41 1031 like kind exchange worksheet

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

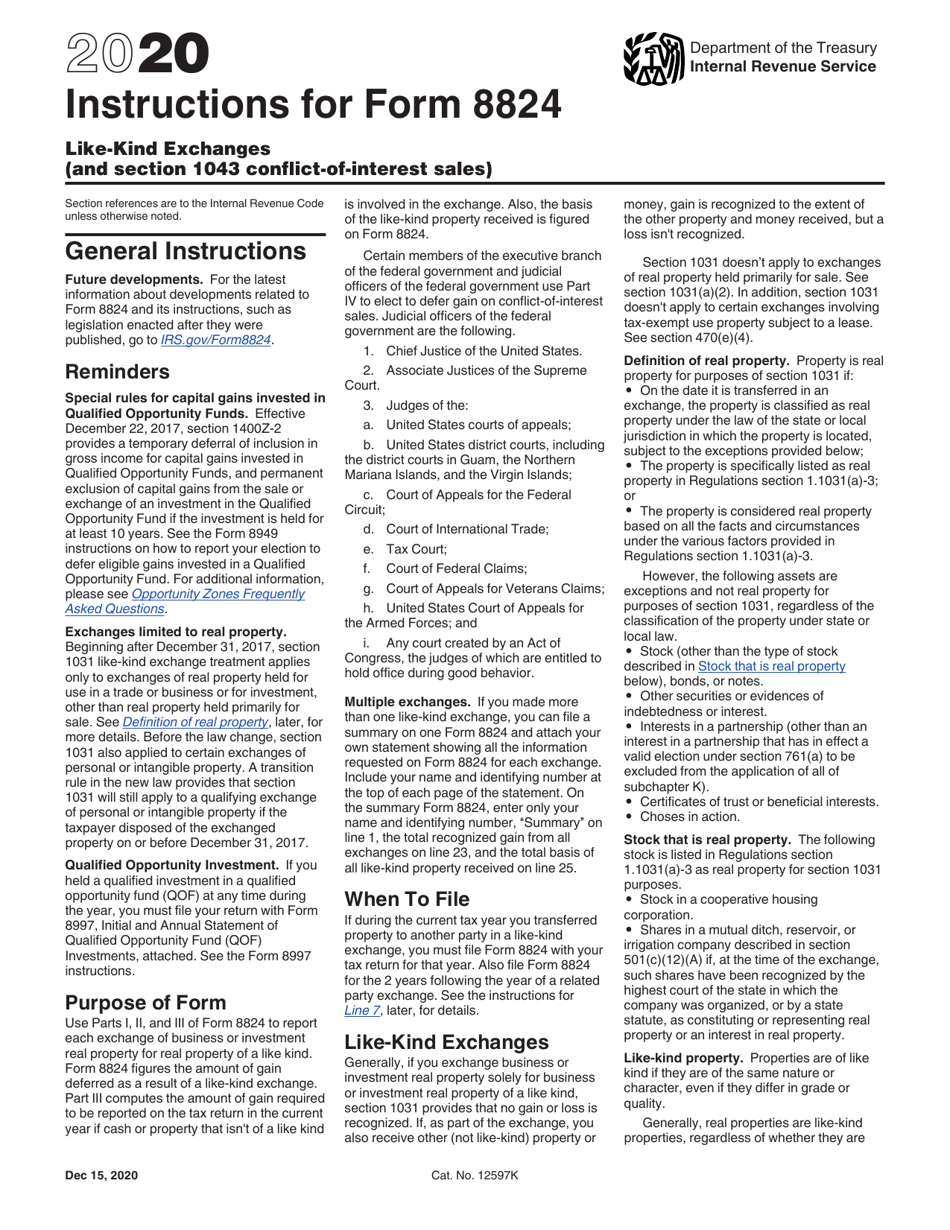

Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

1031 like kind exchange worksheet

Form 8824: Do it correctly | Michael Lantrip Wrote The Book Failure to report your 1031 Exchange will invalidate your Exchange and trigger the Capital Gains tax and the Depreciation Recapture, and probably some penalties. The name of the form is Form 8824, it's called Like-Kind Exchanges, and you attach it to your Form 1040 if you are an individual. FORM 8824 INSTRUCTIONS 1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value. Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

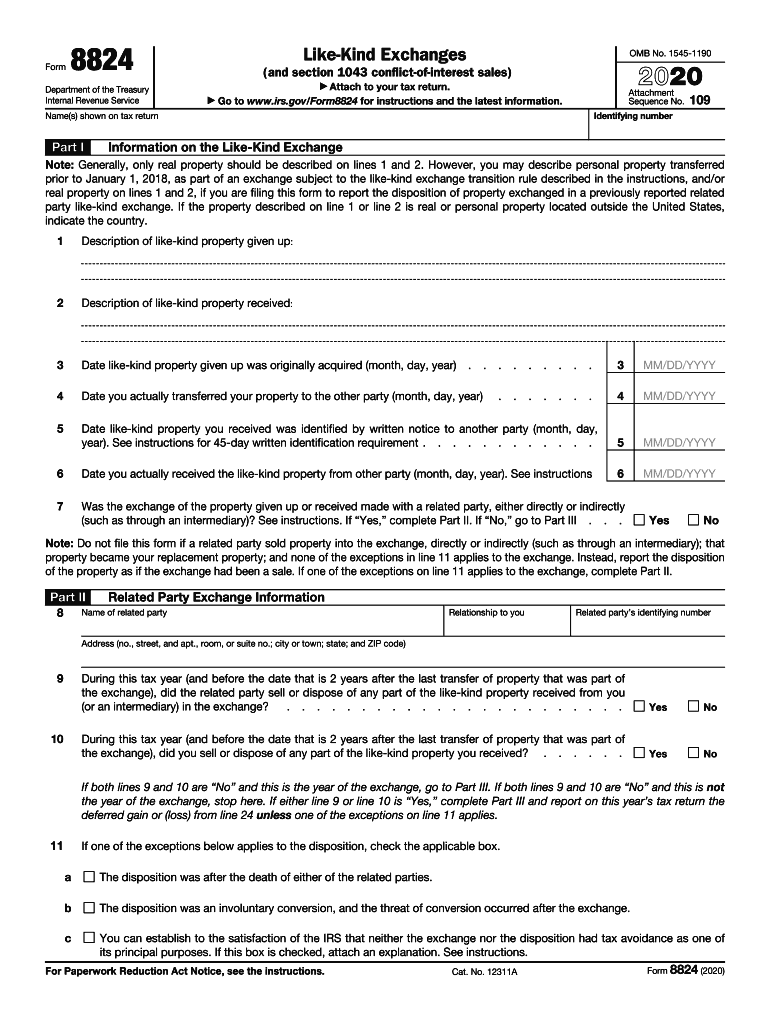

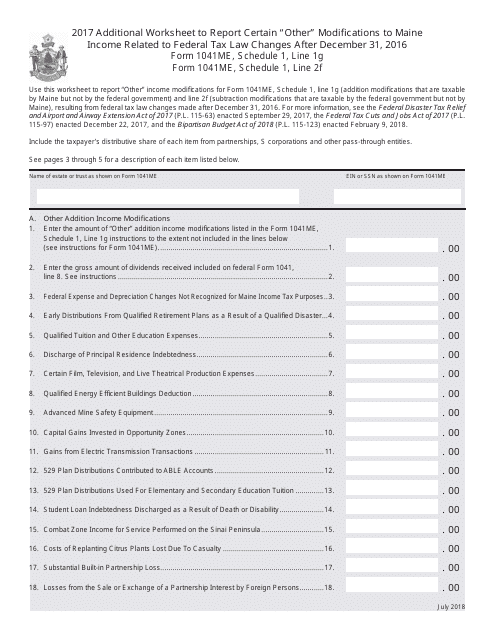

1031 like kind exchange worksheet. 41 like kind exchange worksheet excel - Worksheet For You A like-kind exchange under United States tax law also known as a 1031 exchange is a transaction or series of transactions that allows for the disposal of an asset and the acquisition of another replacement asset without generating a current tax liability from the sale of the first asset. 42 like kind exchange worksheet - Worksheet Was Here Like ... IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange ... Worksheet April 17, 2018. We tried to get some great references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ... PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

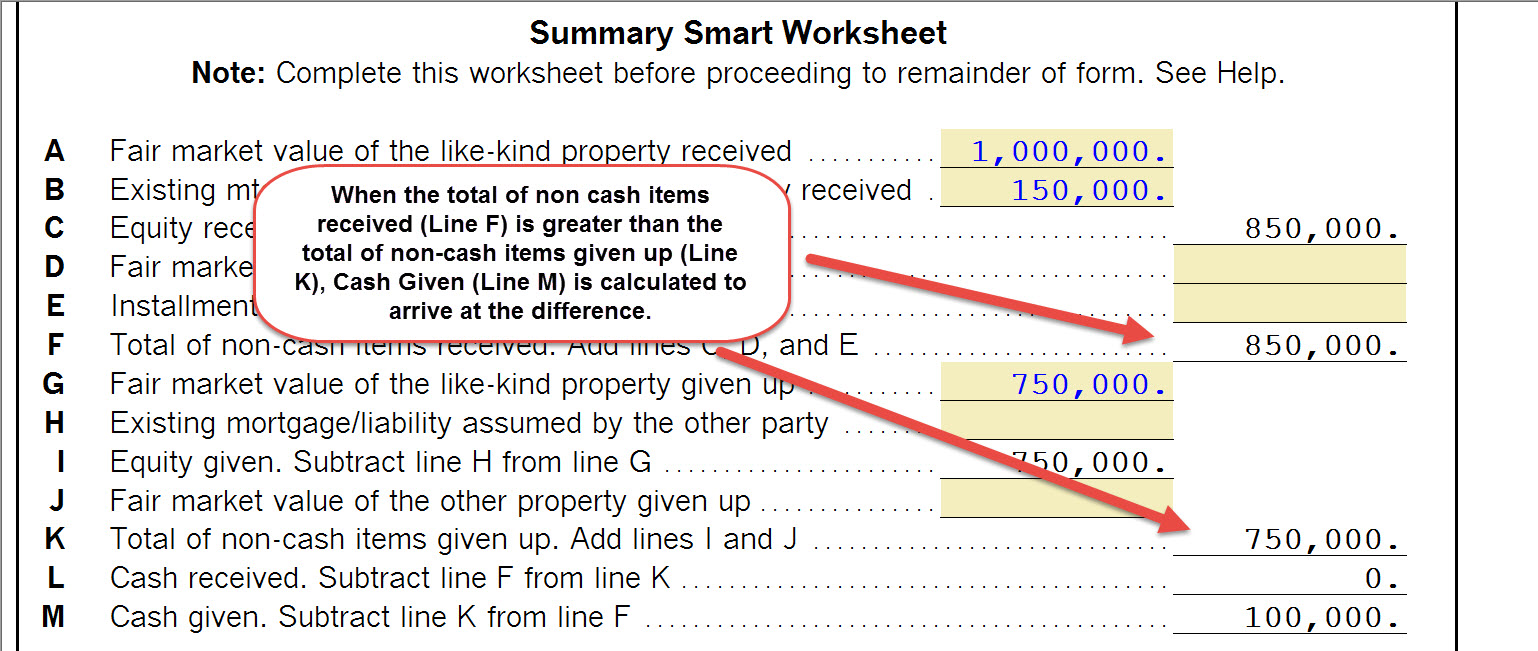

XLS Welcome - Hutchins, Canning & Company | CPA Services for ... 1031 Worksheet 5 GAIN OR LOSS REALIZED (Line 7 less line 13 Date of Sale of Property Traded Date of Settlement of New Property Received Description of New Property Received Description of Old Property Traded Date New Property to be Received was Identified Fair Market Value of the new property received List any cash you received in the ... 1031 Replacement Property Worksheet. Read more. 1031 "Like-Kind" Exchange Best Practices. Raising the Bar for Secure, Transparent, and Compliant Exchanges. Read more. How to do a 1031 Exchange. The 1031 Forward Exchange Process. Read more. Home; PDF 2019 - 1031 Corp Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6 1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

1031 Exchange Examples | 2022 Like Kind Exchange Example This is known as a "Partial Exchange" and the portion the exchange proceeds that are not reinvested are referred to as "Boot" and are subject to taxes. Ron and Maggie believe their property can be sold for $2,850,000. Assuming the mortgage balance will be $800,000, their evaluation of a suitable Replacement Property will look like this: 1031 Tool Kit - TM 1031 Exchange Click here for your 1031 Exchange Tool Kit including at 1031 checklist, qualified intermediary locator, close date form, 1031 identification form and more. Click here to schedule your free 1031 exchange and investment consultation. IRC Section 1031 Like-Kind Exchange Calculator: IRS Home ... A 1031 exchange refers to Internal Revenue Service Code 1031 which allows like-kind exchanges on properties. This exchange defers capital gains on the property during the exchange and allows properties to be purchased temporarily tax-free with the capital gains on both investments to be collected when the second property is sold. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet ... We always attempt to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek an image according specific topic, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all.

39 like kind exchange worksheet excel - Worksheet Online Like kind exchange worksheet excel. Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) Worksheet ...

Asset Worksheet for Like-Kind Exchange You depreciate property you received in a like kind exchange (Section 1031), as though you never gave up the original property. You use the same adjusted basis as the property given up.

PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 The Exchange is reported on IRS Form 8824, Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV.

The 6 Best 1031 Exchange Companies of 2022 - The Balance A 1031 like-kind exchange is a tax strategy to delay paying capital gains taxes when selling investment properties. These taxes can be up to 20% of the sale price. The name 1031 comes from Section 1031 of the U.S. Internal Revenue Code. This section of the tax code lets taxpayers sell a qualified property. Then, they can reinvest the proceeds ...

Inspiration Like Kind Exchange Worksheet - Goal keeping ... Like kind exchange worksheet excel and irs 1031 exchange worksheet can be beneficial inspiration for those who seek an image according specific categories you can find it in this site. By changing any value in the following form fields.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges ... Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. By changing any value in the following form fields ...

XLS 1031 Corporation Exchange Professionals - Qualified ... 1031 Corporation Exchange Professionals - Qualified ...

Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value.

Form 8824: Do it correctly | Michael Lantrip Wrote The Book Failure to report your 1031 Exchange will invalidate your Exchange and trigger the Capital Gains tax and the Depreciation Recapture, and probably some penalties. The name of the form is Form 8824, it's called Like-Kind Exchanges, and you attach it to your Form 1040 if you are an individual. FORM 8824 INSTRUCTIONS

/153221908-5bfc2b8c4cedfd0026c118f2.jpg)

0 Response to "41 1031 like kind exchange worksheet"

Post a Comment