41 foreign earned income tax worksheet

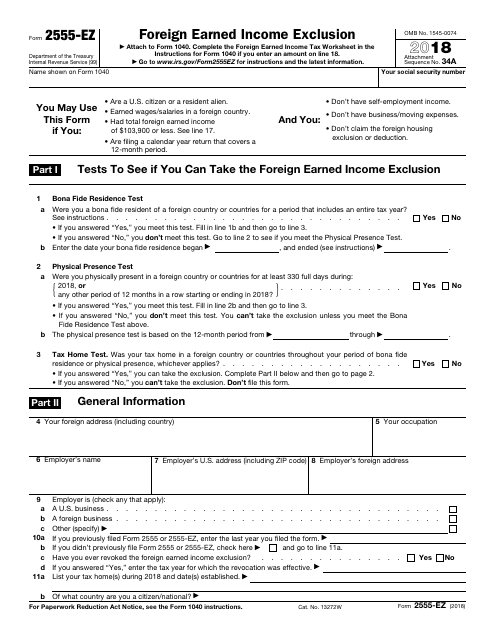

Do I Have to Report Income From Foreign Sources? - Investopedia For the tax year 2021, you may be eligible to exclude up to $108,700 of your foreign-earned income from your U.S. income taxes. For the tax year 2022, this amount increases to $112,000. Generating Form 2555 in ProSeries - Intuit Complete the Foreign Earned Income Allocation Worksheet. You can find the QuickZoom to this worksheet on Part IV of Form 2555. ... To see a list of countries that have US tax treaties in effect, see the IRS's List of Tax Treaties. For more information on the Foreign Earned Income Exclusion and the bona fide residence test, ...

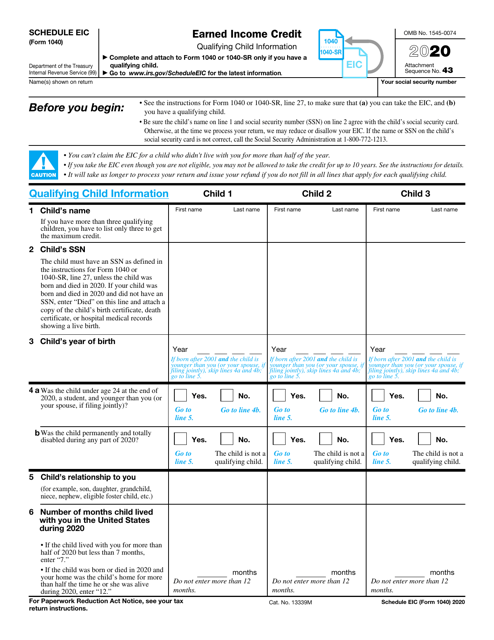

Forms and Instructions (PDF) - IRS tax forms Information to Claim Earned Income Credit After Disallowance (Spanish Version) 1221 12/14/2021 Inst 2106: Instructions for Form 2106, Employee Business Expenses 2021 12/14/2021 Form 1116: Foreign Tax Credit (Individual, Estate, or Trust) 2021 12/14/2021 Form 1041 (Schedule K-1)

Foreign earned income tax worksheet

US Taxes Abroad for Dummies (update for tax year 2021) The Foreign Earned Income Exclusion (FEIE, using IRS Form 2555) allows you to exclude a certain amount of your FOREIGN EARNED income from US tax. For tax year 2021 (filing in 2022) the exclusion amount is $108,700. What this means is that if, for example, you earned $113,000 in 2021, you can subtract $108,700 from that leaving $4,300 as taxable ... Questions and Answers- Accounting Training Unlimited Tax. Regular Tax. Who must use the Foreign Earned Income Tax Worksheet to calculate regular tax? Who should use the Qualified Dividends and Capital Gain Tax Worksheet to calculate regular tax? Who is a child for purposes of the kiddie tax? Who does the kiddie tax apply to? Tax-Schedule 2. Alternative Minimum Tax. Why is there an alternative ... FTC and Foreign Earned Income Exclusion calculation for married filed ... For tax year2021, the maximum foreign earned income exclusion is the lesser of the foreign income earned or $108,700 per qualifying person. For tax year2022, the maximum exclusion is $112,000 per person. If two individuals are married, and both work abroad and meet either the bona fide residence test or the physical presence test, each one can ...

Foreign earned income tax worksheet. 2021 Foreign Earned Income Exclusion and Tax Rates I believe the Foreign Earned Income Exclusion is the only tax exclusion that can be lost if you don't file. For example, you would be allowed to take the Foreign Tax Credit if you have failed to file, but not the Foreign Earned Income Exclusion. Tax Rates and Brackets for 2021. There are seven tax brackets for 2021. They are: 10%, 12%, 22% ... COMPLETE guide to unearned income and taxes [2022] - Stilt Blog Unearned income is usually taxed differently from earned income or business earnings. The tax also varies between types of Unearned Income. It's ordinarily exempt from payroll and other employment taxes like Medicare and Social Security. On the other hand, Unearned Income could be subjected to Capital Gains Tax. Taxed on Foreign income that has been excluded - Intuit Here are the instructions from the Schedule D worksheet. 1. Enter your taxable income from Form 1040, 1040-SR, or 1040-NR, line 15. (However, if you are filing Form 2555 (relating to foreign earned income), enter instead the amount from line 3 of the Foreign Earned Income Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16) US Expat Taxes: 25 Tips Every Expat Should Know - Greenback Expat Tax ... For the 2021 tax year, you may be able to exclude up to $108,700 of foreign earned income from US taxation with the Foreign Earned Income Exclusion! This is the most common way expats reduce or eliminate their US tax liability. You might also be able to exclude certain housing expenses, such as rent and utilities, using the Foreign Housing ...

Expat Tax Services, Preparation, & Consultation - WCG CPAs But, if you earn wages as an employee or have self-employment income while working in a foreign country as an ex-patriate or expat, you might be able to use the foreign earned income exclusion to exclude up to $107,600 (for the 2021 tax year) as tax-free income (or 2 x $108,700 or $217,400 if married to another foreign income earner). FREE 2020 Printable Tax Forms - Income Tax Pro Official IRS 2020 income tax forms and instructions are printable and can be downloaded for free. ... worksheets, 2020 tax tables, and instructions for easy one page access. ... Foreign Earned Income: 3800: General Business Credit: 3903: Moving Expenses: 4136: Credit For Federal Tax Paid On Fuels: How To Foreign Tax Credit Form 1116 | MyExpatTaxes The Foreign Tax Credit (FTC) from the IRS in the United States is a dollar-for-dollar reduction towards your foreign earned income. This means, for example, if you paid 200 Euros to the Italian government as a resident of a foreign country, you can take a 200 dollar credit and apply it to any US taxes you owe. IRS Form 1116: Foreign Tax Credit With An Example - 1040 Abroad In Amy's case, utilizing form 1116 Foreign Tax Credit over the Foreign Earned Income Exclusion is a better decision. Considering that the FEIE would cover only the first $108,700 of the earnings, while the passive income will be taxed regularly. Frequently Asked Questions . 1.

Foreign Earned Income Exclusion Definition - Investopedia Foreign Earned Income Exclusion: The amount of income earned from a foreign source that is excludable from domestic taxation. The foreign earned income exclusion can only be claimed by those who ... Correction to Line 9 in the 2021 Instructions for Form 8615 - IRS tax forms Under the section "Using the Qualified Dividends and Capital Gain Tax Worksheet for line 9 tax," steps 5, 7, and 8 should read as shown below. 5. If the Foreign Earned Income Tax Worksheet was used to figure the parent's tax, go to step 6 below. Otherwise, skip steps 6, 7, and 8 of these instructions below, and go to step 9. What is required for foreign income? - Fannie Mae Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. . Verification of Foreign Income. Copies of signed federal income tax returns for the most recent two years ... Partner's Instructions for Schedule K-3 (Form 1065) (2021) What's New. Schedule K-3 (Form 1065) is new for the 2021 tax year. Schedule K-3 replaces, supplements, and clarifies the former line 16, Foreign Transactions, in Part III of Schedule K-1 (Form 1065).Schedule K-3 also replaces, supplements, and clarifies the reporting of certain amounts formerly reported on line 20, Other information, in Part III of Schedule K-1.

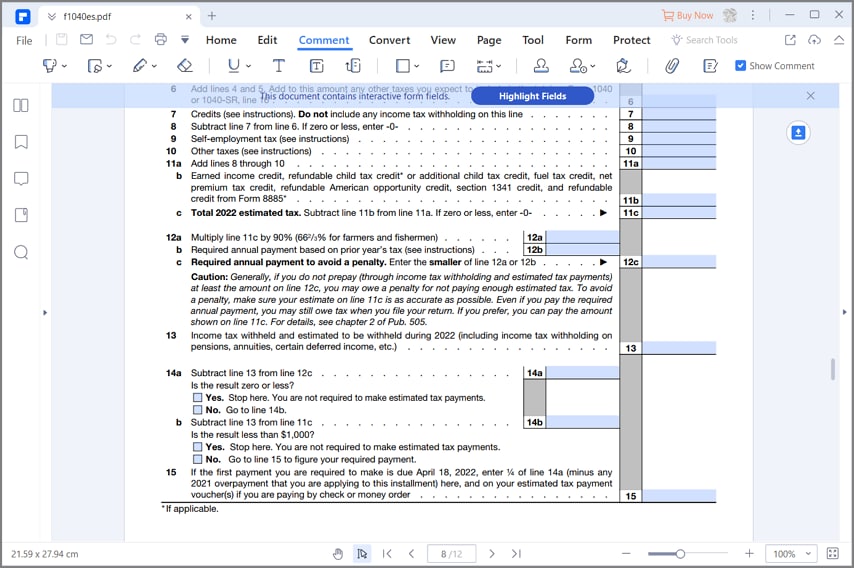

US taxes: FEIE and Capital Gains/Dividends : r/JapanFinance - reddit So for an income of $108.7k or less ($217.4k or less married filing jointly), Line 9 ("Total Income") and Line 11 ("AGI") is just interest+dividends+capital gains. If this AGI is less than $12.5 ($25k married), Line 15 becomes zero. If you use the FEIE, you are supposed to calculate tax using "Foreign Earned Income Tax Worksheet" per page 34 of ...

U.S. IRS Updates Frequently Asked Questions (FAQs) About ... - Orbitax When am I required to use of the Foreign Earned Income Tax Worksheet when calculating my U.S. income tax? (updated August 2, 2022) Expatriation: Former Citizens and Long-term Permanent Residents. 1. What is the purpose of Form 8854, Initial and Annual Expatriation Information Statement, and where can I get the form? (updated August 2, 2022)

Claiming the Foreign Tax Credit with Form 1116 - TurboTax Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when:

FREE 2021 Printable Tax Forms - Income Tax Pro Official IRS 2021 income tax forms and instructions are printable and can be downloaded for free. ... worksheets, 2021 tax tables, and instructions for easy one page access. ... Foreign Earned Income: 3800: General Business Credit: 3903: Moving Expenses: 4136: Credit For Federal Tax Paid On Fuels:

Completing Form 1040 and the Foreign Earned Income Tax Worksheet If you earned more than $100,000, use the tables found on page 77 of the IRS's Instructions for Form 1040. It is important to note that when you are claiming the Foreign Earned Income Exclusion, there is a special worksheet to complete to calculate your tax due for the year. This can be found on page 35 of the IRS's Instructions for Form 1040.

IRS Form 1040-ES: PDFelement to the Rescue - Wondershare PDFelement Check worksheet 2-7 and 2-8 in Pub.505 to find out the tax if you have a net capital gain or expect to exclude or deduct foreign earned income or housing. Enter the alternative minimum tax from Form 6251 or included on Form 1040A, Line 28. Add line 6 and 7 plus any other tax amount expected to include on form 1040 line 44.

Earned Income Credit, EIC Table - National Tax Reports Have less than $$10,000 of investment income for the tax year. Not file a Foreign Earned Income Form 2555 or Foreign Earned Income Exclusion. ... The Earned Income Tax Credit Worksheet can be used to calculate your eligibility and how much credit you qualify for. The worksheet can be found in the instruction booklet for IRS Form 1040.

Foreign Earned Income Exclusion And US or IRS Tax Returns - e-File This is Form 2555, Foreign Earned Income which can be used if you are also claiming foreign housing cost amount exclusion or if you are only claiming the foreign income tax exclusion. Form 2555 should be filed with your timely filed Form 1040 (Individual Income Tax Return) or Form 1040-X (Tax Amendment). See a view a full list of foreign income ...

What Is Tax Form 6251? - The Balance You only need to complete the second page (Part III) if you claimed the foreign earned income tax credit and the worksheet instructed you to do so, or if you reported capital gains distributions or qualified dividends on your tax return and if you are also filing Form 2555.

Solved: Foreign earned income - Intuit Accountants Community 06-14-2022 04:35 PM. To the left of Line 1 on the front page of the 1040, click in the blank space and a hidden box appears, you can enter foreign income there and it will land on Line 1 Wages, rather than Other Income. ♪♫•*¨*•.¸¸ ♥Lisa♥ ¸¸.•*¨*•♫♪. View solution in original post. 4 Cheers.

Filing Taxes While Overseas - TurboTax Tax Tips & Videos Foreign earned income exclusion. One tax break for expatriates is the Foreign Earned Income Exclusion. If an American moves abroad, he or she can exclude foreign-earned income up to $108,700 as of 2021 from U.S. taxation. To qualify, that person must have lived outside the United States for 330 days in 12 consecutive months, said Wilson, a ...

FTC and Foreign Earned Income Exclusion calculation for married filed ... For tax year2021, the maximum foreign earned income exclusion is the lesser of the foreign income earned or $108,700 per qualifying person. For tax year2022, the maximum exclusion is $112,000 per person. If two individuals are married, and both work abroad and meet either the bona fide residence test or the physical presence test, each one can ...

Questions and Answers- Accounting Training Unlimited Tax. Regular Tax. Who must use the Foreign Earned Income Tax Worksheet to calculate regular tax? Who should use the Qualified Dividends and Capital Gain Tax Worksheet to calculate regular tax? Who is a child for purposes of the kiddie tax? Who does the kiddie tax apply to? Tax-Schedule 2. Alternative Minimum Tax. Why is there an alternative ...

US Taxes Abroad for Dummies (update for tax year 2021) The Foreign Earned Income Exclusion (FEIE, using IRS Form 2555) allows you to exclude a certain amount of your FOREIGN EARNED income from US tax. For tax year 2021 (filing in 2022) the exclusion amount is $108,700. What this means is that if, for example, you earned $113,000 in 2021, you can subtract $108,700 from that leaving $4,300 as taxable ...

0 Response to "41 foreign earned income tax worksheet"

Post a Comment