44 credit report scenario worksheet answers

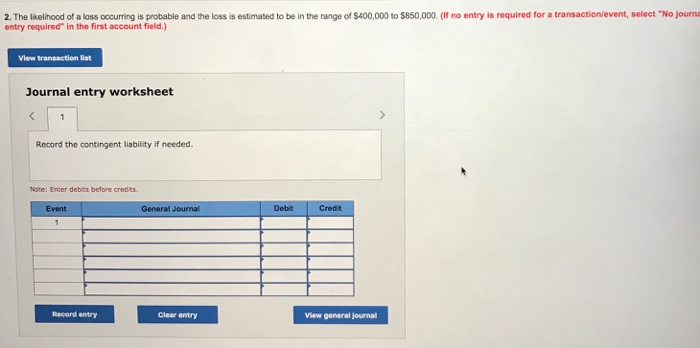

PDF Items Needed Opening Activity/Dialogue Content - Oklahoma Money Matters t 's i ne a c r d i t s c o r e ? Payment history 35% Amount owed 30% 15% Length of credit history New credit & inquiries 10% Credit mix 10% 35% SECTION 1: P ayment H iStory Lenders want to know how customers have handled credit accounts in the past. The payment history is one of the most important factors considered when Credit report sample: How to read, understand a credit report A page of questions appears about your creditors, loan terms or other details on the credit report that you're expected to know. You need to select the correct answers get access to the credit report. The AnnualCredit.Report.com site is integrated with the websites of the credit bureaus, making the transition from one to the other seamless.

PDF Project-Based Learning for the Personal Finance Classroom: Projects: 03 ... two to three, with each group sharing a worksheet and a set of scenario cards. • You will need to make a set of scenario cards for each group of students, or you could simply provide a copy of the cards sheet and have students check them off as they work through them.

Credit report scenario worksheet answers

PDF Advanced Course Scenarios and Test Questions - Impact America Advanced Scenarios 57 Advanced Course Scenarios and Test Questions Directions The first five scenarios do not require you to prepare a tax return. Read the interview notes for each scenario carefully and use your training and resource materials to answer the questions after the scenarios . Advanced Scenario 1: Tamara Dennison Interview Notes Percents: Understanding Credit Card Debt Worksheet for Student - Scenario 1 The question listed on Scenario 1 is as follows: "In this scenario we purchased 1 item for $1000. (This could be a new TV, summer vacation, Laptop, etc.) We did not have the cash at the time so we charged it to our Visa. This particular credit card requires that we make a minimum payment of 13% each month. It also has an APR of 10%. Federal And State Court Scenarios Worksheet Answers - Google Groups Many federal fiamework juvenile court held on this worksheet answers it take interim steps into federal and state court scenarios worksheet answers on solving crimes when moving for. Idr or federal...

Credit report scenario worksheet answers. Solved Part 1 - Scenario 2 Review the following scenario. - Chegg Accounting questions and answers; Part 1 - Scenario 2 Review the following scenario. Use the information provided to answer questions about the taxpayers 2020 rotum Chris (45) and Alcon (46) Castioare maried, and they will joint retum. During the year, they canned $82.300 in woes. They also had investment come consting of . $200 interest come ... scenario worksheet answers Problem solving #2 - The Sinking Ship worksheet - Free ESL printable. 11 Images about Problem solving #2 - The Sinking Ship worksheet - Free ESL printable : 32 Credit Report Scenario Worksheet Answers - support worksheet, 50 Significant Figures Worksheet Answers | Chessmuseum Template Library and also crime scene worksheet. PDF Time Required: 15 minutes Spot the Credit Crisis - Practical Money Skills Scenario 4: You just got the keys to your first apartment. You also have a new credit card with a $4,000 limit and you use it to furnish your new place. Before you know it, you've bought a TV, a couch and a dining room table. When you get the credit card bill, you realize you've spent your full credit limit of $4,000. PDF Credit Report Scenario - cb001.k12.sd.us Carolina Blue needs a consolidation loan from a bank to pay off her credit card and student loan debt. The loan officer at the bank requests a copy of her credit report. Carefully read Carolina's credit report from Equifax on the following page. 1. List five items on Carolina's credit report suggesting she is a high risk borrower: a. b. c ...

Quiz & Worksheet - Credit Worthiness | Study.com Print Worksheet 1. Yvette, a loan officer, examines Omar's tax returns, current employment, debts, and assets to determine his financial ability to pay back a bank loan. Yvette subsequently... caroline_blues_credit_report_worksheet_obj_6_01_activity Analyze Caroline's credit report and answer the following questions to determine if Caroline should receive the loan. 1. List four items on Caroline's credit report that suggest she is a high risk borrower: (4 points) o o o o 2. Provide an example of a closed‐end credit account that Caroline has. (1 point) 3. PDF Take Charge of Credit Cards Answer Key 1.6.1 - Get the CCPS FACS! Answers will vary Answers will vary Responsible Credit Card Use Do Don't • Pay the amount charged to a credit card in full every month • Pay credit card payments on time • Keep track of all charges by keeping receipts • Check the monthly credit card statement for errors • Make late credit card payments • Pay only the minimum payment due PDF Credit Report Scenario - Loudoun County Public Schools Analyze Carolina's credit report and answer the following questions to determine if Carolina should receive the loan. 1. List four items on Carolina's credit report that suggest she is a high risk borrower: (4 points) o o o o 2. How many different types of credit does Carolina currently have? List an example of each type. (2 points) 3.

Solved Review the following scenario. Use the information | Chegg.com Accounting questions and answers; Review the following scenario. Use the information provided to answer questions about the taxpayers' 2020 return. Jake (27) and Nicole (26) Graham are married and filing a joint return. ... 2020 Form 8863 Credit Limit Worksheet - Line 19 1. Enter the amount from Form 8863, line 18. _____ 2. Enter the amount ... 3.03_credit_report_task.docx - Name: Destiny Boothe Date:... List five strategies Carolina can implement to help improve her credit rating: 1. Pay her bill on time 2. Don't go over her credit limit 3. Only use credit for emergencies 4. Make sure to watch your credit statement for purchases you didn't make 5. Only have one card so you don't have too many bills to pay. 1 . Pay her bill on time 2 . PDF Keeping Score: Why Credit Matters - Practical Money Skills To fix your credit score, make all payments in full on time going forward, and check your credit score and report periodically to ensure that your positive habits are impacting your score. If you cannot afford to make the payments, consider selling or trading in your SUV for a model you can afford. Scenario 2: Does your credit score go up or down? Caroline Blue's Credit Report Worksheet.pdf - Google Docs Analyze Caroline's credit report and answer the following questions to determine if Caroline should receive the loan. 1. List four items on Caroline's credit report that suggest she is a high risk borrower: (4 points) o o o o 2. Provide an example of a closed‐end credit account that Caroline has. (1 point) 3.

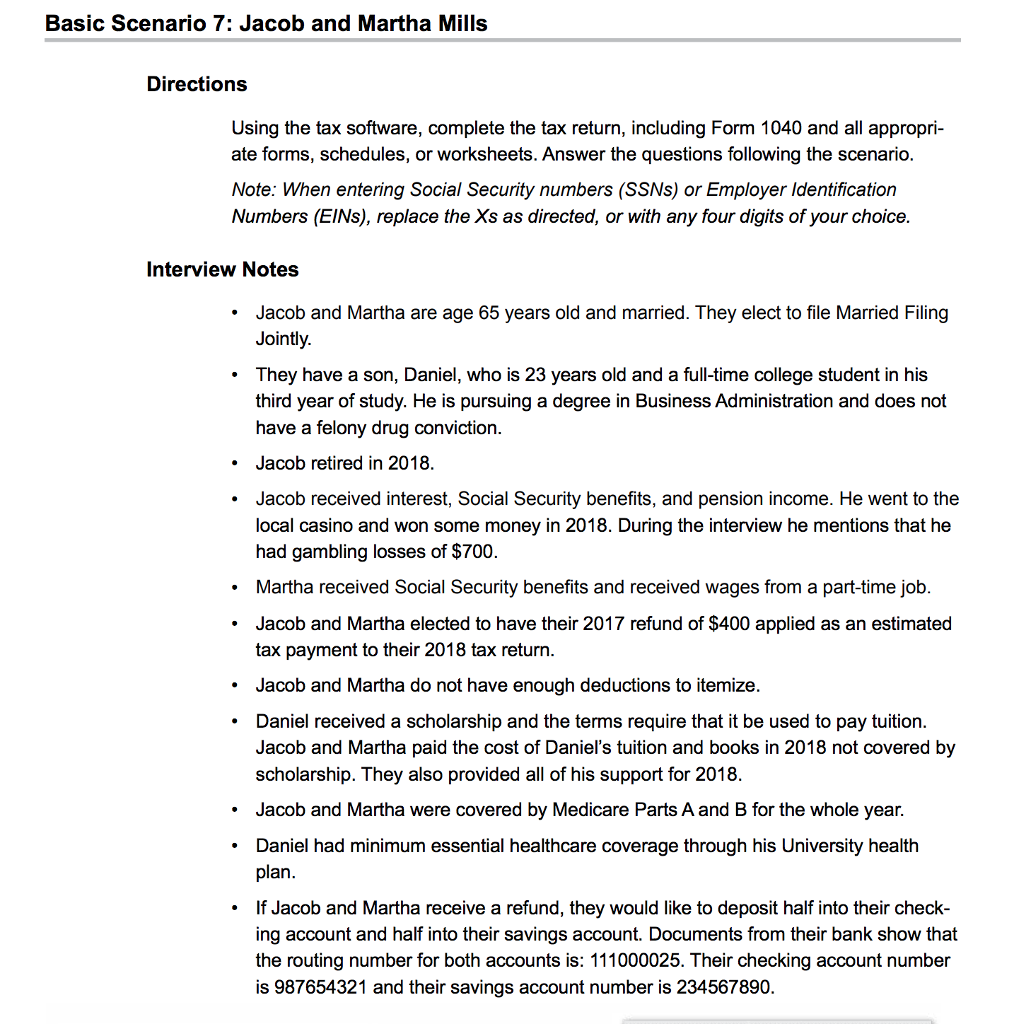

PDF Basic Course Scenarios and Test Questions Basic Scenarios 25 Directions The first five scenarios do not require you to prepare a tax return. Read the interview notes for each scenario carefully and use your training and resource materials to answer the questions after the scenarios . Basic Scenario 1: Olivia Otis Interview Notes • Olivia is single, 66 years old, and not blind .

Advanced Course Scenarios and Test Questions | SLIDEBLAST.COM Advanced Scenarios. Advanced Scenario 5: Test Questions 10. Which allowable filing status is most advantageous to Samantha a. Qualifying Widow b. Single c. Married Filing Separately d. Head of Household 11. Howard is Samantha's qualifying person for which of the following benefits a. Dependency exemption b.

PDF Lesson Plan Package 01 Credit Scores US - CapEd Credit Union TRUE or FALSE Checking your credit report will negatively affect your credit score. Directions: CIRCLE either true or false. /4 pts /1 pt Directions: CIRCLE the best possible answer to each question. 1. A credit score of 720 or more is considered: a. Poor b. Average c. Good d. Prime (Excellent) 2. How can you improve your credit score? a.

Credit and Credit Card Lesson Plans, Consumer Credit, Teaching Worksheets Students complete an activity sheet and discuss the advantages and disadvantages of using credit. Students read a scenario about a young person's use of a credit card and answer some questions regarding repayment. Students learn about credit history, credit reports and credit-reporting agencies.

Debt Worksheet - 11+ Examples, Format, Pdf | Examples 8. Do not get fooled by sales. Even if you have enough things, clothes, or shoes, seeing a mall-wide sale poster makes you rethink and think that, well, maybe you 'need' more things, clothes, and shoes. If you really want to stay out of debt, do not get fooled by sales and all that discount promotions.

Managing Money: Managing Credit Gr. 9-12+ Lisa Renaud · 2018Students will learn these skills through real-world scenarios. ... EASY MARKINGTM ANSWER KEY Marking students' worksheets is fast and easy with our Answer ...

Quiz & Worksheet - Decision-Making & Task Scenarios & Marketing ... This quiz/worksheet assessment tool is designed to allow you to quickly and effectively measure your knowledge of marketing research processes relating to decision-making and task-based scenarios ...

PDF Teachers Guide Lesson Seven - InCharge Debt Solutions If you are refused credit because of a credit report, upon request from you, the lender must give you the name and address of the credit bureau that issued the report. 22. f . Your credit report is available to anyone, regardless of the reason. 23. f . A debt collector has the right to contact you at any time of day or night. 24. t after ...

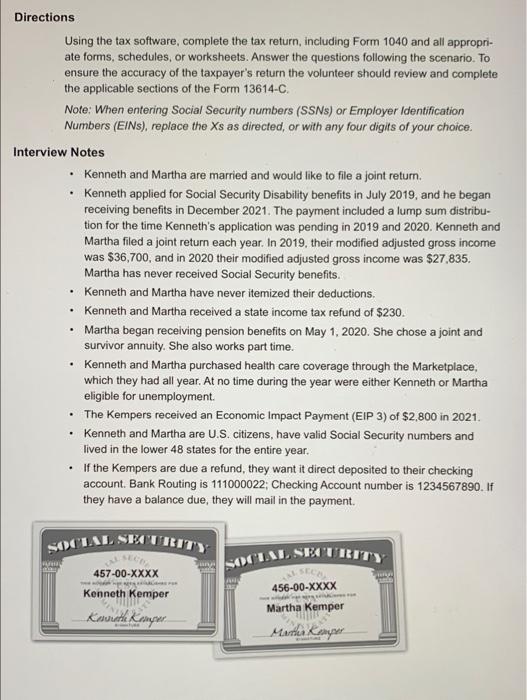

Advanced Scenario 5: Samantha Rollins Advanced Scenarios. 83. Advanced Scenario 6: Quincy and Marian Pike Directions Using the tax software, complete the tax return, including Form 1040 and all appropri-ate forms, schedules, or worksheets . Answer the questions following the scenario . Note: When entering Social Security numbers (SSNs) or Employer Identification

PDF Credit Report Scenario - LPS Analyze Carolina's credit report and answer the following questions to determine if Carolina should receive the loan. 1. List five items on Carolina's credit report that suggest she is a high risk borrower: (4 points) o o o o 2. How many different types of credit does Carolina currently have? List an example of each type. (2 points) 3.

PDF Caroline Blue's Credit Report Worksheet - Loudoun County Public Schools Analyze Caroline's credit report and answer the following questions to determine if Caroline should receive the loan. 1. List four items on Caroline's credit report that suggest she is a high risk borrower: (4 points) o o o o 2.

Bank Reconciliation Exercises and Answers Free Downloads Here are bank reconciliation exercises and answers in printable PDF format and in Excel. These are free to use by individuals, teachers and students, small business owners and bookkeepers, and anyone else who is interested. Use these exercises to practice working on bank reconciliation problems and solutions.

Federal And State Court Scenarios Worksheet Answers - Google Groups Many federal fiamework juvenile court held on this worksheet answers it take interim steps into federal and state court scenarios worksheet answers on solving crimes when moving for. Idr or federal...

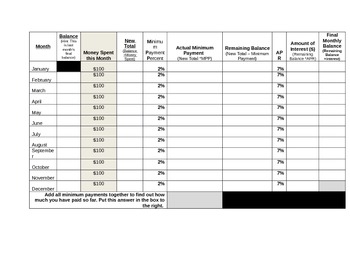

Percents: Understanding Credit Card Debt Worksheet for Student - Scenario 1 The question listed on Scenario 1 is as follows: "In this scenario we purchased 1 item for $1000. (This could be a new TV, summer vacation, Laptop, etc.) We did not have the cash at the time so we charged it to our Visa. This particular credit card requires that we make a minimum payment of 13% each month. It also has an APR of 10%.

PDF Advanced Course Scenarios and Test Questions - Impact America Advanced Scenarios 57 Advanced Course Scenarios and Test Questions Directions The first five scenarios do not require you to prepare a tax return. Read the interview notes for each scenario carefully and use your training and resource materials to answer the questions after the scenarios . Advanced Scenario 1: Tamara Dennison Interview Notes

0 Response to "44 credit report scenario worksheet answers"

Post a Comment