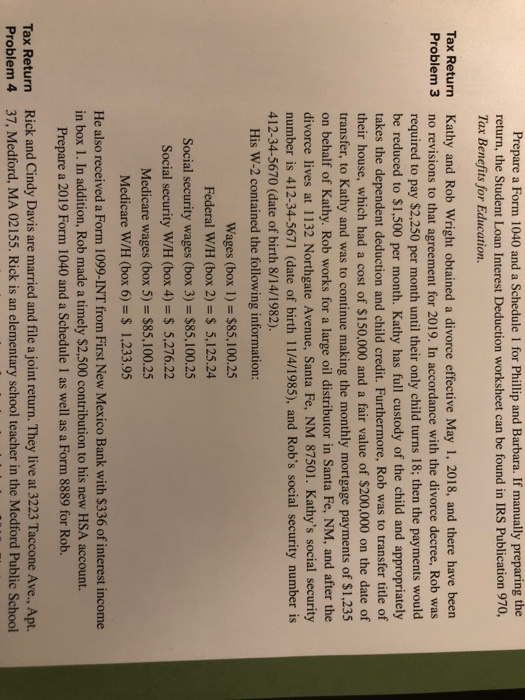

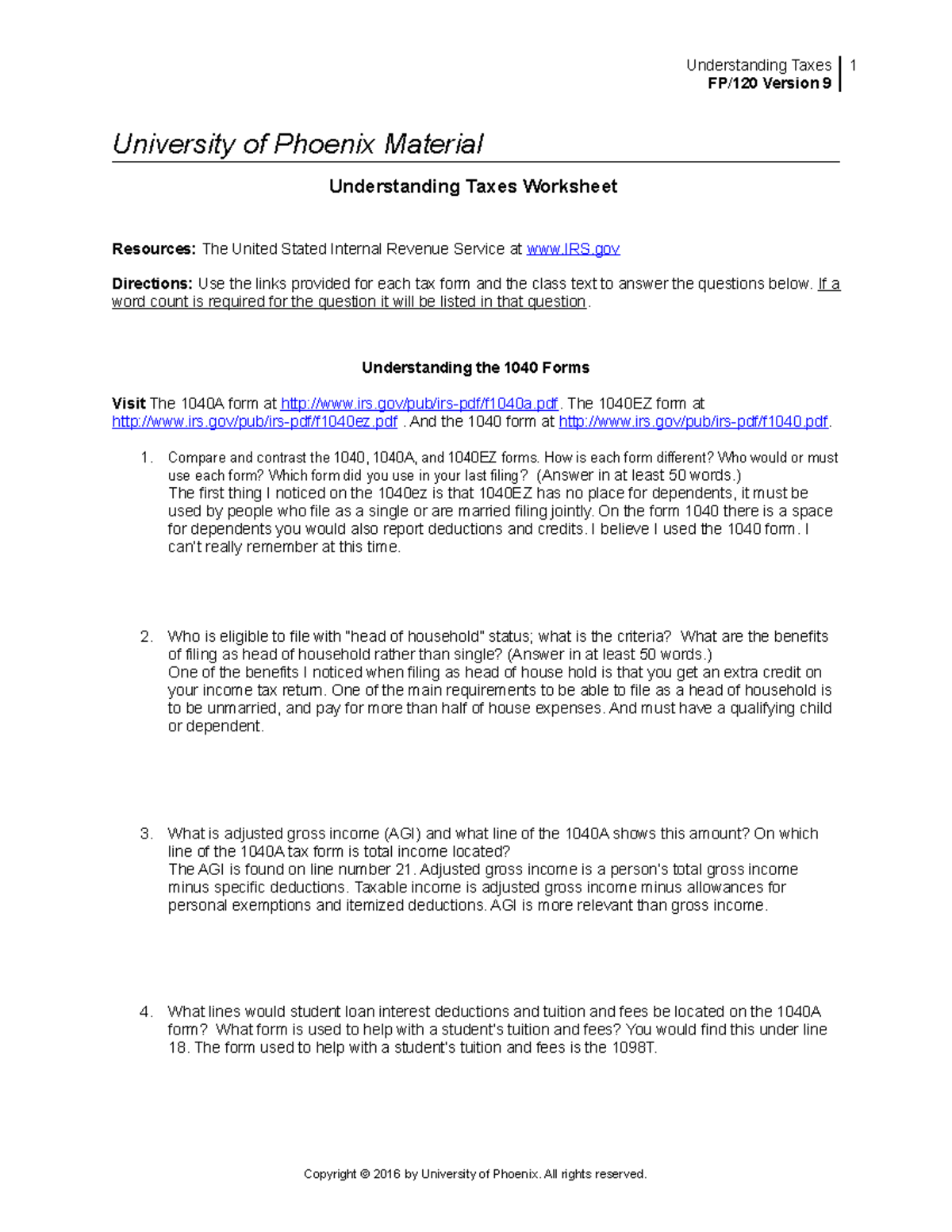

38 student loan interest deduction worksheet 1040a

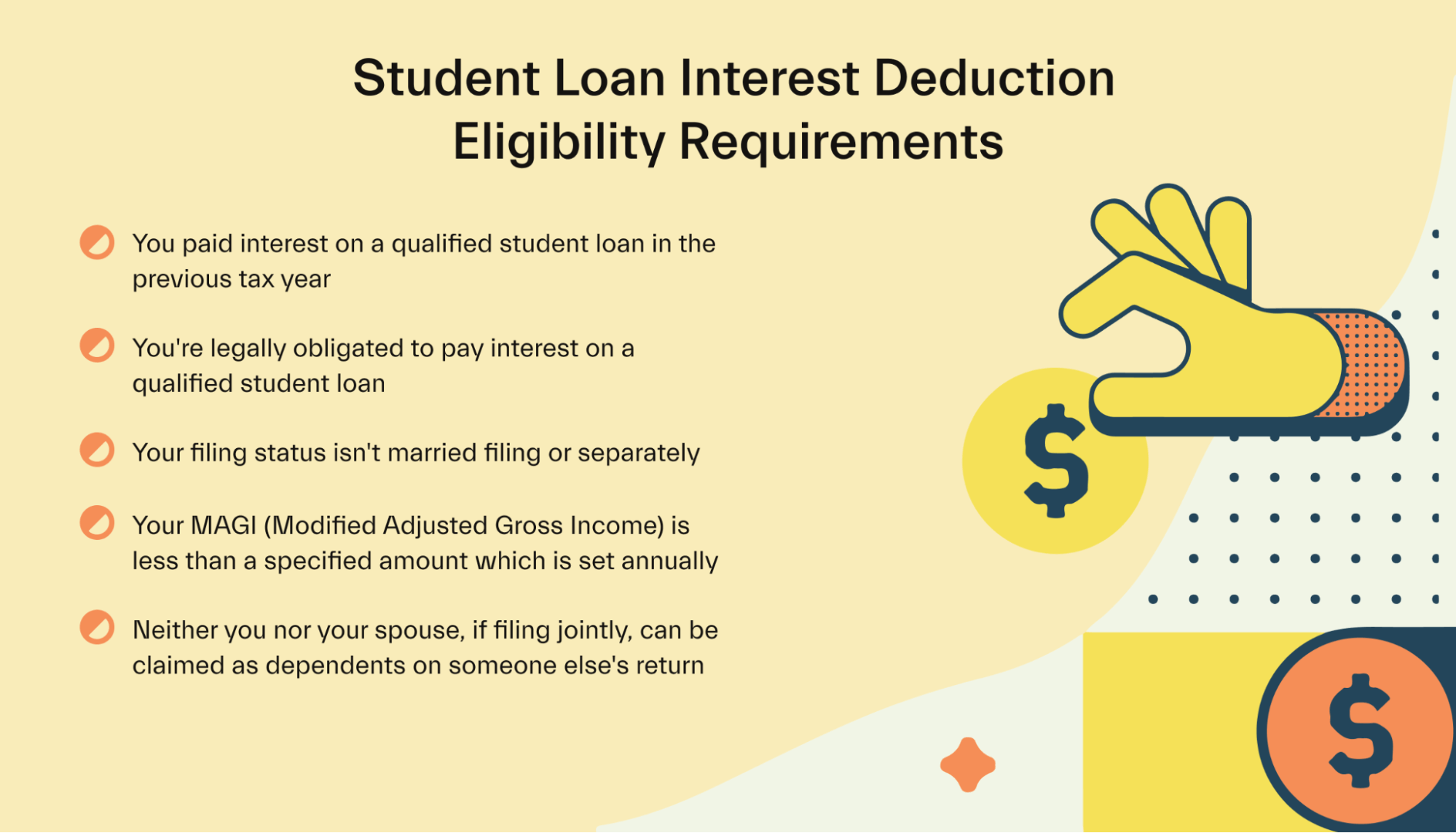

Publication 970 (2021), Tax Benefits for Education | Internal Revenue ... Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. Reporting ... Student Loan Interest Deduction | H&R Block You paid interest on a qualified student loan. If you're married filing jointly: You can deduct the full $2,500 if your modified adjusted gross income (AGI) is $140,000 or less. Your student loan deduction is gradually reduced if your modified AGI is more than $140,000 but less than $170,000.

Student Loan Interest Deduction Worksheet interest deduction. For 2016, the amount of your student loan interest deduction is gradu-ally reduced (phased out) if your MAGI is between $ 65,000 and $ 80,000 ($ 130,000 and $ 160,000 if you file a joint return). You can't claim the deduction if your MAGI is $80,000 or more ($160,000 or more if you file a joint re-turn). Trending Searches

Student loan interest deduction worksheet 1040a

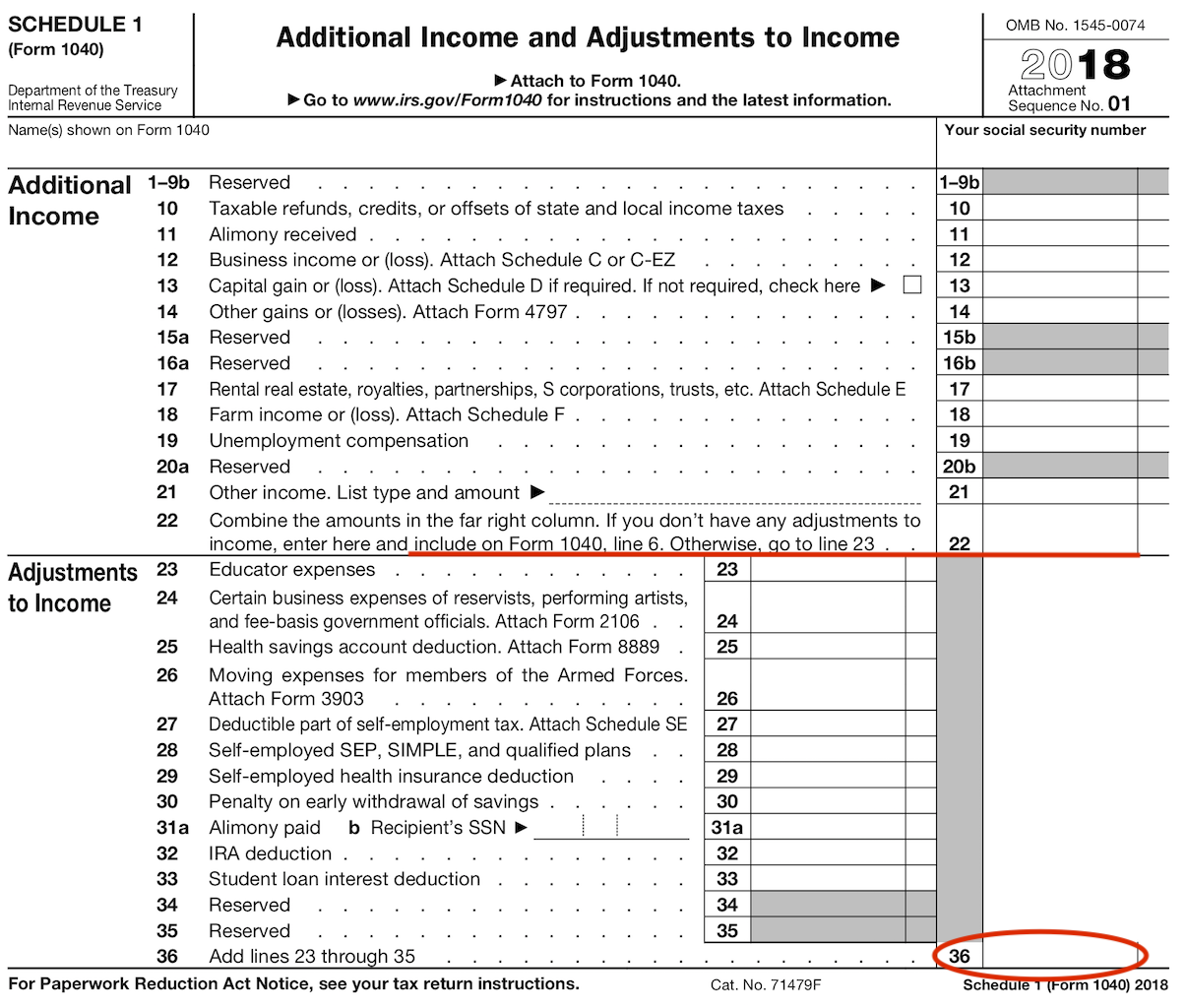

PDF Latricia B Student Loan Interest Deduction Worksheet Qualified student loan interest deductions are reported on Form 1040, Schedule 1. DO NOT FILE July 11, 2019 DRAFT AS OF SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Solved: Can i deduct student loan interest if I use 1040 A? 1 Best answer. June 4, 2019 7:55 PM. Yes the student loan interest deduction can be entered on form 1040A. Federal Student Aid Are you looking for student loan debt relief? The Biden-Harris Administration is providing up to $20,000 in student loan debt relief for eligible borrowers.

Student loan interest deduction worksheet 1040a. Topic No. 456 Student Loan Interest Deduction - IRS tax forms It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status. PDF Student Loan Interest Deduction Worksheet - IRS tax forms Student Loan Interest Deduction Worksheet—Schedule 1, Line 33. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). Be sure you have read the . Exception in the instructions for this line to see if you can use this worksheet instead of Pub. Solved: Student Loan Deduction - Intuit I used the "Student Loan Interest Deduction Worksheet" from IRS.gov and confirmed the 1040 was correct. View solution in original post. 0 2,734 Reply. 4 Replies Lisa995. ... (Line 21 of the 1040 or Line 15 of the 1040A) ♪♫•*¨*•.¸¸♥Lisa♥ ¸¸.•*¨*•♫♪ 0 1 2,738 Reply. zmclell. Returning Member March 27, 2018 11:16 AM. 6+ Creative Student Loan Interest Deduction Worksheet Average student loan interest deduction worth 188. Deduction can reduce the amount of your income subject to tax by up to 2500 in 2009. Do not enter more than 2500 Enter the amount from Form 1040 line 22 or Form 1040A line 15. Taxable income less than 100000. You have successfully completed this document.

Student Loan Interest Is Tax-Deductible: But Who Can Claim? You cannot claim the student loan interest deduction if your modified adjusted gross income is above $85,000 ($170,000 if you file a joint return with your spouse). › publications › p590bPublication 590-B (2021), Distributions from Individual ... Use Worksheet 1-2 in chapter 1 of Pub. 590-A, or the IRA Deduction Worksheet in the Form 1040 or 1040-SR, or 1040-NR instructions to figure your deductible contributions to traditional IRAs to report on Schedule 1 (Form 1040), line 20. › irm › part2121.4.6 Refund Offset | Internal Revenue Service - IRS tax forms See IRM 20.2.4.7.5.2, 45-Day Rule and All Original Tax Returns, for the dates of systemically generated refunds. The 45-day interest-free charts (located here) may also be used for determining what date your adjustment must be input to meet the 45-day interest-free period for a systemically generated refund. How to Use Form 1098-E for My Taxes - The Nest Step 4. Complete the "Student Loan Interest Deduction Worksheet" in the form's instructions to calculate the amount of your deduction. The amount listed in Box 1 of Form 1098-E is the total interest you paid on your student loan. If you paid interest to more than one lender and received more than one Form 1098-E, enter the total amount ...

› college-tips › areAre Scholarships Taxable? We Break Down Taxable and Non-Taxable Feb 01, 2021 · The student loan interest deduction of up to $2500, applicable with a MAGI of less than $65,000. So are scholarships taxable? It might be it might not. Follow our guidelines above to help you understand when the scholarship is viewed as taxable income, and when it is not. › irm › part33.11.3 Individual Income Tax Returns | Internal Revenue Service 3.11.3.15.21 Schedule 1 Line 21 - Student Loan Interest Deduction; 3.11.3.15.22 Schedule 1 Line 22 ; 3.11.3.15.23 Schedule 1 Line 23 - Archer MSA Deduction; 3.11.3.15.24 Schedule 1 Lines 24a through Line 24z - Other Adjustments (Not Transcribed) 3.11.3.15.25 Schedule 1 Line 25 - Total Other Adjustments Federal Student Aid Are you looking for student loan debt relief? The Biden-Harris Administration is providing up to $20,000 in student loan debt relief for eligible borrowers. Solved: Can i deduct student loan interest if I use 1040 A? 1 Best answer. June 4, 2019 7:55 PM. Yes the student loan interest deduction can be entered on form 1040A.

PDF Latricia B Student Loan Interest Deduction Worksheet Qualified student loan interest deductions are reported on Form 1040, Schedule 1. DO NOT FILE July 11, 2019 DRAFT AS OF SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

0 Response to "38 student loan interest deduction worksheet 1040a"

Post a Comment