42 va loan amount calculation worksheet

What Is The IRS Underpayment of Estimated Tax Penalty? - Forbes Apr 14, 2022 · In the U.S., federal income taxes are a pay-as-you-go system. This means the IRS requires you to pay estimated taxes throughout the year—either via withholding from paychecks or by making ... Mortgage loan - Wikipedia Mortgage loan basics Basic concepts and legal regulation. According to Anglo-American property law, a mortgage occurs when an owner (usually of a fee simple interest in realty) pledges his or her interest (right to the property) as security or collateral for a loan. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but …

DIY Seo Software - Locustware.com A.I. Advanced A.I. Content Writer $ 247 Our private A.I. tool requires no monthly subscription. Over 500,000 Words Free; The same A.I. Engine as all of the big players - But without the insane monthly fees and word limits.

Va loan amount calculation worksheet

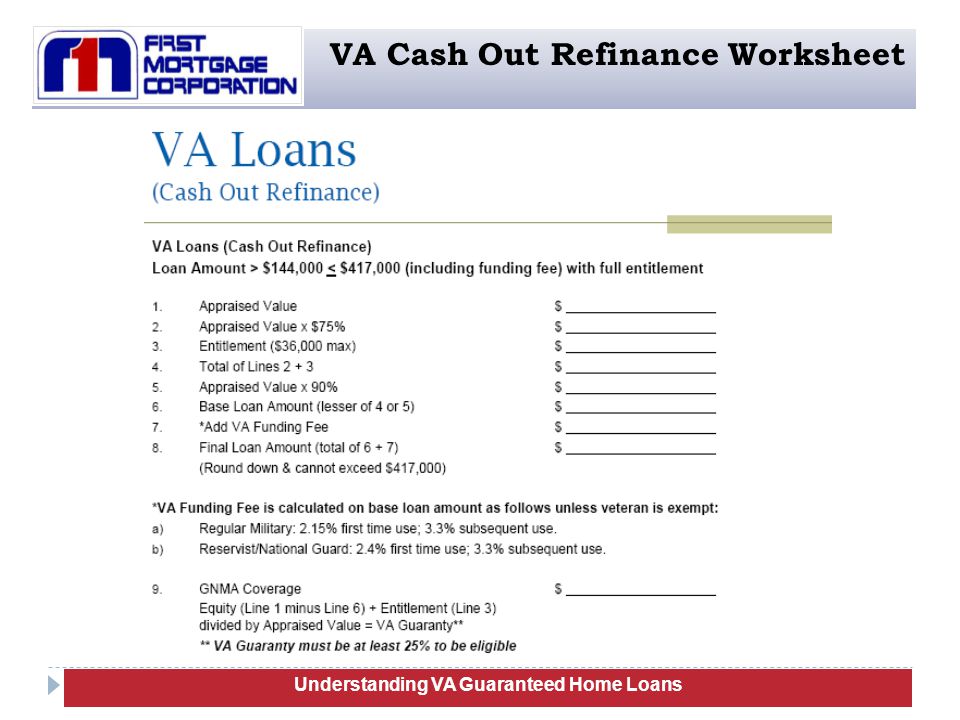

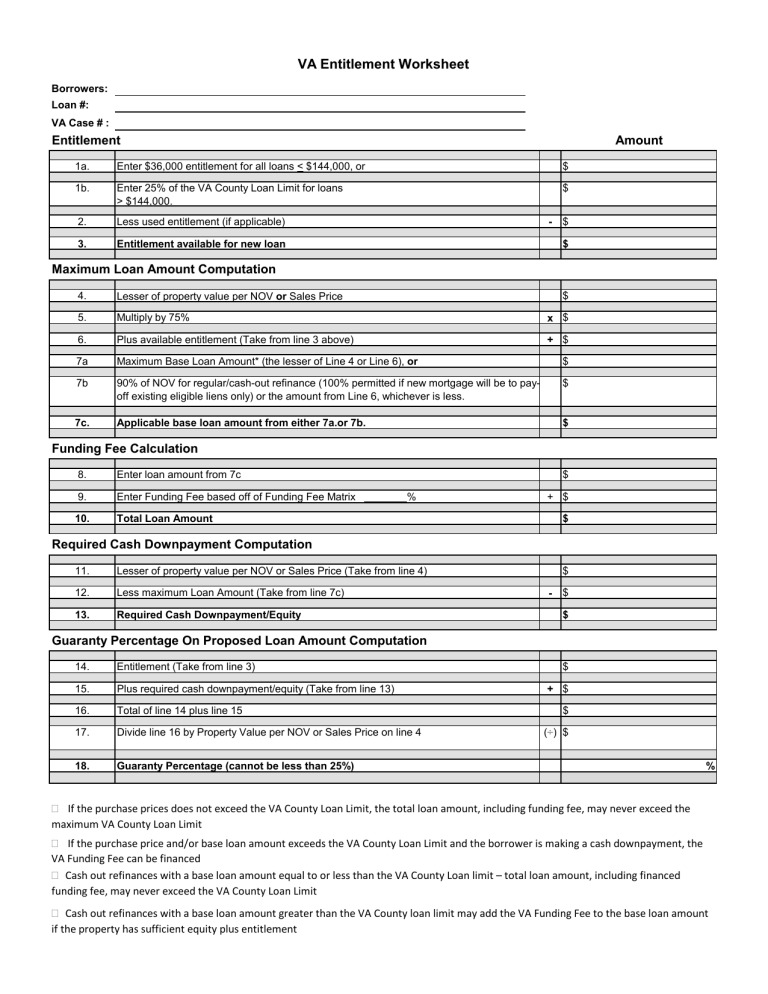

Chapter 3. The VA Loan and Guaranty Overview - Veterans … Chapter 3: The VA Loan and Guaranty 3-4 1. Basic Elements of a VA-Guaranteed Loan, Continued a. General rules (continued) Subject Explanation Section Funding Fee The veteran must pay a funding fee to help defray costs of the VA Home Loan program. • Find the percentage appropriate to the veteran’s particular circumstances on the funding fee ... Publication 505 (2022), Tax Withholding and Estimated Tax Use this worksheet to figure the amount to enter on Worksheet 1-3, line 4, if you expect your filing status for 2022 to be Single. Expected Taxable Income (a) Enter amount from Worksheet 1-3, line 3* (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c). Enter the result here and on Worksheet 1-3 ... Publication 936 (2021), Home Mortgage Interest Deduction The amount on Table 1, line 16, of the worksheet ($15,000); or. The total amount of interest allocable to the business ($16,500), figured by multiplying the amount on line 13 (the $30,000 total interest paid) by the following fraction.

Va loan amount calculation worksheet. Publication 525 (2021), Taxable and Nontaxable Income Other loan forgiveness under the CARES Act. Gross income does not include any amount arising from the forgiveness of certain loans, emergency Economic Injury Disaster Loan (EIDL) grants, and certain loan repayment assistance, each as provided by the CARES Act, effective for tax years ending after 3/27/2020. (See P.L. 116-136 and P.L. 116-260.) Publication 970 (2021), Tax Benefits for Education | Internal … Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. Reporting ... May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Publication 936 (2021), Home Mortgage Interest Deduction The amount on Table 1, line 16, of the worksheet ($15,000); or. The total amount of interest allocable to the business ($16,500), figured by multiplying the amount on line 13 (the $30,000 total interest paid) by the following fraction. Publication 505 (2022), Tax Withholding and Estimated Tax Use this worksheet to figure the amount to enter on Worksheet 1-3, line 4, if you expect your filing status for 2022 to be Single. Expected Taxable Income (a) Enter amount from Worksheet 1-3, line 3* (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c). Enter the result here and on Worksheet 1-3 ... Chapter 3. The VA Loan and Guaranty Overview - Veterans … Chapter 3: The VA Loan and Guaranty 3-4 1. Basic Elements of a VA-Guaranteed Loan, Continued a. General rules (continued) Subject Explanation Section Funding Fee The veteran must pay a funding fee to help defray costs of the VA Home Loan program. • Find the percentage appropriate to the veteran’s particular circumstances on the funding fee ...

0 Response to "42 va loan amount calculation worksheet"

Post a Comment