39 qualified dividends and capital gain tax worksheet line 44

2012 Qualified Dividends Worksheets - K12 Workbook Worksheets are 44 of 107, 2014 qualified dividends and capital gain tax work, 43 of 107 fileid ionsi10402017axmlcycle16, 2012 pennsylvania telefile work, Capital gains and losses, Line 44 the tax computation work on if you are filing, 2018 form 6251, Form 1040 es payment voucher 1. *Click on Open button to open and print to worksheet. Qualified Dividends And Capital Gain Tax Worksheet 2021 The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing.

Microsoft is building an Xbox mobile gaming store to take on … Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Qualified dividends and capital gain tax worksheet line 44

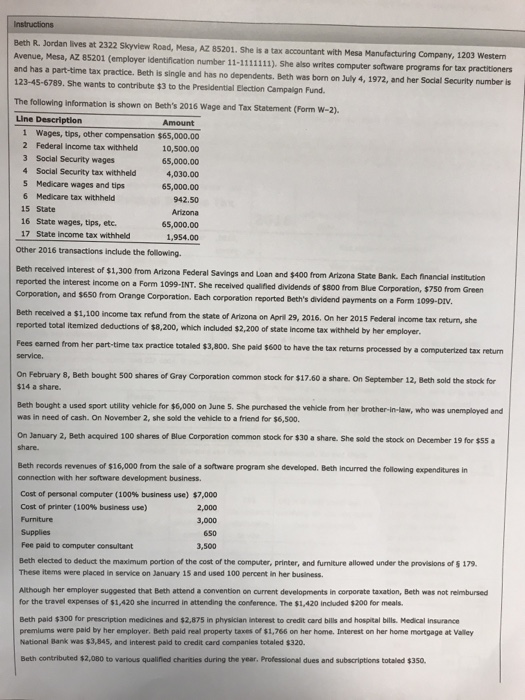

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return. Publication 17 (2021), Your Federal Income Tax - IRS tax forms The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a ... PDF Line 44 the Tax Computation Worksheet on if you are filing Form 2555 or ... 1. Reduce (but not below zero) the amount you would otherwise enter on line 3 of your Qualified Dividends and Capital Gain Tax Worksheet or line 9 of your Schedule D Tax Worksheet by your capital gain excess. 2. Reduce (but not below zero) the amount you would otherwise enter on line 2 of your Qualified Dividends and Capital Gain Tax Worksheet or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3.

Qualified dividends and capital gain tax worksheet line 44. Qualified dividends and capital gain tax worksheet | Chegg.com Question: Qualified dividends and capital gain tax worksheet line 44 This question hasn't been solved yet Ask an expert Ask an expert Ask an expert done loading › fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing. Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon Long term capital gains. 2017 Qualified Dividends and capital gain tax worksheet—line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. • Before completing this worksheet, complete Form 1040 through line 43. At what income level, or capital gains amount, do you become eligible for the alternate minimum capital-gains tax (AMT)? QUAL DIV - 2013 Form 1040—Line 44 Qualified Dividends and Capital Gain ... 2013 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 44 - Tax Guru Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. 1. Enter the amount from Form 1040, line 43. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the worksheet on page 37.....1. 2. Enter the amount from Form 1040 ... › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV. See Pub. 550 for the definition of qualified dividends if you received dividends not reported on Form 1099-DIV. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Publication 559 (2021), Survivors, Executors, and Administrators A worksheet to reconcile amounts reported in the decedent's name on information returns including Forms W-2, Wage and Tax Statement; 1099-INT, Interest Income; 1099-DIV, Dividends and Distributions; etc. ... write the same phrase on the line for total tax. If the individual was killed in a terrorist or military action, put “KITA” on the ... Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Qualified Dividends And Capital Gain Tax Worksheet Line 44 [PDF] - 50 ... We come up with the money for Qualified Dividends And Capital Gain Tax Worksheet Line 44 and numerous book collections from fictions to scientific research in any way. among them is this Qualified Dividends And Capital Gain Tax Worksheet Line 44 that can be your partner. Business Taxpayer Information Publications 2004 Tele-tax United States.

Instructions for Form 1116 (2021) | Internal Revenue Service See Adjustment exception under Qualified Dividends and Capital Gain Tax Worksheet (Individuals ... line 4g, is zero or less; or (c) line 43 is equal to or greater than line 44. You figured your tax using the Schedule D Tax Worksheet (in the Schedule D (Form 1040) instructions) and (a) line 18 is zero, (b) line 9 is zero or less, or (c) line 45 ...

› publications › p559Publication 559 (2021), Survivors, Executors, and Administrators Net operating loss (NOL) carryback. Generally, an NOL arising in a tax year beginning in 2021 or later may not be carried back and instead must be carried forward indefinitely. However, farming losses arising in tax years beginning in 2021 or later may be carried back 2 years and carried forward indefinitely.For special rules for NOLs arising in 2018, 2019 or 2020, see Pub. 536, Net Operating ...

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1.

2021 Instructions for Schedule D (2021) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · “After the Merger, Microsoft would gain control of this important input and could use it to harm the competitiveness of its rivals.” In other words, if Microsoft owned Call of Duty and other Activision franchises, the CMA argues the company could use those products to siphon away PlayStation owners to the Xbox ecosystem by making them ...

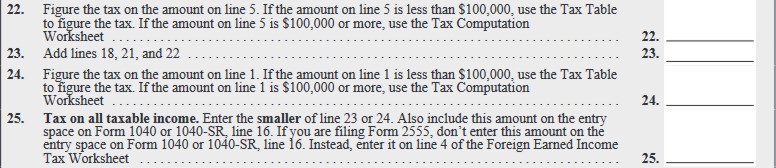

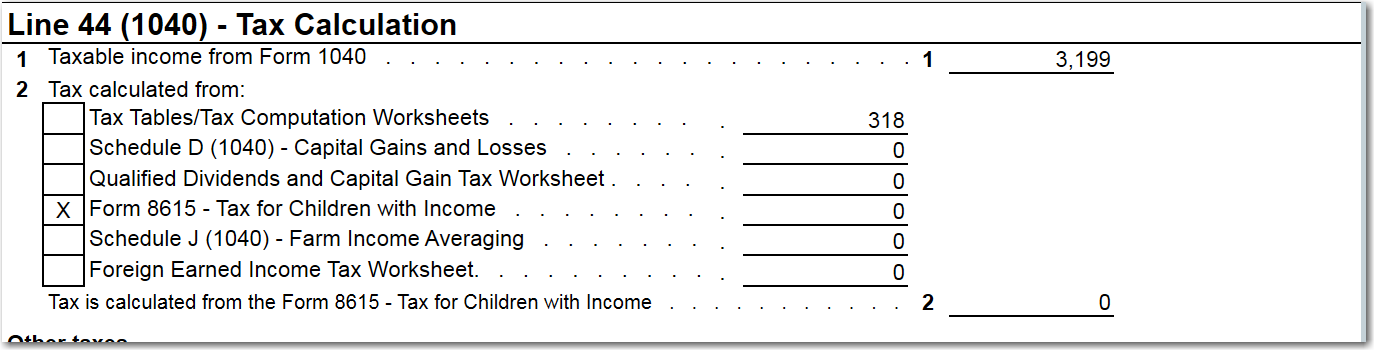

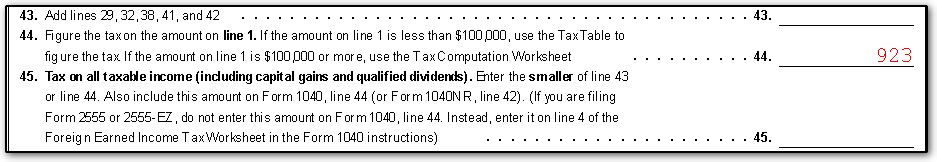

Instructions for Line 44 on Tax Form 1040 | Sapling Line 44 Calculations. If your taxable income is under $100,000, use the IRS Tax Table to determine the tax rate for line 44. If it's $100,000 or more, use the Tax Computation Worksheet. Use Form 8615 to calculate the tax for dependent child income over $2,000. The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18 or 19 exceed zero.

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

› instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

PDF Capital Gains and Losses - IRS tax forms Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR. . Go to . . for instructions and the latest information. . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2017. Attachment Sequence No. 12. Name(s) shown on return . Your social security number. Part I

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Qualified Dividends and Capital Gain Tax Worksheet. Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 7.

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

Qualified Dividends And Capital Gain Tax W0rksheet Line 44 Worksheets are Line 44 the tax computation work on if you are filing, Capital gains and losses, Qualified dividends and capital gain tax work line, Form 1040lines 42 and 44 you must complete and attach, Capital gains and losses, 40 of 117, Prepare and e file your federal tax return for, 23 work opa 142. *Click on Open button to open and print to worksheet.

Qualified Dividends and Capital Gain Tax Worksheet 2016.pdf... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Publication 550 (2021), Investment Income and Expenses - IRS tax forms Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D

PDF Line 44 the Tax Computation Worksheet on if you are filing Form 2555 or ... 1. Reduce (but not below zero) the amount you would otherwise enter on line 3 of your Qualified Dividends and Capital Gain Tax Worksheet or line 9 of your Schedule D Tax Worksheet by your capital gain excess. 2. Reduce (but not below zero) the amount you would otherwise enter on line 2 of your Qualified Dividends and Capital Gain Tax Worksheet or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a ...

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return.

0 Response to "39 qualified dividends and capital gain tax worksheet line 44"

Post a Comment