39 calculating your paycheck worksheet

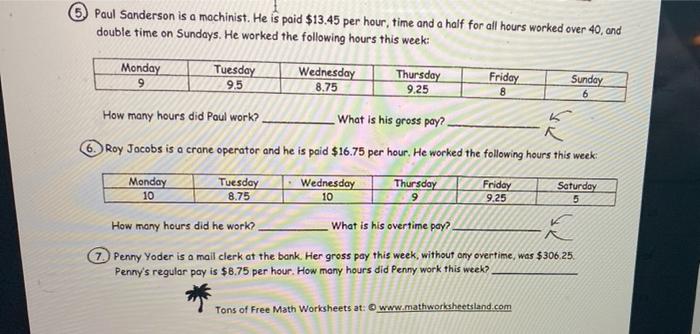

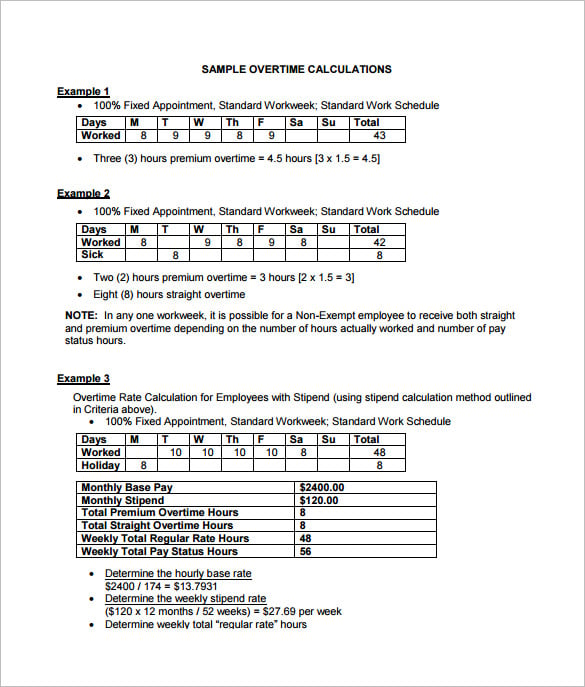

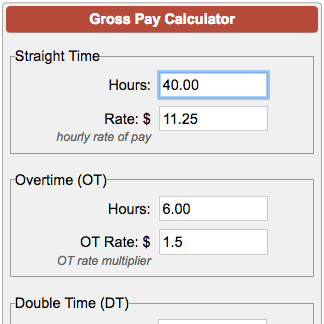

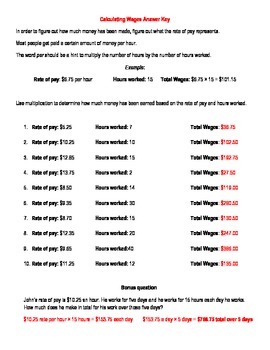

Seller Closing Cost Calculator for Texas (2022 Data) - Anytime Estimate Use our Texas seller closing cost calculator to estimate how much you'll owe at closing when you sell your house. Most Texas home sellers should expect to pay closing costs of between 7.7-8.7%, including realtor fees. Based on the median home value in Texas ($308,628), that'd be between $23,764-$26,850. Remember that closing costs will ... How to Calculate Gross Income Per Month - The Motley Fool For hourly employees, the calculation is a little more complicated. First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week and then multiply the total...

How To Make A Monthly Budget In 5 Simple Steps | Bankrate 1. Calculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month. This will set the limit for how much you can spend (and save ...

Calculating your paycheck worksheet

Paycheck stub calculator - TalisaMette Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. As you have our free check stub maker by your side it is an extremely easy task to create pay stubs on-the-go. We use the most recent and accurate information. Adjusted Monthly Income - Section 8 WorkWORLD calculates your Adjusted Monthly Income by: 1. Determining the total annual gross income of your family. WorkWORLD does this by adding together the unearned income, earned income, and income from assets of all household members. 2. Subtracting income exclusions to get the annual Gross Non-Excluded Income 3. VA Residual Income Calculator (2022 Data) - Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense.

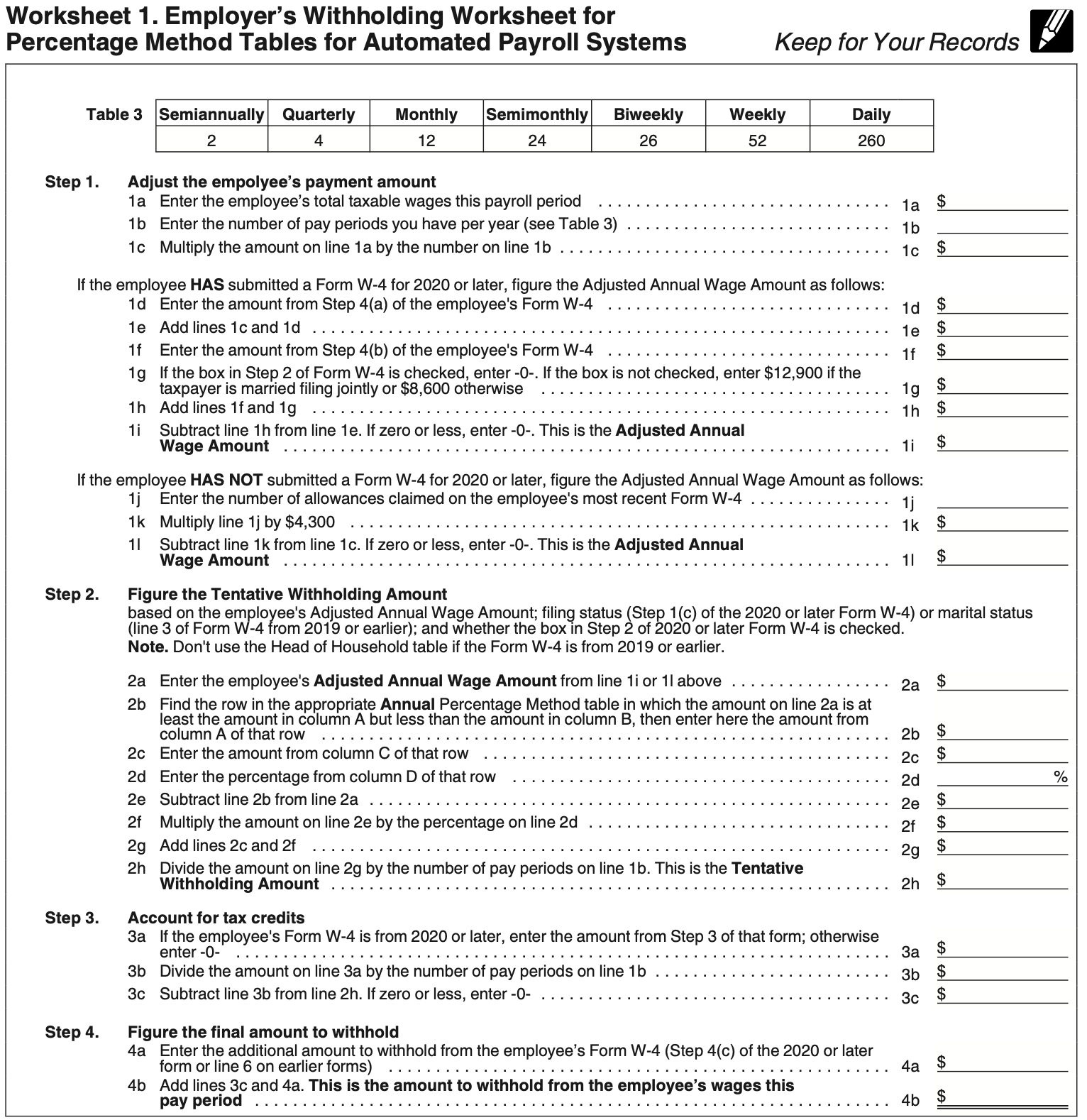

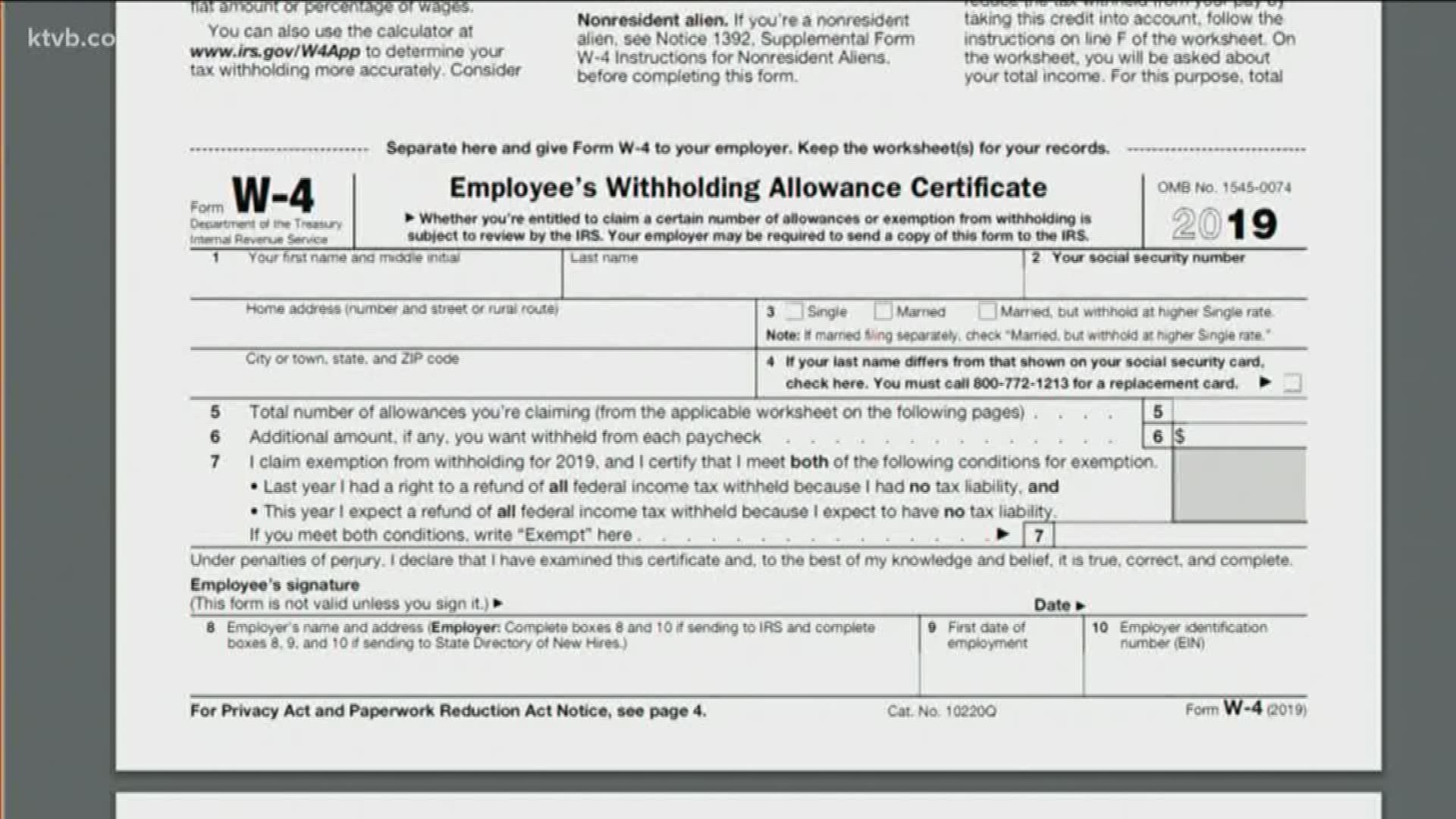

Calculating your paycheck worksheet. The Self-Employment Health Insurance Deduction A worksheet is provided in the Instructions for Form 1040 to calculate the deduction, and a more detailed worksheet can be found in Publication 535. Use Worksheet P found in Publication 974, Premium Tax Credit if you obtained insurance through a health insurance exchange and received a premium assistance tax credit . Paycheck gross to net calculator - EmmaVianney The PaycheckCity salary calculator will do the calculating for you. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. First enter the net paycheck you require. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. How To Calculate Your Mortgage Payment | Rocket Mortgage The amortization calculator asks you to input your current loan amount, the length of your loan, your interest rate and the state you live in. You can also see what the effect of a one-time, monthly or yearly additional payment would be on your number of monthly payments or interest. Pay Raise Calculator: How to Calculate a Future Pay Raise This would be 0.429 x 100 = 42.9%, which is a 142.9% increase to your hourly wage. To check if you have the right percentage figure, you can multiply your previous salary or an hourly rate by the percent increase. For example, you can multiply $45,000 x 22.2/100, the answer is $54,900, which rounds up to $55,000 per annum.

2021 IRS Form 940: Simple Instructions + PDF Download | OnPay Form 940, Part 1 - Line: 1a. If your business has to pay state unemployment tax, enter the state abbreviation on line 1a. 1b. If your business has to pay state unemployment tax in more than one state, you will need to check the box on line 1b and complete Schedule A. 2. If you paid wages in a state that is subject to credit reduction, which ... Employee Summary - U.S. Office of Personnel Management Basic Insurance. Basic life insurance is equal to the greater of (a) your annual rate of basic pay rounded up to the next $1,000 plus $2,000 or (b) $10,000. The Federal Government pays one-third of the cost of your Basic life insurance. The U.S. Postal Service pays 100% of the cost of Basic for Postal Service employees. 6 Best Free Net Worth Spreadsheets - Tiller This straightforward Excel worksheet from Microsoft shows your net worth at a glance. Simply enter your assets and liabilities to see your net worth in a vibrant assets and liabilities chart. Download Excel .XLSX file | Open in Browser 5: Cross-Border Net Worth Spreadsheets from SquawkFox CalculatorResults 1f. Monthly Gross Income (1a+1b+1c-1d-1e) 2a. Number of Nonjoint Child (ren) in the Home (Maximum number allowed is 2) 2b. Deduction for Nonjoint Child (ren) in the Home. 3. Parental Income for Determining Child Support (PICS) 4.

Paycheck calculator with tips - ailbealesha.blogspot.com Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. In a few easy steps you can create your own paystubs and have them sent to your email. Paycheck Calculator Gross Pay Gross Pay Pay Period Estimated Gross Annual Pay. Paycheck tips are gratuities that are paid to the employee ... Net paycheck calculator - JenniBilliejo Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. For instance a. Then enter your current payroll information and deductions. 1099-MISC Instructions and How to Read the Tax Form OVERVIEW. In tax year 2020, the IRS reintroduced Form 1099-NEC for reporting independent contractor income, otherwise known as nonemployee compensation. If you're self-employed, income you receive during the year might be reported on the 1099-NEC, but Form 1099-MISC is still used to report certain payments of $600 or more you made to other ... Residual Income Calculator - Blueprint Monthly Income Taxes - Taxable Income Amount: $0.00; Suggested Federal Rate: Federal Income Tax: $0.00: Suggested State Rate: State Income Tax: $0.00: Social Security/Medicare: $0.00: Total Income Tax: $0.00: Residual Income Residual Income Amount: $0.00; Adjustment to required residual income

Estimated Income Tax Payments for 2022 and 2023 - Pay Online - e-File 90% of the expected taxes of your 2022 Tax Return, or. 100% of the taxes shown on your 2021 Tax Return. In other words, you can use your exact figure from your previous year return or you can estimate within 10% of your anticipated 2022 tax balance. Of course, these are just estimated.

Quarterly Estimated Tax Payments: When Are They Due, How Do You File ... Estimated taxes are paid quarterly, usually on the 15th day of April, June, September and January of the following year. One notable exception is if the 15th falls on a legal holiday or a weekend ...

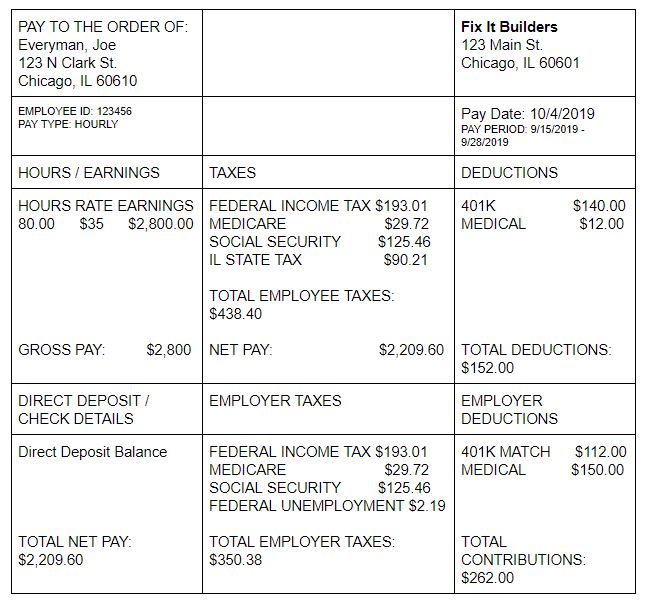

Payroll Calculator Template For Ms Excel Word Excel Templates Excel payroll templates help you to quickly calculate your employees income withholdings and payroll taxes- use payroll stub templates to conveniently generate . Home; News; Technology. All; Coding; Hosting; Create Device Mockups in Browser with DeviceMock. Creating A Local Server From A Public Address.

Form 941 Worksheet 4, Q3 2021 | 3rd & 4th quarter new Worksheet Enter either amount from step 1 of this worksheet that applies to your business: Line 1a Line 1g Line 2f Copy the amount from Worksheet 3, Step 2, Line 2r here. Line 2g Subtract the amount on Line 2f from the amount on Line 2e, enter the difference here. Line 2h This is the total non-refundable portion of the employee retention credit.

The End of the Employee Retention Credit: How Employers ... - Investopedia Amount of the Credit for 2021. For 2021, the credit was equal to 70% of up to $10,000 in qualified wages per employee (including amounts paid toward health insurance) for each eligible calendar ...

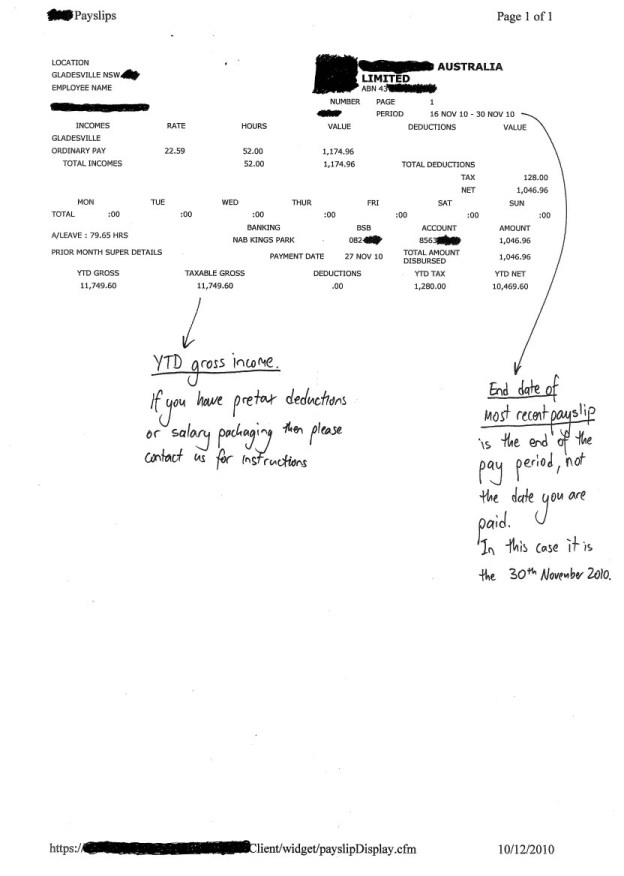

Your Paycheck and Payslip | Integrated Service Center In the upper left corner of Workday, select Menu > Pay. In View section, select the Payslips button. On the next screen, locate the payslip you want to access, and select the View button; to print it, select the Print button. Visit the How to Read Your Payslip page for help understanding the information that appears on your payslip. FAQs

Forms & Resources - Finance & Accounting Gross-Up Worksheet Worksheet to help calculate the amount that the department needs to pay to an employee. This amount will show up on the employee's check before withholdings. Instructions to Import Payroll Calendar Step-by-step instructions on how to import a payroll calendar into Outlook. Overpayments and Underpayments

Actual wages worksheet document | State Revenue Office Actual wages worksheet document Our wages worksheet can help you calculate your total taxable wages. Taxable wages up to 30 June are included in that financial year's annual reconciliation. Download payroll-tax-wages-worksheet.docx / 33.64 KB Last modified: 9 September 2022 Can't find what you're looking for? Visit the Help Centre

The Motley Fool | The Motley Fool Foolish Calculators. You wanna calculate something? We can help. Savings, retirement, investing, mortgage, tax, credit, affordability?

Yearly salary paycheck calculator - BlaynEzmae To calculate your yearly. 1500 per hour x 40 600 x 52 31200 a year. It can also be used to help fill steps 3 and 4 of a W-4 form. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. For the cashier in our example at the. How Your Texas Paycheck Works.

VA Residual Income Calculator (2022 Data) - Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense.

Adjusted Monthly Income - Section 8 WorkWORLD calculates your Adjusted Monthly Income by: 1. Determining the total annual gross income of your family. WorkWORLD does this by adding together the unearned income, earned income, and income from assets of all household members. 2. Subtracting income exclusions to get the annual Gross Non-Excluded Income 3.

Paycheck stub calculator - TalisaMette Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. As you have our free check stub maker by your side it is an extremely easy task to create pay stubs on-the-go. We use the most recent and accurate information.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/how-to-make-a-budget-1289587-Final2-updated-17bbe4528d38430ca42f4138f599ed56.png)

0 Response to "39 calculating your paycheck worksheet"

Post a Comment