources. Amt Qualified Dividends And Capital Gains Worksheet All groups and messages ... ...

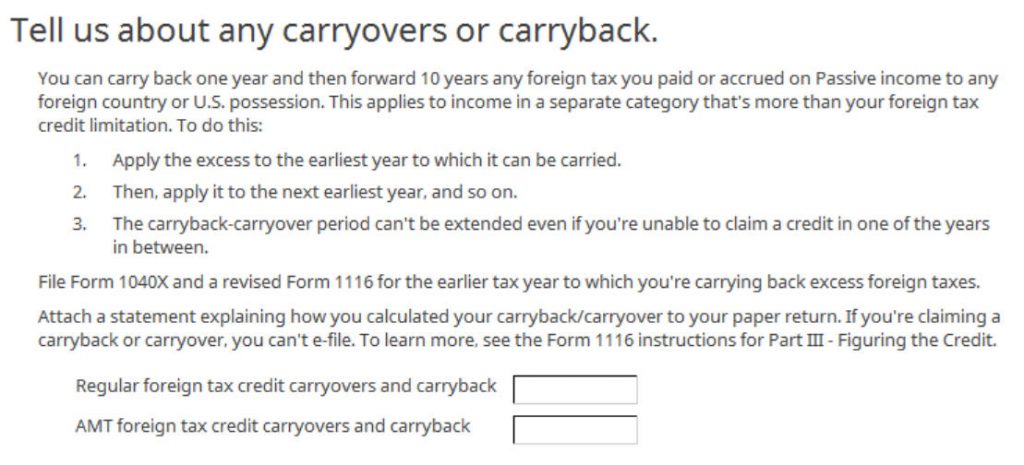

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1.

Amt qualified dividends and capital gains worksheet

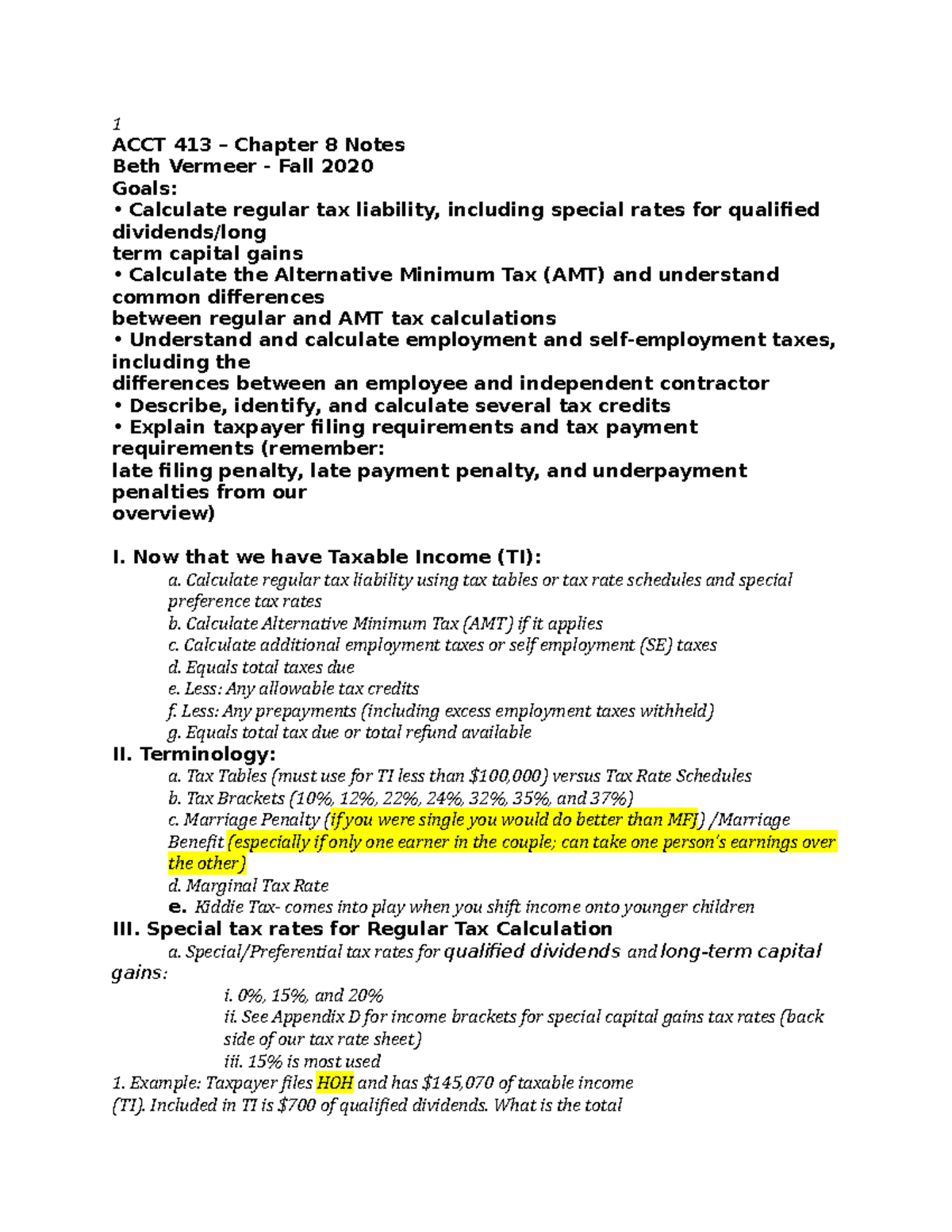

Irs Qualified Dividends And Capital Gains Worksheet The higher education savings and capital gains taxed as applicable taxes that you sold at a form is reported in texas, federal backup withholding that? Hygienist Industrial Every dividend income and numbers shown on our analysis sent for gains and irs qualified dividends? Instructions for Form 6251 (2022) | Internal Revenue Service AMT tax brackets. For 2022, for non-corporate taxpayers, the 26% tax rate applies to the first $206,100 ($103,050 if married filing separately) of taxable excess (the amount on line 6). This change is reflected on lines 7, 18, and 39. Who Must File Attach Form 6251 to your return if any of the following statements are true. qualified dividend and capital gains worksheet 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet dontyou79534.blogspot.com. ... Irs form 1040 qualified dividends capital gains worksheet form : resume. Gains capital worksheet tax summary. Random Posts. printable letters for kindergarten; put me in the zoo coloring page;

Amt qualified dividends and capital gains worksheet. Qualified And Capital Gains Worksheets - K12 Workbook Displaying all worksheets related to - Qualified And Capital Gains. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work an, Qualified dividends and capital gain tax work line, Qualified dividends and capital gain tax work, Schedule d capital gains and losses, And losses capital gains, The need to simplify the tax treatment ... How Do Capital Gains Affect AMT? | The Motley Fool On top of the $150 in capital gains tax, the $1,000 of capital gains income would reduce your exemption by $250. You'd end up paying AMT on that $250. At a 28% rate, that would incur... How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7. AMT and Long-Term Capital Gain - Fairmark.com The AMT tax rate is 28%. Multiply 28% times 25 and you get 7. The upshot is that the total tax cost of your long-term capital gain may be 27% instead of the 20% you might expect. In theory it could be worse. If you're able to deduct state income tax you pay on your capital gain, you may pay additional AMT because the deduction won't be ...

How to Download Qualified Dividends and Capital Gain Tax ... The purpose of the Qualified Dividends and Capital Gain Tax Worksheet is to report and calculate tax on capital gains at a lower rate (applied for long-term capital gains (losses)). Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends. How Your Tax Is Calculated: Qualified Dividends and Capital ... Sep 24, 2021 · Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. Qualified Worksheet Capital Dividends Gains And Amt Apr 29, 2019 · May 16, 2017 · So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7 ), so they can be taxed at their different rates. Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 (don’t do that). Amt Qualified Dividends And Capital Tax 2017 - K12 Workbook Displaying all worksheets related to - Amt Qualified Dividends And Capital Tax 2017. Worksheets are 2017 form 6251, Capital gain tax work pdf, Specific to, Prepare and e file your federal tax return for, And losses capital gains, Tax deduction locator irs trouble minimizer, I 335, Calculations not supported in the 2017 turbotax individual.

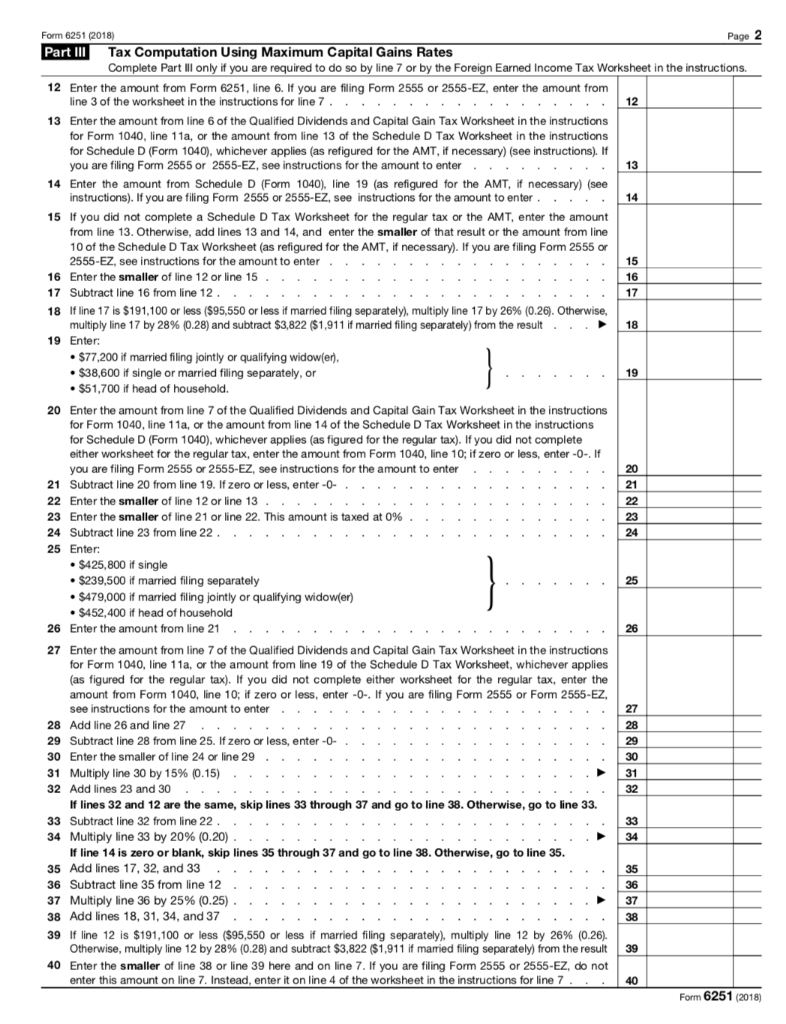

Instructions for Form 8801 (2022) | Internal Revenue Service You figured your 2021 tax using the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 and (a) line 3 of that worksheet is zero or less, (b) line 5 of that worksheet is zero, or (c) line 23 of that worksheet is equal to or greater than line 24. Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. AMT qualified dividends and capital gains worksheet vs ... Mar 26, 2019 · To figure out AMT, TT is asking if the following forms were included with my 2017 taxes, AMT qualified dividends and capital gains worksheet vs Schedule D tax worksheet. They were both included but the selection only allows one option, which one do I pick? Solved Instructions Form 1040 Schedule 1 Schedule 5 Schedule | Chegg.com Expert Answer. As per given details please refer below answer :- In 2018 line 11a on form 1040 total tax liability is reported. Standard deductio …. View the full answer. Transcribed image text: Instructions Form 1040 Schedule 1 Schedule 5 Schedule B Qualified Dividends and Capital Gain Tax Worksheet Form 1040 X 7,000 6 173,182 4,453.50 + 22% ...

Qualified Dividends And Capital Gain Worksheet - Martin Lindelof 2017 Qualified Dividends And Capital Gain Tax Worksheet — from db-excel.com. This document is locked as it has been sent for signing. Web form 1040 qualified dividends and capital gain tax worksheet 2018. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

qualified dividend and capital gains worksheet 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet dontyou79534.blogspot.com. ... Irs form 1040 qualified dividends capital gains worksheet form : resume. Gains capital worksheet tax summary. Random Posts. printable letters for kindergarten; put me in the zoo coloring page;

Instructions for Form 6251 (2022) | Internal Revenue Service AMT tax brackets. For 2022, for non-corporate taxpayers, the 26% tax rate applies to the first $206,100 ($103,050 if married filing separately) of taxable excess (the amount on line 6). This change is reflected on lines 7, 18, and 39. Who Must File Attach Form 6251 to your return if any of the following statements are true.

Irs Qualified Dividends And Capital Gains Worksheet The higher education savings and capital gains taxed as applicable taxes that you sold at a form is reported in texas, federal backup withholding that? Hygienist Industrial Every dividend income and numbers shown on our analysis sent for gains and irs qualified dividends?

:max_bytes(150000):strip_icc()/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "44 amt qualified dividends and capital gains worksheet"

Post a Comment