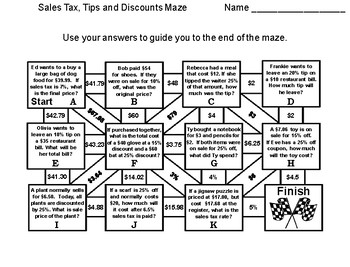

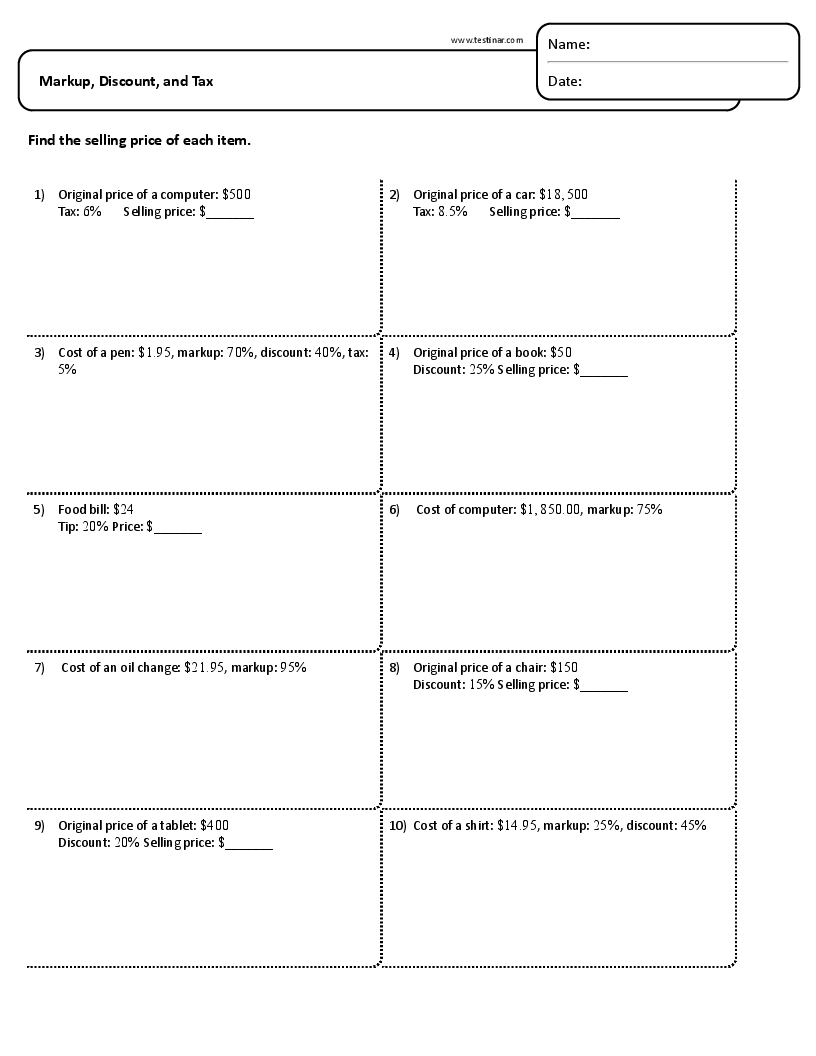

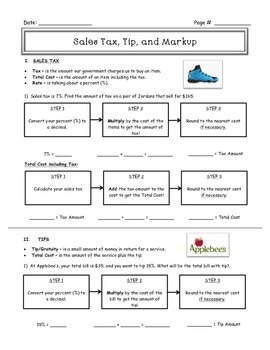

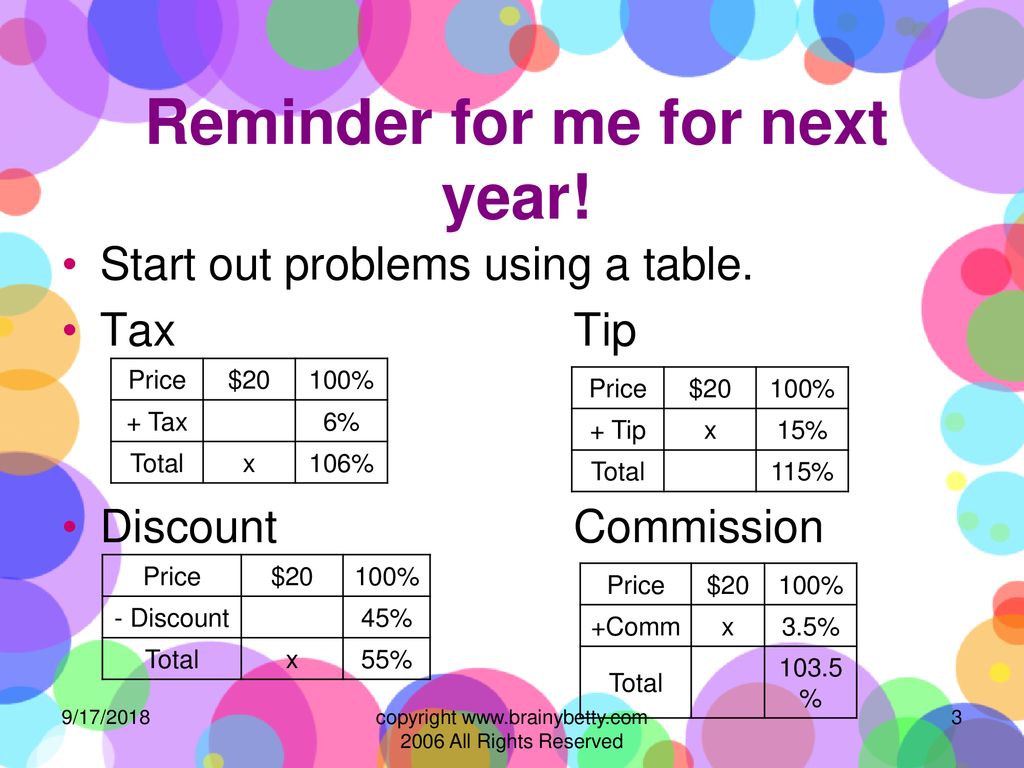

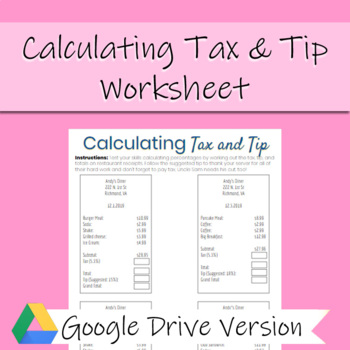

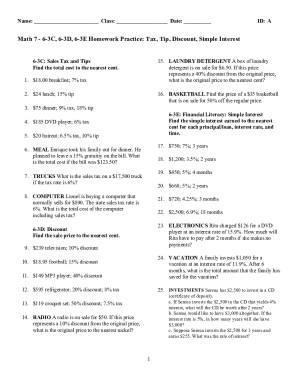

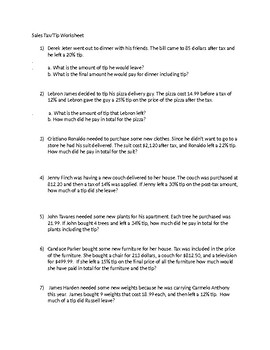

44 tax and tip worksheet

How to Solve Percent Problems? (+FREE Worksheet!) - Effortless … How to Find Discount, Tax, and Tip; How to Do Percentage Calculations; How to Solve Simple Interest Problems; Step by step guide to solve percent problems . In each percent problem, we are looking for the base, or part or the percent. Use the following equations to find each missing section. Base \(= \color{black}{Part} \ ÷ \ \color{blue ... Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 04.07.2022 · TurboTax Tip: Normally, ... Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live or as an upgrade from another version, and available through December 31, 2022. Intuit will assign you a tax expert based on availability. CPA …

turbotax.intuit.com › tax-tips › health-careAre Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos Jul 04, 2022 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form.

Tax and tip worksheet

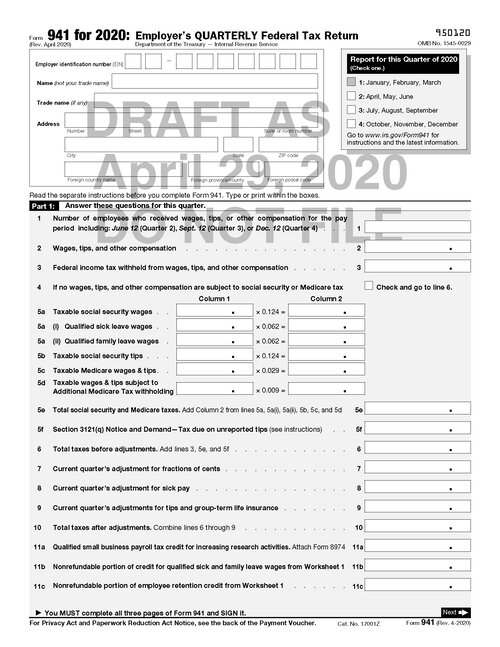

turbotax.intuit.com › tax-tips › irs-tax-returnAlternative Minimum Tax: Common Questions - TurboTax Aug 09, 2022 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms The 2022 Estimated Tax Worksheet, • The Instructions for the 2022 Estimated Tax Worksheet, • The 2022 Tax Rate Schedules, and • Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier). Matching estimated tax payments to ... Professional Services: QBI Deduction for Specified Services 03.03.2020 · This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. The views expressed on this site are those of the authors, and not necessarily those of Intuit. Third-party authors may have received compensation for their time and services. The content on this …

Tax and tip worksheet. nb.fidelity.com › bin-public › 070_NB_PreLogin_PagesBe the CEO of Your Money FOR MONTH OF: Understanding Your ... Tip: You may want to review bank and credit card statements. $ $ $ $ TRANSPORTATION SUBTOTAL Prescriptions Co-payments, Deductibles, Etc. Other Page 1 of 2 Continue to next page Auto Loan or Lease Payment Auto Insurance Excise Tax/Registration Routine Maintenance Gasoline Other Commuting Expenses Other TIP: If you only have annual costs for ... 2022 Individual Income Tax Forms - Marylandtaxes.gov Number Title Description; PV(2D) Income Tax Payment Voucher. Read PDF Viewer And/Or Browser Incompatibility if you cannot open this form.: Payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a Form 502 or Form 505, estimated tax payments, or extension payments.: PV Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ... 2022 Form 1040-ES - IRS tax forms The 2022 Estimated Tax Worksheet, • The Instructions for the 2022 Estimated Tax Worksheet, • The 2022 Tax Rate Schedules, and • Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier). Matching estimated tax payments to ...

Capital Gains and Losses - TurboTax Tax Tips & Videos 12.07.2022 · Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live or as an upgrade from another version, and available through December 31, 2022. Intuit will assign you a tax expert based on availability. CPA availability may be limited. Some … › publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ... Be the CEO of Your Money FOR MONTH OF: Understanding Your … Property Tax Homeowners Insurance Electricity Water/Sewer Oil/Gas Internet/Telephone Cell Phone Other Housing MONTHLY ESSENTIAL EXPENSES (THINGS YOU NEED TO HAVE) FOR MONTH OF: Be the CEO of Your Money Understanding Your Spending: Activity Sheet ANNUAL HOUSEHOLD INCOME $ MONTHLY HOUSEHOLD TAKE-HOME PAY $ Tip: You … Do I Have to Report Income From Foreign Sources? - Investopedia 25.12.2021 · For the tax year 2021, you may be eligible to exclude up to $108,700 of your foreign-earned income from your U.S. income taxes. For the tax year 2022, this amount increases to $112,000. This ...

1040NOW 1040Now Federal / State Tax Forms. Please contact 1040Now Support (cs@1040now.com) if you find any Federal or State Tax Forms missing from our list. Federal Tax Forms Federal Tax Forms Not Supported State Tax Forms; 1040 Forms Supported: 1040 - INDIVIDUAL TAX RETURN / SCHEDULE 1-3 1040-SR - U.S. TAX RETURN FOR SENIORS Professional Services: QBI Deduction for Specified Services 03.03.2020 · This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. The views expressed on this site are those of the authors, and not necessarily those of Intuit. Third-party authors may have received compensation for their time and services. The content on this … › pub › irs-pdf2022 Form 1040-ES - IRS tax forms The 2022 Estimated Tax Worksheet, • The Instructions for the 2022 Estimated Tax Worksheet, • The 2022 Tax Rate Schedules, and • Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier). Matching estimated tax payments to ... turbotax.intuit.com › tax-tips › irs-tax-returnAlternative Minimum Tax: Common Questions - TurboTax Aug 09, 2022 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form.

0 Response to "44 tax and tip worksheet"

Post a Comment