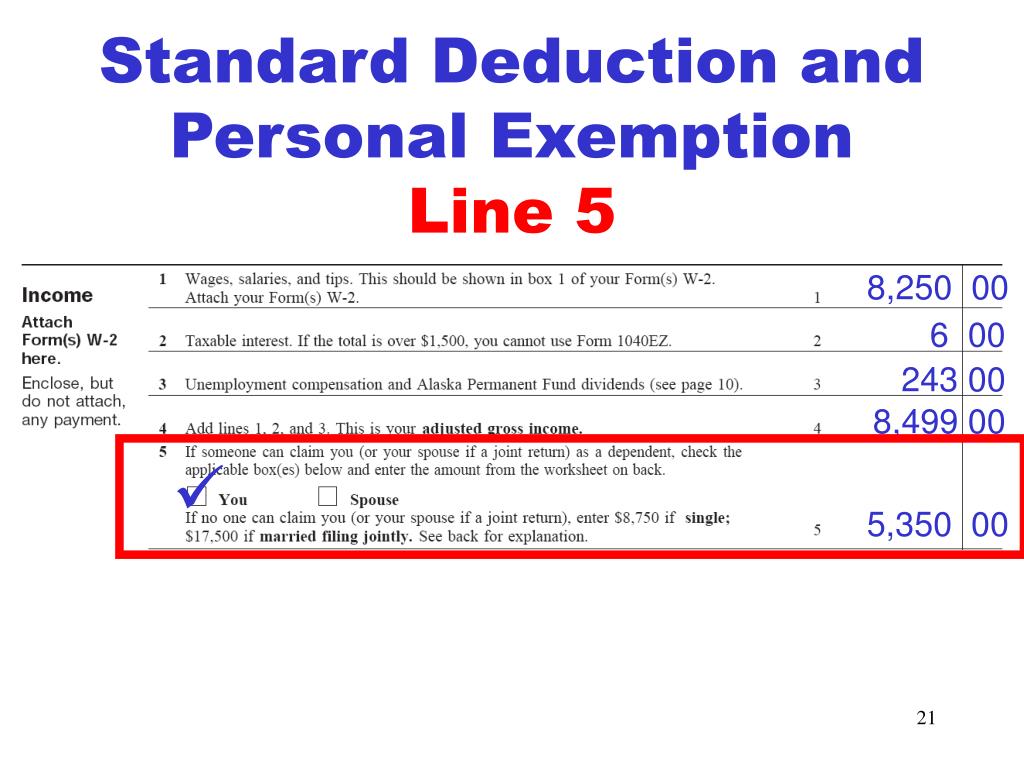

38 1040ez worksheet for line 5

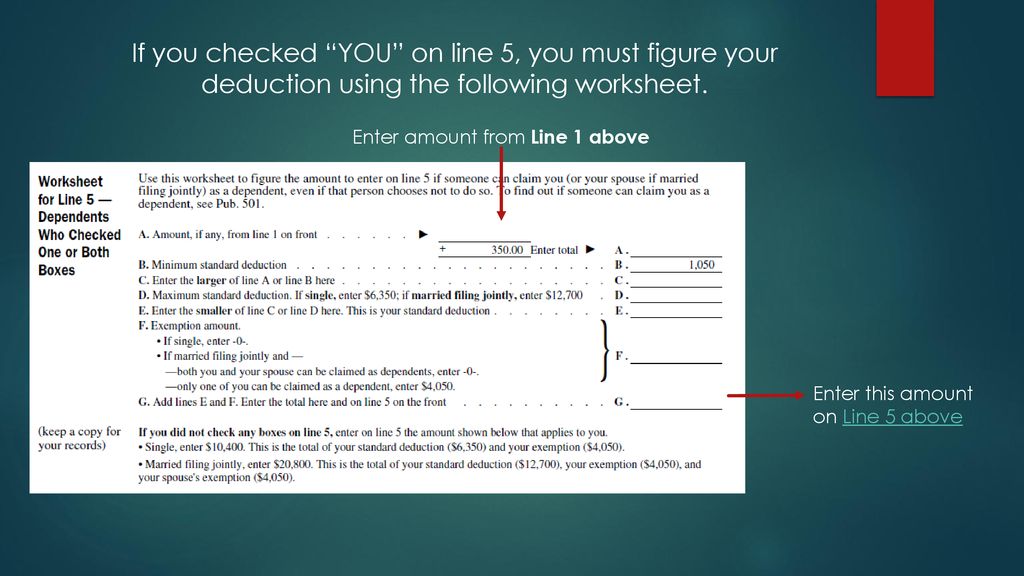

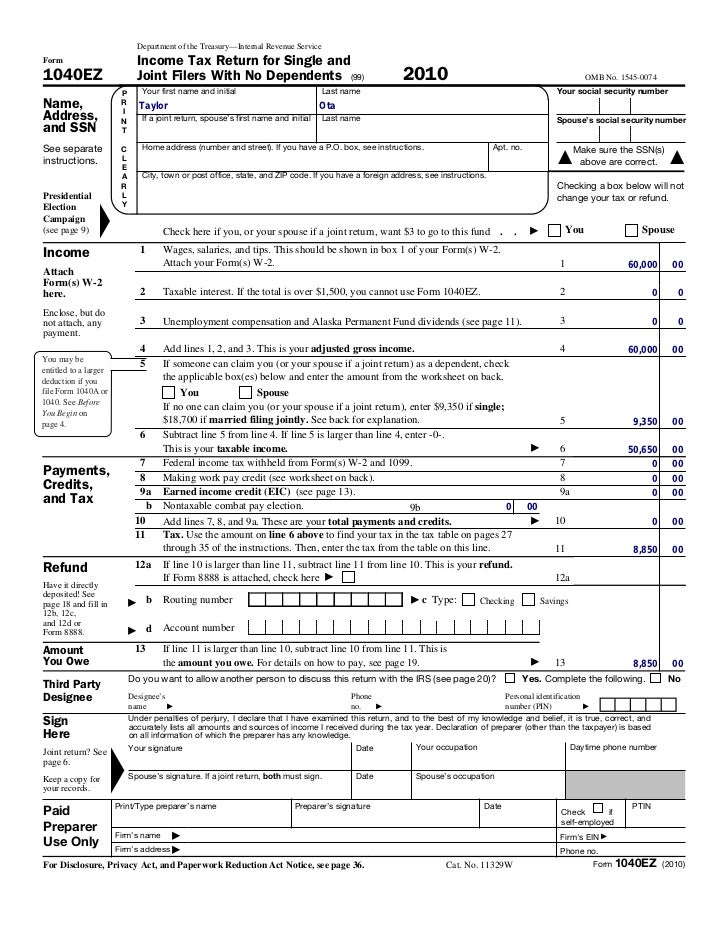

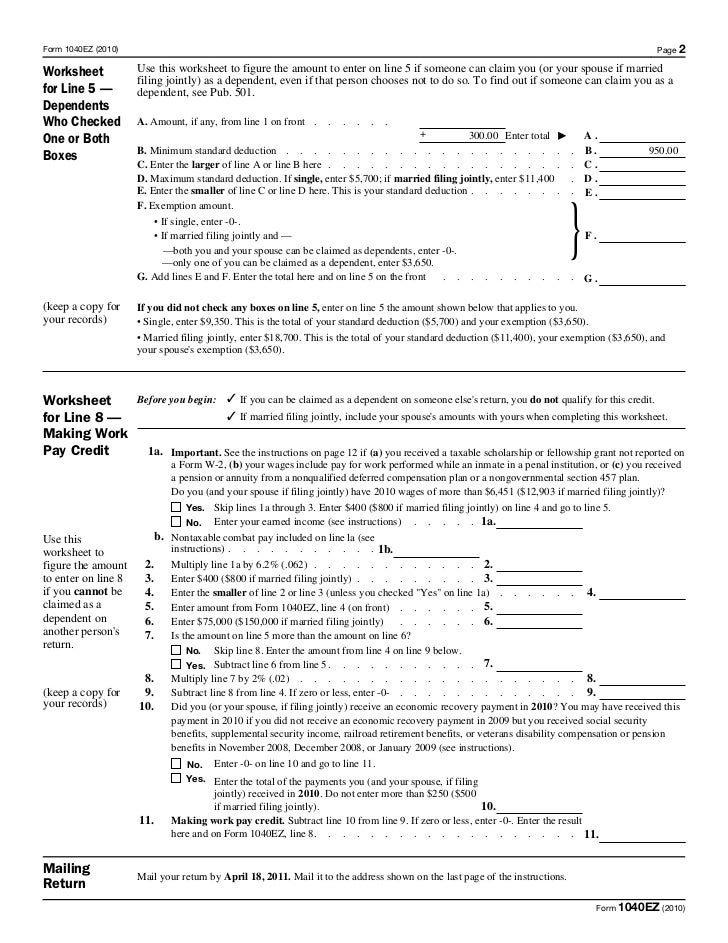

PDF 2017 Form 1040EZ - Classroomtools Worksheet for Line 5 — Dependents Who Checked One or Both Boxes (keep a copy for your records) Use this worksheet to figure the amount to enter on line 5 if someone can claim you (or your spouse if married filing jointly) as a dependent, even if that person chooses not to do so. To find out if someone can claim you as a dependent, see Pub. 501. A. 2016 Form 1040EZ 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,350 if . single; $20,700 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

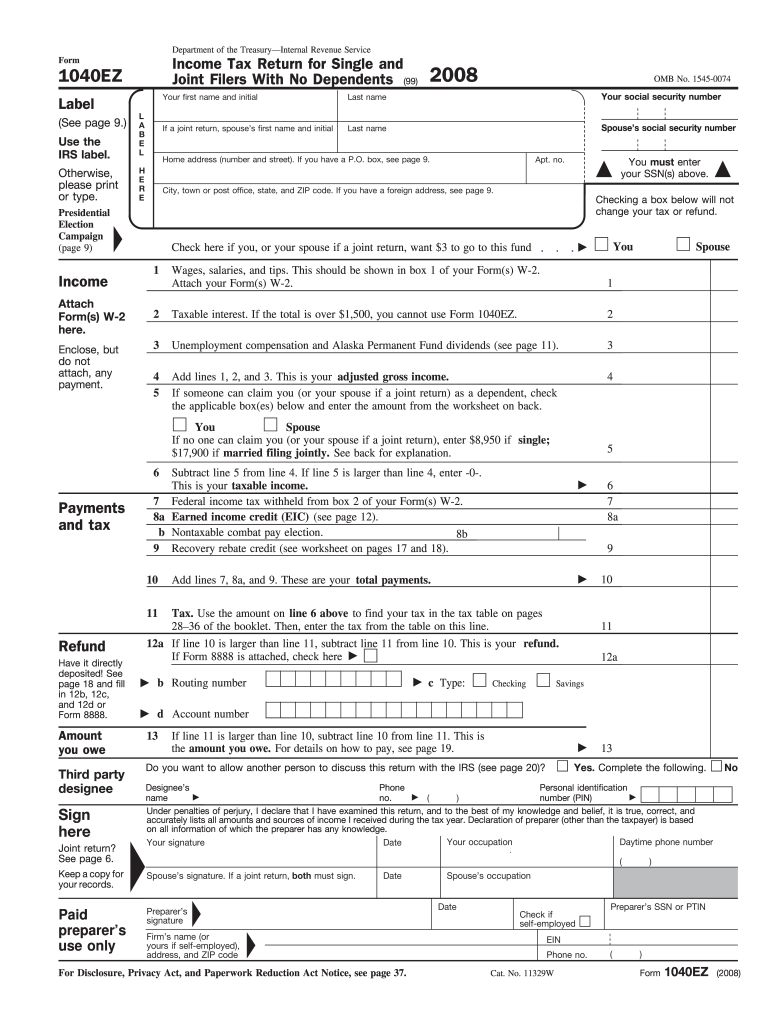

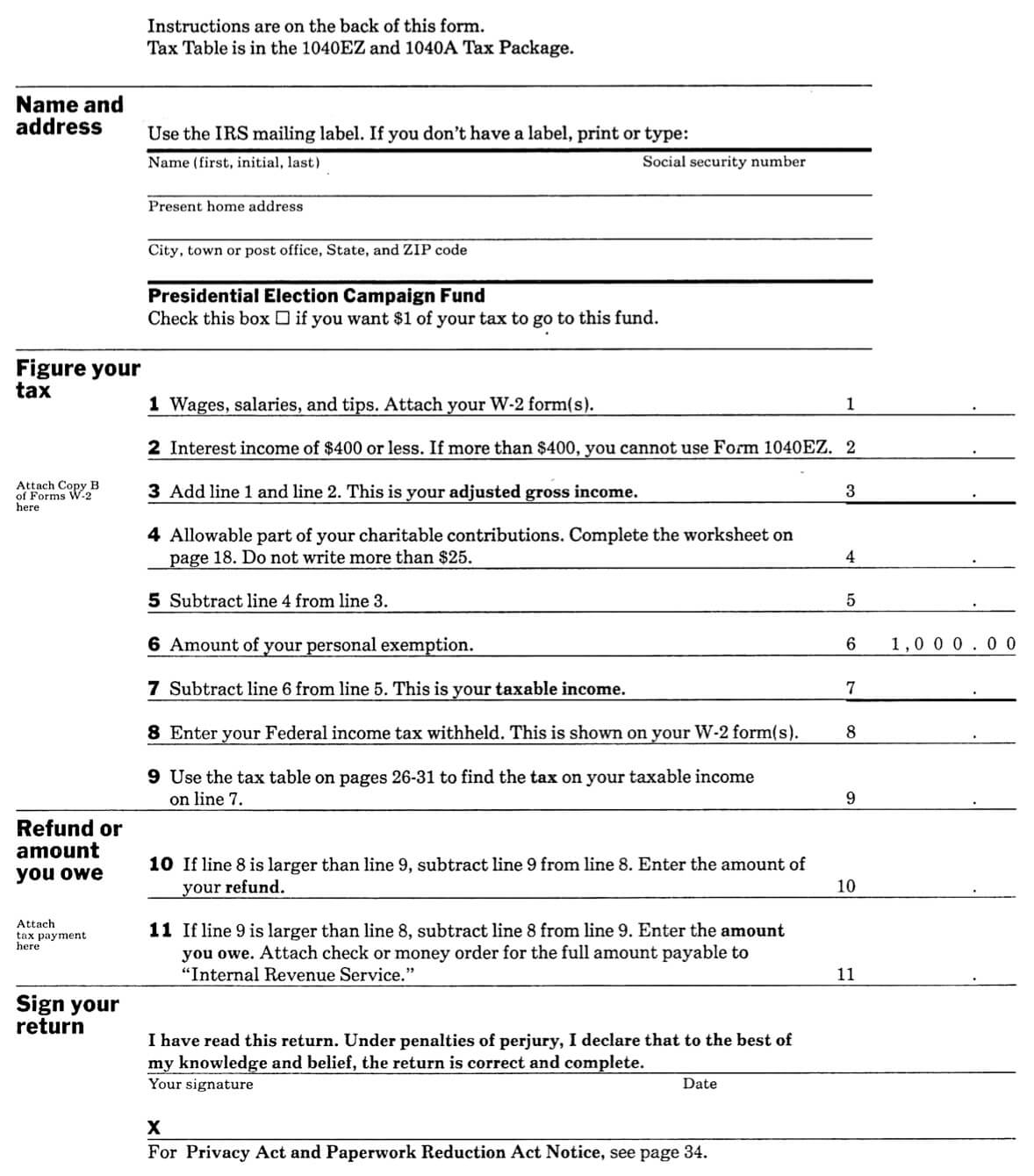

How to Fill Out a US 1040EZ Tax Return (with Pictures) - wikiHow Subtract line 5 from line 4 and enter that amount on line 6. If line 5 is larger than line 4, enter 0 (zero) on line 6. This is your taxable income. If the amount is more than $100,000, you can't use the 1040EZ and must file either form 1040 or 1040A. Part 4 Completing the Payments, Credits and Tax Section Download Article 1

1040ez worksheet for line 5

PDF DRAFT AS OF - IRS tax forms 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,150 if single; $20,300 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ... line f ez worksheet 9 Best Images Of EZ Math Worksheets - 2013 1040EZ Worksheet Line 5, IRS worksheet line 1040ez ez worksheets math worksheeto federal via .com (Worksheetfun) On Pinterest tracing line worksheetfun pins 1040ez Line F Worksheet formulaf1results.blogspot.com fresh 1040ez Maryland Tax Form 502 Instructions | eSmart Tax 1040EZ: line 1: line 37: line 21: line 4: line 1a: line 7: line 7: line 1: line 1b: See Below: line 7: line 1: Line 1b. If you are claiming a federal earned income credit (EIC), or poverty level credit (PLC), enter the earned income you used to calculate your credit. ... Copy the amount from line 5 of the worksheet onto line 10 of Form 502.

1040ez worksheet for line 5. tax.ohio.gov › static › formsINSTRUCTIONS ONLY • NO RETURNS • - Ohio Department of ... If you have any questions or need assistance with your return, you can contact our Taxpayer Assistance line at 1-800-282- 1780, or click on ‘Contact Us’ at tax.ohio.gov . Best wishes, › taxes › guide-to-form-1040Form 1040: Your Complete 2021 & 2022 Guide - Policygenius Dec 22, 2021 · Line 21 asks you to add your child tax credit (line 19) and your Schedule 3 credits (line 20). Line 22 instructs you to subtract line 21 (your total tax credits) from line 18 (additional taxes you may owe). Line 23 requires you to write in certain other additional taxes you paid, like self-employment tax, as found on Schedule 2, line 21. How to Calculate Capital Gains Tax | H&R Block Note: Gains on the sale of collectibles (rental real estate income, collectibles, antiques, works of art, and stamps) are taxed at a maximum rate of 28%. More help with capital gains calculations and tax rates . In most cases, you’ll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Form 1040 - Wikipedia Form 1040 (officially, the "U.S. Individual Income Tax Return") is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. Income tax returns for individual calendar year taxpayers are due by Tax Day, …

INSTRUCTIONS ONLY • NO RETURNS • - Ohio Department of … Need Help? – To help answer your questions and ensure that your tax returns are filed accurately, the Department of Taxation provides the following resources at tax.ohio.gov: Additionally, the website has all individual income and school district income tax forms for you to download or print. 2020 Instructions for Form 540 2EZ Personal Income Tax Booklet - California The maximum amount of credit allowable for a qualified taxpayer is $1,000. The credit amount phases out as earned income exceeds the "threshold amount" of $25,000, and completely phases out at $30,000. For more information, see the instructions for line 24 of Form 540 2EZ, and get form FTB 3514. PDF 1040EZ • Federal Form • Federal Form 13 Tax Computation Worksheet (Keep this worksheet for your records.) A Taxable Income: Print the amount from Form IT-540B, Line 11. A 00 B First Bracket: If Line A is greater than $12,500 ($25,000 if filing status is 2 or 5), print $12,500 ($25,000 if fil- ing status is 2 or 5). If Line A is less than $12,500 ($25,000 if filing status is 2 or 5), enter amount from Line A. What Is Line 5a on IRS Form 1040? - The Balance Line 5a on Form 1040 or 1040-SR is for the total amount of pension and annuity payments you received during the tax year. You calculate that figure by adding up the amounts in box 1 of any Forms 1099-R you received from financial service providers. Leave line 5a blank if your pension and annuity payments were fully taxable.

pdf.wondershare.com › pdf-forms › fill-in-irs-form-wIRS Form W-4P: Fill it out in an Efficient Way - PDFelement Sep 06, 2022 · The employer will take care of the estimated tax payment of the employee by withholding money from the employee's paycheck based on their W-4.If you are a receiver of pensions, annuities and other deferred compensation, you are expected to use the IRS Form W-4P to tell the payers the correct amount to be withheld from your federal income tax. PDF NJ Alternative Financial Aid Application - hesaa.org On the 1040EZ, if a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. If a person checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,950 equals one exemption). 2021 1040 Form and Instructions (Long Form) - Income Tax Pro For the 2021 tax year, federal tax form 1040, US Individual Income Tax Return, must be postmarked by April 18, 2022 . Federal income taxes due are based on the calendar year January 1, 2021 through December 31, 2021. Prior year federal tax forms, instructions, and schedules are also available, and should be mailed as soon as possible if late. 2017 Form 1040EZ 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,400 if . single; $20,800 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

PDF Sample - Do not submit On the 1040EZ, if a person checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,500 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. Notes for questions 42 and 43 (page 4) and 92 and 93 (page 7)

How to Fill Out Form 1040EZ | 1-800Accountant Line 5 For line 5, refer to the worksheet on page 2 of your Form 1040EZ if someone can claim you or your spouse as a dependent. The worksheet will tell you what amount you should put down on line 5. Otherwise, enter $12,200 if you're a single filer or $24,400 if you're a joint filer. This is the standard deduction.

PDF Do not use staples. 2012 - Ohio Department of Taxation IT 1040EZ Individual Income Tax Return for Full-Year Ohio Residents Rev. 10/12 Filing Status - Check one (as reported on federal income tax return) Married fi ling jointly Single or head of household or qualifying widow(er) Married fi ling separately (enter spouse's SS#) Do you want $1 to go to this fund? ..........................................

IRS Form W-4P: Fill it out in an Efficient Way - Wondershare … 6.9.2022 · The employer will take care of the estimated tax payment of the employee by withholding money from the employee's paycheck based on their W-4.If you are a receiver of pensions, annuities and other deferred compensation, you are expected to use the IRS Form W-4P to tell the payers the correct amount to be withheld from your federal income tax.

IRS Form 1040EZ - See 2022 Eligibility & Instructions - SmartAsset On Line 4, add lines 1, 2 and 3 to get your Adjusted Gross Income (AGI). On Line 5, indicate whether someone can claim you (or your spouse if you're filing a joint return) as a dependent. If so, check the applicable box(es) and enter the amount from the worksheet on the back of Form 1040EZ.

How do I request an IRS Verification of Non-Filing Letter? There are three different questions on the FAFSA regarding being an unaccompanied homeless youth. The determination that you meet the definition of an unaccompanied homeless youth must be provided in writing by your high school or school district homeless liaison, a director of a homeless shelter or transitional housing program funded by HUD, or a director of a runaway or …

1040 (2021) | Internal Revenue Service - IRS tax forms Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments. Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099; Line 25c—Other Forms; Line 26. 2021 ...

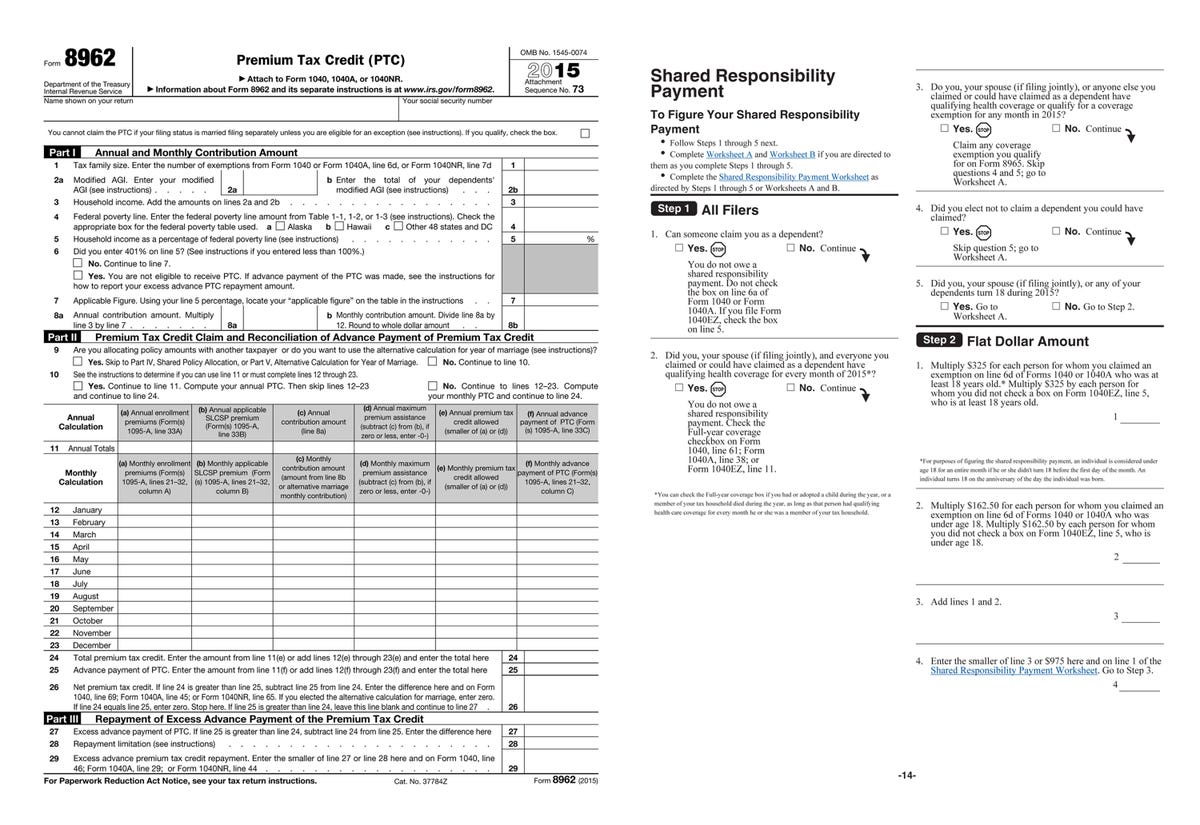

› financial-aid › questionHow do I request an IRS Verification of Non-Filing Letter? Per federal regulations copies of tax returns (IRS Forms 1040, 1040A, and 1040EZ) cannot be accepted to verify tax information. You must provide copies of your and/or your parent(s) 2015 tax return transcript(s) obtained from the IRS.

2019 Instructions for Form 540 2EZ Personal Income Tax Booklet - California The maximum amount of credit allowable for a qualified taxpayer is $1,000. The credit amount phases out as earned income exceeds the "threshold amount" of $25,000, and completely phases out at $30,000. For more information, see the instructions for line 24 of Form 540 2EZ, California Resident Income Tax Return and get form FTB 3514 ...

PDF 2014 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,150 if . single; $20,300 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

Schedule 8812 Line 5 Worksheet - Intuit There is no Line 5 worksheet to be found anywhere. The worksheet is used to determine the child tax credit amount based on income limitations, so it's a key worksheet to have available. 1 35 6,504 Reply 35 Replies JohnB5677 Expert Alumni March 14, 2022 10:32 AM I agree that I cannot find the "Line 5 Worksheet" in TurboTax. I have passed this along.

Line-by-Line Help Free File Fillable Forms - IRS tax forms Line 5b is a manual entry in the column. It also has an associated dropdown menu to the left of the column. Enter your taxable Pensions and Annuities in the right column (5b). If your Pensions and Annuities were not fully taxable use the dropdown menu to enter the code. Review the form instructions regarding line 5b codes.

› tax-forms › maryland-form-502Maryland Tax Form 502 Instructions | eSmart Tax 4. Enter the amount from line 1 or 2, whichever is larger Compare lines 3 and 4. If line 4 is greater than or equal to line 3, STOP HERE. You do not qualify for this credit. If line 3 is greater than Line 4, continue to Line 5. _____ 5. Multiply line 2 by 5% (.05). This is your State Poverty Level Credit.

2021 1040EZ Form and Instructions (1040-EZ, Easy Form) - Income Tax Pro Prior year 1040EZ tax forms and instructions may still be printed using the links below on this page. File Form 1040EZ if you meet these requirements: Filing status is single or married filing jointly. No dependents to claim. You and your spouse were under age 65 and not blind. Taxable interest income of $1,500 or less.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... The 2019 W-4 Worksheet, Line by Line. ... W-4 Line 5. Use W-4 line 5 to indicate the total number of allowances you're claiming (from the applicable worksheet on the following pages). ... Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of ...

Child Tax Credit Form 8812 Line 5 worksheet - Intuit Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned income less $2,500. The result is your additional child tax credit up to the maximum potential credit on Line 5 of Schedule 8812. **Say "Thanks" by clicking the thumb icon in a post.

Screen FAFSA - Federal Student Aid Application Information (1040) Select Setup > 1040 Individual > Other Return Options > Other tab, and mark the box for Calculate FAFSA earnings from work per the Expected Family Contribution Worksheet to use that method (W-2 box 5 + line A.4 or B.6 of Schedule SE) General Information Use this section to indicate how the FAFSA Worksheet will calculate.

Form 1040-EZ: Step-by-Step Instructions | Free PDF | FormSwift The 1040EZ only allows a person to record wages, salaries, tips, taxable interest under $1,500, and unemployment compensation payments. The 1040 Form contains more types of income such as dividend payments, retirement account distributions, farm and rental income, Social Security benefits, and alimony.

PDF Do not use staples. 2013 Refund less interest and penalty (line 21 minus line 23). Enter the amount here. (If line 23 is more than line 21, you have an amount due. Subtract line 21 from line 23 and enter this amount on line 24.) ......... YOUR REFUND 25. If your refund is $1.00 or less, no refund will be issued. If you owe $1.00 or less, no payment is necessary. IT 1040EZ

Federal Income Tax 1040EZ Taxes Worksheet, Lesson Plan - Money Instructor Give an introductory lesson about paying taxes to your students. Hand out the 1040EZ form to the students and explain to them each of the lines on the form. Also explain some terms such as IRS, W-2, Gross Income, etc. As you walk through the form, explain that you start with money earned, and then calculate taxes based on the money earned.

› pub › irs-prior2016 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,350 if . single; $20,700 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

Claiming A Charitable Donation Without A Receipt | H&R Block Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income ... H&R Block Emerald Advance® line of credit, H&R Block Emerald Savings® and H&R Block Emerald Prepaid Mastercard® are offered by MetaBank®, N.A., Member FDIC.

› pub › irs-prior2017 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,400 if . single; $20,800 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ...

Form 1040: Your Complete 2021 & 2022 Guide - Policygenius 22.12.2021 · Line 21 asks you to add your child tax credit (line 19) and your Schedule 3 credits (line 20). Line 22 instructs you to subtract line 21 (your total tax credits) from line 18 (additional taxes you may owe). Line 23 requires you to write in certain other additional taxes you paid, like self-employment tax, as found on Schedule 2, line 21.

Maryland Tax Form 502 Instructions | eSmart Tax 1040EZ: line 1: line 37: line 21: line 4: line 1a: line 7: line 7: line 1: line 1b: See Below: line 7: line 1: Line 1b. If you are claiming a federal earned income credit (EIC), or poverty level credit (PLC), enter the earned income you used to calculate your credit. ... Copy the amount from line 5 of the worksheet onto line 10 of Form 502.

line f ez worksheet 9 Best Images Of EZ Math Worksheets - 2013 1040EZ Worksheet Line 5, IRS worksheet line 1040ez ez worksheets math worksheeto federal via .com (Worksheetfun) On Pinterest tracing line worksheetfun pins 1040ez Line F Worksheet formulaf1results.blogspot.com fresh 1040ez

PDF DRAFT AS OF - IRS tax forms 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,150 if single; $20,300 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ...

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "38 1040ez worksheet for line 5"

Post a Comment