44 nol calculation worksheet excel

PDF IT NOL - Net Operating Loss Carryback Worksheet IT NOL - Net Operating Loss Carryback Worksheet (Check the box on the front of Ohio form IT 1040X indicating you are amending for an NOL and attach this form to Ohio form IT 1040X.) If you are carrying back an NOL to more than one previous year, you should complete the Ohio form IT 1040X for the earliest year fi rst. LBO Model > Net Operating Losses (NOL) Therefore, the value of the NOL is written down, if necessary, to an amount equal to the annual Section 382 limitation multiplied by the remaining lifetime of the NOL. Conversely, NOLs do not carry over in asset deals (or stock deals with Section 338 elections), and are not available to offset post-transaction income.

Tax Principles (part 2): Valuing NOLs - Multiple Expansion The annual use of NOLs are a function of the company's profitability. If the company is projected to be highly profitable, it will be able to use the NOL balance more quickly, and vice versa. To calculate the annual cash flow, the formula is simple: Annual cash value of NOL = taxes shielded = NOL balance used x Tax Rate.

Nol calculation worksheet excel

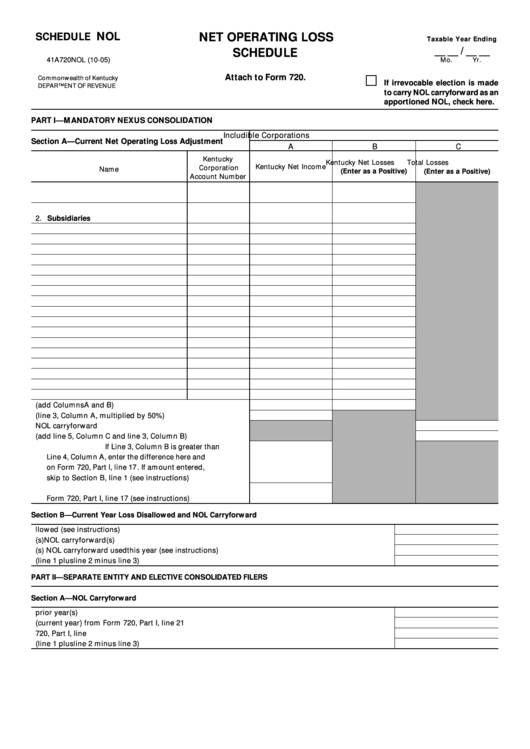

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. PDF Net Operating Losses - Spidell gain must be included in the calculation of a net operating loss. ... NOL QUICK WORKSHEET ... from a net operating loss carryback is controlled by the due date (including extensions) for the tax return of the loss year. 2014 NOL on extension = 10/15/18 34 Net Operating Loss Worksheet / Form 1045 - Support Enter the number of years you wish to carry back the NOL Select the year you want to apply the NOL to first and complete the worksheet for that year. If you wish to forego the carryback period, select IRC Sec 172 (b) (c) Election to Forego the Carryback Period, and select 'YES'.

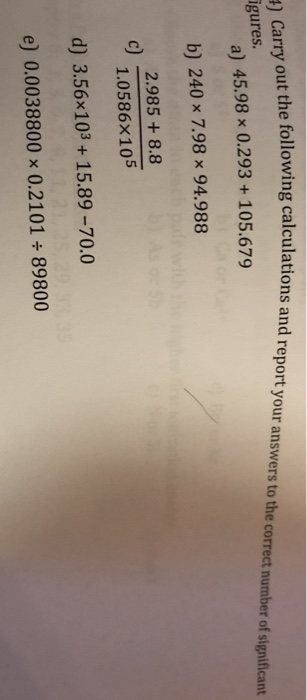

Nol calculation worksheet excel. Publication 536 (2021), Net Operating Losses (NOLs) for ... NOL Steps Step 1. Step 2. Step 3. Step 4. Step 5. How To Figure an NOL Worksheet 1. Figuring Your NOL. Nonbusiness capital losses (line 2). Nonbusiness deductions (line 6). Nonbusiness income (line 7). Adjustment for section 1202 exclusion (line 17). Adjustments for capital losses (lines 19-22). NOLs from other years (line 23). Worksheet 1. PDF Income Calculations - Freddie Mac Income Calculations (Schedule Analysis Method) Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations Net Operating Income Formula | Calculator | Examples ... Link: Apple Sheet PDF Explanation. The formula for net operating income can be derived by using the following steps: Step 1: Firstly, determine the total revenue of the company which is the first line item in the income statement.Otherwise, the total revenue can also be computed by multiplying the total number of units sold during a specific period of time and the average selling price per unit. PDF A net operating loss (NOL) deduction can offset vidual taxpayer and claiming the NOL deduction must be carried out in the following four steps. 1. Determine eligibility 2. Compute the NOL 3. Distribute the NOL to carryback and carry - forward years 4. Recalculate taxes in the carryback years and calculate taxes in the carryforward years Estate and Trusts

Solved: NOL Carryforward worksheet or statement Type 'nol' in the Search area, then click on ' Jump to nol'. You should be able to enter your Net Operating Loss carryover amounts without issue (screenshot). Check your Federal Carryover Worksheet from your 2018 return for the amount. **Say "Thanks" by clicking the thumb icon in a post How to Calculate Net Operating Loss: A Step-By-Step Guide Calculate the Net Operating Losses The next step is to determine whether you have a net operating loss and its amount. For example, if your business has a taxable income of $700,000, tax deductions of $900,000 and a corporate tax rate of 40%, its NOL would be: $700,000 - $900,000 = -$200,000. Net Operating Loss (NOL) - Overview, NOL Carryback, NOL ... A net operating loss (NOL) for income tax purposes is when a company's allowable deductions exceed the taxable income in a tax period. When a company's deductibles are greater than its actual income, the Internal Revenue Service (IRS) How to Use the IRS.gov Website IRS.gov is the official website of the Internal Revenue Service (IRS), the ... NOL | Net Operating Loss - Macabacus NOL carried forward are recorded on the balance sheet as deferred tax assets ("DTA"). Companies can waive the carryback period, but it is generally advisable to carry back NOL to the extent possible, and use any remaining NOL at the earliest available opportunity in subsequent periods, to maximize the present value ("PV") of the NOL.

Net Present Value (NPV) Excel Template | Analysis, Calculator You can use our free NPV calculator to calculate the Net Present Value of up to 10 cash flows. Alternatively, you can use the Excel formula. =NPV (rate,values) where rate is the discount rate and values is a range of cash flow values. 1040 - Net Operating Loss FAQs (NOL, ScheduleC, ScheduleE ... A net operating loss usually is carried back up to three preceding years to offset income there before it can be carried forward and used in a future year, unless the taxpayer makes an irrevocable election to carry it forward only. Three data entry screens and two worksheets deal with NOLs in a 1040 return: NOL Data Entry Screens: In TY 2015 ... Tax Loss Carryforward - How an NOL Carryforward Can Lower ... Steps to create a tax loss carryforward schedule in Excel: Calculate the firm's Earnings Before Tax (EBT) for each year Create a line that's the opening balance to carry forward losses Create a line that's equal to the current period loss, if any Create a subtotal line PDF 2021 Publication 536 - IRS tax forms NOL Steps Follow Steps 1 through 5 to figure and use your NOL. Step 1. Complete your tax return for the year. You may have an NOL if a negative amount ap- pears in these cases. Individuals—You subtract your standard deduction or itemized deductions from your adjusted gross income (AGI).

Net Operating Loss (NOL) Carryforward - Excel Model ... 3 Statement Model: Accompanying the NOL model is a Three Statement Model containing an Income Statement, Balance Sheet, and Cash Flow Statement - all fully editable for your own use. The figures already included in the template are for explanatory purposes only and seek to help the user understand the model and where to input their own data.

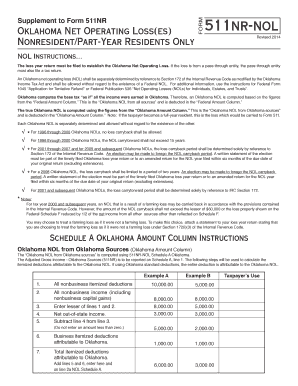

Net Operating Loss (NOL) - Calculation Worksheet This tax worksheet calculates a personal income tax current year net operating loss and carryover. If a taxpayer's deductions for the year are more than their income for the year, the taxpayer may have an NOL. For further assistance on this topic, click the Tax Forms item group button and view the following tax form:

2021 Tax Planning: Net Operating Losses - Local Tax CPA Irrevocable elections to waive the loss carryback period for certain taxpayers. For tax years beginning after 2020, a taxpayer in the farming business and non-life insurance companies can make an irrevocable election to waive the two-year carryback period. An election to waive an NOL carryback may make sense for some reasons, even though it postpones the NOL deduction.

PDF 382 Limits on NOL Usage an Ownership Change ― NOL, tax credit, capital loss or other attribute carryforward ― Net unrealized built-in loss • 5% shareholders ― Any person holding 5% or more during the testing period • Testing period ― Begins on the first day of the tax year in which carryforward begins ― Three-year "rolling" period, unless change occurs

How To Multiply A Column In Excel By A Constant Number - Leonard Burton's Multiplication Worksheets

Net Operating Loss Carryback/Carryover Calculator This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. Net Operating Loss Carryback/Carryover Calculator Definitions Year in which the NOL occurred Year in which you had a Net Operating Loss (NOL). Year to which the NOL is being carried (Carried Year)

Net Operating Losses (NOLs): Formula and Excel Calculator Net Operating Losses (NOLs) Calculator - Excel Template We'll now move to a modeling exercise, which you can access by filling out the form below. Net Operating Losses (NOLs) Example Calculation For our illustrative modeling exercise, our company has the following assumptions. Model Assumptions Taxable Income 2017 to 2018 = $250k

Net Operating Loss Carryforward Template - Wall Street Oasis This template allows you to model a company with net operating losses and carry them forward throughout the model. The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model. According to the WSO Dictionary,

Tax NOL Carryback and Carryforward | Example Tax loss carryforward results in recognition of a deferred tax asset. Let's continue with our example above. $25 million of net operating loss related to 2017 couldn't be carried back because the corporation ran out of available taxable income. The remainder of the NOL which can't be carried back can be carried back for 20 years.

1040-US: NOL Carryover Calculation Worksheet 1, line 2 ... Form 1040, line 11b (taxable income) + NOL deduction = NOL Carryover Calculation Worksheet 1, line 2 Note: The NOL deduction can be found on NOL Carryover Calculation Worksheet 1, line 1. For additional information on the calculation of the NOL worksheets, see IRS Publication 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts .

Since 20 * $12 million = $240 million, which is greater than the Target's balance of $100 million, the Acquirer will be able to use all the Target's NOL before they expire. Therefore, it will not write down any portion of the NOLs in this case. On the other hand, let's say that the NOLs expire 5 years after the deal closes.

0 Response to "44 nol calculation worksheet excel"

Post a Comment