38 workers comp audit worksheet

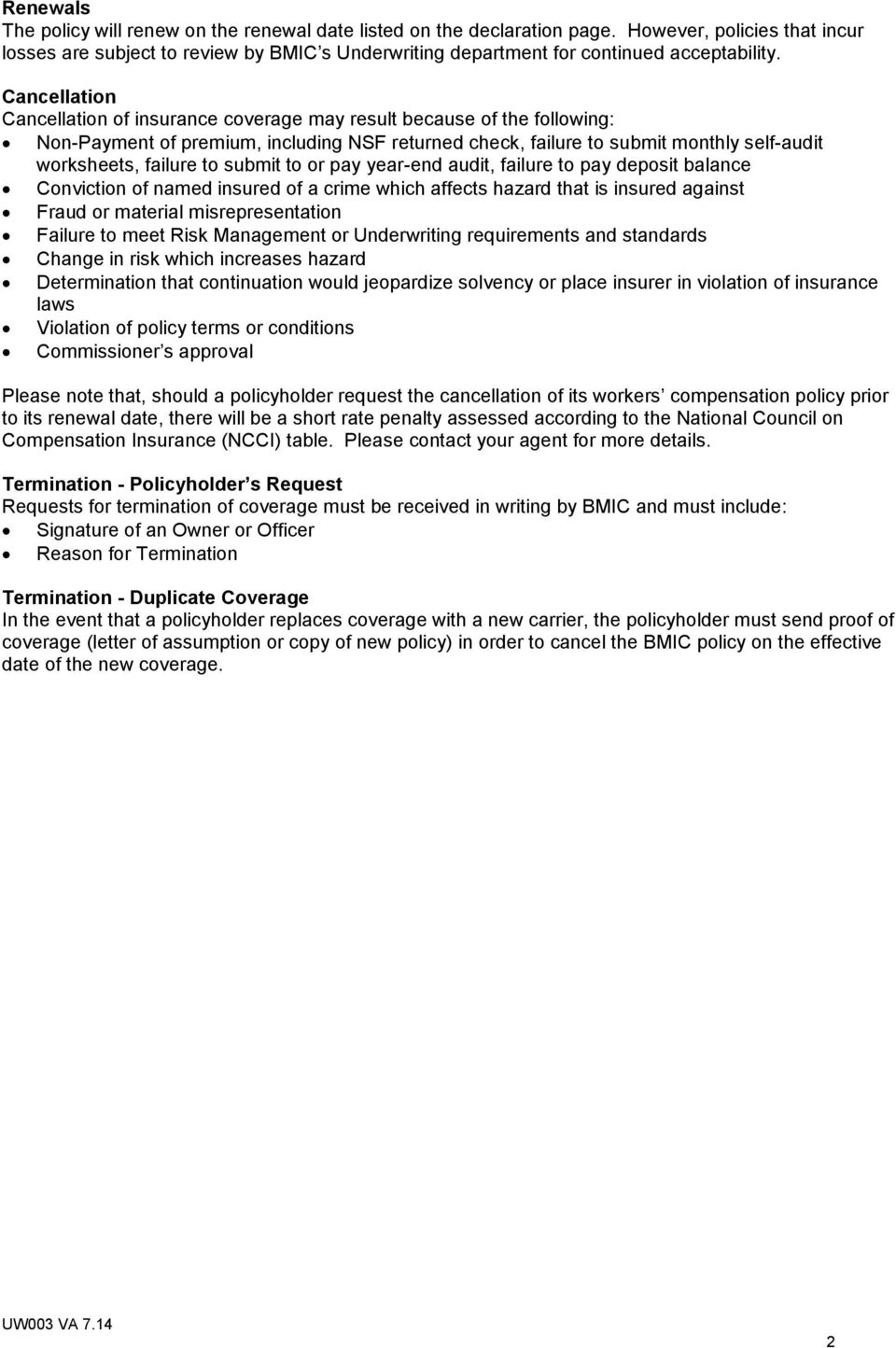

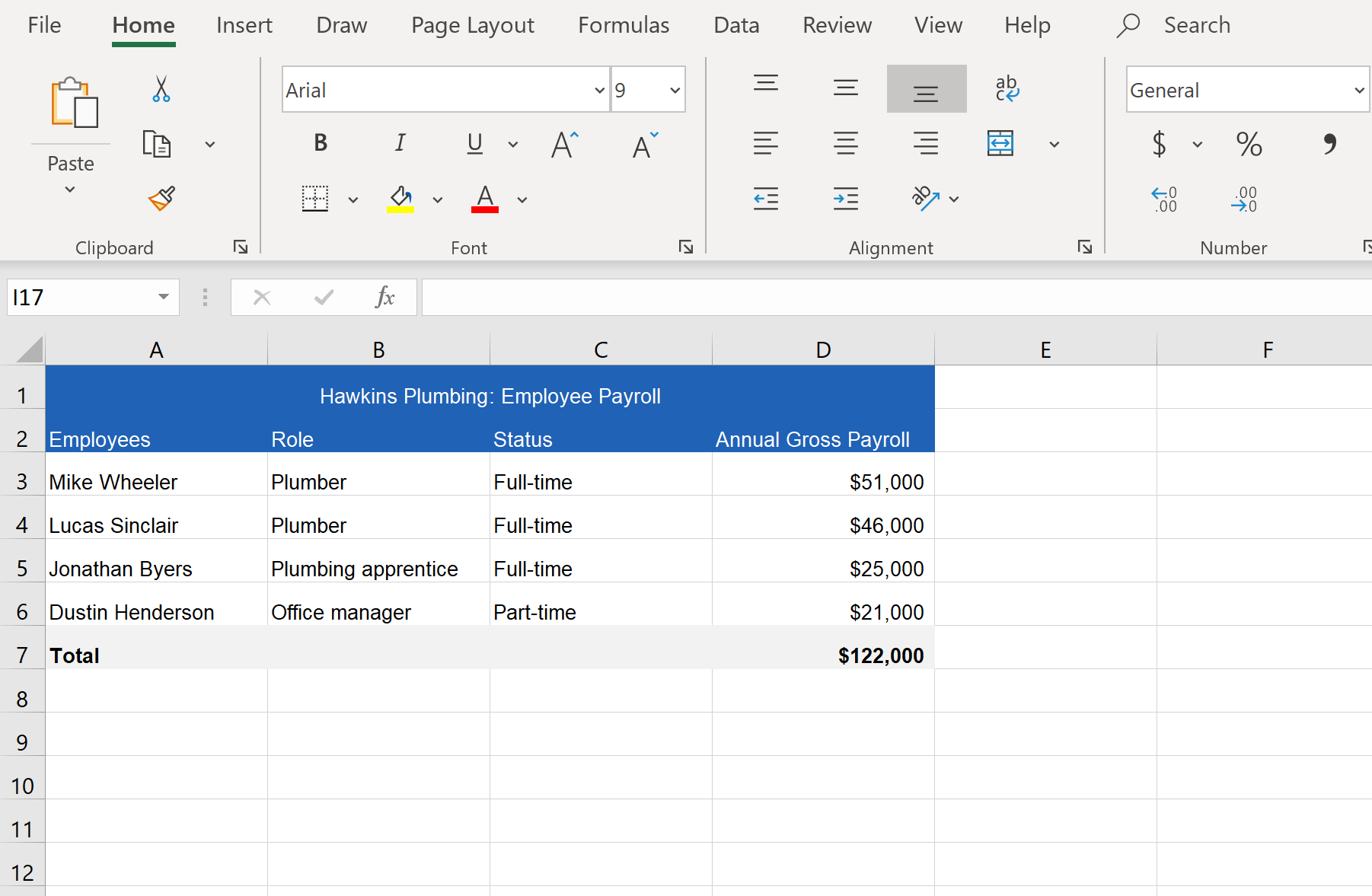

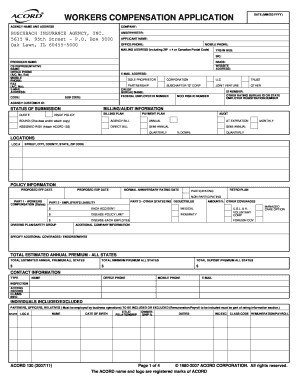

Workers' Comp Audit | Workers' Compensation Audit - The Hartford During a workers' compensation audit, your company's payroll will get verified. Audits look at your payroll because your workers compensation premiums are partly based on the amount of compensation paid to your employees over a policy term. The amount paid includes money and benefits your workers have received. Workers Compensation Documents we need to conduct a work comp audit review Copies of your audit billing statements and all audit worksheets. (At least the last 5 years if available) Copies of your workers compensation policy declaration pages for the current and all past years that correspond with the audit periods in question. NCCI experience modification worksheets for the current and each of the past 5 years.

Workers' Compensation: A Premium Audit Checklist - Spark By Kelly Spors. When your insurer conducts a premium audit, it will ask you for payroll, employee and/or sales and tax records related to your business. That's because the premiums on your workers' compensation and other types of small business insurance policies are based on this information. The insurer will use the information you provide to ...

Workers comp audit worksheet

7 steps to a stress-free New York workers' compensation audit Ask the auditor for the worksheet when the audit session is done, and have your insurance agent review it for accuracy. If you believe there are errors, you have the legal right to ask for a corrected audit. Spending some time preparing for your next workers' compensation audit is a worthwhile investment. Workers Compensation Audit Worksheet Audit Worksheet, This is the actual worksheet the auditor uses to gather and catagorize all the premium generating items from the audit. It generally includes all information regarding your company payroll for the audit period. Many times this worksheet must be requested and is not just attached to your billing statement. Premium Audit | Markel Specialty To contact the Premium Audit department, please call 888-500-3344 and ask for assistance with your premium audit. Or you can email us at auditdepartment@markel.com. Complete audit online, COMPLETE AUDIT ONLINE, Remote physical worksheets, Download forms (PDF) All states (excluding CA) California, Premium audit worksheets, Downloads forms (PDF)

Workers comp audit worksheet. Workers' Compensation Forms and Worksheets - Nevada D-9 (c) Permanent Partial Disability Award Calculation Worksheet for Stress Claims Pursuant to NRS 616c.180 (6/10) D-10 (a) Election of Method of Payment of Compensation (8/21) D-10 (b) Election of Method of Payment of Compensation for Disability Greater Than 30 Percent (8/21) D-11 Reaffirmation - Retraction of Lump Sum Request (8/21) How to Prepare for a Workers Compensation Audit: 15 Steps - wikiHow After the audit, review the auditor's worksheets for errors. Part 1, Gathering Required Records, 1, Ask what you need to provide. You shouldn't volunteer more information than requested. [1] , For this reason, you should ask what documents the auditor needs to see and then gather those documents ahead of time. 2, Collect payroll records. WCB Forms - Maine Complaint for Audit: WCB-320: Application for Evaluation Employment Rehabilitation Services Pursuant to 39-A M.R.S.A. §217(1) WCB-322: Application for Wage Credit Employment Rehabilitation Fund: WCB-400: Complaint for Penalties Pursuant to 39-A §205(3) WCB-410: Complaint for Penalties Pursuant to 39-A §205(4) WCB-420 Frequently Asked Premium Audit Questions - TheZenith A written, detailed description of the issue(s) you are disputing on your audit. If your account was physically audited, review a copy of the auditor's worksheets prior to submitting the dispute. This will enable you to pinpoint what it is you are disputing. To request a copy of the worksheet, use the information above to contact us.

Workers Comp Audit Worksheets - Scott Simmonds Workers Comp Audit Worksheets, September 30, 2009, Ask your insurer to provide you with a copy of the audit worksheet prepared for your most recently expired workers' compensation policy. This document provides the details of how the insurance company determined your final premium. It lists employees, classifications and payrolls. Experience Modification Rate - Emod, X-Mod, EMR Rating The workers comp experience modification worksheet is a summary of claims and losses. It indicates how expected losses compare to actual losses over a period of time. Each year, qualifying businesses will receive a new Emod worksheet about 90 days prior to their Rating Effective Date. Workers Compensation Audit Worksheets in 2021 - Klear.ai Workers Compensation Audit Worksheets are like a tool that the auditor uses to gather all the important information like payroll, classification codes, and independent contractors that are collected from the employer during the audit process. Workers Compensation Audit Worksheets are a blueprint of the data that the auditor has gathered. Download: WORKERS COMPENSATION AUDIT WORKSHEETS in PDF ... PDF Workers' Compensation Audit - Irving Weber Associates, Inc. Designate someone from the company to receive the audit worksheets, as the worksheets contain confidential payroll information. After the Audit Process COMPLETED, Review the audit billing statement carefully and compare that document to your original policy. o Balance the total audited payroll figures to the documentation provided.

MSF - Employer Documents & Forms - Montana State Fund We would like to hear from you. Contact Us. Customer Service. 406-495-5000. MORE CONTACTS Employer's Role in Workers' Comp Claims - NYSIF Employers must file a report of work-related injury or illness with NYSIF immediately upon becoming aware of the injury or illness, and no later than 10 days after the employer’s knowledge of the injury or illness, in all cases where the injury/illness:. Has caused or will cause the employee’s loss of time from regular duties of one day beyond the workday or shift during … Make Payments - Holston Conference of the United Methodist … VIDEO tutorial available to help with completion of this worksheet. Each week/month, complete the worksheet on your computer and then attach it in an e-mail to the treasurer's office. NOTE: This form should be returned with your payment by the 10th of the month following receipt of the funds by the local church. Workers Compensation Audit Rules Employers Need to Understand Please email: AIM@cutcomp.com or call us at 800-288-9256 with questions on disputes, audits, classifications, experience modifiers, or other aspects of Workers Comp premiums and audits. "Thanks to your persistence and effort, we received a refund of over $36,000 from our insurance company."-Polar Tool,

PDF Workers' Compensation Audit - BCG Advisors Workers' Compensation Audit For: Date: Unlike the estimated premium originally used to calculate your workers' compensation insurance premium, an annual premium audit determines the accurate costs for the policy period. ... The contact person should review the prior year's billing statements and auditor's worksheets (if requested in the ...

Workers' Comp Audit Help || Can you ignore a workers' comp audit? Workers' Compensation Audit Worksheet is like a tool that the auditor uses to gather all the information that has been collected from the employer during the audit process. Important information like payroll, classification codes, and independent contractors are included here. It is a blueprint of the data that the auditor has gathered.

PDF Workers Compensation Insurance Participants July 15, 2022 16 Pages - NCLM Please note: Failure to return the audit by December 1 st will result in an estimated audit being processed. The estimated audit will be processed by applying a 25% debit to the payroll listed in your policy. This year your WC Self Audit is in Excel. There is a tab at the bottom of the worksheet for each section of the audit. If

PDF Preparing for your Premium Audit Workers Compensation Policy - Travelers Your Workers Compensation premium audit will require payroll information as well as details on payments to Subcontractors and Contract Labor. Specific information is detailed below and on the next page. Additional information may be found online.

EMR Rating for Contractors – Construction and Bid Contracts Independent Audit Review – It is a contractors payroll audit information that is reported to the rating bureau by the workers compensation insurance company that is used in developing the EMR. The audit provides rating payroll used on the policy and assigned classification codes assigned to the contractor. Incorrect payroll assignment to incorrect class codes will result in …

Workers Comp Excel Audit Spreadsheet Worksheets - K12 Workbook Worksheets are Instructions for using insurance audit spread, Prepare for audit howto kd final, Auditing spread, Workers compensation audit form instructions, Reimbursement procedure for fema public assistance, My workers comp log summary name date of injury, Accounting for accrued workers compensation costs, Form 1 insurance cost information work.

PDF Workers' Compensation: Premium Audit - ICW Group Please use the following most common payroll items as a general guideline for reporting payroll for workers' compensation. Make sure to check below for any exceptions (*) that apply in your state. Report Total Gross Payroll Including: • Vacation and Holiday Pay* • Bonuses* and Commissions • Sick Pay — not paid by a third-party ...

Workers' Comp Insurance Premium Audit | AmTrust Insurance Online Enhancements AmTrust is excited to announce a significant enhancement to our Online Audit Portal. Policyholders with voluntary (online) audits that went to non-cooperative status on or after 3/15/20 can now login to AmTrust Online to complete the audit. There is no need to call the Customer Service Center to unlock access and we will leave access open on non-cooperative …

The Workers Compensation Audit: What It Is & How to Prepare Workers Compensation Audit Results, Once an audit is completed, you'll receive a statement from the carrier outlining the differences between what you paid during the year and the adjusted premium due, based on your actual payroll. Typically, if you have more payroll than originally estimated, there will be an additional premium due.

PDF WORKERS' COMPENSATION AUDIT - DirectWorkComp WORKERS' COMPENSATION AUDIT Presented by Thams Agency Date: Review conducted by: Unlike the estimated premium originally used to calculate your workers' compensation insurance premium, an ... The contact person should review the prior year's billing statements and auditor's worksheets (if requested in the past) to understand the issues ...

Circulars | Workers Compensation | NCRB 01.09.2022 · North Carolina Rate Bureau (NCRB) is a non-profit, unincorporated rating bureau created by the General Assembly of North Carolina under the provisions of Article 36 of Chapter 58 of the General Statutes of North Carolina on September 1, 1977. NCRB provides services and programs for the insurance industry in North Carolina for automobile, property and workers …

PDF Checklist for Worker's Compensation Audit - Great American Insurance ... Checklist for Worker's Compensation Audit, Gathering the necessary information is the first step to submitting your documentation for auditing. To ensure a smooth submission process, be sure to have the following on hand. Please read this document in its entirety to ensure a smooth submission process for your audit. GAIG.com/Audit,

Worker's Comp - Premium Audit - Great American Insurance Group - web Complete your form. Download a Microsoft Excel Spreadsheet (.xlsx) template of the Workers' Compensation Self-Audit form, which you should have also received in the mail. Complete all information requested in the template, with the exception of the signature, and save the file to your computer. You will upload the completed template later.

How To Prepare For Your Workers Comp Audit How to prepare for a workers compensation audit, things you need to know about the workers comp audit process and simple steps you can take to prepare ahead for the auditor and audit. How to prepare for a workers compensation audit, things you need to know about the workers comp audit process and simple steps you can take to prepare ahead for the auditor and audit. …

Workers Compensation Insurance Audit Finally, ask to make a copy of the audit worksheet they prepare. It is not uncommon for auditors to make mistakes on the audit worksheets. Remember, they work for the carrier and most mistakes are in favor of the insurance companies. Audits are a contractual obligation within the workers compensation insurance policy. It is common practice for carriers to add an additional …

10+ Payroll Audit Report Templates in PDF | DOC The audit report might also exhibit that reductions haven't been made for some workers. Payroll audits make sure that your business is maintaining exact, precise records and following appropriate payroll laws. Have a look at the payroll audit report templates provided down below and choose the one that best fits your purpose.

6 Common Mistakes Made In A Workers' Comp Premium Audit "Workers' Comp Claims Review Checklist: 9 Must-Have, Serious-Impact Elements", The Audit, Insurance carriers conduct premium audits to verify a company's payroll for the period during which it provided coverage. It occurs after the policy expires to determine the accuracy of the payrolls for that year to see if the premium must be adjusted.

What is a Workers' Compensation audit? | NEXT Why is a Workers' Compensation audit needed? When you purchase workers' comp, you are asked to share an estimate of your total payroll and the primary types of work your employees will do while the policy is active. Insurance providers use this estimate to help determine workers' comp insurance costs. However, predicting a year's payroll is hard.

How to Prepare for Workers' Compensation Audit Workers' Compensation Audit Tips. Preparing for a workers' compensation audit can seem daunting, but coming prepared can save you time and effort. Remember to thoroughly review any worksheets that your auditor prepares, and engage them during the process, asking any questions that you may have. Follow the below tips to help your audit go as ...

Premium Audit | Markel Specialty To contact the Premium Audit department, please call 888-500-3344 and ask for assistance with your premium audit. Or you can email us at auditdepartment@markel.com. Complete audit online, COMPLETE AUDIT ONLINE, Remote physical worksheets, Download forms (PDF) All states (excluding CA) California, Premium audit worksheets, Downloads forms (PDF)

Workers Compensation Audit Worksheet Audit Worksheet, This is the actual worksheet the auditor uses to gather and catagorize all the premium generating items from the audit. It generally includes all information regarding your company payroll for the audit period. Many times this worksheet must be requested and is not just attached to your billing statement.

7 steps to a stress-free New York workers' compensation audit Ask the auditor for the worksheet when the audit session is done, and have your insurance agent review it for accuracy. If you believe there are errors, you have the legal right to ask for a corrected audit. Spending some time preparing for your next workers' compensation audit is a worthwhile investment.

![How to Prepare for Workers' Comp Audits in 4 Steps [+Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2020/05/word-image-20.jpeg)

/an-industrial-warehouse-workplace-safety-topic--a-worker-injured-falling-or-being-struck-by-a-forklift--1163443516-7409310367d9438b91d3e0e057ff118e.jpg)

0 Response to "38 workers comp audit worksheet"

Post a Comment