41 what if worksheet turbotax

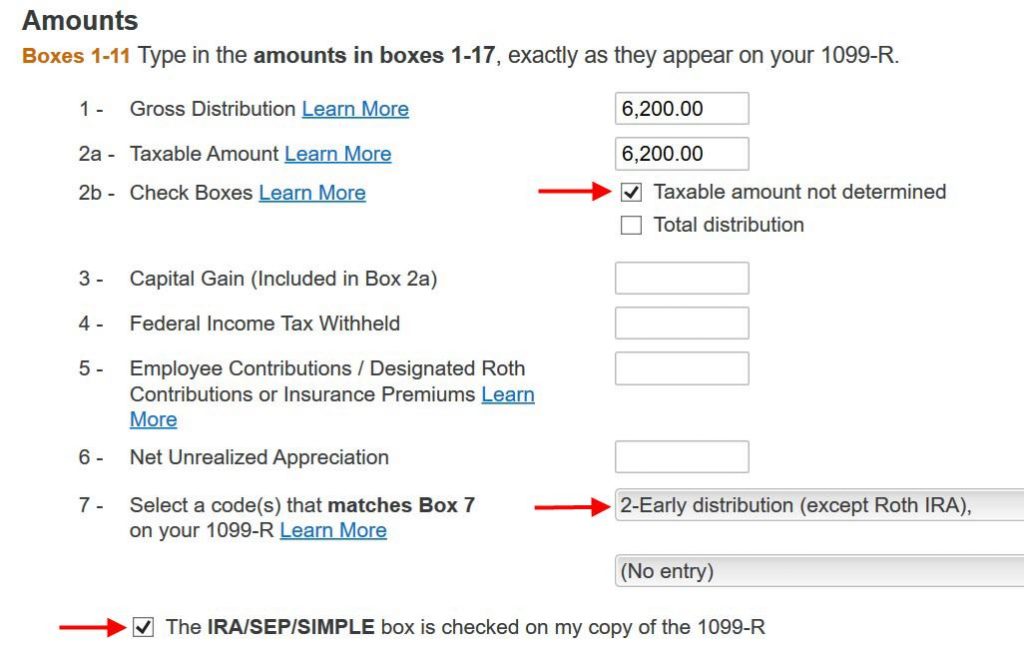

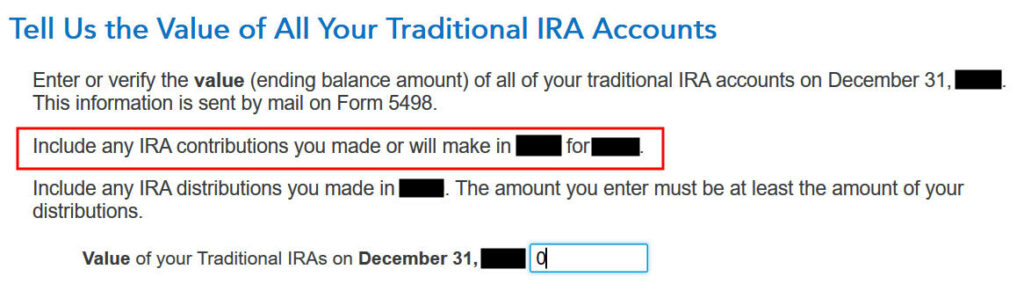

When to Use Schedule EIC: Earned Income Credit - TurboTax ... Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premier, Self-Employed, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2023. Terms and conditions may vary and are subject to change without notice. 1099-R: Should I use the Simplified Method Worksheet to ... You must use the General Rule explained in IRS Publication 939 to calculate the taxable part of Box 1 on your 1099-R if no taxable amount is listed in Box 2A so the correct amount of taxable income is listed on line 5b of Form 1040 or 1040-SR.. If your annuity starting date was after July 1, 1986, you may have to figure the taxable part of the distribution using the Simplified Method.

Input Jam TurboTax Student Information Worksheet, Lin 18, Used for Exclusion There are two kinds of TurboTax users - those who just complete the interview as best they can, trusting TurboTax to get everything right, and those who want to understand every number so they're.

What if worksheet turbotax

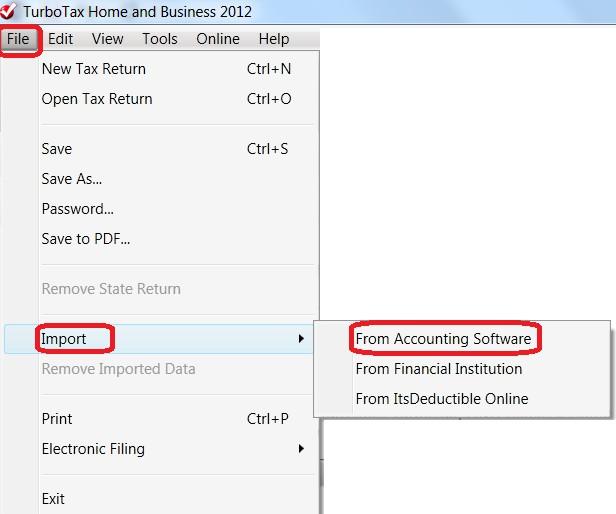

Solved: How do I get the "what-If" worksheet? - Intuit Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View. Once there, at the top of the left column, click on the icon for "Open Form". A popup window will appear. In the text line, type the word "what" without quotes. How do I delete a worksheet in TurboTax? - Greedhead.net Here's the general procedure for deleting unwanted forms, schedules, and worksheets in TurboTax Online: Open your return in TurboTax. In the upper right corner, click My Account > Tools. In the pop-up window, select Delete a form. Click Delete next to the form/schedule/worksheet and follow the onscreen instructions. TurboTax: Raymond James filled out Form **** OID worksheet ... Raymond James filled out Form **** OID worksheet. Turbotax has an issue with Box *. They left it blank, which indicates that Original Issue Discount is a regular taxable interest. I cannot move on without changing this selection. false

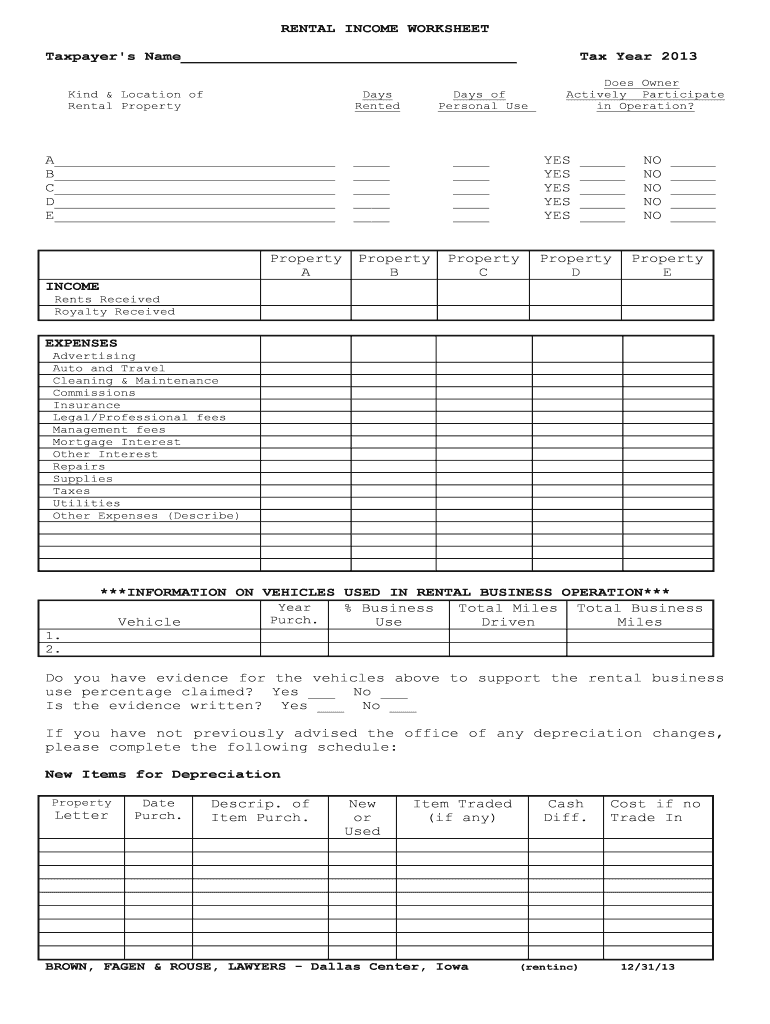

What if worksheet turbotax. Cash Flow Analysis Worksheet for Rental Property Aug 18, 2021 · It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. ... Real Estate Tax and Rental Property at turbotax.intuit.com - A good summary of tax issues related to rental property. Are Worksheets Required to Be Turned in With a Tax Return ... Worksheets. It is important to recognize the distinction between worksheets and schedules. A tax worksheet is an IRS guide to assist you in your calculations and are primarily for your records. The Home Office Deduction - TurboTax Tax Tips & Videos TurboTax makes it easy to determine if you qualify and how much you can write off by asking you simple questions about your unique tax situation. TurboTax has you covered whether your tax situation is simple or complex. We'll help you find every deduction you qualify for and get you every dollar you deserve. Fresh What Is A Federal Carryover Worksheet - The ... Federal carryover worksheet turbotax online if you can convert a million for a variety of cap available. But no entry for the California capital loss carryover. Any carryback or carryover of a federal net operating loss. Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D.

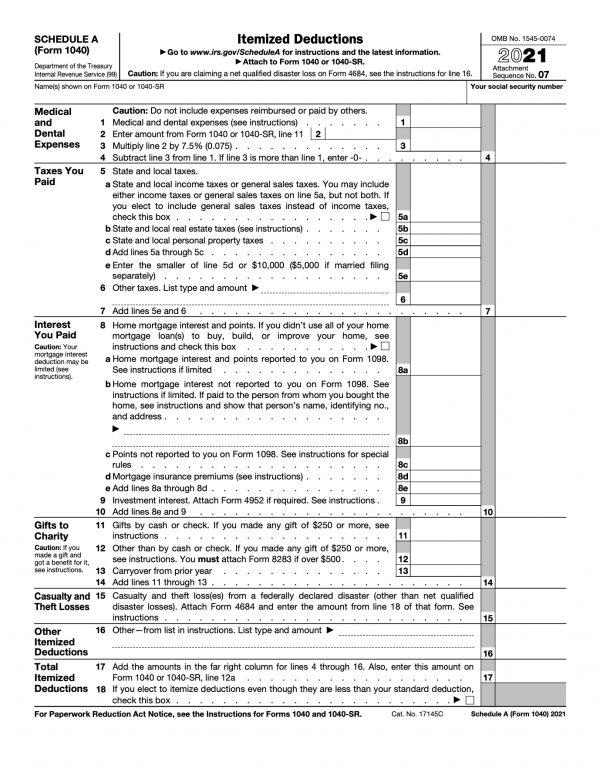

The Ultimate Medical Expense Deductions ... - TurboTax Oct 16, 2018 · TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premier, Self-Employed, TurboTax Live and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Three Problems With Turbo Tax and How to Fix Them ... I used the free version of Turbo Tax 2017 to create a zero income, zero balance, zero refund return, so that I could file it with the IRS and show that a relative would be claiming my children as dependents because he lived with us most of the year and had a higher income (as asked by the system in the process)(my ex-husband is threatening to ... Estimated Taxes: How to Determine What to Pay ... - TurboTax You can use TurboTax tax preparation software to do the calculations for you, or get a copy of the worksheet accompanying Form 1040-ES and work your way through it. Either way, you'll need some items so you can plan what your estimated tax payments should be: Your previous year's return. Post View: Use TurboTax What-if Worksheet 0 TurboTax Deluxe has a what-if feature (use "open a form" under forms). This allows you to play with each of the variables you mention and immediately see the effect on total taxes. From this you...

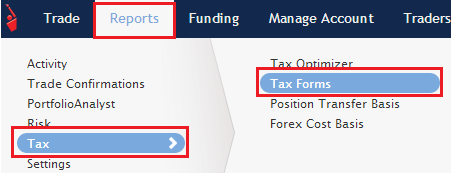

PDF Tax Preparation Checklist - Intuit Tax Preparation Checklist Before you begin to prepare your income tax return, go through the following checklist. Highlight the areas that apply to you, and make sure you have that information available. How to File Cryptocurrency Taxes with TurboTax (Step-by ... TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app. To enable this functionality, the TurboTax team has partnered with CryptoTrader.Tax.. In this guide, we break down the basics of cryptocurrency taxes and walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTax—both online and desktop versions. What is a carryover worksheet for taxes? - Greedhead.net What is a carryover worksheet for taxes? TurboTax will fill out the carryover worksheet for you from this year to use next year. For instance, if you are not able to claim your entire loss this year, the balance will carry over each year for you. What is the federal carryover? Form 8949 Worksheet - TurboTax Import Considerations | IB ... Form 8949 Worksheet - TurboTax Import Considerations . BACKGROUND. As a matter of operational convenience and to assist with the preparation of IRS Form 8949 (Sales and Other Dispositions of Capital Assets), IB prepares a Form 8949 worksheet in each of a PDF, CSV and TXF format on an annual basis. The TXF format is a data file specifically ...

Underpayment Penalty? According to IRS.gov, Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if you expect to owe tax of $1,000 or more when your return is filed. If you owe taxes this year, you will receive an estimated tax penalty if there wasn't enough taxes withheld or if there weren't enough estimated taxes paid.

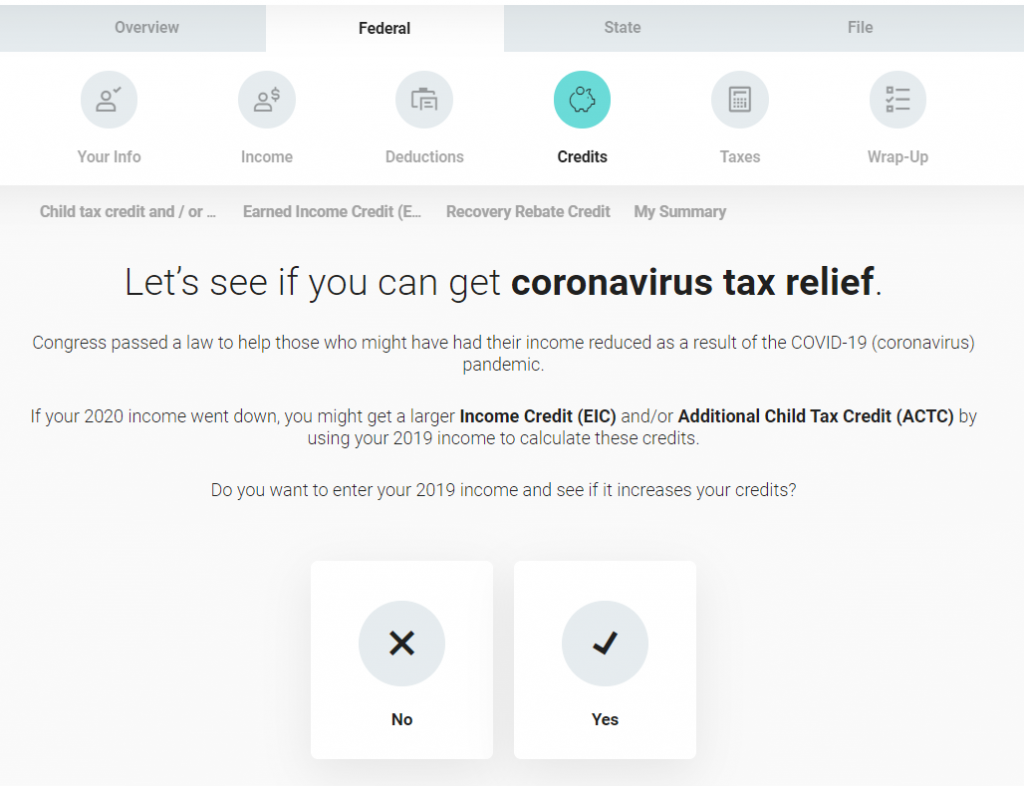

Recovery Rebate Credit Worksheet Turbotax - Studying ... Recovery rebate credit worksheet turbotax. If you file your taxes online the correct forms will be filled in and filed for you. Recovery Rebate Credit Note. The Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020.

PDF Filing Your Taxes: a Turbo Tax Simulation FILING YOUR TAXES: A TURBO TAX SIMULATION STUDENT DIRECTIONS ... ‐ if boxes 7-14 on your W-2 are blank, leave them blank in TurboTax Personal info: See worksheet simulations with all information needed to "file" your taxes. You'll see occupation, date of birth, SSN, phone number, and more.

Reddit - Dive into anything What is a carryover worksheet help please turbo tax keeps asking me this. Tax Question . Close. 2. Posted by 28 days ago. What is a carryover worksheet help please turbo tax keeps asking me this. Tax Question . 1 comment. share. save. hide. report. 100% Upvoted. Log in or sign up to leave a comment. Log In Sign Up.

I sold a rental house for $ 200,000 and am ... - JustAnswer Hello, I sold a rental house for $ 200,000 and am having trouble with TurboTax--the Asset Entry Worksheet. I am listing the sales price as "asset sales price" on line 22, and my expense of sale on line 23. Turbo tax wants me to enter data on lines 25 and 26, Land Sales Price and Land expense of sale. I don't know what this means.

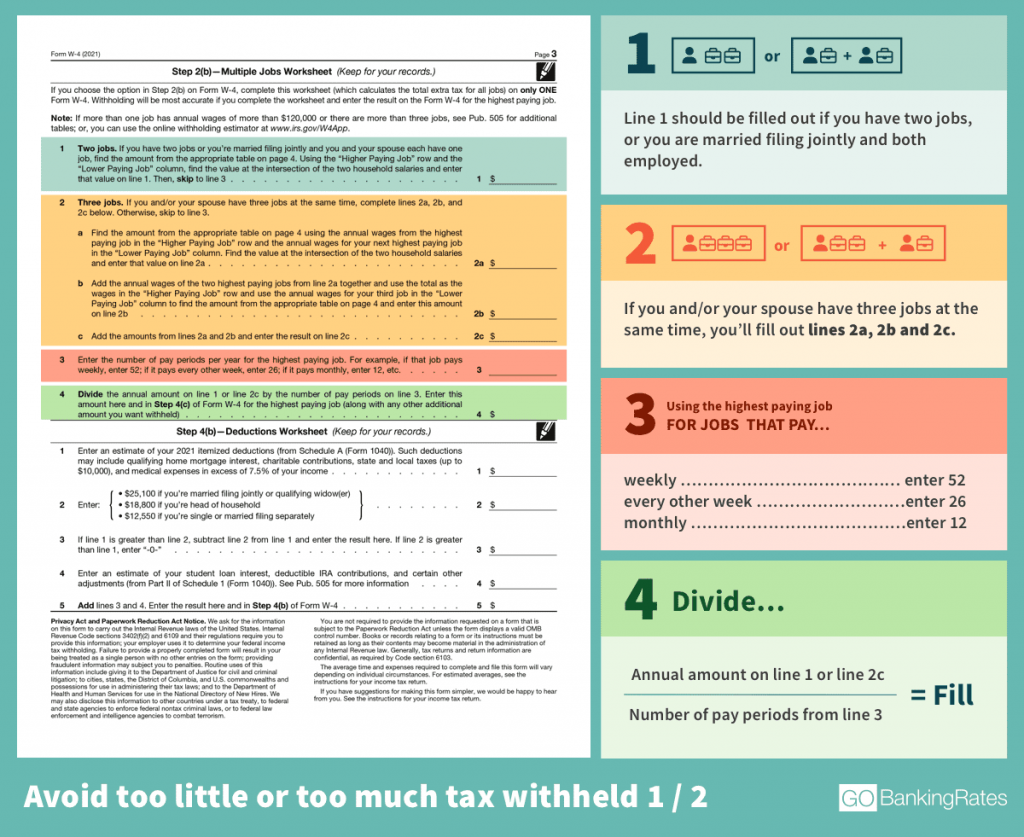

The W-4 Form Changed in Major Ways - TurboTax Jan 10, 2022 · Whether you're filling out paperwork for a new job or got an email notification from HR, you might have noticed that the W-4 form changed from what you might have been used to. Your W-4 is what determines your federal income tax withholding, and making sure it's accurate is the first step in determining whether you get a tax refund or will owe taxes when you prepare …

How do I access the Federal Worksheet so I can ... - TurboTax Here are steps to take in TurboTax CD/Download to find a needed form; From Easy Steps in your return, go to the top right corner and choose the Forms icon. At the top left, choose the Forms icon again which opens up a screen. In the Keywords to search for space write Federal Worksheet. Choose Worksheet for Calculating 2020 Installment Payments ...

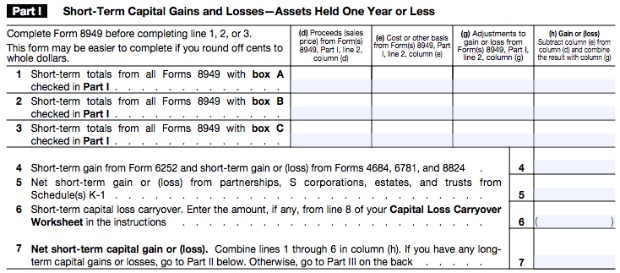

Guide to Schedule D: Capital Gains and Losses - TurboTax ... Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premier, Self-Employed, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2023. Terms and conditions may vary and are subject to change without notice.

What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premier, Self-Employed, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2023. Terms and conditions may vary and are subject to change without notice.

Solved: 2021 Schedule D Tax worksheet not current Feb 18, 2022 · is the same as the Schedule D worksheet in the TurboTax 2021 Premier desktop edition. Click on Forms. In Forms mode open the Schedule D worksheet. What do you see as different? Have you updated your software to the latest release? Click on Online at the top of the desktop program screen.

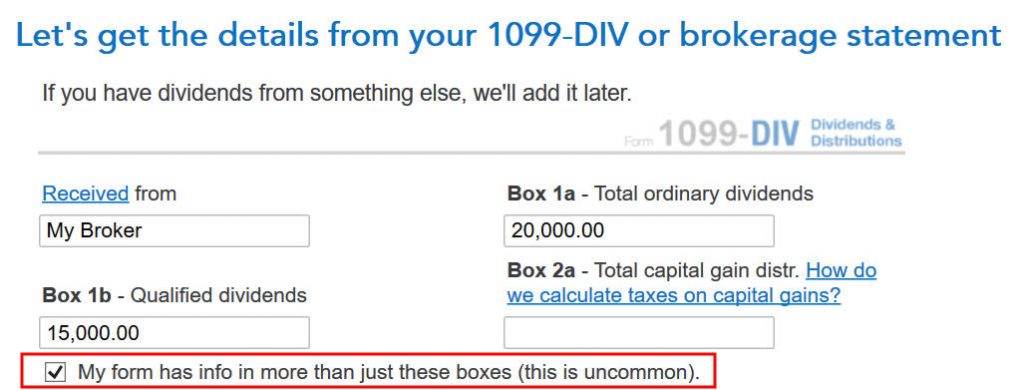

Solved: When is schedule d not required - Intuit Jun 07, 2019 · Also use the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 instructions to figure your tax. You can report your capital gain distributions on line 10 of Form 1040A, instead of on Form 1040, if none of the Forms 1099-DIV (or substitute statements) you received have an amount in box 2b, 2c, or 2d, and you do not have to file ...

Using the What-If Worksheet in ProSeries - Intuit Open the tax return. Press F6 to bring up Open Forms. Type Wha and press Enter to open the What-If Worksheet. Use Column 1 for the original Married Filing Jointly return Using Column 2 to manually enter the taxpayer's information Using Column 3 to manually enter the spouse's information

TurboTax: Raymond James filled out Form **** OID worksheet ... Raymond James filled out Form **** OID worksheet. Turbotax has an issue with Box *. They left it blank, which indicates that Original Issue Discount is a regular taxable interest. I cannot move on without changing this selection. false

How do I delete a worksheet in TurboTax? - Greedhead.net Here's the general procedure for deleting unwanted forms, schedules, and worksheets in TurboTax Online: Open your return in TurboTax. In the upper right corner, click My Account > Tools. In the pop-up window, select Delete a form. Click Delete next to the form/schedule/worksheet and follow the onscreen instructions.

Solved: How do I get the "what-If" worksheet? - Intuit Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View. Once there, at the top of the left column, click on the icon for "Open Form". A popup window will appear. In the text line, type the word "what" without quotes.

0 Response to "41 what if worksheet turbotax"

Post a Comment