39 qualified dividends and capital gain tax worksheet fillable

PDF Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. Need more information or forms? Visit IRS.gov. -40-Title: Form 14216 (3-2011) Author: IRS 'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […]

1040 (2021) | Internal Revenue Service - IRS tax forms Worksheet To See if You Should Fill in Form 6251—Schedule 2, Line 1; Line 2. Excess Advance Premium Tax Credit Repayment; ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details..

Qualified dividends and capital gain tax worksheet fillable

Qualified Dividends And Capital Gain Tax Worksheet 2021 - Fill Out and ... Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). Estimated Income Tax Spreadsheet - Mike Sandrik His taxable income is several thousand bucks over $200,000, so he also starts picking up a bit of net investment income tax, though the rate is only 1.9% and not the full 3.8% since part of his investment income still fits below the $200,000 threshold. His overall effective rate is 19.74%. Example 4. Fat cat city!

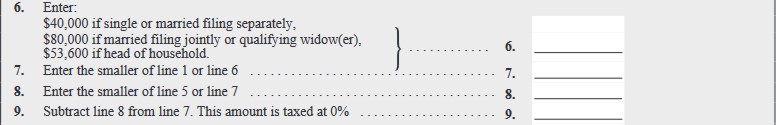

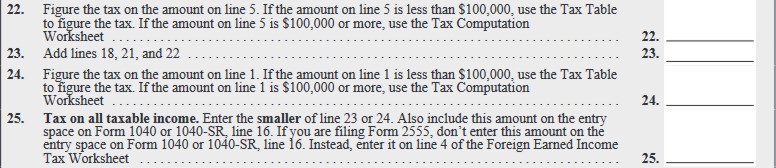

Qualified dividends and capital gain tax worksheet fillable. Qualified Dividends And Capital Gain Tax Worksheet Irs Tax Filers With Qualified Dividends And Capital Gains Have To Fill The Relevant Worksheet. All forms are printable and downloadable. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for forms 1040 and. Before completing this worksheet, complete form 1040 or. PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to Schedule D FS-2004-11, February 2004 Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip Schedule D entirely. Lower Tax Rates How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. It's Line 11a of Form 1040. How Your Tax Is Calculated: Understanding the Qualified Dividends and ... So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7), so they can be taxed at their different rates. Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 (don't do that).

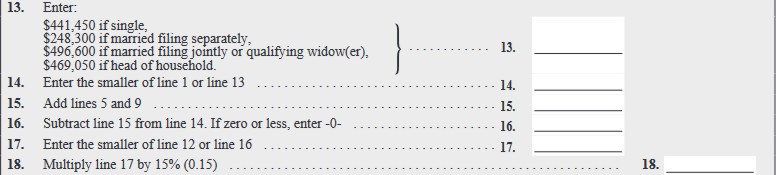

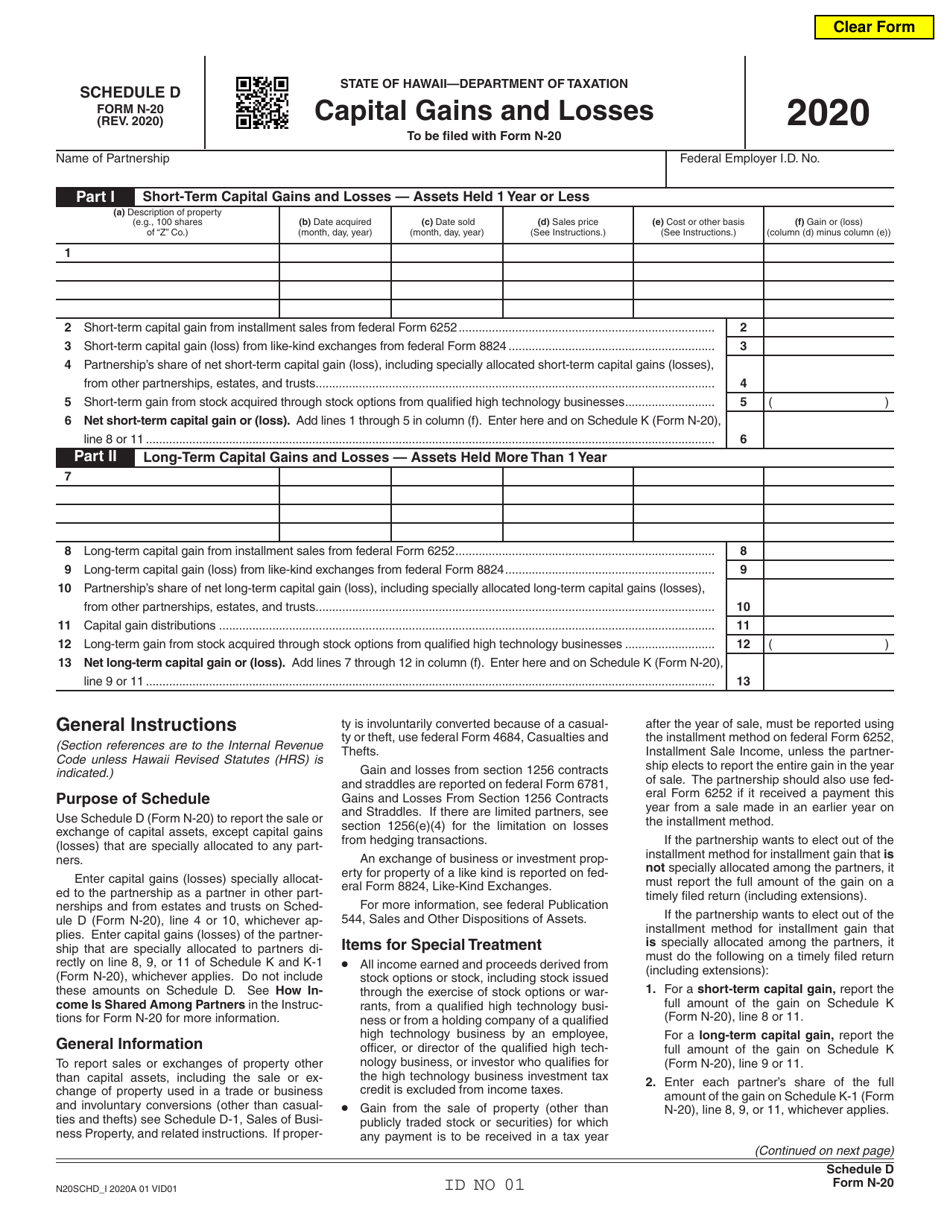

Qualified Dividends and Capital Gains Flowchart - The Tax Adviser The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to ... Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub... Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill and Sign ... Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use drag&drop graphical user interface makes it easy to add or relocate fields. 2020 Irs Capital Gains Worksheet - tpdevpro.com SCHEDULE D Capital Gains and Losses - IRS tax forms 5 days ago Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D … Show more View Detail

Qualified Dividends Tax Worksheet - Fill Out and Use - FormsPal The Qualified Dividends Tax Worksheet is a tax form used to calculate the 15% excise tax on qualified dividends paid by regular C corporations. If you wish to acquire this form PDF, our editor is what you need! By pressing the orange button below, you'll access the page where it's possible to edit, save, and print your document. How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7. How does IRS know that I calculated tax using worksheet "Qualified ... I am filing 2021 Federal Tax and got long-term capital gains (will also file Schedule D). I calculated tax using "Qualified Dividends and Capital Gain Tax Worksheet" How will IRS know that tax calculation is from "Qualified Dividends and Capital Gain Tax Worksheet" Should I write it next to 1040 line 16? Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

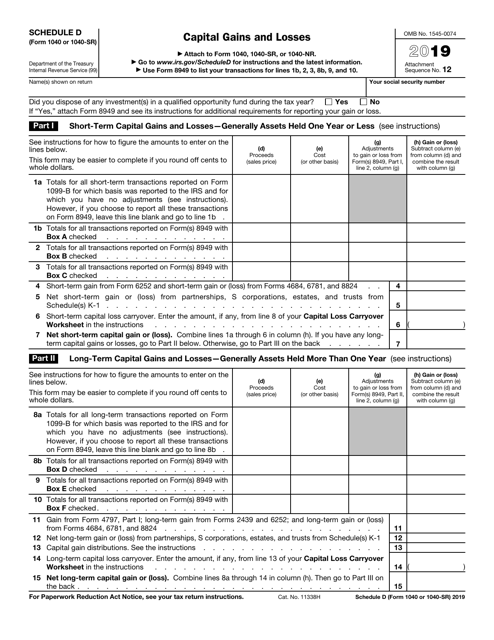

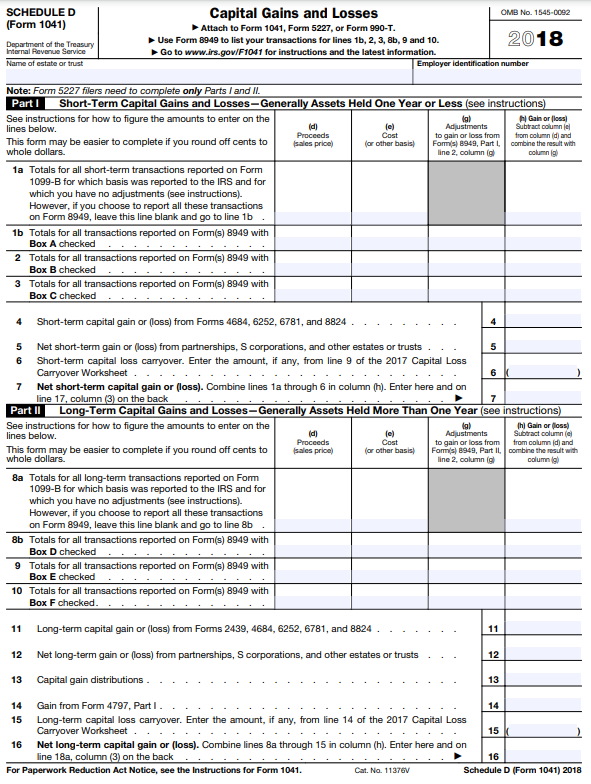

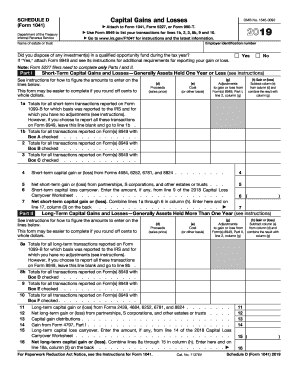

Free Microsoft Excel-based 1040 form available Just in time for tax season, Glenn Reeves of Burlington, Kansas has created a free Microsoft Excel-based version of the 2008 U.S. Individual Tax Return, commonly known as Form 1040. The spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule D - Capital Gains and Losses, along with its worksheet.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

" Qualified Dividends and Capital Gain Tax Worksheet." not showing - Intuit In the search box type "qualified dividend" - singular, without the quotes. The Qualified Dividend and Capital Gain Tax Worksheet will then appear in the selection list. You can select it and open it. But if it's not in the list of forms in your return, that means it's not being used to calculate your tax.

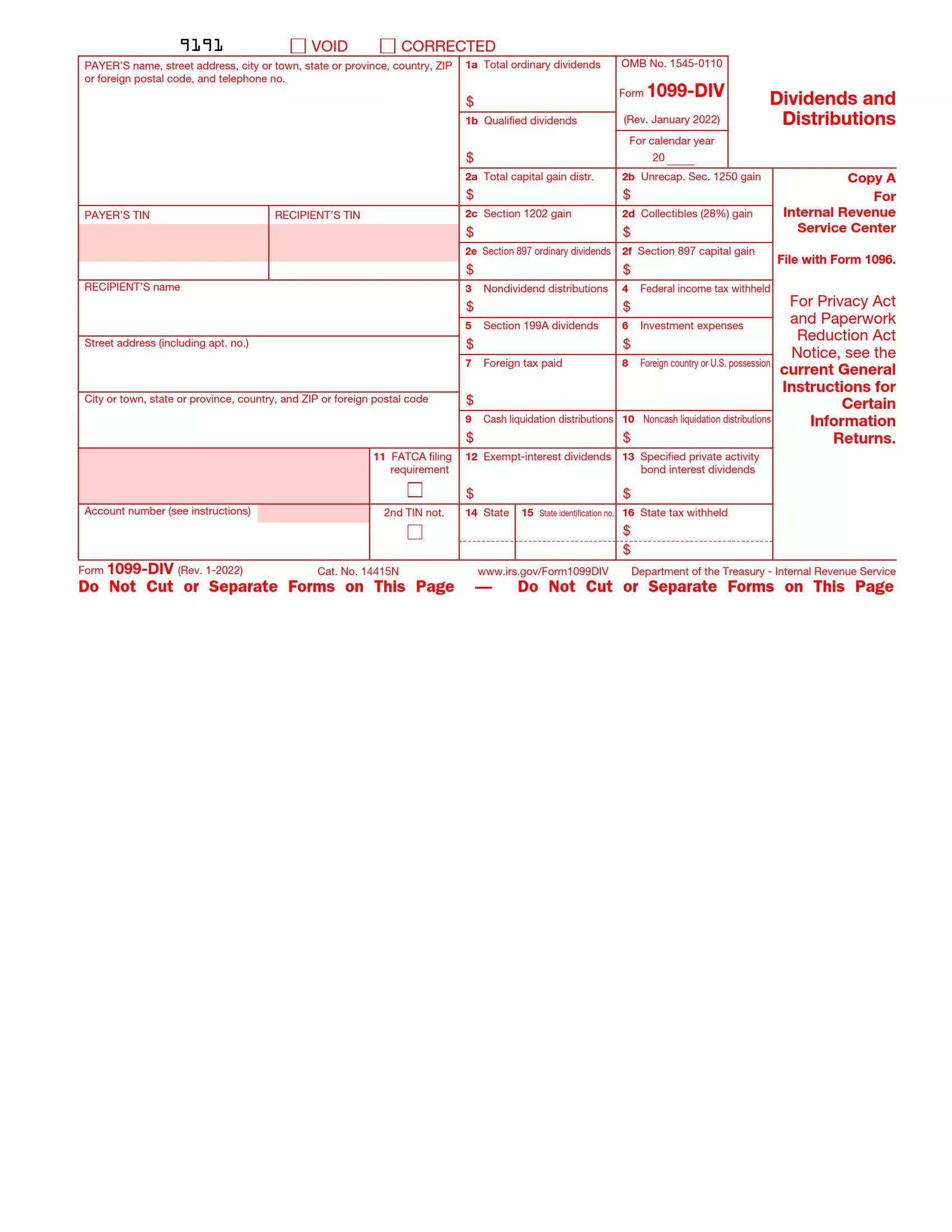

How to Figure the Qualified Dividends on a Tax Return Use Form 1099-DIV to determine your qualified dividend amount. Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your...

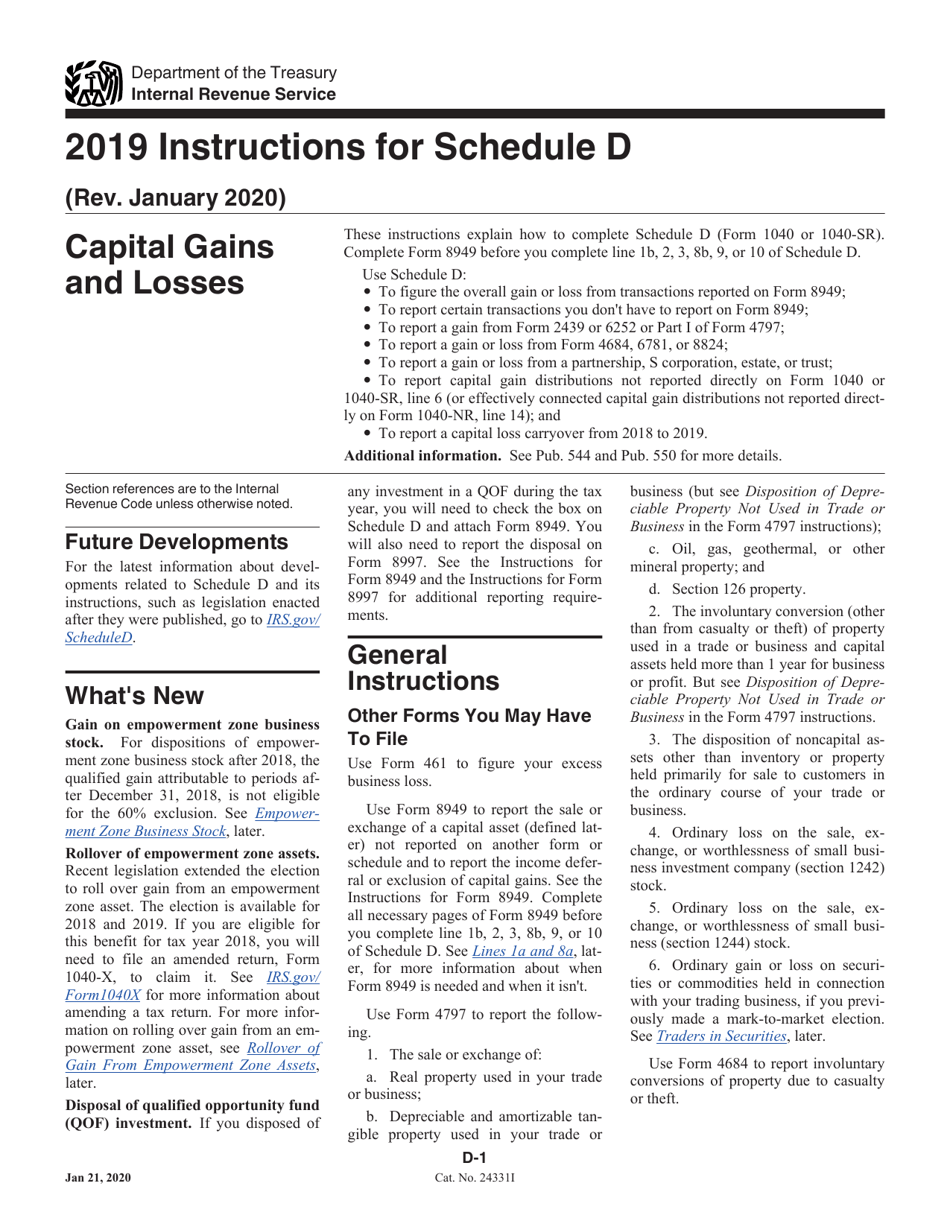

How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Part II: Long-Term Capital Gains and Losses. Fill out this section of the IRS Schedule D tax worksheet in a similar manner as you calculated your short-term capital gains and losses, transferring ...

What is a Qualified Dividend Worksheet? - Money Inc If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a." In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10.

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete

Estimated Income Tax Spreadsheet - Mike Sandrik His taxable income is several thousand bucks over $200,000, so he also starts picking up a bit of net investment income tax, though the rate is only 1.9% and not the full 3.8% since part of his investment income still fits below the $200,000 threshold. His overall effective rate is 19.74%. Example 4. Fat cat city!

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

Qualified Dividends And Capital Gain Tax Worksheet 2021 - Fill Out and ... Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "39 qualified dividends and capital gain tax worksheet fillable"

Post a Comment