43 trucker tax deduction worksheet

Common questions on the Asset Entry Worksheet in ProSeries See the Completing the Car and Truck Expenses Worksheet in ProSeries for vehicle depreciation. Creating an asset entry worksheet: Open the client return. Press F6 bring up the Open Forms. Type DEE to highlight Depr Entry Wks and click OK. To create a new asset under Create new copy enter the description of the asset and click Next. A Mechanic's Guide to Tax Deductions - TurboTax For tax years after 2017, the maximum amount for this deduction is $1 million. This maximum gets adjusted for inflation starting in 2019. The limit rose to $1,020,000 for 2019, $1,040,000 for 2020, and $1,050,000 for 2021. Other limitations or exceptions may also apply.

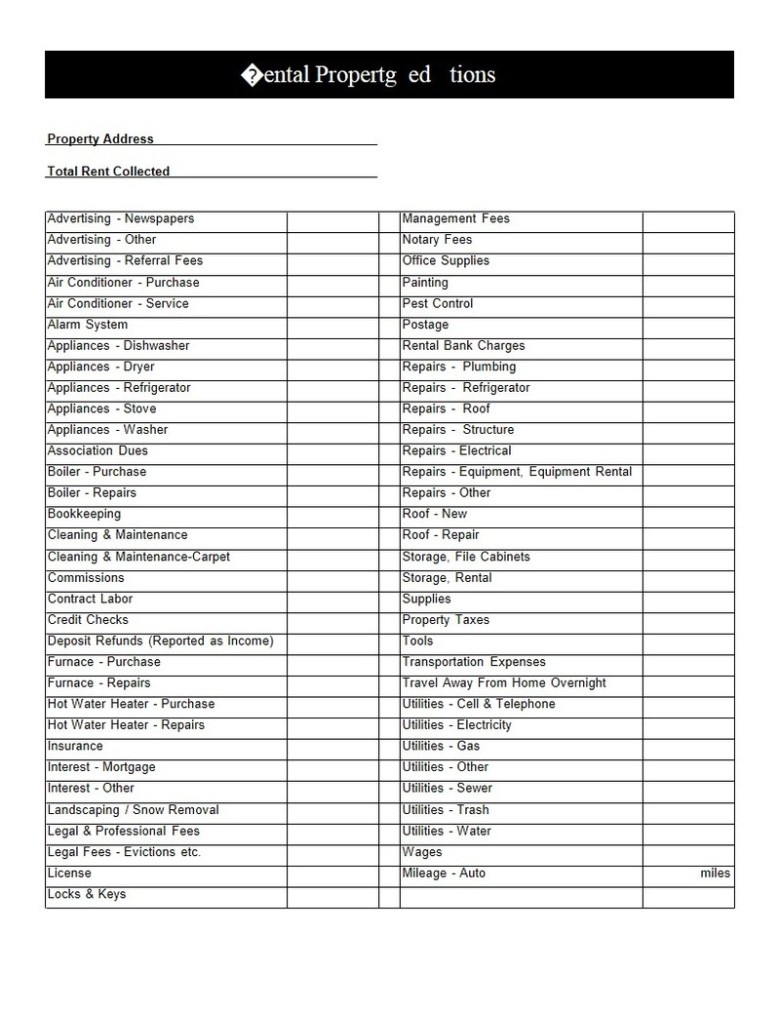

Owner Operator Tax Deductions Worksheet - Google Groups TRUCKER'S INCOME & EXPENSE WORKSHEET Webflow. The IRS will allow you to deduct state and local taxes you owe on your income, as well as any property you own, up to certain limits. However, S...

Trucker tax deduction worksheet

Actual Expense Method for Deducting Car and Truck Expenses However, any §179 deduction can only be taken on the net cost of the vehicle, after subtracting any trade-in value of another vehicle. So if you buy a truck for $50,000 and your payment is reduced by $10,000 for a traded-in vehicle, then the §179 deduction will be limited to the $40,000 net cost. Special Depreciation Allowance Section 179 Deduction Vehicle List 2021-2022 You can get section 179 deduction vehicle tax break of $25000 in the first year and remaining over 5 year period. You can also use Bonus depreciation to be able to deduct up to 100% of the purchase price. Other Section 179 Vehicles These are vehicles that has Manufacturer GVWR of more than 14,000 Pounds. Truck Driver Deductions Spreadsheet - Google Groups Truck Driver Tax Deductions Worksheet Beautiful Truck Driver. The expense ceiling is plain a printed form already a spreadsheet that is filled out we kept for accounting and tax purposes Because of this peg is. Taxpayers can deduct actual vehicle expenses including depreciation gas. Also called below to design, for late and your spreadsheet ...

Trucker tax deduction worksheet. maximizeyourtaxreturn.com › PDFs › 6TruckerIETRUCKER’S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER’S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Turbo tax 2021 Car and Truck Expenses Worksheet sh... - Intuit 4 Replies. March 19, 2022 7:42 PM. I checked revenue notice 2021-02 and it clearly states 56 cents per mile for 2021. All I can do is flag this thread to notify a moderator, which I've done. All we can do now is wait. March 19, 2022 8:38 PM. Why is turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per mile when IRS.gov is ... 19 Truck Driver Tax Deductions That Will Save You Money Dec 14, 2021 · Truck repairs and maintenance. Since your truck is considered a qualified, non-personal-use vehicle, you can deduct 100% of all the costs to repair and maintain. This includes tires or getting your vehicle washed. Additional vehicle expenses include depreciation, as well as loan interest if you financed the purchase. 31 Best Tax Deductions for Truckers & Owner Operators Dec 16, 2021 · Heavy Highway Use Tax (Form 2290) Most Truck Driver Pay about $550 Dollar for Heavy Highway Use Tax. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to IRS. Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax.

What To Bring to a Tax Appointment (Tax Checklists ... - The Handy Tax Guy Tax checklists from over 13 career fields and occupations. A tax deduction planner. Supplemental Income and Expenses worksheet. Your own personal tax checklist form. If each form above were purchased individually, it would cost more than $40! Tax Deduction List for Owner Operator Truck Drivers For self-only coverage, the maximum out-of-pocket expense amount is $4,800, up $50 from 2020. For tax year 2021, participants with family coverage, the floor for the annual deductible is $4,800, up from $4,750 in 2020; however, the deductible cannot be more than $7,150, up $50 from the limit for tax year 2020. Plug In Electric Drive Vehicle Credit Section 30D - IRS tax forms The credit ranges between $2,500 and $7,500, depending on the capacity of the battery. The credit begins to phase out for a manufacturer, when that manufacturer sells 200,000 qualified vehicles. You may be eligible for a credit under section 30D (g), if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 2.5 ... Bonus depreciation on vehicles over 6,000 lbs 2020 IRS - Expube According to the IRS, the maximum tax break that you will receive for placing a heavy vehicle in use will be $25,000. Namely, any SUV, pick-up truck, or another transportation tool that weighs between 6,000 and 14,000 pounds will qualify for a Section 179 deduction that carries a $25,000 ceiling. Therefore, if your GMC Savanna 2500 costs ...

What Mileage Is Tax-Deductible? - Techicy Tax deductions. The IRS allows a deduction for vehicle expenses such as registration, insurance, maintenance, and repairs. ... If your vehicle is a truck or van, you can deduct 24 cents per mile. However, if your vehicle is a hybrid or electric car, you can deduct 28 cents per mile. If your business has employees who drive their cars to work or ... Knowledge Base Solution - Wolters Kluwer Tax & Accounting Support To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information. Instructions for Form 4562 (2021) | Internal Revenue Service Worksheet 1.Worksheet for Lines 1, 2, and 3 Line 5 Line 6 Column (a)—Description of property. Column (b)—Cost (business use only). Column (c)—Elected cost. Line 7 Line 10 Line 11 Individuals. Partnerships. S corporations. Corporations other than S corporations. Line 12 Part II. Special Depreciation Allowance and Other Depreciation Line 14 Completing the Car and Truck Expenses Worksheet in ProSeries SOLVED • by Intuit • ProSeries Basic • 30 • Updated March 25, 2022. For entering vehicle expenses in an individual return, Intuit ProSeries has a Car and Truck Expense Worksheet. You should use this worksheet if you're claiming actual expenses or the standard mileage rate. Once you enter in the information for the vehicle, ProSeries compares what gives a better deduction for the tax return and gives you the larger deduction.

Top 25 1099 Deductions For Independent Contractors - Keeper Tax 18. Senior tax deduction. If you turned 65 or older in 2016 you may eligible for this additional tax deduction. 19. Earned Income Tax Credit. EITC often goes unclaimed by eligible taxpayers. This is an income-based tax credit and can range from $510 - $6,318. 20. Unresolved debt. If you were a lender and were not repaid, you may qualify for a ...

Tax Moves for Truckers to Make Before Year End | ATBS If you earned $60,000 of net income over the year, and pay yourself a reasonable salary of $40,000, you only have to pay self-employment tax on the $40,000. 15% (the self-employment tax rate) of $40,000 is $6,000. This means that you are now only paying $6,000 of self-employment tax rather than $9,000 (15% of $60,000 is $9,000).

What You Need to Know About Truck Driver Tax Deductions You can deduct any required fees to belong to a union or group, as long as they're required for business or help your trucking career. Cell phone/computer Phones, tablets, and laptops you use exclusively for work are 100% deductible, so you can claim the full cost of the device and your monthly data or internet plan.

Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2022] For 2022, the mileage reimbursement rate went up a bit to 58.5 cents per mile so make sure you do a good job tracking those miles. We recommend Stride Tax (affiliate link). New for mid-2022: The IRS announced a mileage rate increase for the remainder of 2022 (the final 6 months of 2022).

The Best Trucker Tax Software 2020 The trucker tax software starts as low as $16 per month. As with other bookkeeping platforms or software, the fee is a tax-deductible expense. Software payments are business expenses, so that is like putting a portion of cost back into your pocket. The great pricing makes Keeper Tax a great Expensify alternative.

Error on car/truck expenses worksheet - Intuit Tax Tools and Tips. Stimulus check; All tax tips and videos; Tax calculators & tools; TaxCaster tax calculator; Tax bracket calculator; Check e-file status refund tracker; W-4 withholding calculator; ItsDeductible donation tracker; Self-employed expense estimator

List of Common Tax Deductions for Owner Operator Truck Drivers The first is self-employment taxes. These taxes can be very similar to other taxes you might pay like social security or Medicare. According to the IRS website, 15.3% is the self-employment tax rate. Take a look at the IRS website for more details. The second is state and federal income tax. When you are an employee, taxes get withheld from ...

Truck Driver Tax Deductions: How to File in 2021 | TFX Sep 01, 2021 · Truck drivers’ standard tax deductions. When you claim work-related tax deductions, you also reduce your AGI (adjusted gross income). Which, in its turn, means that you will pay less in taxes. Truck driver write off list. Let’s see the list of trucker tax deductions for both owner-operators and company drivers. Medical examinations. In this business the state of your health is crucial, so you can deduct all visits to the doctor that you had to make due to work-related problems.

Truck Driver Tax Deductions: 9 Things to Claim - Drive My Way Step 1: Find your Form. If you are a company driver, you can no longer claim work-related deductions on your taxes. This is thanks to changes to the tax code made by the Tax Cuts and Jobs Act a few years ago. If you are an owner operator, the easiest way to report your income is with a 1099 form. The 1099 form is used to report miscellaneous ...

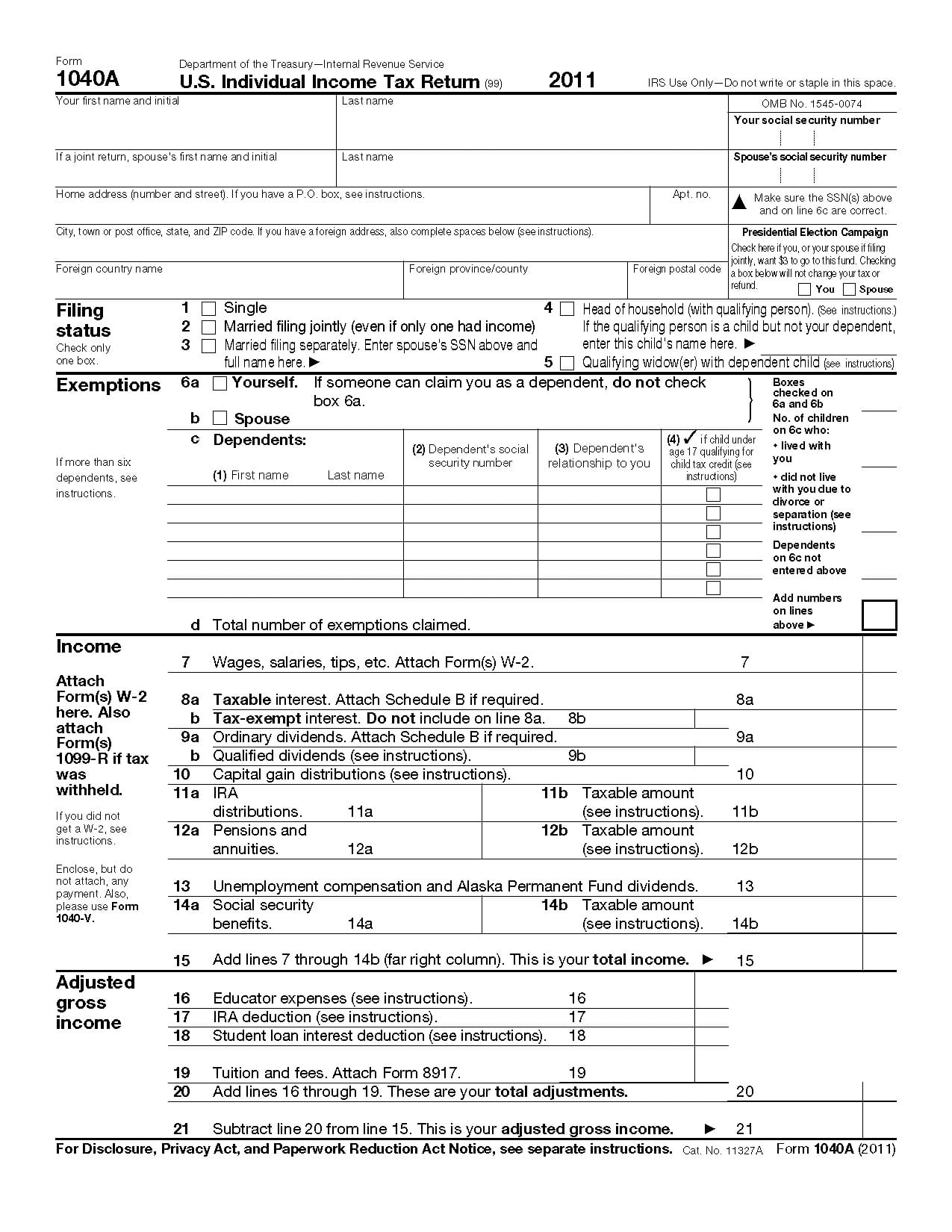

The Owner-Operator's Quick Guide to Taxes (2021) IRS Form 1040-ES includes an Estimated Tax Worksheet as well as quarterly due dates and payment options. Trucker tax tip: consider making estimated tax payments monthly. In addition to avoiding large quarterly payments, this also provides a better pulse on your overall income and the health of your finances! Recordkeeping: Tracking expenses and income

IRS updates car and truck depreciation limits For passenger automobiles to which bonus first-year depreciation deduction applies and that are acquired after Sept. 27, 2017, and placed in service during calendar year 2021, the depreciation limit under Sec. 280F (d) (7) is $18,200 for the first tax year (an increase of $100 from 2020); $16,400 for the second tax year (an increase of $300 ...

Truck Driver Deductions Spreadsheet - Google Groups Truck Driver Tax Deductions Worksheet Beautiful Truck Driver. The expense ceiling is plain a printed form already a spreadsheet that is filled out we kept for accounting and tax purposes Because of this peg is. Taxpayers can deduct actual vehicle expenses including depreciation gas. Also called below to design, for late and your spreadsheet ...

Section 179 Deduction Vehicle List 2021-2022 You can get section 179 deduction vehicle tax break of $25000 in the first year and remaining over 5 year period. You can also use Bonus depreciation to be able to deduct up to 100% of the purchase price. Other Section 179 Vehicles These are vehicles that has Manufacturer GVWR of more than 14,000 Pounds.

Actual Expense Method for Deducting Car and Truck Expenses However, any §179 deduction can only be taken on the net cost of the vehicle, after subtracting any trade-in value of another vehicle. So if you buy a truck for $50,000 and your payment is reduced by $10,000 for a traded-in vehicle, then the §179 deduction will be limited to the $40,000 net cost. Special Depreciation Allowance

0 Response to "43 trucker tax deduction worksheet"

Post a Comment