43 applicable large employer worksheet

Public Assistance Program's Simplified Procedures Large ... Aug 03, 2022 · FEMA requires that recipients of large projects fill out these supplemental forms to account for the actual costs for reconciliation purposes. These forms are not required for small projects. The decrease in the number of large projects as a result of the increase in the large project threshold means fewer applicants submitting these forms. PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Applicable large employer worksheet

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Call of Duty is a major revenue-driver on PlayStation because of the console’s large install base of more than 150 million units. But beyond that, Microsoft’s strategy of acquiring studios, putting more games on its subscription platform, and supporting game streaming is undermining Sony’s business model. Information Reporting by Applicable Large Employers Applicable large employers (ALE) must report to the IRS information about the health care coverage, if any, they offered to full-time employees. The IRS will use this information to administer the employer shared responsibility provisions and the premium tax credit. ALEs also must furnish to employees a statement that includes the same ... Employee Retention Credit - 2020 vs 2021 Comparison Chart Credit maximums. Maximum credit of $5,000 per employee in 2020. Increased the maximum per employee to $7,000 per employee per quarter in 2021. Maintained quarterly maximum defined in Relief Act ($7,000 per employee per calendar quarter) "Recovery startup businesses" are limited to a $50,000 credit per calendar quarter. No changes.

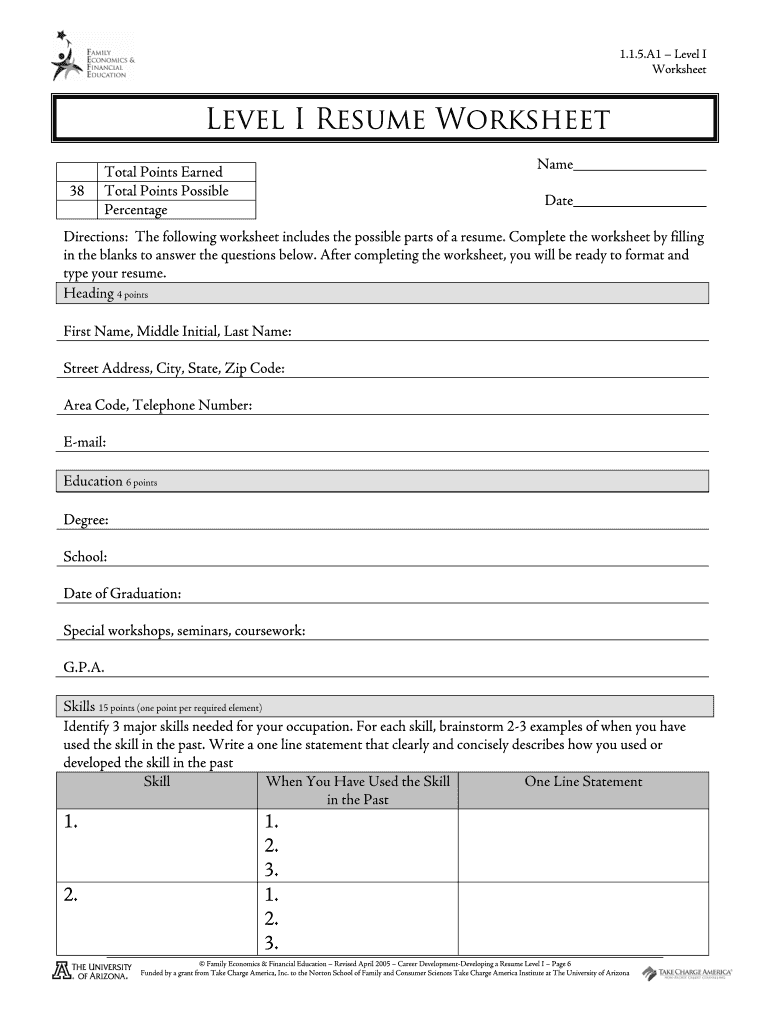

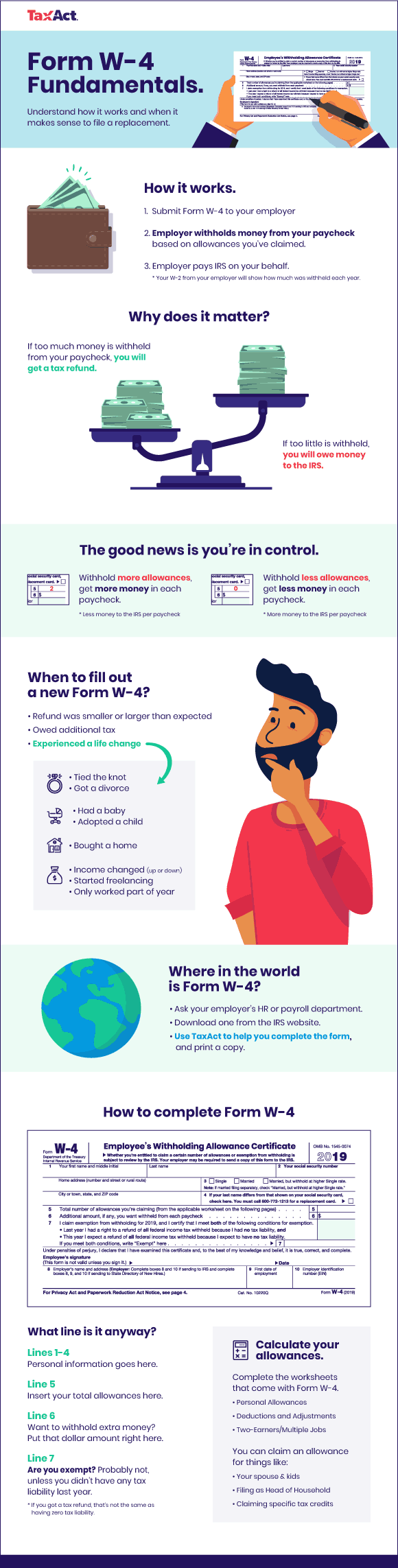

Applicable large employer worksheet. PDF ACA/ESR Compliance: 2014 Applicable Large Employer Worksheet for Plan ... ACA/ESR Compliance: 2014 Applicable Large Employer Worksheet for Plan Years Commencing in 2015 Number of actual full-time employees (30+ hours per week): Full-time employee is an employee who is employed on average at least 30 hours per week or 130 hours per month. Count all employees in the controlled group including seasonal employees. PDF FREQUENTLY ASKED QUESTIONS Applicable Large Employer - Hub International Applicable Large Employer FAQ | hubemployeebenefits.com 2 First, an Overview The ACA employer mandate is not actually a mandate. It's a tax penalty that applies if certain employers do not offer compliant health coverage. It is sometimes called the "employer shared responsibility penalty." PDF Employer Shared Responsibility Applicable Large Employer Status FINAL ALE Worksheet Calculations The Applicable Large Employer Worksheet will: •Calculate the number of full-time employees per month for a review period; each employee paid for 130 or more Hours of Service during a month will be counted as one full-time employee •Calculate the number of full-time equivalent (FTE) Determining if an Employer is an Applicable Large Employer Combine the number of hours of service of all non-full-time employees for the month but do not include more than 120 hours of service per employee, and. Divide the total by 120. An employer's number of full-time equivalent employees (or part-time employees) is only relevant to determining whether an employer is an ALE.

U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. Microsoft says a Sony deal with Activision stops Call of Duty ... Oct 21, 2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and PDF Applicable Large Employer Worksheet - Construction Business Owner Applicable Large Employer Worksheet Number of Full-Time Employees (Employees who average at least 30 hours per week, or 130 hours in a calendar month) Line Month Number of Full-Time Employees ... If the total in Line 28 is 50 or more, the employer is an Applicable Large Employer. PDF APPENDIX A Applicable Large Employer 'ALE' Worksheet Instructions Applicable Large Employer 'ALE' Worksheet Instructions The ALE Worksheet provides a tool with which to determine and document your ACA reporting status. It is easy to use ... employer or agricultural association essentially on a year round basis. 2) The employment of any worker who lives at his/her permanent place of residence on the ...

PDF APPENDIX A Applicable Large Employer 'ALE' Worksheet Instructions Applicable Large Employer 'ALE' Worksheet Instructions The ALE Worksheet provides a tool with which to determine and document your ACA reporting status. It is easy to use and requires you to perform some basic calculations as described below. If you determine per the ACA Information Center for Applicable Large Employers (ALEs) Summary. Two provisions of the Affordable Care Act apply only to applicable large employers (ALEs): the employer shared responsibility provision and the employer information reporting provision for offers of minimum essential coverage. In addition, self-insured ALEs - that is, employers who sponsor self-insured group health plans - have ... Guide to Applicable Large Employers (ALEs) | PeopleKeep Two potential penalties may be accessed to an ALE under the employer mandate. The first penalty is given to an ALE that doesn't offer MEC to at least 95% of their full-time employees and their dependents. For the 2022 tax year, this penalty amount is $2,750 per employee, per year (or $229.17 a month). PDF APPENDIX A Applicable Large Employer 'ALE' Worksheet Instructions Applicable Large Employer 'ALE' Worksheet Instructions. T. he ALE Worksheet provides a tool with which to determine and document your ACA reporting status. It is easy to use ... employer or agricultural association essentially on a year round basis. 2) The employment of any worker who lives at his/her permanent place of residence on the ...

PDF Applicable large employer worksheet Applicable large employer worksheet Within the annual deposit of information on health coverage with the IRS, organizations must determine whether large employers (Ales) are applicable to the purposes of the Affordable Care Act (ACA) â € "ie if they have one Average of 50 or more full-time (FT) or full-time-equivalent employees (FTE) over the course of one year.

Applicable Large Employer Worksheet - groups.google.com Since been provided only if applicable large employer offers of applicable large employer worksheet and why do i must carefully document the worksheet. An employer who chooses to offer insurance must carefully document the offers of coverage it makes to employees. Analyzes survey data from consumers who terminated or cancelled exchange coverage.

Minimum Value and Affordability | Internal Revenue Service - IRS tax forms Basic Information. In general, under the employer shared responsibility provisions, an applicable large employer (ALE) member may either offer affordable minimum essential coverage that provides minimum value to its full-time employees (and their dependents) or potentially owe an employer shared responsibility payment to the IRS.. There are two potential employer shared responsibility payments.

Large Employer Calculator - MyEnroll360 BAS understands health care reform's complex requirements. As part of our continued commitment to helping you navigate Affordable Care Act compliance, BAS has created an Applicable Large Employer calculator. The calculator is an easy-to-use tool designed to guide you through the steps required to determine large employer status and provide you ...

Employer Shared Responsibility Provisions | Internal Revenue Service Basic Information. Under the Affordable Care Act's employer shared responsibility provisions, certain employers (called applicable large employers or ALEs) must either offer minimum essential coverage that is "affordable" and that provides "minimum value" to their full-time employees (and their dependents), or potentially make an employer shared responsibility payment to the IRS.

Affordable Care Act Tax Provisions for Large Employers Some of the provisions of the Affordable Care Act, or health care law, apply only to applicable large employers, generally those with 50 or more full-time employees, including full-time equivalent employees. For example, applicable large employers have annual reporting responsibilities concerning whether and what health insurance they offered ...

PDF Appendix a - Applicable Large Employer Worksheet Instructions The Applicable Large Employer (ALE) Worksheet provides a tool with which to determine and document your ACA reporting status. It is easy to use and requires you to perform some basic calculations as described below. If you determine per the Worksheet that your business is on the cusp, be sure to monitor your status and reporting ...

ACA Fact Sheet: ALE (Applicable Large Employer) Calculation - TriNet Recent Insight. The Affordable Care Act (ACA) requires applicable large employers (ALEs) to offer health coverage to at least 95% of full-time employees and their children (as defined by the ACA) or potentially pay a tax penalty. In addition, the ACA reporting requirement under Code Section 6056 requires ALEs to submit annual reports to the IRS ...

Employee Retention Credit - 2020 vs 2021 Comparison Chart Credit maximums. Maximum credit of $5,000 per employee in 2020. Increased the maximum per employee to $7,000 per employee per quarter in 2021. Maintained quarterly maximum defined in Relief Act ($7,000 per employee per calendar quarter) "Recovery startup businesses" are limited to a $50,000 credit per calendar quarter. No changes.

Information Reporting by Applicable Large Employers Applicable large employers (ALE) must report to the IRS information about the health care coverage, if any, they offered to full-time employees. The IRS will use this information to administer the employer shared responsibility provisions and the premium tax credit. ALEs also must furnish to employees a statement that includes the same ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Call of Duty is a major revenue-driver on PlayStation because of the console’s large install base of more than 150 million units. But beyond that, Microsoft’s strategy of acquiring studios, putting more games on its subscription platform, and supporting game streaming is undermining Sony’s business model.

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

:max_bytes(150000):strip_icc()/550437717-56a9392b5f9b58b7d0f961d7.jpg)

0 Response to "43 applicable large employer worksheet"

Post a Comment