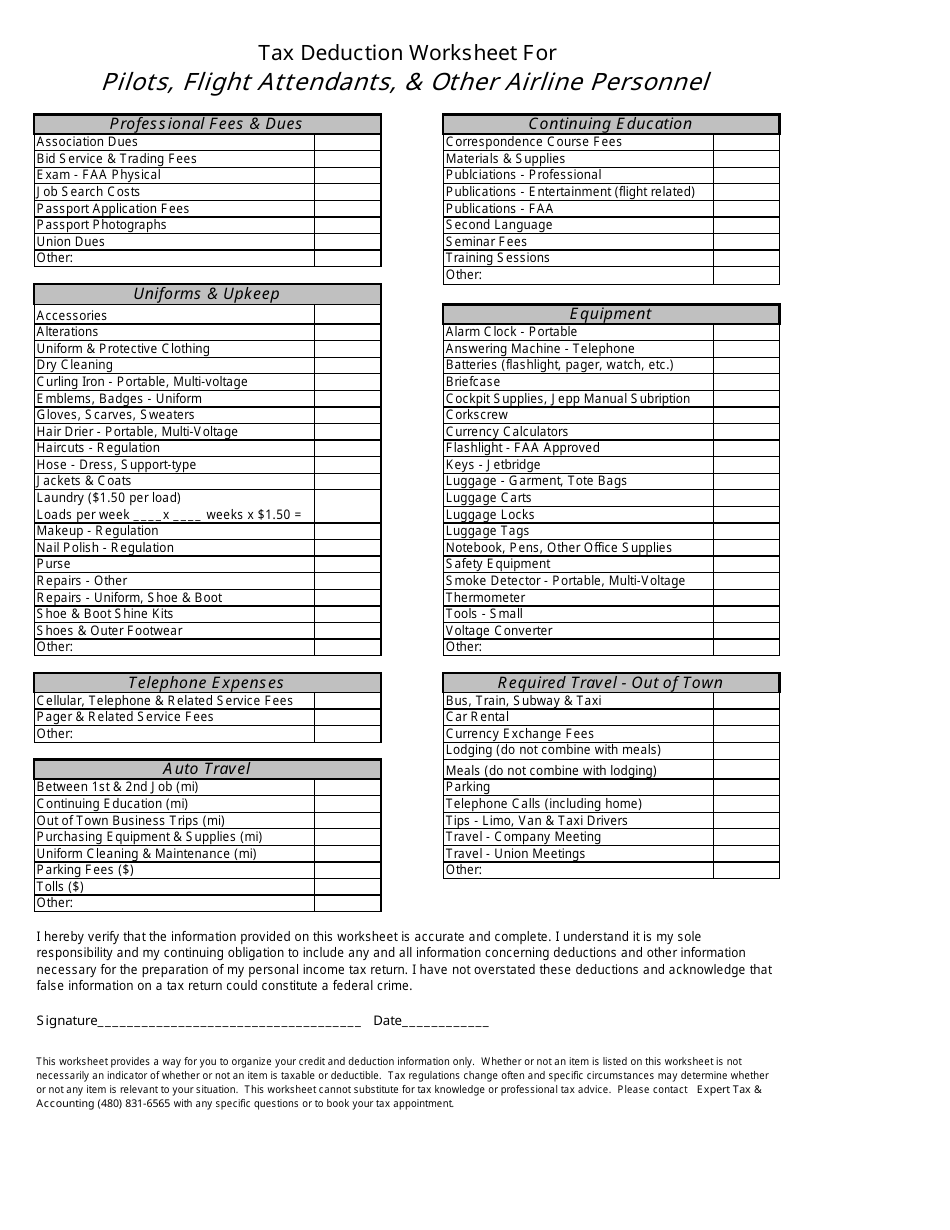

38 income tax deduction worksheet

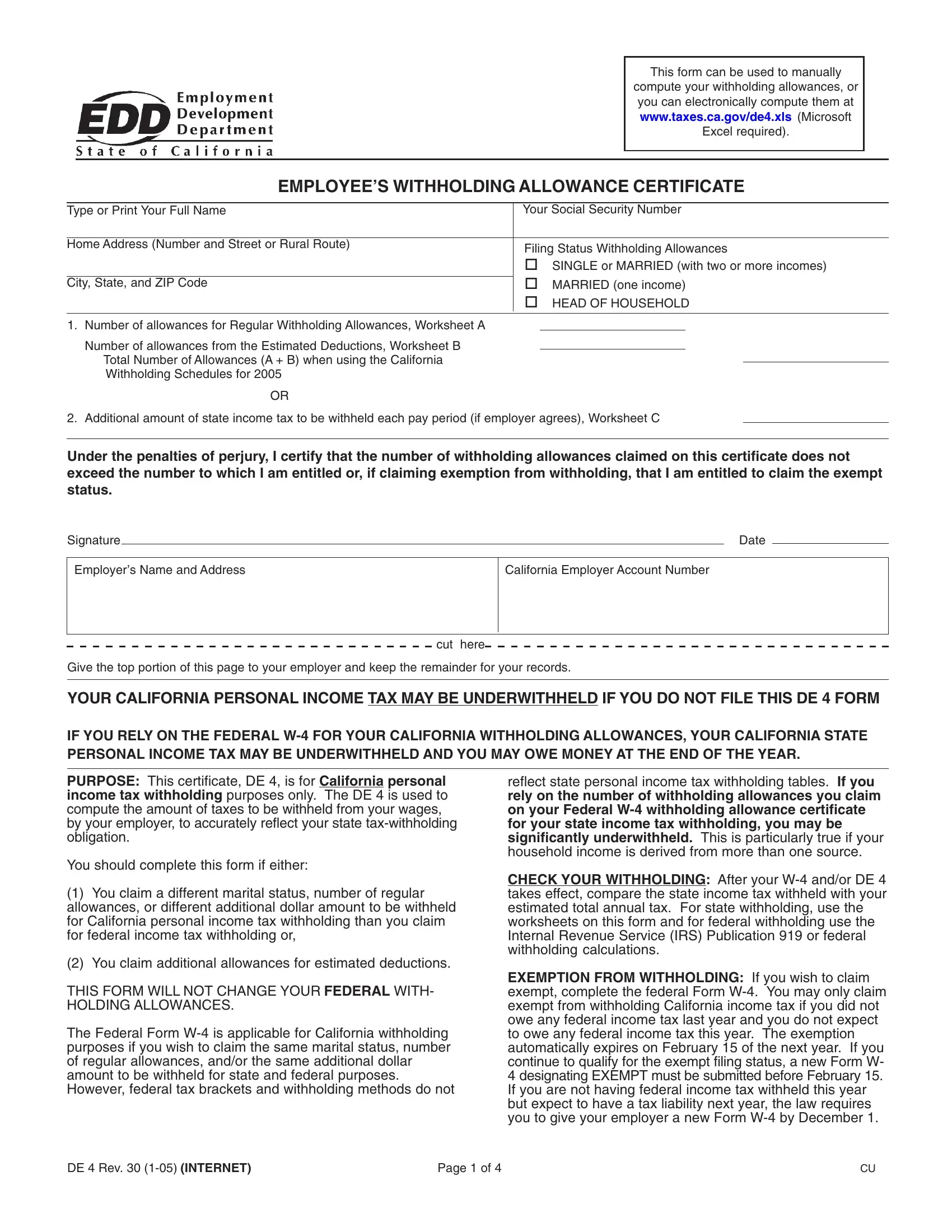

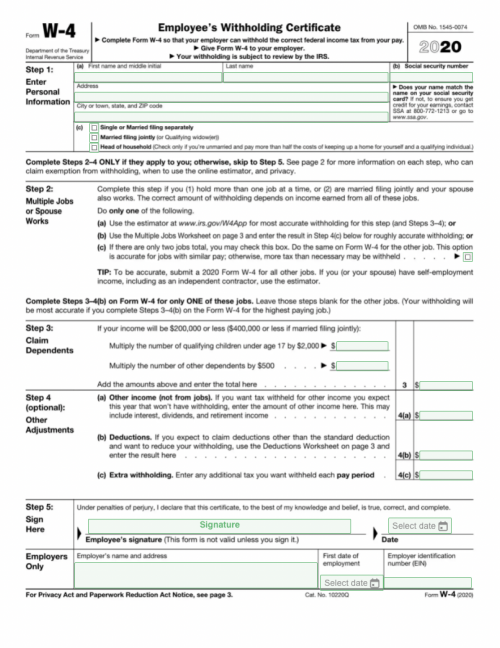

A Free Home Office Deduction Worksheet to Automate Your Tax Savings The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

PDF Standard Deduction (continued) - IRS tax forms Generally, your earned income is the total of me amount(s) you reported on Form 1040. line I and Sch 1 - line 3 business inc or (loss); line 6 farm inc or (loss); line 14 deductible part of SE tax. ** Married Filing Separately — You can check the boxes for 'Your spouse " if your filing siaÍus is separately and your spouse had no income.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Income tax deduction worksheet

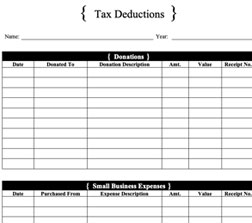

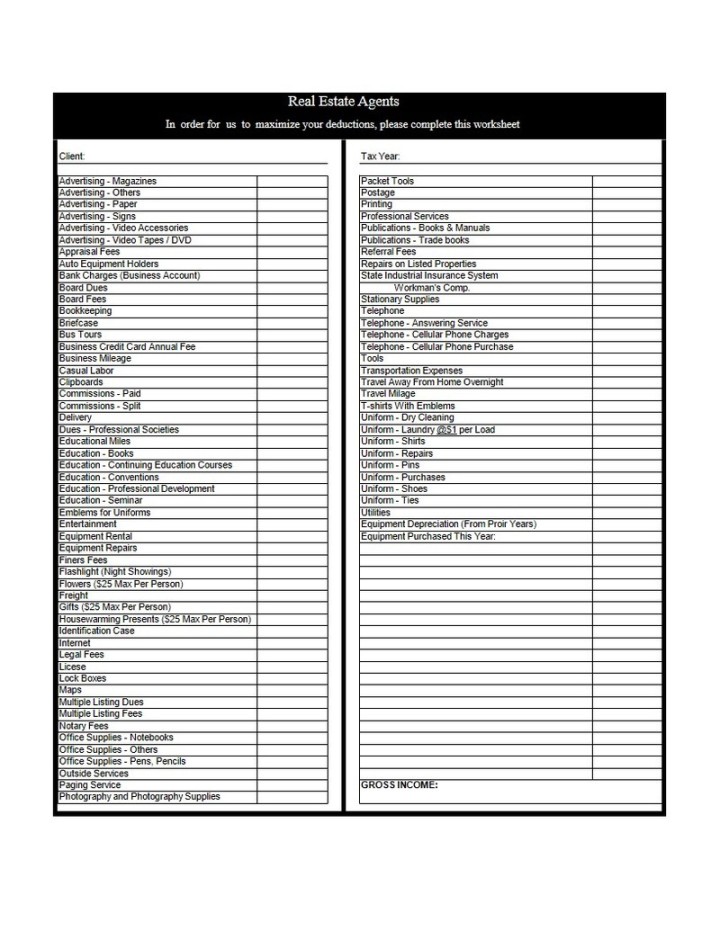

IRS Federal Standard Tax Deductions For 2021 and 2022 - e-File On a federal level, the IRS allows the taxpayer to deduct $12,550 from this, meaning only $7,450 of the total income is subject to income taxes. There are different rules if you make income from self-employment or as an independent contractor. In general, if you make $400 or more from self-employment, you will need to file taxes. About Schedule A (Form 1040), Itemized Deductions About Schedule A (Form 1040), Itemized Deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Downloadable tax organizer worksheets Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax return is unique. Therefore we also have specialized worksheets to meet your specific needs. All the documents on this page are in PDF format.

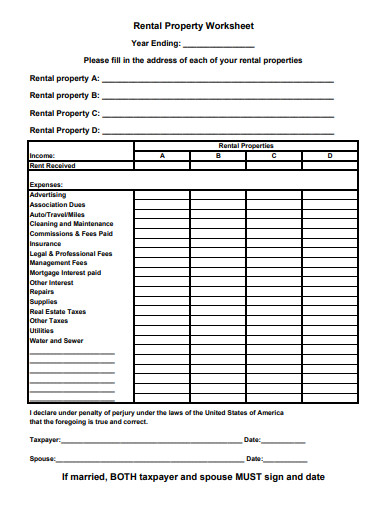

Income tax deduction worksheet. Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category. 2021 Tax Return Preparation and Deduction Checklist in 2022 - e-File If you miss an important form on your tax return, such as income or deduction form, you will have to prepare a tax amendment. In order to avoid the hassles of a tax amendment, we at eFile.com strongly recommend to not e-file your 2021 Taxes before February 1, 2022. This is for the simple reason that all 2021 Forms need to be mailed to you ... Tax Deduction | Excel Templates Included in this template or Features Included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation section. These areas are where you will fill out your personal financial details that correspond to each category. Optional Tips 1. 2021 FIT Deduction Worksheet - Alabama Department of Revenue 1, Federal Income Tax Deduction Worksheet, INSTRUCTIONS: Clear All Forms/schedules/worksheets. 2, Part I - Enter the amounts as they appear on the worksheet ...

PDF 2 Deductions and Adjustments Worksheet - IRS tax forms 1Enter the number from line G on page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet)1 2Find the number in Table 1 below that applies to the LOWEST paying job and enter it here2 3If line 1 is GREATER THAN OR EQUAL TO line 2, subtract line 2 from line 1. Deductions | FTB.ca.gov - California 1. 2. Minimum standard deduction 2. $1,100 3. Enter the larger of line 1 or line 2 here 3. 4. Enter amount shown for your filing status: Single or married/RDP filing separately, enter $4,803 Married/RDP filing jointly, head of household, or qualifying widow (er) enter $9,606 4. 5. Enter the smaller of line 3 or line 4 here and on Form 540, line 18. Income Tax Worksheet Income Tax Worksheet Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES. Worksheet – work out your net rental income or loss May 26, 2022 ... Deductions for decline in value (see Note 1). $796 ; Gardening/lawn mowing. $350 ; Insurance. $495 ; Interest on loans. $11,475 ; Land tax. $200.

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes. ITEMIZED DEDUCTION WORKSHEET (14A) STANDARD ... PART III - Calculation of State and Local Income Tax Limitation. Use calculation in Part III only if your federal itemized deductions were limited on your ... income tax organizer worksheet Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet. Tax db-excel.com. tax worksheet deductions deduction itemized income business spreadsheet printable template self employed excel expense federal sheet organizer preparation worksheets documents. Rental Income Calculation Worksheet Excel - Edit, Fill, Print Form IT-203-B Nonresident and Part-Year Resident Income ... 234001210094. Department of Taxation and Finance. Nonresident and Part-Year Resident Income Allocation. And College Tuition Itemized Deduction Worksheet.

Publication 505 (2022), Tax Withholding and Estimated Tax Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022: ... When figuring your 2022 estimated tax, it may be helpful to use your income, deductions, and credits for 2021 as a starting point. Use your 2021 federal tax return as a guide ...

Federal Worksheet - Canada.ca You may also have to complete the Federal Worksheet (for all provinces and territories) to calculate the amount for the following lines: Lines 12000 and 12010 - Taxable amount of dividends from taxable Canadian corporations Line 12100 - Interest and other investment income Line 22100 - Carrying charges, interest expenses, and other expenses

Tax Worksheets - Assured Tax Tax Worksheets. Our Tax Organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your tax return. The organizer is revised annually to be compatible with the ever-changing tax laws. These organizers are primarily for the current tax year, although it can be used for past years.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... Claim Dependents. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000. Multiply the number of other dependents by $500 . Add the amounts above and enter the total.

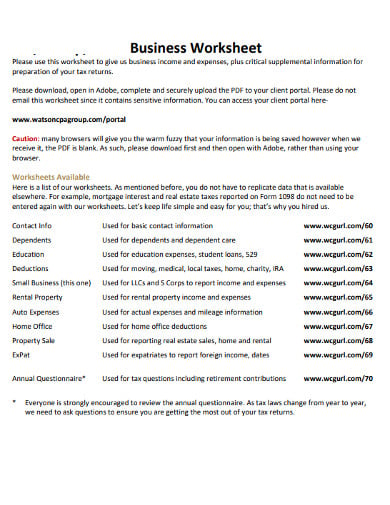

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

PDF 2022 Form W-4 - IRS tax forms Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1: Enter Personal Information (a) First name and middle initial Last name Address City or town, state, and ZIP code

IRC Section 965 Income & FIT Deduction Worksheet Nov 8, 2018 ... To claim any portion of Transition Tax paid as a federal income tax deduction, the taxpayer must complete this worksheet and attach it to the.

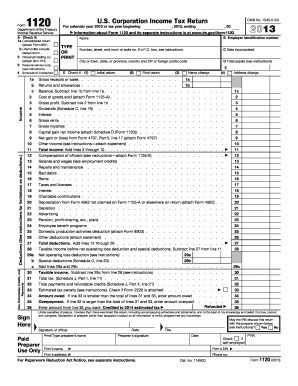

1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. ... You should receive a Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. This ...

PDF Schedule A - Itemized Deductions - IRS tax forms were on a pre-tax basis) • Funeral, burial, or cremation expenses • Health savings account payments for medical expenses • Operation, treatment, or medicine that is illegal under federal or state law • Life insurance or income protection policies, or policies providing payment for loss of life, limb, sight, etc. • Maternity clothes

Alabama Tax Law Changes - Federal Income Tax Deduction Worksheet - Support The increased federal income tax deduction will reduce the amount of tax due on an Alabama individual income tax return. Tax returns that have already been electronically filed do not need to be amended. The Alabama Department of Revenue will adjust returns that have already been e-filed. Tax returns that were paper filed will need to be amended.

2021 Instructions for Schedule A - Itemized Deductions - IRS federal income tax will be less if you take the larger of your itemized ... this worksheet, you can find your deduction by using the Sales Tax Deduction.

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

PDF 19 2021 Itemized Deduction (Sch A) Worksheet - cotaxaide.org 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors.

W-4 Form: How to Fill It Out in 2022 - Investopedia 2022 Form W-4 Married Filing Jointly Income Tax Table. ... To estimate your deductions, use the Deductions Worksheet provided on page 3 of the W-4. 2022 Form W-4 Deductions Worksheet.

Federal Income Tax Deduction Worksheet – IRC Section 965 Note: For lines 1, 2, & 3, ONLY INCLUDE the portion of the referenced lines related to IRC 965 income. 4. Total deductions from Alabama tax base related to IRC ...

Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator if the older of you or your spouse (if married filing jointly) was born during the period january 1, 1953 through january 1, 1954, and reached the age of 67 on or before december 31, 2020, you may deduct the personal exemption amount and taxable social security benefits, military compensation (including retirement benefits), michigan national …

AL - Federal Income Tax Deduction Worksheet Changes (Drake21) 17648: AL - Federal Income Tax Deduction Worksheet Changes (Drake21). 5 Months Ago; Alabama. How do I make entries for the ...

Estimated Tax Worksheet Use 100% of the 2022 estimated total tax. 0. Refund from 2021 designated as an estimated payment. Income tax withheld and estimated to be withheld. Balance (override if a different amount is desired: ) (Payment not required if less than $1000) 0. Quarterly amount.

What is this tax and interest deduction worksheet - Intuit February 6, 2020 12:38 PM. The tax and interest deduction worksheet shows the itemized deductions claimed for state and local taxes, including real estate taxes, and mortgage interest. You would only itemize if your total deductions were greater than the standard deduction for your filing status. However, these deductions can still be listed on ...

Downloadable tax organizer worksheets Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax return is unique. Therefore we also have specialized worksheets to meet your specific needs. All the documents on this page are in PDF format.

About Schedule A (Form 1040), Itemized Deductions About Schedule A (Form 1040), Itemized Deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

IRS Federal Standard Tax Deductions For 2021 and 2022 - e-File On a federal level, the IRS allows the taxpayer to deduct $12,550 from this, meaning only $7,450 of the total income is subject to income taxes. There are different rules if you make income from self-employment or as an independent contractor. In general, if you make $400 or more from self-employment, you will need to file taxes.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

0 Response to "38 income tax deduction worksheet"

Post a Comment