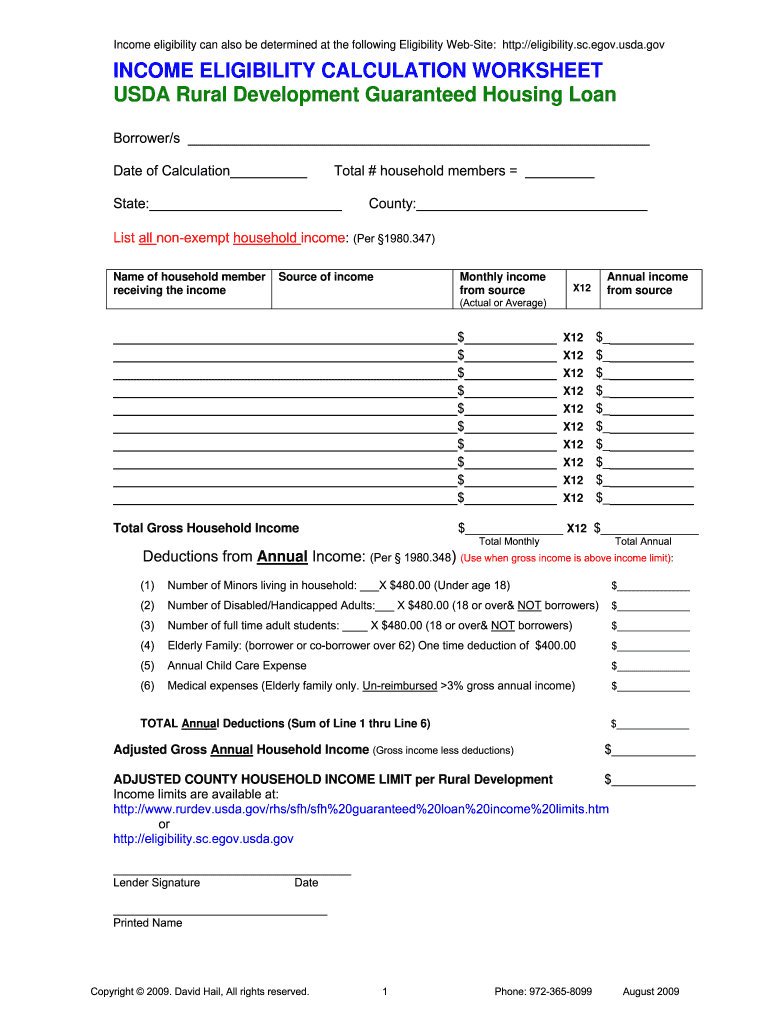

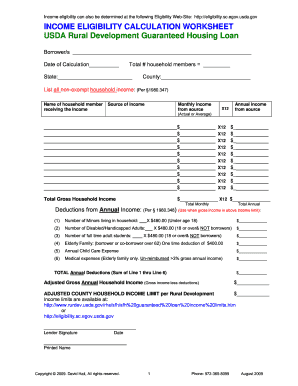

38 usda income calculation worksheet

Center for Nutrition Policy and Promotion (CNPP) - USDA USDA Modernizes the Thrifty Food Plan, Updates SNAP Benefits. News Item. The Thrifty Food Plan Re-Evaluation. Infographics. USDA Food Plans: Cost of Food. Data. Thrifty Food Plan - 2021. Report. USDA Celebrates MyPlate’s Decade of Support for Healthy Habits. News Item. MyPlate/ MiPlato. Technical Assistance & Guidance. Return to top. Home . Data & Research. Grants. … TENANT CERTIFICATION PROCESS - USDA • Zero Income – RD’s policy is to not accept a tenant certification for an applicant or tenant with zero income unless all income is specifically exempted. • If applicant or tenant states they have no household income, they will need to demonstrate financial capability to meet essential living expenses.

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Usda income calculation worksheet

CHAPTER 12: SECTION 504 LOANS AND GRANTS - USDA Rural Development A. Income In order to be eligible for a Section 504 loan or grant, the adjusted income at the time of loan/grant approval and at loan closing must not exceed the applicable very low-income limit. Low-income applicants cannot receive assistance under Section 504. Medical deductions in excess of 3% of annual income should be closely examined and Form RD 3555-21 UNITED STATES DEPARTMENT ... - Rural Development Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member(s) Who Are Not a Party to the Note (Primary Employment from Wages, Salary, Self- Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income CHAPTER 9: INCOME ANALYSIS - USDA Rural Development • Income sources that will not be received for the entire ensuing 12 months must continue to be included in annual income unless excluded under 3555.152(b)(5). Examples include, but are not limited to, child support, alimony, maintenance, Social Security, etc. Annual income is the total of all income sources for a 12- month timeframe.

Usda income calculation worksheet. Emergency Relief Program - Farm Service Agency 31.03.2022 · Form AD-2047, Customer Data Worksheet; ... Payment Limitation and Adjusted Gross Income Adjusted Gross Income (AGI) limitations do not apply to ELRP, however the payment limitation for ELRP is determined by the person’s or legal entity’s average adjusted gross farm income (income derived from farming, ranching, and forestry operations). Specifically, a … Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. WORKSHEET FOR DOCUMENTING ELIGIBLE HOUSEHOLD AND REPAYMENT INCOME Calculate and record how the calculation of each income source/type was determined in the space below. 5. Income from Assets (Income from household assets as described in HB-1-3555, Chapter 9). Calculate and record how the calculation of each income source/type was determined in the space below. 6. Annual Household Income (Total 1 through 5) You are here: Home - USDA Welcome to the USDA Service Center Agencies eForms. eForms allows you to search for and complete forms requesting services from Farm Service Agency (FSA), Natural Conservation Service (NRCS), and Rural Development (RD). There are 2 ways to use the eForms site. You can click the Browse Forms menu option on the left of the page and search for your form. You can …

Emergency Relief Program ERP - Farm Service Agency calculation. The ERP Phase 1 payment calculation for a crop and unit will depend on the type and level of coverage each producer’s loss consistent with the loss procedures . for the type of coverage purchased but using the ERP factor in place of the coverage level. This calculated amount would then be adjusted by subtracting out the net crop CHAPTER 9: INCOME ANALYSIS - USDA Rural Development • Income sources that will not be received for the entire ensuing 12 months must continue to be included in annual income unless excluded under 3555.152(b)(5). Examples include, but are not limited to, child support, alimony, maintenance, Social Security, etc. Annual income is the total of all income sources for a 12- month timeframe. Form RD 3555-21 UNITED STATES DEPARTMENT ... - Rural Development Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member(s) Who Are Not a Party to the Note (Primary Employment from Wages, Salary, Self- Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income CHAPTER 12: SECTION 504 LOANS AND GRANTS - USDA Rural Development A. Income In order to be eligible for a Section 504 loan or grant, the adjusted income at the time of loan/grant approval and at loan closing must not exceed the applicable very low-income limit. Low-income applicants cannot receive assistance under Section 504. Medical deductions in excess of 3% of annual income should be closely examined and

0 Response to "38 usda income calculation worksheet"

Post a Comment