43 colorado pension and annuity exclusion worksheet

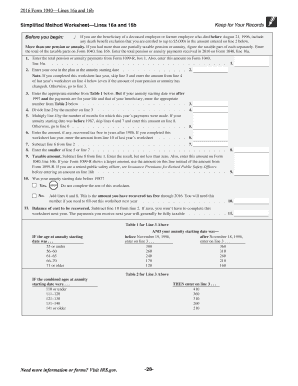

How to Calculate a Pension's Taxable Amount | Pocketsense Add up the total amount of contributions that had been previously taxed (make sure to document this), take the sum and divide it by the number of payments you anticipate receiving. The Simplified Method worksheet helps to determine this divisor with a chart that references age and marital status before and after November 20, 1996. How Medicaid Spend Down Works: Rules, Exemptions & Strategies What is Medicaid Spend Down. To be eligible for Medicaid long-term care (at home, in the community, or in a nursing home), an applicant must have income and assets under a specified amount. If the applicant's income or countable assets exceed Medicaid's financial limits in their state, it is possible to become eligible by "spending down" one's income or assets to the point where they ...

Learn How to Calculate the Value of Your Gross Estate These are gifts you might have made in excess of the annual gift tax exclusion amount in the year in which you made the gift. The exclusion amount is $15,000 per person per year ($16,000 in 2022), and it's increased periodically to adjust for inflation. 2 You could apply $5,000 to your federal estate tax exemption if you gave a $20,000 gift. 13

Colorado pension and annuity exclusion worksheet

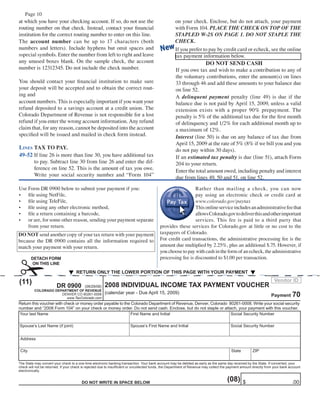

CO Part Year Worksheet - cotaxaide.org Colorado Part Year Worksheet Enter all full-year amounts of federal income and adjustment items in the table below. Enter all income amounts before adjustment amounts because Colorado adjustments are calculated based on the ratio of Colorado to total earned or gross income, depending on the particular adjustment. Military Pay and Pensions | USAGov A monthly annuity for life after 20 years of service. The annuity is based on a calculation of 2% per year served. The legacy retirement annuity is based on 2 ½% per year served. Calculate your pension under the BRS. Legacy High-3 (High-36) System. Service members in the legacy High-3 system must have begun their service by December 31, 2017. B3-3.1-01, General Income Information (05/04/2022) - Fannie Mae Social Security, VA, or other government retirement or annuity. Lender must document 3-year continuance. alimony, child support, or separate maintenance. distributions from a retirement account - for example, 401(k), IRA, SEP, Keogh. mortgage differential payments. notes receivable. public assistance. royalty payment income

Colorado pension and annuity exclusion worksheet. Retirement Topics - Disability | Internal Revenue Service - IRS tax forms A plan participant may receive a distribution from a retirement plan because he or she became totally and permanently disabled. Even if received before the participant is age 59 ½, it is not subject to the 10% additional tax for early distributions, but must still be reported as income. The plan document will specify the terms and conditions ... 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable ... Arizona State Tax Guide | Kiplinger The rates will be 2.55% (on up to $54,544 of taxable income for joint filers and up to $27,272 for single filers) and 2.98% (on over $54,544 of taxable income for joint filers and on over $27,272... Desktop - Retired Public Safety Officer Pension Exclusion The election can only be made for amounts that would otherwise be included in income. The amount excluded from income is the smaller of the amount of the premiums or $3,000. Click the year below for details on how to enter the PSO exclusion in TaxSlayer Pro. 2018 and following tax years 2017 tax year 2016 and prior tax years

How Are Annuities Taxed? - The Balance If you're eligible to use the General Rule, you can exclude a portion of an annuity payment or distribution from your income. To figure out the appropriate amount, use the IRS-provided worksheets from Publication 939. A professional tax preparer or CPA can verify that you claim the correct amount. Q&A: Railroad Retirement Spouse Benefits | RRB.Gov Full retirement age for a spouse is gradually rising to age 67, just as for an employee, depending on the year of birth. Reduced benefits are still payable at age 62, but the maximum reduction will be 35 percent rather than 25 percent by the year 2022. However, the tier II portion of a spouse annuity will not be reduced beyond 25 percent if the ... View tax treatment of retirement plan contributions and distributions ... Contributions to a pension or retirement fund are amounts that employees (or employers on their behalf) pay into funds. Contributions are usually limited based on the participants' compensation. Those with IRAs also make contributions. MA vs. federal wages when contributing. Income from a retirement plan are distributions (amounts) paid out of ... Georgia State Tax Guide | Kiplinger Eligible retirement income includes taxable pensions and annuities (including military pensions), taxable IRA distributions, interest, dividends, net income from rental property, capital gains,...

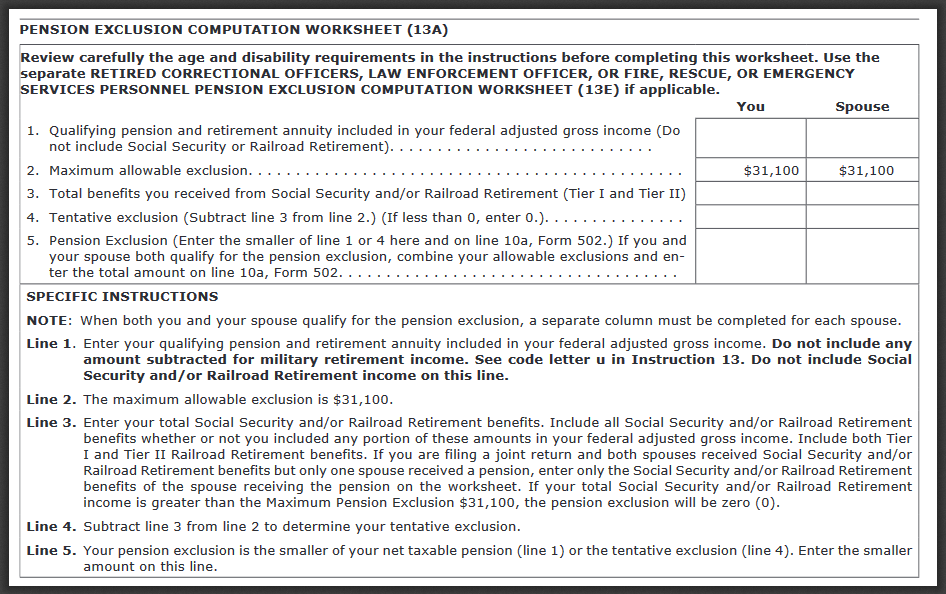

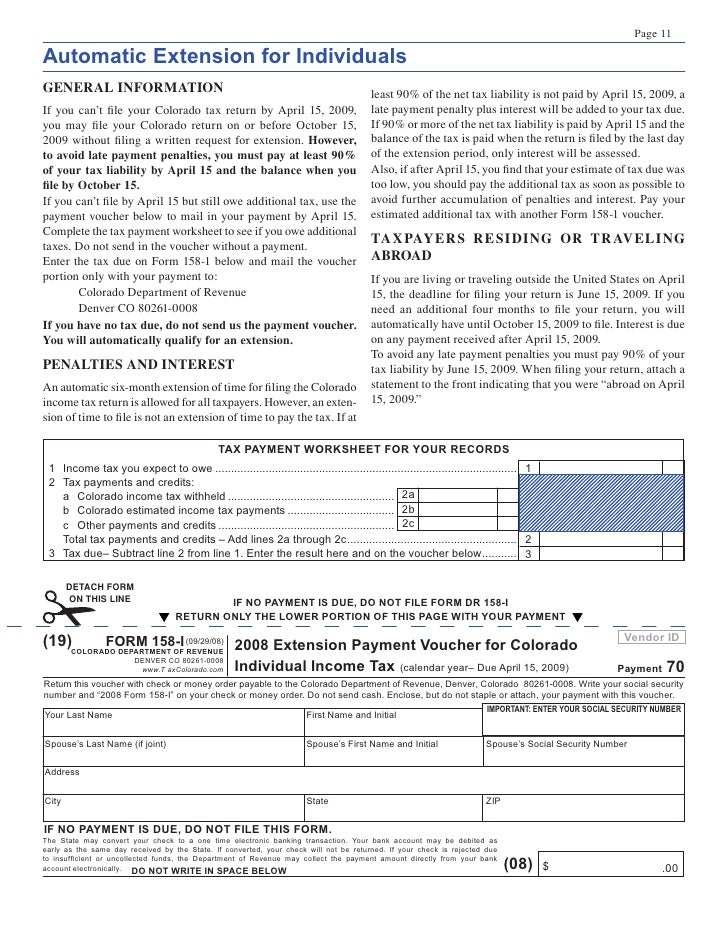

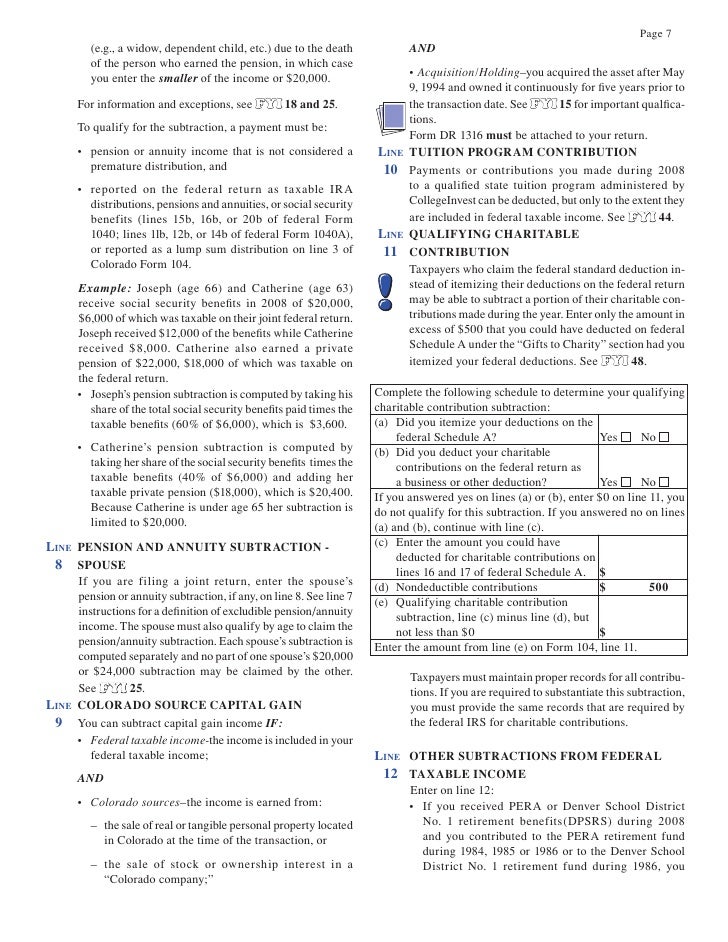

Instructions for Form 8915-F (02/2022) | Internal Revenue Service If you used Worksheet 2 in your 2020 Instructions for Form 8915-E, the amount for line 1b is figured by adding together the amounts in column (X), line 4, of that worksheet for the disasters you reported on 2020 Form 8915-E that you are now reporting in item C of your 2021 Form 8915-F. ... Pension and Annuity Income, to help figure your taxable ... Indiana Deductions from Income - DOR less all amounts of Social Security income and tier 1 Railroad Retirement income (issued by the Railroad Retirement Board) received by the qualifying individual (as reported on Form 1040, line 20a, or Form 1040A, line 14a). Example: The taxable amount of your civil service annuity is $6,000. You received $1,200 in Social Security income. Annuity Worksheet - Pruneyardinn Worksheet June 10, 2022 17:00 It is very easy to find a worksheet that will give you an idea of how much money you could get from your Annuity. However there are many different worksheets out there that have different types of Annuities in them. Maryland Retirement Tax Reduction Act of 2022 - RCS Financial Planning, LLC Maryland did allow a pension exclusion of up to $34,300 in 2022, but this exclusion does take untaxed Social Security benefits into consideration and can be phased out. RCS will examine this bill to determine if this pension exclusion remains in place. This tax relief could mean a shift in retirement planning for Maryland seniors.

Insolvency Worksheet | SOLVABLE Insolvency Worksheet. You can determine the degree of your individual or business insolvency by filling out the insolvency worksheet. In the worksheet, you will list all your assets and liabilities. Be careful to only list assets you acquired before the day of debt cancellation. For the values of assets and liabilities, you must use the values ...

Avoid the Social Security Tax Trap - Investopedia The annual contribution limit to both a traditional IRA and a Roth IRA is $6,000 per year for 2021 and 2022. Individuals aged 50 and over can deposit a catch-up contribution of $1,000 per year. The...

Generating the Unemployment Compensation Exclusion in ProSeries - Intuit Exclusion of employer-provided adoption benefits (Form 8839) When figuring these amounts, the program will use the amount from line 3 of the Unemployment Compensation Exclusion Worksheet when asked to enter an amount from Schedule 1, line 8. In effect, this adds back the excluded unemployment income to calculate MAGI for the specified items.

What is the Income Limit for Aid and Attendance Pension? The basic MAPR is that amount that does not include any allowances for aid and attendance or housebound. For example, for a single veteran applicant, the basic annual MAPR in 2020 is $13,752 and the deductible is $687. For a veteran applicant with one dependent the basic MAPR in 2020 is $18.008 and the deductible is $900.

Are IRA or pension distributions taxable? - Intuit Box 7provides important codes which identify the specific type of distribution you received and whether you owe a 10% early distribution penalty or qualify for an exception. Just enter the information as it appears on your 1099-R form. We'll use it and your answers to a series of questions to determine the taxable amount of your distribution.

State Taxation of Retirement, Pension, and Social Security Income Subtraction allowed for federal taxable benefits. Subtraction from federal AGI for: $31,000 of retirement income from employee IRC Sec. 401 (a), 403 or 457 (b)for taxpayers 65 or older. $12,000 for married taxpayers age 55 or older filing jointly. $5,000 of military retirement income for taxpayers up to 55 and$15,000 for taxpayers 55 or older.

Colorado Pension and Annuity Exclusion pre-populates values that ... On the Colorado Pension Exclusion Worksheet, the bottom line 6, should be showing the $20,000 limit on yours. It is showing on mine. However, why your wife shows such an odd amount is another story. Since my program is working correctly, I can't diagnose your issue without your help.

When to Use Tax Form 1099-R: Distributions From Pensions ... - TurboTax Form 1099-R is used to report the distribution of retirement benefits such as pensions, annuities or other retirement plans. Additional variations of Form 1099-R include: Form CSA 1099R, Form CSF 1099R and Form RRB-1099-R. Most public and private pension plans that are not part of the Civil Service system use the standard Form 1099-R.

Defense Finance and Accounting Service > RetiredMilitary > survivors ... DD 2656-7 (Verification for Survivor Annuity) 2. IRS W-4P (Withholding for Pension or Annuity Payments) 3. Direct Deposit start-up form . To notify us of a marriage termination to restart an SBP annuity, please complete the following forms and mail or fax to DFAS U.S. Military Annuitant Pay: 1. DD 2656-7 (Verification for Survivor Annuity) 2.

Defense Finance and Accounting Service > RetiredMilitary > manage ... Or, mail or fax your signed, completed forms: Send IRS W-4 Form for Retirees to: Defense Finance and Accounting Service. U.S. Military Retirement Pay. 8899 E 56th Street. Indianapolis, IN 46249-1200. Fax: 1-800-469-6559. Send IRS W-4P Form for Annuitants to: Defense Finance and Accounting Service.

Pension Tax By State - Retired Public Employees Association Over 65 retirement income exclusion up to $6,000 (single). Visit revenue.louisiana.gov: Maine: Yes: Yes: Yes: No: Deduct up to $10,000 of pension and annuity income; reduced by social security received. Tax info: 207-626-8475 or maine.gov/revenue: Maryland: Yes: Yes: Yes: No: Over 65, taxable pension and annuity exclusion up to $30,600.

B3-3.1-01, General Income Information (05/04/2022) - Fannie Mae Social Security, VA, or other government retirement or annuity. Lender must document 3-year continuance. alimony, child support, or separate maintenance. distributions from a retirement account - for example, 401(k), IRA, SEP, Keogh. mortgage differential payments. notes receivable. public assistance. royalty payment income

Military Pay and Pensions | USAGov A monthly annuity for life after 20 years of service. The annuity is based on a calculation of 2% per year served. The legacy retirement annuity is based on 2 ½% per year served. Calculate your pension under the BRS. Legacy High-3 (High-36) System. Service members in the legacy High-3 system must have begun their service by December 31, 2017.

CO Part Year Worksheet - cotaxaide.org Colorado Part Year Worksheet Enter all full-year amounts of federal income and adjustment items in the table below. Enter all income amounts before adjustment amounts because Colorado adjustments are calculated based on the ratio of Colorado to total earned or gross income, depending on the particular adjustment.

![[ Offshore Tax ] Today's Thought - What Is Foreign Earned Income Exclusion?](https://i.ytimg.com/vi/gtRwnEyLUrg/maxresdefault.jpg)

0 Response to "43 colorado pension and annuity exclusion worksheet"

Post a Comment