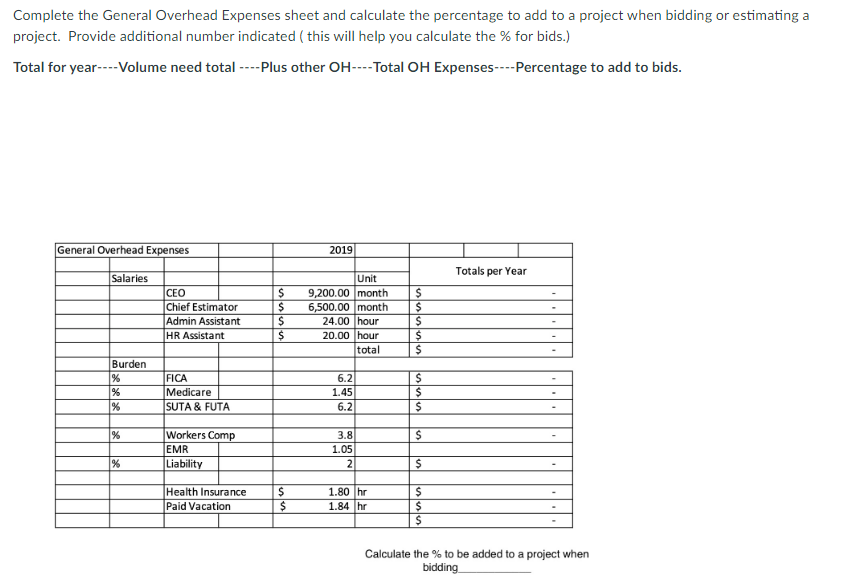

41 business overhead expense worksheet

Overhead Expense Insurance Overhead Expense Insurance. Overhead Expense (OE) insurance reimburses a business owner for business expenses incurred during an owner's disability. Covered expenses are those that are deductible for federal income tax purposes, such as replacement salaries, utilities, phone bills, and lease payments. The policy is non-cancelable and guaranteed ... Business expense budget - templates.office.com Business expense budget Learn new skills with Office templates. Explore them now Templates Budgets Business expense budget Business expense budget Evaluate actual expenses against your annual budget plan with this accessible template, which includes charts and graphs of your monthly variances. Excel Download Share

PDF Business Overhead Expense Worksheet - Truluma Type of Business Normal Monthly Overhead Expense Outlay 1. Rental Real Estate Depreciation, or Business Mortgage Principal (show only one) $ 2. Utilities a. Heat $ b. Power $ c. Water/Sewer $ d. Fixed Telephone/Fax $ 3.

Business overhead expense worksheet

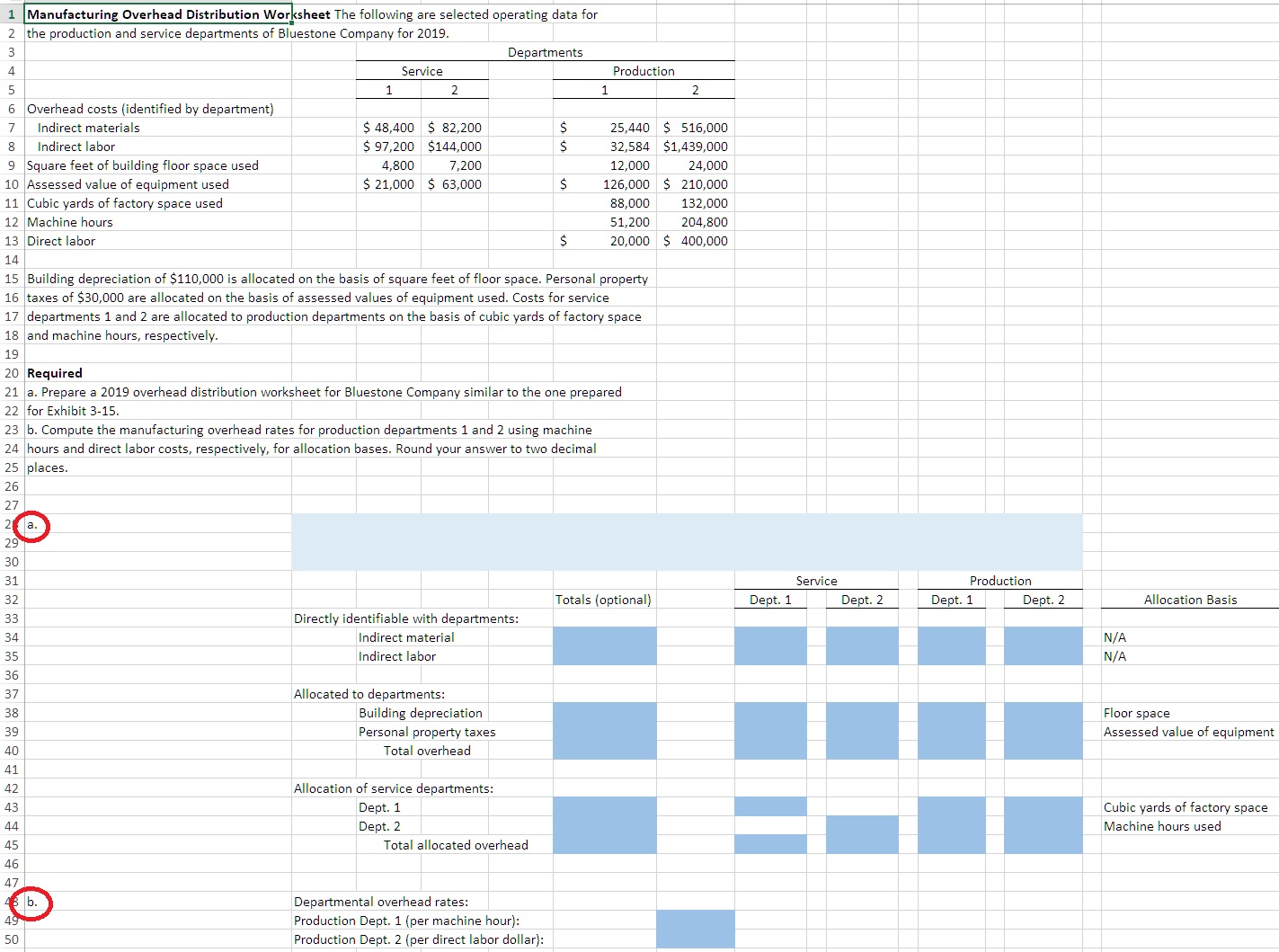

Calculating the Overhead Rate: A Step-by-Step Guide | The ... Overhead rates are calculated by adding the indirect or overhead costs incurred by your business and allocating those costs based on a specific measure. Indirect costs are part of doing business ... PDF Know your needs If you don't know how much Business Overhead Expense Insurance you need, use this worksheet to find out. If your practice is a professional corporation or a partnership, only list your portion of the expenses. Monthly expense worksheet Rent or mortgage $ Employee salaries $ Employee benefits $ Depreciation of equipment $ Property taxes $ Overhead Formula | How to Calculate Overhead Ratio (Excel ... Overhead Ratio Formula in Excel (With Excel Template) Here we will do the same example of the Overhead Ratio formula in Excel. It is very easy and simple. You need to provide the three inputs of Operating Expenses, Operating Income, and Taxable Net Interest Income. You can easily calculate the Overhead ratio using Formula in the template provided.

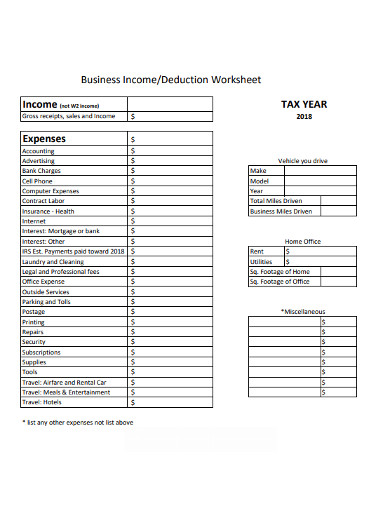

Business overhead expense worksheet. PDF Business Income and Expense Summary Month & Year This worksheet was created to give you a manual method of tracking your business income and expenses monthly to assist with annual tax preparation.Enter your informationdirectly in the worksheetand print it to have a summarizedrecord of your monthly businessdata. I recommendyou affix it to the frontof a 9"x12"envelope that is Overhead Expense Template - Small Business Expenses ... The business expenses template was designed to be a simple and effective way to easily track your overhead expenses. All expense categories are customizable, giving you the most flexibility. First you simply enter the expense categories you want to use in the orange column A: Business Expense Spreadsheet [100% Free Excel Format ... Travel expense spreadsheet: For organizing charges for meals, hotels, and transportation this type of spreadsheet is used. Business mileage expense spreadsheet: Sometimes, employees use their personal transport for business trips and later on the company has to pay for it to the employees. Overhead/Expense Worksheet - Carr's Corner Overhead/Expense Worksheet The following worksheet is for members and business owner to develope good universal business practices. Money expended in the promotion of any business must be recaptured through the sale of your product and its pricing. It offers the following data. Fill in the blanks to get teh cost to run your business for each ...

PDF Business Overhead Expense Worksheet - Official Site Business Overhead Expense Worksheet (To be sumitted with Application) Firm Name: Business structure: SOLE PROPRIETOR . PARTNERSHIP . CORPORATION . Percentage of Ownership of firm % ELIGIBLE MONTHLY EXPENSES OF THE BUSINESS . Rent or mortgage payments (including principal, interest and taxes) or . Depreciation-if greater than principal payments Business Owners Package and Directors and Officers ... The AICPA Business Overhead Expense (BOE) Insurance Plan reimburses business owners for existing overhead expenses incurred while they are disabled, keeping the company up and running while the owner recovers. Regular expenses that could be covered under a BOE policy include employee salaries, rent, leases and utilities to name a few. Business Overhead Calculator | Plan Projections The Excel business overhead budget template, available for download below, helps a business in calculating overhead by entering the amount under the relevant category for each of the five years. Business Overhead Calculator Download The business overhead calculation spreadsheet is available for download in Excel format by following the link below. PDF Overhead Expenses - Monthly Item: - Rent _____ - Utilities _____ - Phone Charges _____ - Salaries _____ - Payroll (taxes, payroll services, etc) _____

PDF Business Income & Extra Expense Worksheet Manufacturers business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period. Failure to submit a signed current worksheet will automatically reinstate the Coinsurance Provision for the period going forward. Overhead Expenses Template, Spreadsheet | Small Businesses Monthly Overhead Expenses - 1 Month Worksheet Excel Also known as "fixed" costs, monthly overhead expenses include: rent and utilities, employees and payroll taxes, phone and Internet, vehicles, marketing, professional fees, supplies and materials, bank and credit card charges, travel expenses, and more. Business Owners Package and Directors and Officers ... If you don't know how much Business Overhead Expense Insurance you need, use this worksheet to find out. If your firm is a professional corporation or a partnership, only list your portion of the expenses. Click here to download the worksheet. Examples of monthly expenses click here to complete your monthly expense worksheet Business Insurance Business Overhead Expenses: What They Are and How To ... Business overhead expenses encompass the ongoing costs of operating a business. They include costs such as: Marketing costs Administrative compensation and benefits Rent & utilities Professional fees Other general company costs such as licenses, dues and subscriptions, administrative vehicles, professional development, etc.

PDF Disability Business Overhead Expense (Boe) Insurance Worksheet DISABILITY BUSINESS OVERHEAD EXPENSE (BOE) INSURANCE WORKSHEET 877-254-4429 LLIS.com YOUR ONE(STOP INSURANCE RESOURCE FOR Term Life ermanent Individual Survivorship Life Annuities Disability Critical Care LTCi ybrid Life/LTCi ybrid Annuity/LTCi olicy Reviews Life Settlements

Overhead Expense Worksheet - kaplanmanagement.net Overhead Expense Worksheet . Overhead expense insurance covers the monthly tax-deductible expenses of a business entity. Below find a worksheet sheet that will help you determine your total monthly expenses. Regular lease, rental or mortgage payment on business premises $ _____ Rental, mortgage or realty taxes _____ ...

Business monthly budget - templates.office.com This Excel spreadsheet budget arrives fully formatted and ready for your numbers. Summarize your largest expenses with a business budget template that compares projected and actual spending, helps you track personnel, and more. Formatted with various typical business categories, this budget is also easily adaptable to your needs.

How to calculate and track overhead costs for your small ... How to calculate overhead costs. Once all costs are properly classified, you can figure out your business's overhead rate as a percentage of sales. This is done by adding up all overhead costs, breaking them down by month, and then dividing that total by monthly sales. The formula is below: (Overhead ÷ monthly sales) x 100 = overhead percentage

Business Overhead Expense - CPAI Business Overhead Expense (BOE) Insurance, issued by The Prudential Insurance Company of America (Prudential), endorsed by the AICPA, is a member-exclusive coverage that can help you run your business in the event that you become disabled and are unable to work. Benefits help: Cover day-to-day fixed operating expenses. Provide for your employees.

PDF Business Overhead Expense Worksheet - PIU Petersen nternational nerwriters Business Overhead Expense Worksheet - 03-15-2019 Business Overhead Expense Worksheet 23929 Valencia Boulevard Second Floor, Valencia, CA 91355 | (800) 345-8816 | Fax (661) 254-0604 | piu@piu.org Proposed Insured: Firm Nma e: Business Structure: Ownership: First _____ M.I.

Business Overhead Expense - Southwest DI Business Overhead Expense is an insurance policy that reimburses a small business owner for certain business expenses if they become sick or hurt and unable to work. The monthly benefit amount is based on qualified business expenses at the time the policy is purchases. A typical policy can reimburse up to $50,000 of monthly expenses.

PDF Overhead Worksheet - National Institutes of Health Please provide the total dollar value for each cost item listed below. The line totals and cumulative total of; all expenses must agree with the totals found on your Financial Statements, General Ledger, etc. for your

Publication 535 (2021), Business Expenses | Internal ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... Factory overhead.

Business Expenses Template, Overhead Expenses Tracking ... About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

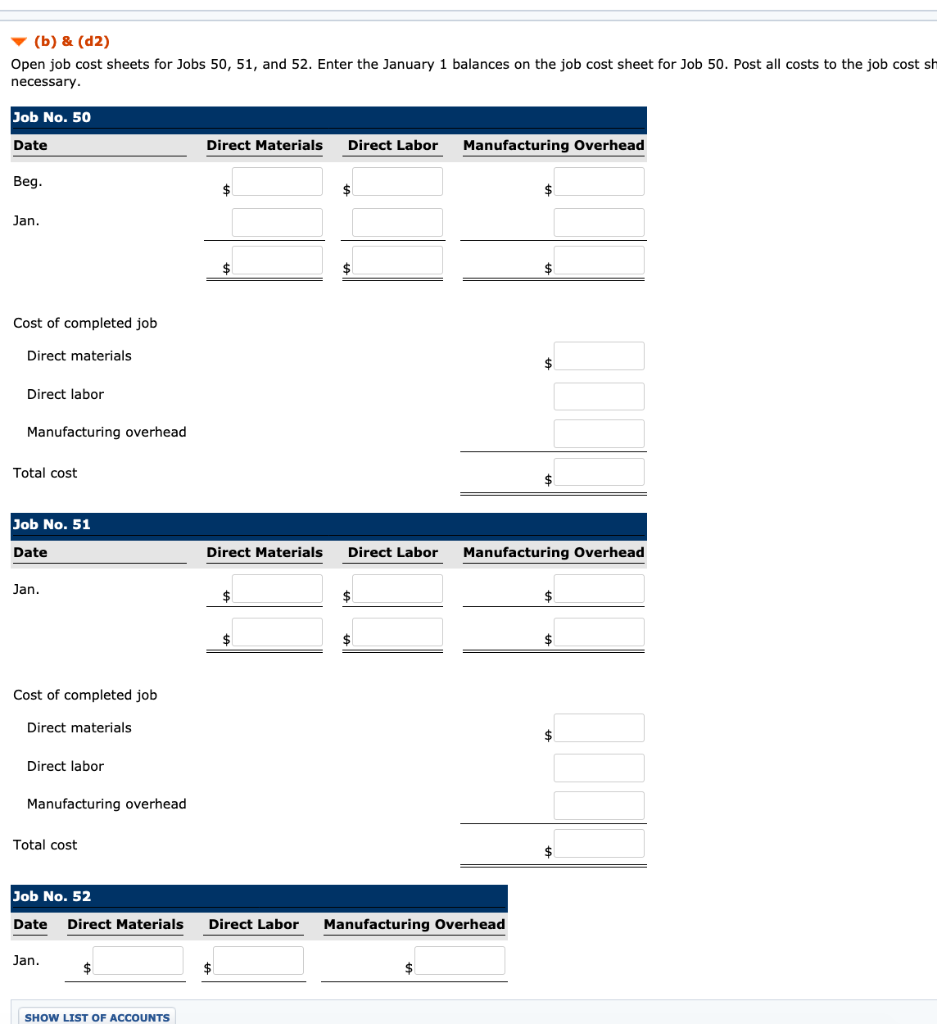

Business Operating Expenses Excel Worksheet Use this Business Operating Expenses Excel Worksheet to track your actual and estimated business operating expenses. There are 4 worksheets to help you keep track of your business operating expenses. The first worksheet contains your actual line item expenses. The second worksheet contains your estimated line items expenses

Overhead Formula | How to Calculate Overhead Ratio (Excel ... Overhead Ratio Formula in Excel (With Excel Template) Here we will do the same example of the Overhead Ratio formula in Excel. It is very easy and simple. You need to provide the three inputs of Operating Expenses, Operating Income, and Taxable Net Interest Income. You can easily calculate the Overhead ratio using Formula in the template provided.

PDF Know your needs If you don't know how much Business Overhead Expense Insurance you need, use this worksheet to find out. If your practice is a professional corporation or a partnership, only list your portion of the expenses. Monthly expense worksheet Rent or mortgage $ Employee salaries $ Employee benefits $ Depreciation of equipment $ Property taxes $

Calculating the Overhead Rate: A Step-by-Step Guide | The ... Overhead rates are calculated by adding the indirect or overhead costs incurred by your business and allocating those costs based on a specific measure. Indirect costs are part of doing business ...

0 Response to "41 business overhead expense worksheet"

Post a Comment