40 affordable care act worksheet form

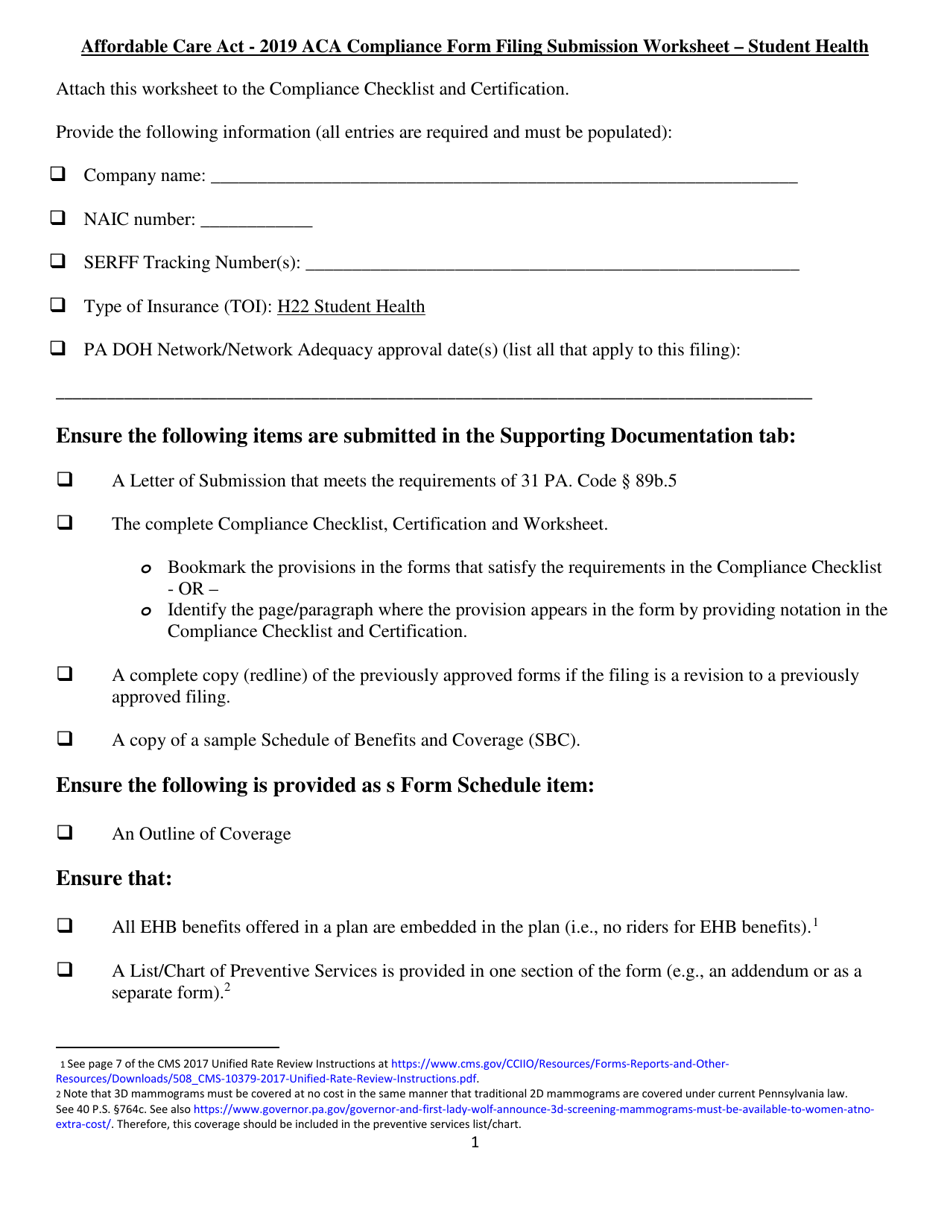

Other Resources | CMS Forms Summary of Benefits and Coverage (SBC) Template Standard Format (DOC) (DOC) Accessible Format (PDF) (PDF) Chinese Standard Format (DOCX) (DOC) Chinese Accessible Format (PDF) (PDF) Spanish Standard Format (DOCX) (DOC) Spanish Accessible Format (PDF) (PDF) Tagalog Standard Format (DOCX) (DOC) Tagalog Accessible Format (PDF) (PDF) PDF Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet 1 Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. Company name: _____________________________________________________________ 2. NAIC number: ____________ 3.

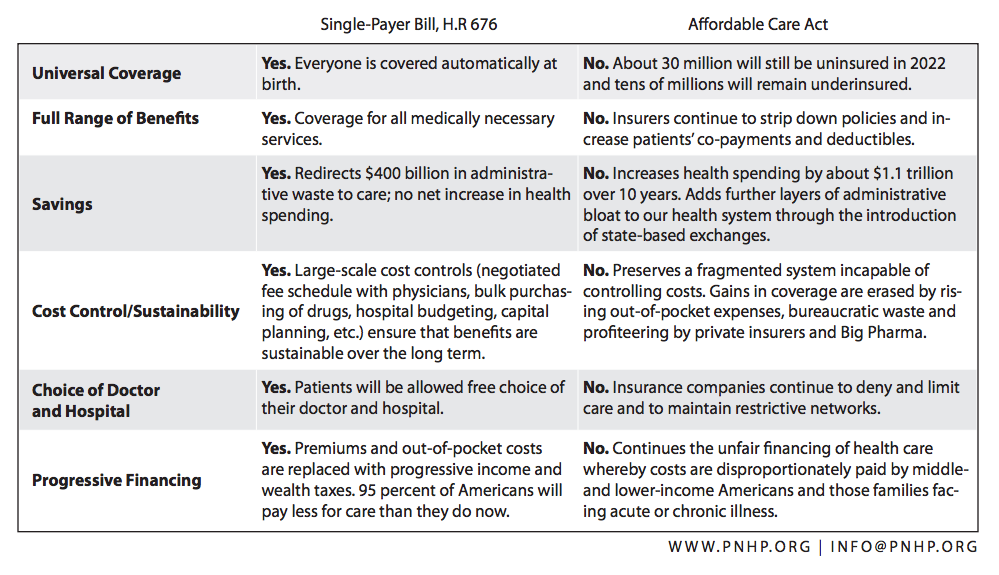

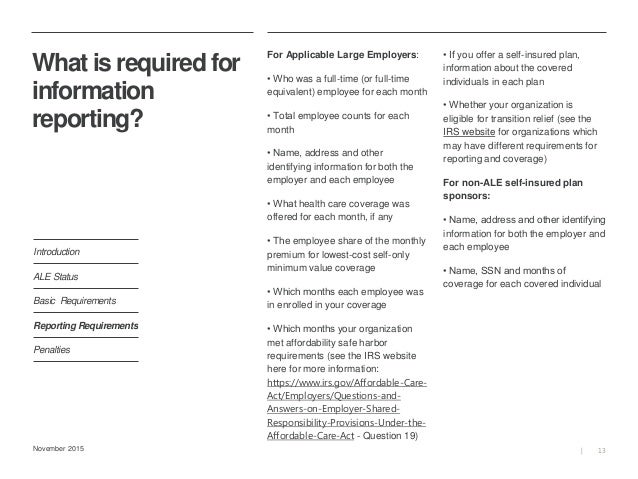

Affordable Care Act | Internal Revenue Service - IRS tax forms Employers The Affordable Care Act includes requirements for employers regarding health care coverage. The size and structure of your workforce determines your responsibility. If you don't have employees, the information doesn't apply to you. Affordable Care Act Forms, Letters and Publications Form 8962, Premium Tax Credit PDF

Affordable care act worksheet form

PDF Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is ... The form includes information about the coverage, who was covered, and when. Affordable Care Act | U.S. Department of Labor - DOL Affordable Care Act; Dependent Coverage; Mental Health and Substance Use Disorder Benefits; Health Benefits Compliance Assistance; ... Forms; Form 5500; Delinquent Filer Voluntary Compliance Program (DFVCP) Audit Quality; Form M-1; Form PR; Compliance Assistance. Educational Seminars and Webinars; Affordable Care Act FAQs (1040) - Thomson Reuters Does the Client Organizer questionnaire include questions related to the Affordable Care Act? What are Forms 1095-A, 1095-B, and 1095-C? Why is Form ACA Cr-2, Health Insurance Marketplace Statement, printing with my Client Organizer? ... and/or the Health Care: Individual Responsibility Worksheet? How can I request a waiver of Form 2210 ...

Affordable care act worksheet form. PDF OR State of Oregon Affordable Care Act (ACA) Newly Hired Temporary Employee Offer of Coverage Worksheet This worksheet is used to document the agency's reasonable expectations regarding the "full-time" status of a newly hired temporary employee. PLACE A COPY OF THIS COMPLETED FORM IN THE EMPLOYEE FILE 1.AGENCY NAME: 2. EMPLOYEE NAME: 2. Affordable Care Act Estimator Tools | Internal Revenue Service To determine the payment when you file your tax return, use the Shared Responsibility Payment Worksheet (Obsolete) in the instructions for Form 8965. Employers The Employer Shared Responsibility Provision Estimator can help employers understand how the provision works and how it may apply. PDF Average Total Number of Employees (ATNE) Worksheet - QualChoice Average Total Number of Employees (ATNE) Worksheet P.O. Box 25610 | L ittle R ock, AR 72211 | 501.228.7111 | 800.235.7111 | QualChoice.com The size of an employer group determines benefit design and Center for Medicare & Medicaid Services reporting ... The Patient Protection and Affordable Care Act (PPACA) defines the number of employees as ... How To Calculate ACA FT and FTE | The ACA Times The members of the group must count the full-time and full-time equivalent employees of all members of the group for each month of the prior year, and calculate the average number of FT and FTE employers for the year. For example, if three firms are jointly owned, with one on average having 20 full-time employees during the year, another having ...

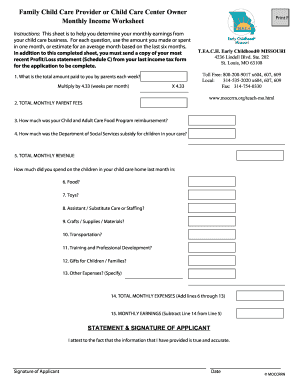

Reporting self-employment income to the Marketplace When you fill out your application and select "self-employment," you'll describe the kind of work you do. There's no special format - just describe the work. If you clean houses, enter "house cleaning." If you make jewelry, enter "jewelry making." If you work on construction projects, enter "construction." Viewpoint Help - Setup - Affordable Care Act Setup Getting Ready for the Affordable Care Act One of the requirements of the Affordable Care Act is that large employers file a Form 1095-C. Viewpoint recommends gathering this information throughout the course of the year, rather than waiting until the Form 1095-C due date. Key data and information required to fill out the 1095-C 1040-US: Affordable Care Act - Form 1095-A, 1095-B, and 1095-C overview Form 1095-A is the reporting document for health insurance purchased through the Health Insurance Marketplace. Each person who, at the time of enrollment, expected to file a tax return and enrolled in a qualified health plan through the Health Insurance Marketplace will receive Form 1095-A or a similar statement for each policy. PDF Affordable Care Act Worksheet - Cordell Neher & Company, PLLC Affordable Care Act Worksheet Are you required to comply with the Act? How many employees does your Company employ: 200 or more fulltime (FT) employees. (Continue to Step 2. You are required to comply with the Act and must automatically enroll all FT employees in health insurance.)

XLSX Washington State Health Care Authority Worksheet Reminders FOR AGENCY USE ONLY 1. Federal Reporting Requirements ... (Affordable Care Act) The Affordable Care Act (ACA) requires employers to determine the anticipated average hours of service of new and returning employees and employees who experience a change in employment status. The employer may be required to enter the ACA code ... Form 8965 - Affordability Worksheet - Support Step One in completing the Affordability Worksheet is to calculate the Affordability Threshold which is 8.16% of Household Income.the tax program will automatically pull into the Household Income calculation all amounts that have been previously entered into the tax return on behalf of the taxpayer and/or spouse. Essential Tax Forms for the Affordable Care Act (ACA) The Affordable Care Act (ACA), also referred to as Obamacare, affects how millions of Americans will prepare their taxes in the new year. The Internal Revenue Service (IRS) has introduced a number of essential tax forms to accommodate the ACA: Form 1095-A, Form 1095-B, Form 1095-C, and Form 8962. TABLE OF CONTENTS The 1095 series for information Modified Adjusted Gross Income under the Affordable Care Act - UPDATED ... The Affordable Care Act definition of MAGI under the Internal Revenue Code [2] and federal Medicaid regulations [3] is shown below. For most individuals who apply for health coverage under the Affordable Care Act, MAGI is equal to Adjusted Gross Income. This document summarizes relevant federal regulations; it is not personalized tax or legal ...

PDF Affordable Care Act - 2019 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2019 ACA Compliance Form Filing Submission Worksheet Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): ... List the form numbers of all forms that are being submitted with the filing: 1 https: ...

PDF LI Worksheet NVstates - Affordable Connectivity Need help? Call the Affordable Connectivity Support Center at 1-877-384-2575 What this worksheet is for Use this worksheet if someone else at your address gets the Affordable Connectivity Program (ACP) benefit. The answers to these questions will help you find out if there is more than one household at your address. What is a household?

PDF Affordable Care Act (ACA) Notification Checklist Affordable Care Act, you may be eligible for a tax credit.1 Note: If you purchase a health plan through Covered California instead of accepting health coverage offered by your employer, then you may lose the employer contribution (if any) to the employer-offered coverage. Also, this employer contribution -as well as your employee

Affordable Care Act - Tax Guide • 1040.com - File Your Taxes Online Form 1095-A shows monthly coverage from the Health Insurance Marketplace and qualifies you for the Premium Tax Credit Form 1095-B shows monthly coverage from your healthcare provider Form 1095-C shows monthly coverage from some employer-provided insurance Some taxpayers may receive multiple forms, depending on when and how they were insured.

Affordable Care Act - Oregon VITA & Taxaide Affordable Care Act Select the appropriate year for associated forms, worksheets, instructions, and tools. ... How-To's. What: 2019: 2018 When Cols B&C are blank on 1095-A: PDF: PDF What to put in Schedule A Medical: PDF: PDF Form 1095-A: Health Insurance Marketplace Statement:

Affordable Care Act Worksheet | Worksheet for Education - Pinterest Dec 31, 2020 - Affordable Care Act Worksheet. Affordable Care Act Worksheet. Affordable Care Act Worksheet

Affordable Care Act PSID Configuration Ceridian provides an ACA PSID Configuration worksheet to assist in gather the information you need to file Form 1094-C with the IRS and preparation for entering the fields on the Affordable Care Act PSID Configuration page. To enter or change Form 1094-C information for a PSID Open the Affordable Care Act PSID Configuration page. How?

PDF Application for Health Coverage and Help Paying Costs Form Approved OMB No. 0938-1191 Application for Health Coverage & Help Paying Costs Apply faster online at . HealthCare.gov Use this application • Marketplace plans that offer comprehensive coverage to help you stay well. to see what coverage • A tax credit that can immediately help lower your premiums for health coverage. you qualify for •

Health Insurance Care Tax Forms, Instructions & Tools Form 8962, Premium Tax Credit (PDF, 110 KB) Form 8962 instructions (PDF, 348 KB) Form 1095-A, Health Insurance Marketplace® Statement This form includes details about the Marketplace insurance you and household members had in 2021. You'll need it to complete Form 8962, Premium Tax Credit.

PDF Affordable Care Act - IRS tax forms Affordable Care Act . Time Required: 15 minutes . Introduction Objectives Topics The lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn ... and TIN on the Form 1040 or Form 1040-NR the taxpayer files for the year. Family coverage: Health insurance that covers more than one individual.

PDF Affordable Care Act Notification Checklist - California Health Benefits Plan Enrollment Form (HBD-12) Date ProvidedDepartment Representative Human Resources Office use Only I certify that data stated herein is correct, complete, and in accordance with all laws and regulations. Department/Agency Name Contact Number HR Representative Printed Name HR Representative Signature Date

Affordable Care Act FAQs (1040) - Thomson Reuters Does the Client Organizer questionnaire include questions related to the Affordable Care Act? What are Forms 1095-A, 1095-B, and 1095-C? Why is Form ACA Cr-2, Health Insurance Marketplace Statement, printing with my Client Organizer? ... and/or the Health Care: Individual Responsibility Worksheet? How can I request a waiver of Form 2210 ...

Affordable Care Act | U.S. Department of Labor - DOL Affordable Care Act; Dependent Coverage; Mental Health and Substance Use Disorder Benefits; Health Benefits Compliance Assistance; ... Forms; Form 5500; Delinquent Filer Voluntary Compliance Program (DFVCP) Audit Quality; Form M-1; Form PR; Compliance Assistance. Educational Seminars and Webinars;

PDF Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is ... The form includes information about the coverage, who was covered, and when.

0 Response to "40 affordable care act worksheet form"

Post a Comment