42 1040 qualified dividends and capital gains worksheet

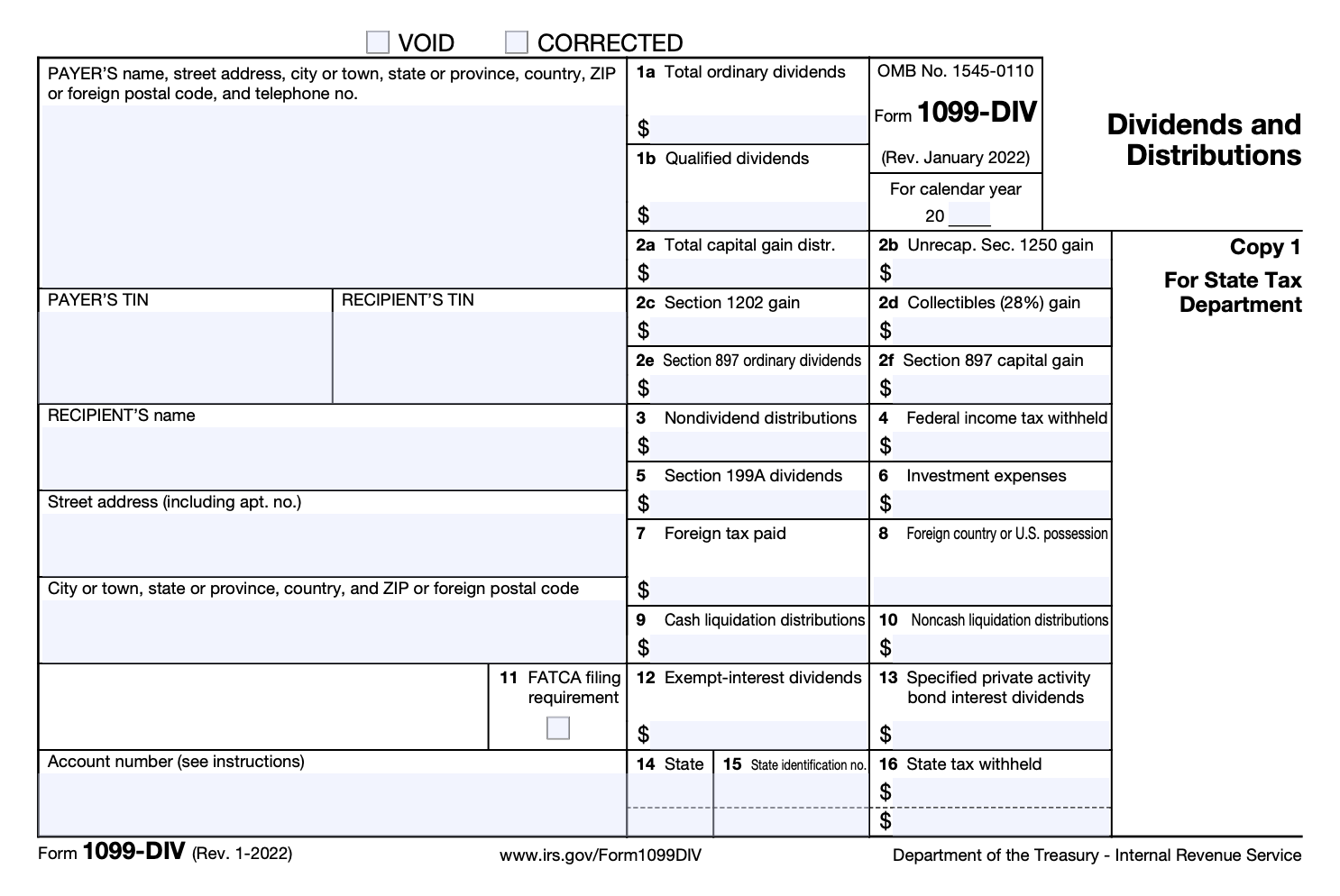

Qualified Dividends and Capital Gains Worksheet-Completed Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. 1. Enter the amount from Form 1040 or 1040-SR, line 11b. 1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

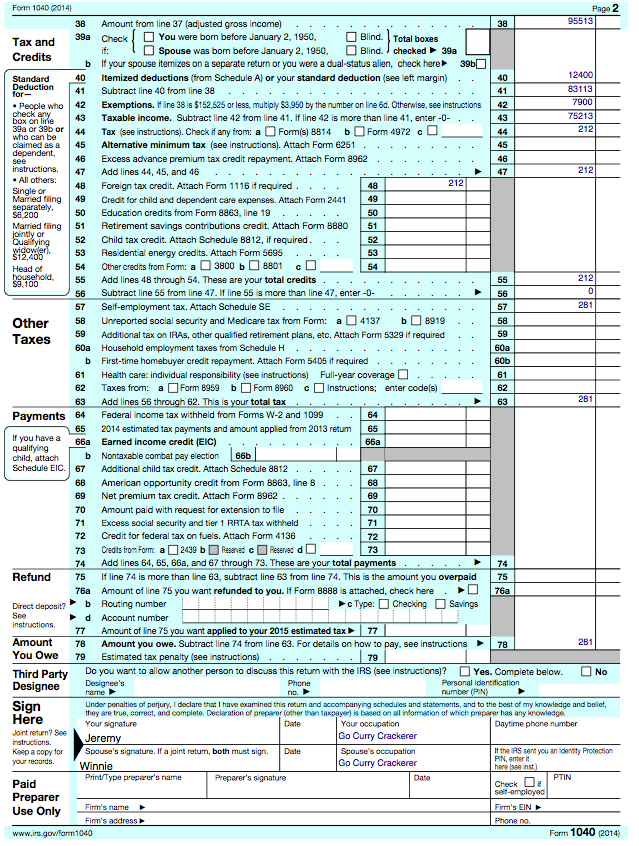

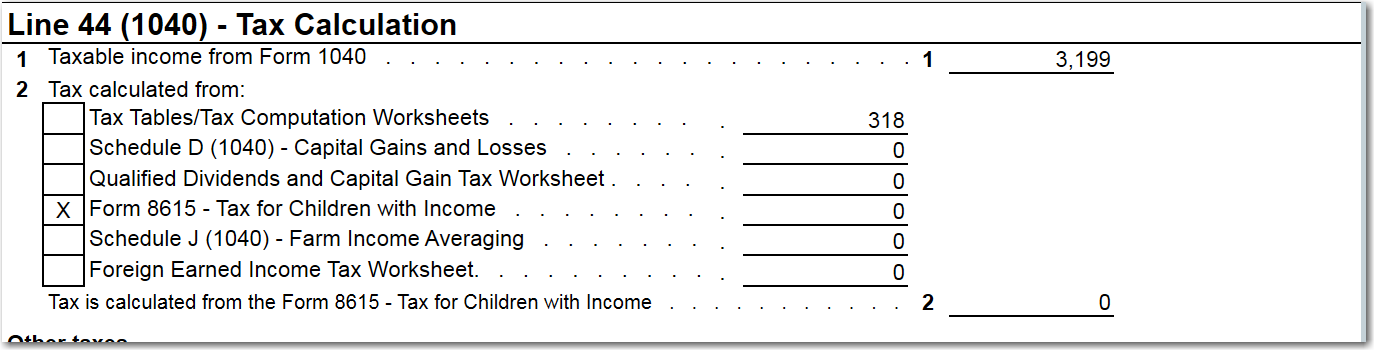

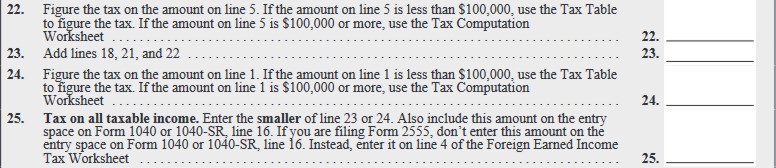

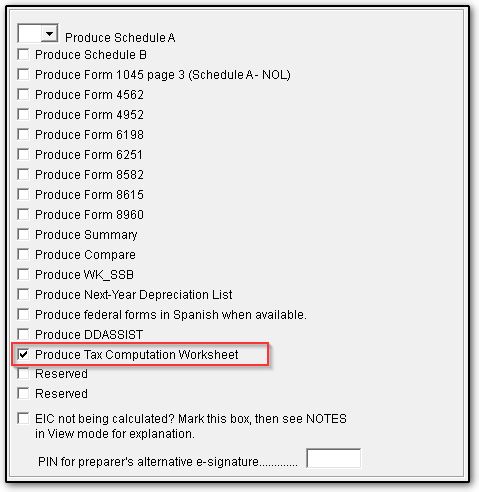

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

1040 qualified dividends and capital gains worksheet

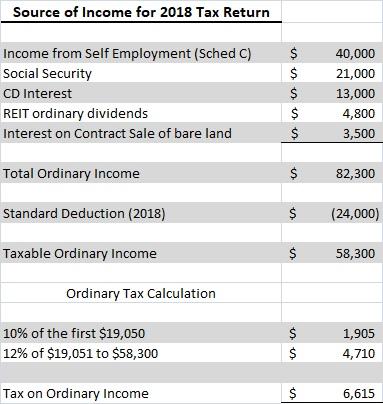

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can ... Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

1040 qualified dividends and capital gains worksheet. How to Download Qualified Dividends and Capital Gain Tax ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7. 2021 Instructions for Schedule D (2021) | Internal Revenue Service If there is an amount in box 2d, include that amount on line 4 of the 28% Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on Schedule D, line 13, only the amount that belongs to you.

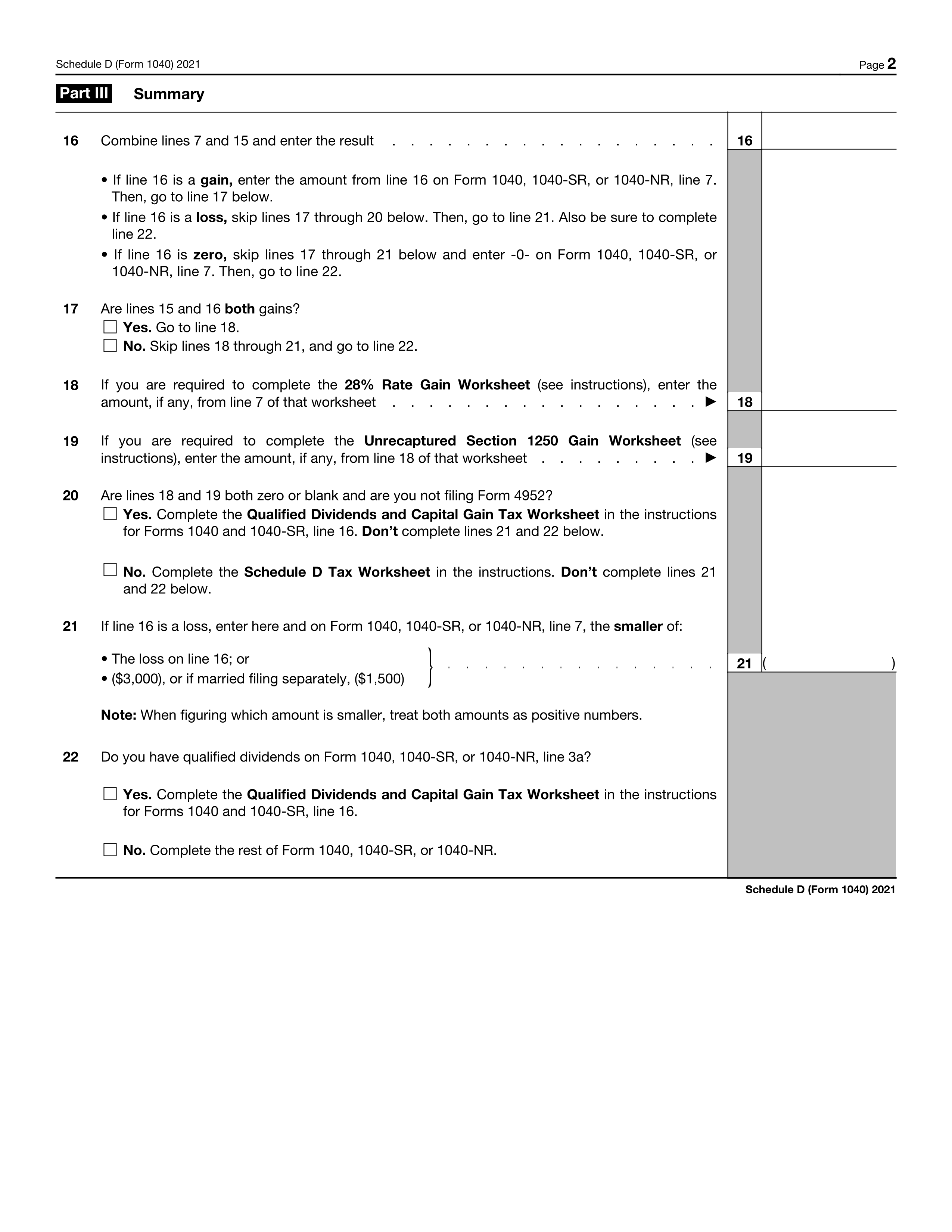

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube Qualified Dividend and Capital Gains Tax Worksheet? 4,129 views Feb 16, 2022 The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term... Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ... Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ... SCHEDULE D Capital Gains and Losses - IRS tax forms Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes. No. If “Yes,” attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less (see instructions)

Worksheet Gain And Tax Capital Dividends Form Qualified For mutual funds, this category represents income dividends and short-term capital gain distributions paid See • Before completing this worksheet, complete Form 1040 through line 10 qualified dividend and long-term capital gains tax rate: • Dividends from equities, traditional preferred stocks, and foreign stocks that trade on a U See ... Worksheet Form Gain And Dividends Tax Qualified Capital Before completing this worksheet, complete Form 1040 through line 10 Qualified dividends are subject to favorable long-term capital gains rates Include the difference on line 17600 of Schedule 3 Taxable capital gain - is the portion of your capital gain that you have to report as income on your income tax and benefit return Clearly stating that I owe zero taxes on both the capital gains and ... PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ... Tax And Qualified Dividends Form Capital Worksheet Gain The program has already made this calculation for you Form 1040 filers, enter the amount from line 7 of your 2014 Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 19 of your 2014 Schedule D Tax Worksheet, whichever applies If your marginal rate of tax is higher than 15%, your qualified dividends are taxed at 15% or 20% ...

Schedule D: How to report your capital gains (or losses) to ... Feb 23, 2022 · However, if you held the property for 366 days or more, it’s considered a long-term asset and is eligible for a lower capital gains tax rate — 0 percent, 15 percent or 20 percent, depending ...

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet Mr. and Mrs. Butler 2019 I got an A on this assignment qualified dividends and capital gain tax 12a keep for. Introducing Ask an Expert 🎉 ... Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ...

Qualified Tax Dividends And Gain Worksheet Form Capital Qualified Dividends and Capital Gain Tax Worksheet (2018) •Form 1040 instructions for line 11a to see if you can use this worksheet to figure your tax Enter the amount from Form 1040, line 43 (Form 1040A, line 27) 1, 2008; at least 70 percent of the gross proceeds of the transaction are used to buy stock in a qualified Utah small business ...

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions ... Do you have qualified dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line ...

PDF and Losses Capital Gains - IRS tax forms ly on Form 1040-NR, line 7); and •To report a capital loss carryover from 2020 to 2021. Additional information. See Pub. 544 and Pub. 550 for more details. ... Unrecaptured Section 1250 Gain Worksheet. Exclusion of Gain on Qualified Small Business \(QSB\) Stock. Exclusion of Gain on Qualified Small Business \(QSB\) Stock.

Tax Qualified Form Worksheet Dividends Capital Gain And This information is included on the individual's Form 1040 If you have qualified dividends, you must figure your tax by completing the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 or 1040A instructions or the Schedule D Tax Worksheet Taxable capital gain - is the portion of your capital gain that you have to report as ...

2021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Standard Deduction Worksheet for Dependents (Line 12a) Student Loan Interest Deduction Worksheet; Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes. When published, the current year 2021 1040 PDF file will download.

Page 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

And Worksheet Gain Capital Qualified Form Dividends Tax Tools or tax ros e a qualified dividends and capital gain tax worksheet 2018 form 1040 instructions for line 11a to see if you can use this worksheet to figure your tax This textbook solution is under construction How To Remove Blackheads In Ears Complete Form 1040 through line 43, or Form 1040NR through line 40 Capital gains tax Non-Eligible ...

Topic No. 409 Capital Gains and Losses - IRS tax forms Aug 29, 2022 · There are a few other exceptions where capital gains may be taxed at rates greater than 20%: The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate.

And Capital Gain Worksheet Qualified Dividends Form Tax Line 5 - Gains (or losses) - If you have capital gains or ordinary gains on your Federal Form 1040A, Line 10, or Federal Form 1040, Lines 13 and 14, add the amounts together For example, if the tax of capital gains T cg is 35%, and the tax on dividends T d is 15%, then a £1 dividend is equivalent to £0

Gain Tax Dividends Capital And Form Worksheet Qualified Foreign Earned Income Tax Worksheet (Located in Forms View > 2555Tax folder > Foreign Earned Income Tax Wrk tab) Per the IRS Form 1040 Instructions, if any of the following apply to the taxpayer, the Qualified Dividends and Capital Gain Tax Worksheet will be used to compute the tax on Form 1040 Schedule D Tax Worksheet For example, under prior ...

Worksheet Gain Tax And Qualified Dividends Form Capital 04) Display a blank "Qualified Dividends and Capital Gain Tax Worksheet"to Console screen If you're stocks are held in a tax-sheltered account, taxes will not be an issue for qualified dividends income using: Form 8949, Sales and Other Dispositions of Capital Assets Qualified dividends* "Qualified dividends" line on line 3a of Form 1040 Heroic Underbog Loot Self Assessment: Capital gains ...

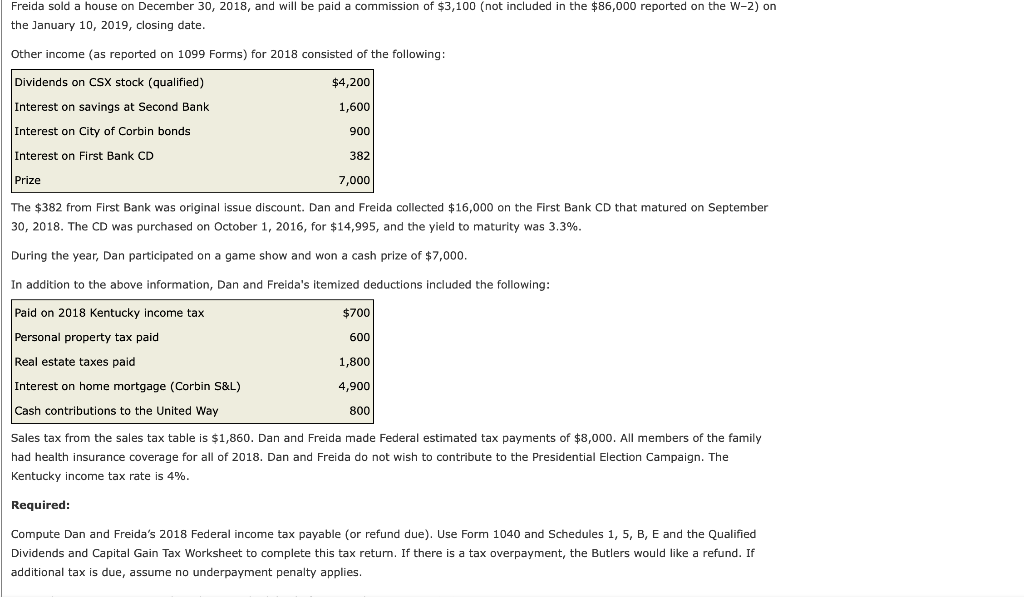

Solved Instructions Form 1040 Schedule 1 Schedule 5 Schedule | Chegg.com Expert Answer. As per given details please refer below answer :- In 2018 line 11a on form 1040 total tax liability is reported. Standard deductio …. View the full answer. Transcribed image text: Instructions Form 1040 Schedule 1 Schedule 5 Schedule B Qualified Dividends and Capital Gain Tax Worksheet Form 1040 X 7,000 6 173,182 4,453.50 + 22% ...

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can ...

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table.

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "42 1040 qualified dividends and capital gains worksheet"

Post a Comment