43 like kind exchange worksheet

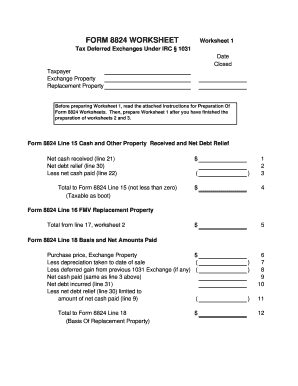

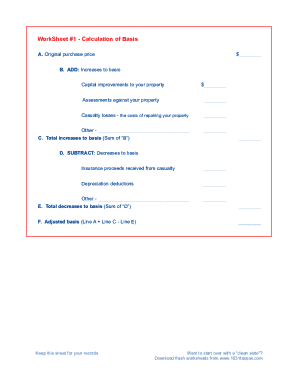

PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____ Guide to Like-Kind Exchanges & Taxable Boot | 1031X She wants to do a 1031 exchange into a $325,000 condo. There will be $10,000 in closing costs at his sale and at his purchase, but Jen also wants to receive $15,000 of her proceeds directly. $300,000 - Jen's relinquished property. $200,000 - Tax Basis. $10,000 - Closing Costs. $15,000 - Cash Received at Closing.

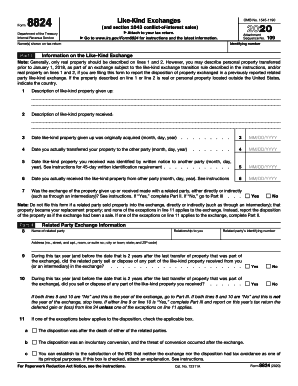

What is IRS Form 8824: Like-Kind Exchange - TurboTax Also, like-kind exchanges carry limits on how long you have to identify and acquire a replacement property: • 45 days from the date you sell to identify potential replacement property and notify the seller of the replacement property or your intermediary • 180 days after the sale to complete the acquisition of the replacement property

Like kind exchange worksheet

Like Kind Exchange Example With Boot | MDS CPA Review Like-Kind Exchange Example/Practice Question. JVC, Inc. offered a 4-year old work truck and $1,000 to Walter Enterprises for a 3-year old work truck. JVC purchased the 4-year old truck when it was new for $28,000, and the truck now has accumulated depreciation of $18,000 and a fair value of $12,000. Walter's truck's original purchase price ... Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? - WallStreetMojo Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset. Table of contents What is the Like-Kind Exchange? Explanation Features Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the Dispositions section.

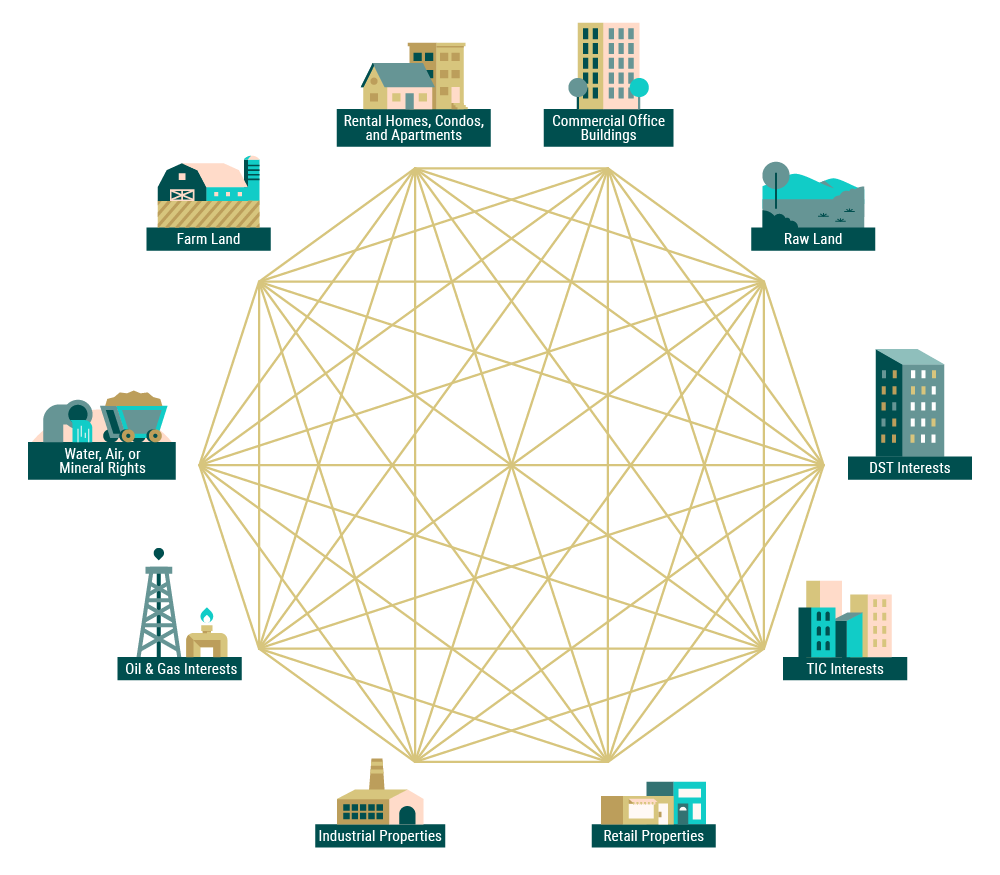

Like kind exchange worksheet. 8824 - Like-Kind Exchange - Drake Software A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive. Due to changes to Section 1031 exchanges listed in the Tax Cuts and Jobs Act ... Accounting for 1031 Like-Kind Exchange - BKPR Doing a like-kind exchange can have a lot of benefits. Aside from deferring capital gains tax, you may be exempt from paying state mandatory withholding. For tax reporting purposes, you need to report a like-kind exchange using Form 8824. The form itself can be confusing. Tax reporting for a Section 1031 exchange can be tricky. › publications › p550Publication 550 (2021), Investment Income and Expenses ... Gain or loss from exchanges of like-kind investment property Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Completing a Like Kind Exchange for business returns in ProSeries - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded.

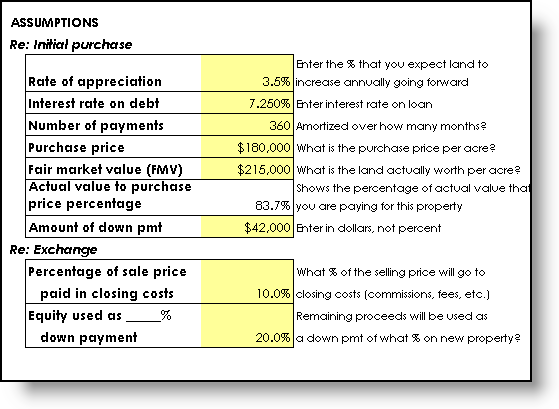

1031 Exchange Examples: Like-Kind Examples to Study & Learn From Example 3. You own a $4,000,000 investment property with a tax basis of $3,500,000 — meaning that you have a $500,000 capital gain. You would like to do a 1031 exchange into a $3,800,000 7-Eleven in Newport News, Virginia. If you exchange your $4,000,000 property for the $3,800,000 7-Eleven. Therefore, a taxable cash boot of $200,000 is realized. 1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We always attempt to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek a picture according specific topic, you can find it in this website. Finally all pictures we have been displayed in this website will inspire you all. Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. › publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... Like-kind exchanges. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Like-Kind Exchange, later. Photographs of missing children.

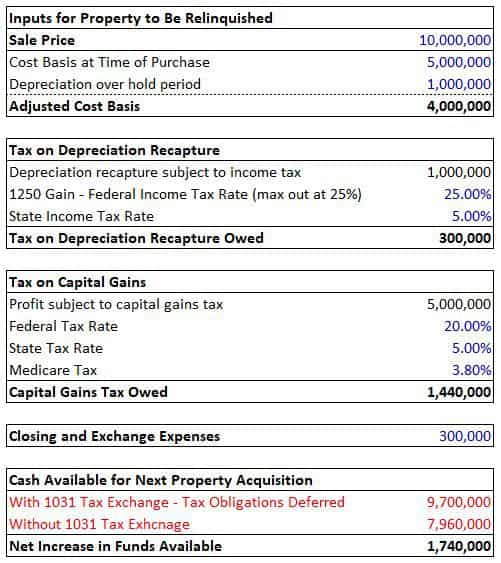

How to Calculate Basis on Like Kind Exchange | Pocketsense Determining the Amount Realized Subtract the commissions and closing costs from your relinquished property's selling price to find the amount realized. If you sell it for $162,000, pay $3,200 in closing costs, and pay $9,720 in commissions, your amount realized is $149,080. Figuring in the Replacement Property 1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or IA 8824 Like Kind Exchange Worksheet 45-017 | Iowa Department Of Revenue Stay informed, subscribe to receive updates. Subscribe to Updates. Footer menu. About; Contact Us; Taxpayer Rights; Website Policies

Like Kind Exchange Vehicle Worksheet And Like Kind ... - Pruneyardinn Worksheet April 17, 2018. We tried to get some amazing references about Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here.

About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

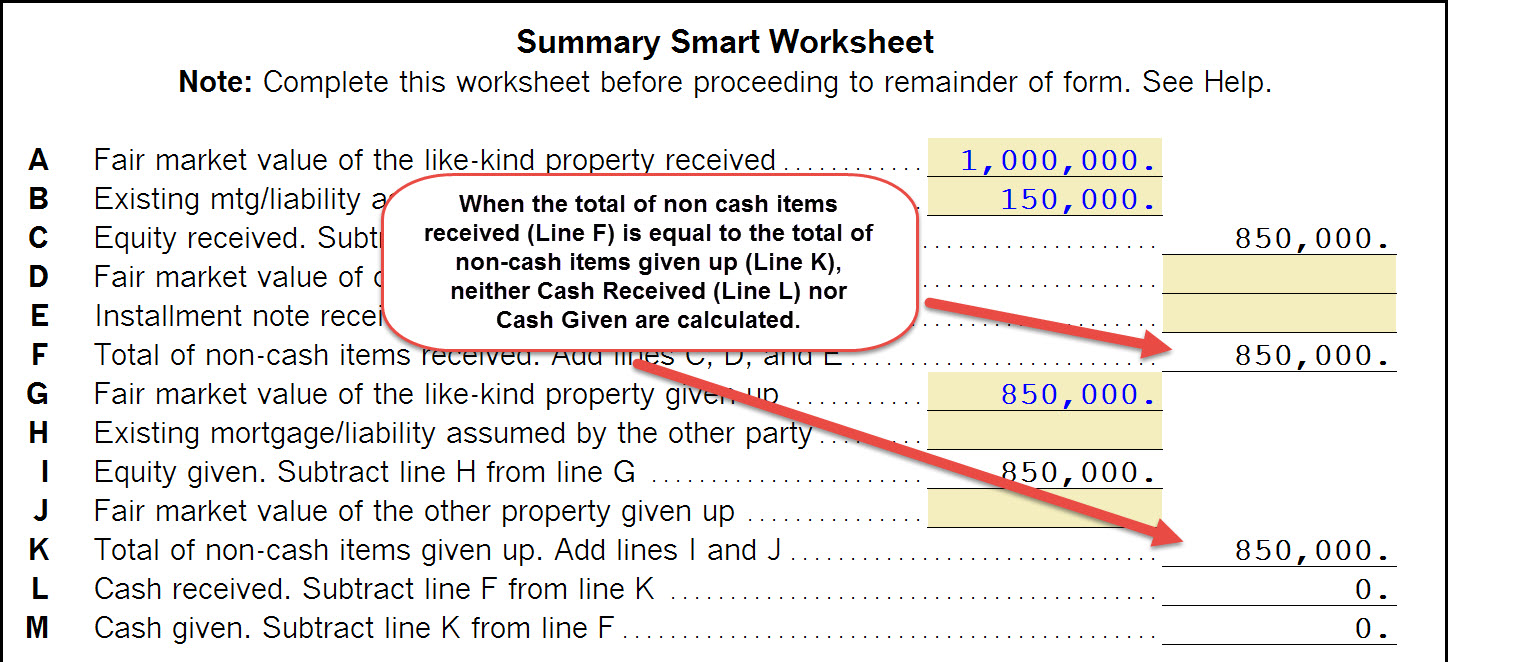

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

mobiri.seMake Website for Free w/o Coding Start creating amazing mobile-ready and uber-fast websites. Drag-n-drop only, no coding. 4000+ site blocks. Free for any use. Easy website maker.

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the Dispositions section.

Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? - WallStreetMojo Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset. Table of contents What is the Like-Kind Exchange? Explanation Features

Like Kind Exchange Example With Boot | MDS CPA Review Like-Kind Exchange Example/Practice Question. JVC, Inc. offered a 4-year old work truck and $1,000 to Walter Enterprises for a 3-year old work truck. JVC purchased the 4-year old truck when it was new for $28,000, and the truck now has accumulated depreciation of $18,000 and a fair value of $12,000. Walter's truck's original purchase price ...

_(800_x_450_px)_(8).png)

0 Response to "43 like kind exchange worksheet"

Post a Comment